The document outlines the syntax and semantic definitions for terms of business between asset managers and clients, applicable to both pooled funds and segregated accounts. It incorporates ISO 20022 components to ensure compatibility with global financial messaging standards and includes sections on syntax rules, cash flow adjustments, and periodic charge formulas. The synoptic charts illustrate the structure and constraints of the syntax for better understanding.

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 3

Part 1: Introduction

This document defines a syntax and provides a semantic reference for preparing documents to describe the terms

of business between an asset manager and its clients regardless of whether the clients are subscribing to a pooled

fund or a segregated account.

The textual listing of the syntax at Part 3 of this document complies with ISO/IEC 14977. A description of that

standard including guidance on how to read it is available on the Internet. Those who are not familiar with the

standard will find the synoptic charts at Part 2 easier to read initially. The following paragraphs offer a short

introduction to how to read the syntax.

The syntax uses a simple set of rules to describe terms of business. Rules have a left-hand-side, a right-hand-side

and a separation character "=", which indicates that the left-hand-side of the rule has the meaning given by the

terms on the right-hand-side. For example, the first and most important rule is:

Terms =

Company, {Company}, Counterparty, {Counterparty}, Agreement, [Product, {Product},

{ProductExclusion}], [Market, {Market}, {MarketExclusion}], {TransactionChargeSet},

{PeriodicChargeSet}, {Payment}, {Report};

which means that terms of business are defined by the company and the counterparty who made them, some legal

terms, the products and markets to which the terms will apply, the charges and payment mandates, etc.

The syntax commonly uses the following forms of control in its rules:

Sequence Items appear in a rule from left to right, separated by commas; their order is important.

Choice Alternative items are separated by the "|" character. One item is chosen from the list of

alternatives; their order is not important.

Option Optional items are enclosed between the characters "[" and "]"; the item can be included or

discarded.

Repetition A repeatable item is enclosed between the characters "{" and "}"; the item can be repeated

zero or more times.

Iteration Limited iteration is indicated by the "*" character. For example, 4 * 'x' means that the

symbol 'x' must be included four times.

The rules also use the following special characters:

Quotation A term enclosed within single quotes stands for itself. For example, 'Clearstream' means

Clearstream Bank.

Group Some terms are grouped together in round brackets (like this) in order to ensure the

desired precedence between operators or to make a rule easier to read.

Termination A semi-colon ";" is used to mark the end of a rule.

Line breaks are sometimes used to make the rules easier to read; they have no special meaning.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-3-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 12

Part 3: Syntax rules listed in alphabetic order

Terms = Company, {Company}, Counterparty, {Counterparty}, Agreement, [Product, {Product}, {ProductExclusion}], [Market, {Market},

{MarketExclusion}], {TransactionChargeSet}, {PeriodicChargeSet}, {Payment}, {Report};

Affiliate = PartyIdentification, {PartyIdentification}, [AccessionDate, [SecessionDate]], {ContactDetails};

Agreement = AgreementID, VersionNumber, [ExecutionDate], [LegalAspects], [TermAndTermination];

AgreementSectionCrossReference = TransactionChargeNumber | PeriodicChargeNumber;

ApplicableLawAndJurisdiction = Law, Jurisdiction;

ApplicableNAV = 'ReferHoldingCount' | 'ReferCalculationLookupFrequency' | 'Daily';1

CalculationFrequency = 'Daily' | 'Weekly' | 'Monthly' | 'Quarterly' | 'HalfYearly' | 'Yearly';2

CashFlow = CashFlowType, [CashFlowThresholdRelative], [CashFlowThresholdAbsolute];

CashFlowThresholdAbsolute = Amount, Currency;

CashFlowType = 'Straight' | 'Backward'; 3

ChequeDetails = [Reference], Currency, PayeeID, AgreementSectionCrossReference, {AgreementSectionCrossReference};

Company = PartyIdentification, {PartyIdentification}, [CompanyCapacity], ContactDetails, {ContactDetails};

CompanyCapacity = CompanyCapacityCode | Proprietary;

CompanyCapacityCode = 'LegalRepresentative' | 'ManagementCompany' | 'GlobalDistributor' | 'Platform';4

