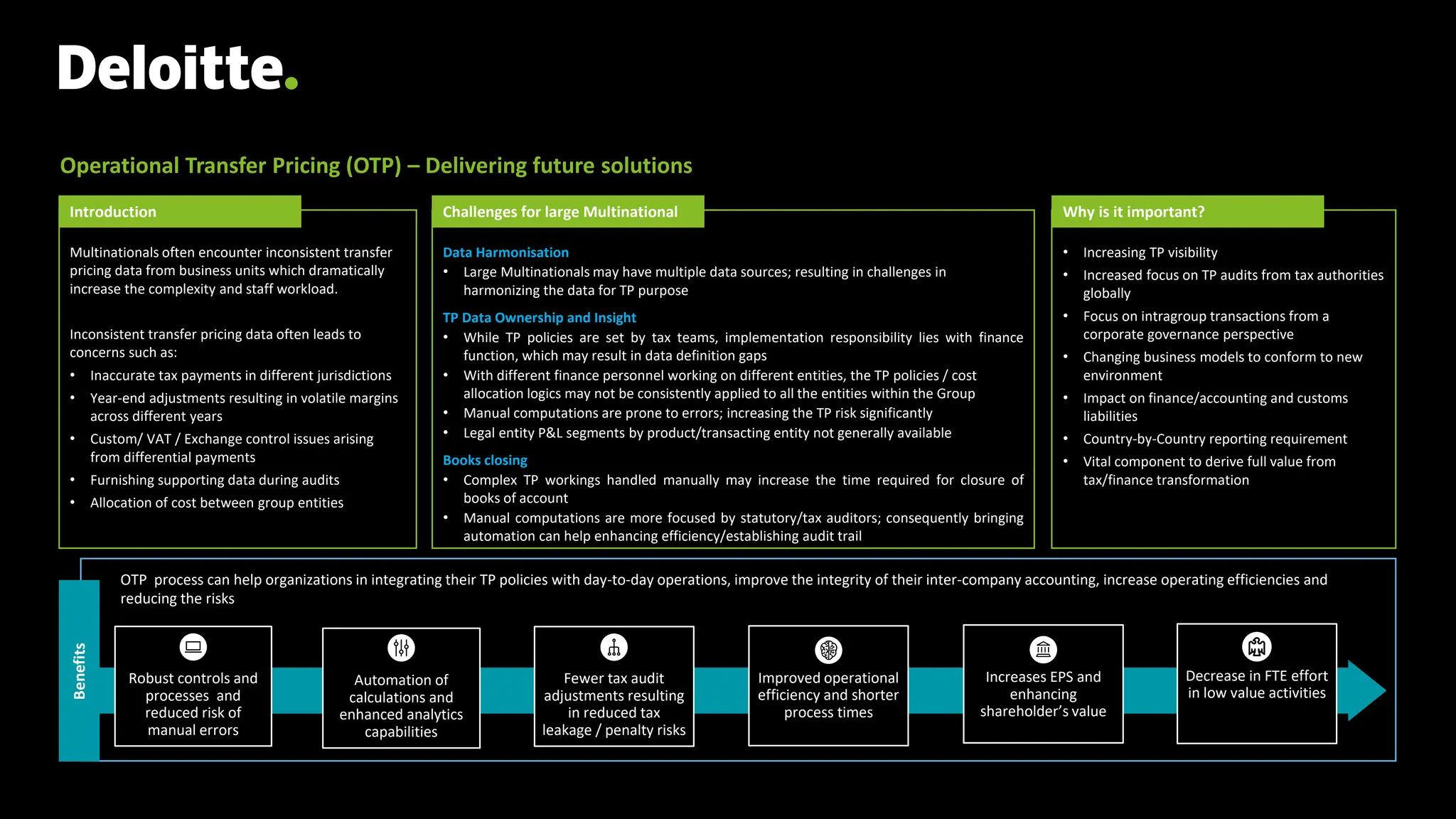

The document discusses the benefits of Operational Transfer Pricing (OTP) for multinational organizations, emphasizing improved integration of transfer pricing policies with operations, reduced inaccuracies in tax payments, and enhanced efficiency through automation. It highlights the importance of robust data management, monitoring capabilities, and the establishment of effective processes to mitigate tax risks and improve shareholder value. Key features of the OTP solution include better insights into tax optimization, customizable reporting, and a governance model that ensures consistent policy implementation across entities.