CompareMethod = 'Arithmetic' | 'Geometric';5

ContactDetails = Name, [Title], [GivenName], [Role], [PhoneNumber], [FaxNumber], [EmailAddress], [SpecialInstructions];

Counterparty = PartyIdentification, {PartyIdentification}, [OfferRights], CounterpartyCapacity, {Affiliate}, ContactDetails, {ContactDetails};

CounterpartyCapacity = CounterpartyCapacityCode | Proprietary;

CounterpartyCapacityCode = 'Platform' | 'Distributor' | 'IntroducingAgent' | 'ProductPackager' | 'InstitutionalInvestor' | 'PlacementAgent' |

'CentralisingAgent';6

CreditTransferDetails = [Reference], Currency, [IntermediaryAgent1], [IntermediaryAgent1Account], [IntermediaryAgent2],

[IntermediaryAgent2Account], [CreditorAgent], [CreditorAgentAccount], [Creditor], CreditorAccount, AgreementSectionCrossReference,

{AgreementSectionCrossReference};

DecrementalTrade = 'TradeDate' | 'SettlementDate';7

DeMinimisCharge = Currency, Threshold;

DeMinimisPayment = Currency, Threshold;

DirectDebitDetails = [Reference], Currency, [Debtor], DebtorAccount, AgreementSectionCrossReference, {AgreementSectionCrossReference};

EligiblePosition = IncrementalTrade, DecrementalTrade, [SpecialInstructions];

FeeSharePeriodicCharge = FeeSharePeriodicChargeCode | Proprietary, RateTable, [LookupFrequency];

FeeSharePeriodicChargeCode = 'ManagementFee' | 'DistributionFee' | 'Management+DistributionFee' | 'TotalExpenseRatio' | 'OngoingCharge' |

'TotalExpenseRatioCap' | 'OngoingChargeCap';8

FixedCharge = FixedChargeType, Amount, Currency;

FixedChargeType = FixedChargeDescription | FixedChargeCode | Proprietary;

FixedChargeCode = 'BenchmarkChange' | 'MinimumPeriodicCharge';9

HoldingAddress = HoldingAddressType, HoldingAddressNumber, SharedAccount, [SharedAccountHoldingUpdateFrequency], [EligiblePosition];

HoldingAddressType = HoldingAddressPath | Platform;

HoldingCount = 'Daily' | 'Weekly' | 'Monthly' | 'Quarterly' | 'HalfYearly' | 'Yearly' | 'WeekEndMean' | 'MonthEndMean' | 'QuarterEndMean' |

'HalfYearEndMean' | 'YearEndMean';10

HoldingValue = HoldingCount, ApplicableNAV;

IncrementalTrade = 'TradeDate' | 'SettlementDate';7](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-12-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 13

ISINAndDescription = ISIN, [Description];

Jurisdiction = Country, [Name];

LatePaymentPenalty = PenaltyRate, BaseRate;

LegalAspects = LegalTerms, {LegalVariation}, ApplicableLawAndJurisdiction, [MostFavouredTerms];

LookupFrequency = 'Daily' | 'Weekly' | 'Monthly' | 'Quarterly' | 'HalfYearly' | 'Yearly';11

Market = Country | Proprietary | URL;

MarketExclusion = Market;

OfferRights = OfferRightsAndDelegation | Proprietary | OfferRightsNarrative;

OfferRightsAndDelegation = OfferRightsCode, DelegationPermitted;

OfferRightsCode = 'PrivatePlacement' | 'PublicOffer' | 'PublicOfferAndPrivatePlacement' | 'None';12

OutPerformBenchmark = Description, [TickerIdentifier], CompareMethod;

PartialChargePeriodConvention = 'Long' | 'Short';13

PartyIdentification = AnyBIC | LEIIdentifier | ProprietaryID | NameAndAddress;

Payee = 'Company' | 'Counterparty';14

Payment = PaymentNumber, [PaymentName], PaymentInstrument;

PaymentCurrency = PaymentCurrencyBasis | Currency;

PaymentCurrencyBasis = 'BaseCurrency' | 'ShareClassCurrency' | 'MandateCurrency' | 'InvestmentCurrency';15

PaymentInstrument = PayThruFund | CreditTransferDetails | ChequeDetails | DirectDebitDetails, [SpecialInstructions];

PaymentMechanism = 'CompanyAutoPay' | 'CounterpartyInvoice';16

PayThruFund = PayThruFundType, [Reference], AgreementSectionCrossReference, {AgreementSectionCrossReference};

PayThruFundSet = HoldingAddressPath, HoldingAddressNumber, PayThruFundPayment, {PayThruFundPayment};

PayThruFundPayment = ISINAndDescription, [Ratio];

PayThruFundSingleAccount = HoldingAddressPath, HoldingAddressNumber;

PayThruFundType = 'ProRata' | PayThruFundSingleAccount | (PayThruFundSet, {PayThruFundSet});

PerformanceMeasurementDate = Month, Day;

PerformancePeriod = TermStartDate, TermEndDate, PerformanceMeasurementDate, PerformancePeriodType, PerformancePeriodYears;

PerformancePeriodHurdleConvention = 'Simple' | 'Compound';17

PerformancePeriodicCharge = ParticipationRate, [OutPerformBenchmark], PortfolioReturnMeasure, Hurdle, HighWaterMark, [OutPerformCap],

PerformancePeriod, SeriesAccounting, [SpecialConditions];

PerformancePeriodStartConvention = PerformancePeriodStartConventionCode | Proprietary;

PerformancePeriodStartConventionCode = 'Neutral' | 'Progressive' | 'Adaptive';18

PerformancePeriodType = PerformancePeriodTypeCode, [PerformancePeriodStartConvention], [PerformancePeriodHurdleConvention];

PerformancePeriodTypeCode = 'Fixed' | 'Extensible' | 'Rolling';19

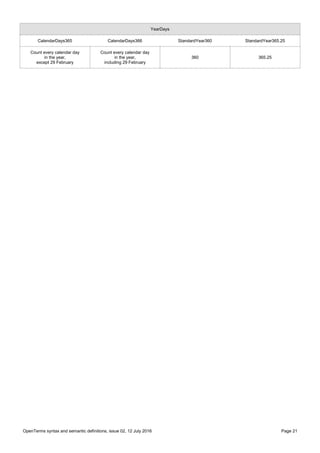

PeriodDays = 'CalendarDays365' | 'CalendarDays366' | 'StandardYear360';20

PeriodicCharge = PeriodicChargeNumber, [PeriodicChargeName], PeriodicChargeType, TermStartDate, TermEndDate, Product, {Product},

{ProductExclusion}, PeriodicChargeHolding, [PeriodicChargeAggregation], CalculationFrequency, PeriodicChargePeriod,

PartialChargePeriodConvention, PeriodDays, YearDays, Payee, Discount, FeeSharePeriodicCharge | VolumePeriodicCharge |

PerformancePeriodicCharge | FixedCharge;

PeriodicChargeAggregation = ProductAggregation, PeriodicChargeHoldingAggregation;

PeriodicChargeHolding = (PeriodicChargeHoldingDetails, {PeriodicChargeHoldingDetails}) | 'DefinedLater';

PeriodicChargeHoldingAggregation = 'Account' | HoldingAddressPath | (PeriodicChargeHoldingDetails, {PeriodicChargeHoldingDetails}) |

'DefinedLater';

PeriodicChargeHoldingDetails = HoldingAddress, (HoldingValue | CashFlow);

PeriodicChargePeriod = 'Weekly' | 'Monthly' | 'Quarterly' | 'HalfYearly' | 'Yearly';21](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-13-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 14

PeriodicChargeSet = PeriodicChargeSetNumber, [PeriodicChargeSetName], PeriodicCharge, {PeriodicCharge}, [NestedCharges],

PaymentCurrency, [SettlementWithin], [RetrospectiveAdjustmentDeadline], [DeMinimisCharge], [DeMinimisPayment], PaymentMechanism,

TerminationMode;

Platform = PlatformCode | Proprietary;

PlatformCode = 'ClearstreamBankLuxembourg' | 'Euroclear' | 'FundSettle' | 'CrestCo' | 'DeutscheBorseClearingAG' |

'CaisseInterprofessionelleDepotsVirementsTitres' | 'FinnishCentralSecuritiesDepositoryLtd' | 'SICOVAM' | 'NECIGEF';22

PortfolioReturnMeasure = 'Net' | 'Gross';23

Product = ISINAndDescription | OtherID | URL;

ProductAggregation = ProductAggregationType | (Product, {Product}, {ProductExclusion});

ProductAggregationType = 'ShareClass' | 'SubFund' | 'Fund';24

ProductExclusion = Product;

RateTransactionCharge = RateTransactionChargeCode | Proprietary, RateTable;

RateTransactionChargeCode = 'FrontEndLoad' | 'BackEndLoad' | 'Switch' | 'Movement';25

RateMethod = 'FlatBand' | 'SlidingScale';26

RateTable = RateMethod, ReferenceCurrency, RateTableRow, {RateTableRow};

RateTableRow = Threshold, Rate;

Report = ReportNumber, [ReportName], ReportMethod, {ReportMethod}, AgreementSectionCrossReference,

{AgreementSectionCrossReference}, [SpecialInstructions];

ReportMethod = PostalAddress | EmailAddress | FaxNumber | Other;

RetrospectiveAdjustmentDeadline = TimeLimitMonths | Other;

RunOff = PeriodMonths, AdmitNewPositions;

SettlementWithin = TimeLimitBusinessDays | TimeLimitCalendarDays | Other, [LatePaymentPenalty];

SharedAccountHoldingUpdateFrequency = 'Daily' | 'Weekly' | 'Monthly' | 'Quarterly' | 'HalfYearly' | 'Yearly';27

Term = FixedTermMonths | 'Open';

TermAndTermination = Term, TerminationNotice;

TermEndDate = Date | 'Open';

TerminationMode = TerminationType | RunOff;

TerminationNotice = Days | Months;

TerminationType = 'CoTerminusAgreement' | 'Survive';28

TermStartDate = Date | 'FirstInvestment';

TransactionCharge = TransactionChargeNumber, [TransactionChargeName], TransactionChargeType, TermStartDate, TermEndDate, Product,

{Product}, {ProductExclusion}, TransactionChargeHolding, [TransactionChargeAggregation], TransactionChargePeriod, Discount,

CounterpartyShare, CompanyShare;

TransactionChargeAggregation = ProductAggregation, TransactionChargeHoldingAggregation;

TransactionChargeHolding = (TransactionChargeHoldingAddress, {TransactionChargeHoldingAddress}) | 'DefinedLater';

TransactionChargeHoldingAddress = HoldingAddressPath, HoldingAddressNumber;

TransactionChargeHoldingAggregation = 'Account' | HoldingAddressPath | (TransactionChargeHoldingAddress,

{TransactionChargeHoldingAddress}) | 'DefinedLater';

TransactionChargePeriod = 'Weekly' | 'SemiMonthly' | 'Monthly' | 'Quarterly' | 'HalfYearly' | 'Yearly';29

TransactionChargeSet = TransactionChargeSetNumber, [TransactionChargeSetName], TransactionCharge, {TransactionCharge},

PaymentCurrency, [SettlementWithin], [RetrospectiveAdjustmentDeadline], [DeMinimisPayment];

TransactionChargeType = RateTransactionCharge | FixedCharge;

VolumePeriodicCharge = VolumePeriodicChargeCode | Proprietary, RateTable, {RateTable}, [LookupFrequency];

VolumePeriodicChargeCode = 'TrailerFee' | 'IntermediaryServiceFee' | 'ItalianSubjectInChargePlacementFee' | 'FranceCentralisingAgentFee' |

'ManagementFee' | 'CustodyFee' | 'ReferralFee' | 'AdvisoryFee' | 'RealEstateFundFee' | 'LifeCompanyFee';30

YearDays = 'CalendarDays365' | 'CalendarDays366' | 'StandardYear360' | 'StandardYear365.25';31](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-14-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 16

Part 4: The periodic charge formula

This formula applies only when the periodic charge is based on some rate such as a management fee or on the

asset volume of the relevant holdings (i.e., when PeriodChargeType is a FeeSharePeriodicCharge or a

VolumePeriodicCharge). If the periodic charge is a fixed charge, follow the instructions defined by the rule

FixedCharge. If the periodic charge is based on performance, follow the instructions defined by the rule

PerformancePeriodicCharge.

For each ISIN at each HoldingAddress, the periodic charge calculated under the terms of a particular

PeriodicCharge instruction are:

Value of periodic charge = ∑ HoldingValuec × PeriodicChargeBasisFactor × Ratec ×

Final Cycle

c=1

DayCount

YearDays

where the terms in the formula have the following meaning:

c

The variable "c" counts from the first to the last periodic charge calculation cycle in the PeriodicChargePeriod.

FinalCycle

FinalCycle is the last calculation cycle in the PeriodicChargePeriod. It is set by the following parameters in the

relevant PeriodicCharge instruction and the following table:

PeriodicCharge → PeriodicChargePeriod

PeriodicCharge → CalculationFrequency

PeriodicChargePeriod

Weekly Monthly Quarterly HalfYearly Yearly

CalculationFrequency

Daily 7

Actual number of

calendar days in the

month

Actual number of

calendar days in the

quarter

Actual number of

calendar days in the

half-year

Actual number of

calendar days in the

year

Weekly 1

Actual number of

calendar weeks in the

month

Actual number of

calendar weeks in the

quarter

Actual number of

calendar weeks in the

half-year

Actual number of

calendar weeks in the

year

Monthly 1 3 6 12

Quarterly 1 2 4

HalfYearly Invalid 1 2

Yearly 1

In the case of a weekly CalculationFrequency the number of weeks in a month, quarter, half-year or year will be

calculated in accordance with ISO 8601, which is briefly explained below:

ISO 8601 defines a calendar week as "an interval of seven calendar days starting with a Monday … " and it says

that "… the first calendar week of a year is the one which includes the first Thursday of that year and […] the last

calendar week of a calendar year is the week immediately preceding the first calendar week of the next calendar

year."

Since years may be divided into months, quarters and halves, this definition permits the number of calendar weeks

in each PeriodicChargePeriod to be calculated precisely. The DayCount and YearDays conventions described

below are valid for both short and long ISO years (52 and 53 weeks).

For example, the year 2010 is described in the following table:](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-16-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 22

Part 6: Syntax semantic definitions

Rule

Terms = Company, {Company}, Counterparty, {Counterparty}, Agreement, [Product, {Product}, {ProductExclusion}], [Market, {Market},

{MarketExclusion}], {TransactionChargeSet}, {PeriodicChargeSet}, {Payment}, {Report};

Synopsis

Terms of business are defined by the following elements:

Company A party making pooled funds available under the agreement or a party managing segregated mandates.

Counterparty A party being granted sales rights in respect of the pooled funds and markets named in the agreement or a

party who awards a segregated mandate to the Company. The Counterparty's affiliates also benefit from the

terms of the agreement.

Agreement The identity, execution date, legal texts and termination notice terms of the agreement.

Product Pooled funds or segregated mandates which are in scope of the agreement.

ProductExclusion Any members of a set of products that should be excluded from the scope of the agreement.

Market The markets in which the Company grants the Counterparty rights to act in respect of the pooled funds

described in Products.

MarketExclusion Any members of a set of markets that should be excluded from the scope of the agreement.

TransactionChargeSet Event driven charges such as pooled fund front-end loads, back-end loads and conversion (switch) charges

and segregated mandate securities transaction charges.

PeriodicChargeSet Periodic charges such as pooled fund rebates (ongoing commissions) that the Company will pay to the

Counterparty, and segregated account management charges that the Counterparty will pay to the Company.

Payment The means by which one party will pay amounts to the other party.

Report The means by which one party will report charges to the other party.

Typology and constraints

Company: Defined in this document.

Counterparty: Defined in this document.

Agreement: Defined in this document.

Product: Defined in this document.

ProductExclusion: Defined in this document.

Market: Defined in this document.

MarketExclusion: Defined in this document.

TransactionChargeSet: Defined in this document.

PeriodicChargeSet: Defined in this document.

Payment: Defined in this document.

Report: Defined in this document.

User guide

This is the root of the rule set.

An agreement can be made between several Companies and Counterparties. This is useful, for example, in the event that one member of the

Company group acts as manager for one fund whilst a second member acts as manager for a second fund and a third and subsequent

members of the Company group act as legal representatives in particular jurisdictions, and all parties, funds and jurisdictions are described

within a single global agreement to which several members of the Counterparty group are party.

In the context of pooled fund business, the agreement implies that the Counterparty will enjoy certain rights over the Products in all Markets

subject to ProductExclusions and MarketExclusions, its CounterpartyCapacity and regulatory restrictions (for example, a fund may not be sold to

the public unless it has been registered for that purpose with the relevant authority; that is why this specification does not explicitly say whether,

if the Counterparty is a distributor, it is restricted to private placement or free to sell the Company's funds by public offer).

If several Products and ProductExclusions are defined, the result should be the relative complement of the union of all Products with respect to

the union of all ProductExclusions. The same principle applies to Markets and MarketExclusions. Example:

An agreement has defined two sets of Products P1 and P2 and two sets of ProductExclusions P3 and P4.

The set of Products to which the Counterparty has rights under the agreement is therefore (P1 ∪ P2) (P3 ∪ P4).

A TransactionCharge or PeriodicCharge (both of which are defined later in this document) might refer to products that are not members of the

set of Products defined by this top-level Terms rule. That is because the products might be related to another agreement between the parties or

to another agreement between the Company and another member of the Counterparty's group or possibly vice versa. In that case, the

Counterparty will have the right to have holdings in the related products taken into account when determining the transaction charge and period

charge rates but it will have no other rights over them under the terms of the agreement (e.g., in the case of pooled funds it will have no right to

distribute them).

TransactionChargeSet and PeriodicChargeSet are optional because it is possible that some agreements are made on terms that do not require

these payments to be made. Payment and Report are optional because, (i) if no transaction charges or periodic charges are defined, no

payments or reports will be necessary and (2) some parties prefer to maintain such details separately.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-22-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 23

Rule

Affiliate = PartyIdentification, {PartyIdentification}, [AccessionDate, [SecessionDate]], {ContactDetails};

Synopsis

A party whom the Counterparty wishes to benefit from the terms of this agreement.

PartyIdentification Refer to the party by any BIC, proprietary identifier or name and address.

AccessionDate Date upon which the party became the Counterparty's affiliate.

SecessionDate Date upon which the party ceased to be the Counterparty's affiliate.

ContactDetails Name of a person or department and communication address at which the affiliate can be contacted.

Typology and constraints

PartyIdentification: Defined in this document.

AccessionDate: ISO 20022 ISODate

SecessionDate: ISO 20222 ISODate

ContactDetails: Defined in this document.

User guide

PartyIdentification may be given in more than one form, e.g., BIC and/or LEI and or a proprietary identifier and/or a name and address provided

that each form given refers to the same unique affiliate.

AccessionDate and SecessionDate should be provided if they are known.

Rule

Agreement = AgreementID, VersionNumber, [ExecutionDate], [LegalAspects], [TermAndTermination];

Synopsis

The heads of the legal Agreement comprise the following elements:

AgreementID A text reference that the parties agree to assign to the agreement to aid their communication about the agreement.

VersionNumber A number to discriminate this agreement from any others that the parties might have made under the same reference.

ExecutionDate The date upon which this version of the agreement was executed.

LegalAspects The clauses, variations, law and jurisdiction that are the legal foundation of the agreement.

TermAndTermination The term of the agreement and any applicable termination notice periods.

Typology and constraints

AgreementID: ISO 20022 Max35Text.

VersionNumber: ISO 20022 Max35Text.

ExecutionDate: ISO 20022 ISODate.

LegalAspects: Defined in this document.

TermAndTermination: Defined in this document.

User guide

If the parties wish to track their business through order routing systems, they may ensure their anonymity (whilst preserving a unique identifier)

by concatenating the AgreementID and VersionNumber values into a text string and transforming it using a suitable one-way hashing function,

and using the hash digest as the tracking number.

A VersionNumber may be assigned to an agreement only once; it may never be reused. It may, however, be cited any number of times in

correspondence about the agreement to which it refers.

Rule

AgreementSectionCrossReference = TransactionChargeNumber | PeriodicChargeNumber;

Synopsis

Defines the relationship between a payment mandate and the charge mandates (e.g., one or several TransactionCharges and/or

PeriodicCharges) of the agreement.

Typology and constraints

TransactionChargeNumber: ISO 20022 Max3NumberNonZero, > 0.

PeriodicChargeNumber: ISO 20022 Max3NumberNonZero, > 0.

User guide

Every payment mandate must refer to at least one charge mandate and every charge mandate must appear in at least one payment mandate. A

payment mandate may refer to more than one charge mandate where the parties wish to settle through a single account. Several payment

mandates may refer to the same charge mandate where the parties wish to settle in more than one currency.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-23-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 25

Rule

CashFlow = CashFlowType, [CashFlowThresholdRelative], [CashFlowThresholdAbsolute];

Synopsis

Prepare a PeriodicCharge using a cash flow adjusted valuation:

CashFlowType Use a straight or backward cash flow adjustment method.

CashFlowThresholdRelative Cash flow adjustment is to be applied only if the cash flow in the period exceeds the value of the relevant

portfolio measured at the start of the PeriodicChargePeriod.

CashFlowThresholdAbsolute Cash flow adjustment is to be applied if the cash flow in the period exceeds this absolute measure during

the PeriodicChargePeriod.

Typology and constraints

CashFlowType: Defined in this document.

CashFlowThresholdRelative: ISO 20022 PercentageRate, > 0.

CashFlowThresholdAbsolute: Defined in this document.

User guide

If neither CashFlowThresholdRelative nor CashFlowThresholdAbsolute are defined then CashFlow must be applied.

If CashFlowThresholdRelative is defined then CashFlow should not be applied unless the cash movement for the HoldingAddress in the

PeriodicChargePeriod expressed as a percentage of the value of the assets at the HoldingAddress measured at the start of the

PeriodicChargePeriod exceeds the threshold.

If CashFlowThresholdAbsolute is defined then CashFlow should not be applied unless the cash movement for the HoldingAddress in the

PeriodicChargePeriod exceeds the amount stated.

If CashFlowThresholdRelative and CashflowThresholdAbsolute are silmultaneously defined then CashFlow should not be applied unless both of

the thresholds are exceeded (i.e., a logical AND test).

Rule

CashFlowThresholdAbsolute = Amount, Currency;

Synopsis

Set a threshold for the application of a cash flow adjustment method by reference to an amount and a currency.

Typology and constraints

Amount: ISO 20022 Number, > 0.

Currency: ISO 20022 CurrencyCode.

User guide

See rule CashFlow.

Rule

CashFlowType = 'Straight' | 'Backward';

Synopsis

Determine whether a cash flow adjustment is to be calculated using the straight or the backward method.

Typology and constraints

CashFlowType is an enumerated type implemented as the following four-letter codes:

'STRT' | 'BKWD'.

User guide

See Part 5 of this document.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-25-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 26

Rule

ChequeDetails = [Reference], Currency, PayeeID, AgreementSectionCrossReference, {AgreementSectionCrossReference};

Synopsis

Charges will be paid by one or more cheques using the following information:

Reference The reference that the parties have agreed to attach to the advice note covering each cheque.

Currency The currency in which the cheque is to be issued.

PayeeID The party to whom the cheque will be payable.

AgreementSectionCrossReference References to the charge mandates for which this cheque mandate is to be used.

Typology and constraints

Reference: ISO 20022 Max35Text.

Currency: ISO 20022 CurrencyCode.

PayeeID: ISO 20022 NameAndAddress5.

AgreementSectionCrossReference: Defined in this document.

User guide

Cheques are uncommon but some countries still use them, and so this scheme must define a rule by which they can be used.

AgreementSectionCrossReferences define the relationship between a cheque mandate and the charge mandates (e.g., one or several

TransactionCharge and/or PeriodicCharge) of the agreement.

AgreementSectionCrossReferences are not intended to be quoted directly in a cheque cover letter but they may be quoted in the charge

statements and reports that are transmitted between the parties to an agreement. If the parties wish to agree to use operational references in

their cheque cover letters to help them trace the payment to the agreement and the underlying TransactionCharges and/or PeriodCharges, they

should define them in Reference.

Payments may be made separately according to the parties' preferences for arranging their business functionally, geographically or by product,

or to keep periodic charges separate from transaction charges.

Rule

Company = PartyIdentification, {PartyIdentification} [CompanyCapacity], ContactDetails, {ContactDetails};

Synopsis

Define the name and address of the Company and its contact details.

Typology and constraints

PartyIdentification: Defined in this document.

CompanyCapacity: Defined in this document.

ContactDetails: Defined in this document.

User guide

PartyIdentification may be given in more than one form, e.g., BIC and/or LEI and or a proprietary identifier and/or a name and address provided

that each form given refers to the same unique Company.

When more than one member of the Company group is a party to the agreement, CompanyCapacity may be used to indicate the capacity in

which each member of Company group is acting. For example, it may be acting as management company to certain funds or as the legal

representative in a certain jurisdiction.

Rule

CompanyCapacity = CompanyCapacityCode | Proprietary;

Synopsis

A Company's capacity may be defined by a pre-defined capacity code or by a proprietary capacity code.

Typology and constraints

CompanyCapacityCode: Defined in this document.

Proprietary: ISO 20022 GenericIdentification30.

User guide

CompanyCapacityCode provides a set of common pre-defined capacities in which Company may act. The term "Proprietary" enables the parties

to use an alternative code (alphanumeric, exactly 4 characters long) provided that they agree what it is and who issued it. For example, if the

message is being used in the context where Company is a platform and Counterparty is a participating member, the parties may agree

proprietary capacity codes that are suitable for their purposes. The meaning of these codes would be defined by the proprietary code issuer.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-26-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 28

Rule

ContactDetails = Name, [Title], [GivenName], [Role], [PhoneNumber], [FaxNumber], [EmailAddress], [SpecialInstructions];

Synopsis

Name of a person or department and communication address at which the affiliate can be contacted.

Name The name of the person or the department.

Title If a person, their title (e.g., Mr, Mrs, Ms, Doctor).

GivenName If a person, their given name or the name by which they are known.

Role If a person, their role.

PhoneNumber The telephone number to be used for contact.

FaxNumber The facsimile number to be used for contact.

EmailAddress The email address to be used for contact.

SpecialInstructions Any special instructions to be used when making contact.

Typology and constraints

Name ISO 20022 Max70Text.

Title ISO 20022 Max70Text.

GivenName ISO 20022 Max70Text.

Role ISO 20022 Max70Text.

PhoneNumber ISO 20022 PhoneNumber.

FaxNumber ISO 20022 PhoneNumber.

EmailAddress ISO 20022 Max256Text.

SpecialInstructions ISO 20022 Max2000Text.

User guide

Not defined.

Rule

Counterparty = PartyIdentification, {PartyIdentification}, [OfferRights], CounterpartyCapacity, {Affiliate}, ContactDetails, {ContactDetails};

Synopsis

Define the name and address of the Counterparty, its offer rights and optionally provide further information on the capacity in which it acts under

the terms of this agreement. Also name any Counterparty affiliates that will benefit from the terms of the agreement and the contact persons.

Typology and constraints

PartyIdentification: Defined in this document.

OfferRights: Defined in this document.

CounterpartyCapacity: Defined in this document.

Affiliate: PartyIdentification, defined in this document.

ContactDetails: Defined in this document.

User guide

PartyIdentification may be given in more than one form, e.g., BIC and/or LEI and or a proprietary identifier and/or a name and address provided

that each form given refers to the same unique Counterparty.

OfferRights should only be available if Markets have been defined.

Rule

CounterpartyCapacity = CounterpartyCapacityCode | Proprietary;

Synopsis

A Counterparty's capacity may be described by a pre-defined capacity code or by a proprietary capacity code.

Typology and constraints

CounterpartyCapacityCode: Defined in this document.

Proprietary: ISO 20022 GenericIdentification30.

User guide

CounterpartyCapacityCode provides a set of common pre-defined capacities in which Counterparty may act. The term "Proprietary" enables the

parties to use an alternative code (alphanumeric, exactly 4 characters long) provided that they agree what it is and who issued it.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-28-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 29

Rule

CounterpartyCapacityCode = 'Platform' | 'Distributor' | 'IntroducingAgent' | 'ProductPackager' | 'InstitutionalInvestor' | 'PlacementAgent' |

'CentralisingAgent';

Synopsis

The Counterparty may be acting in the capacity of:

Platform A party providing administration and execution services to sales agents and/or intermediaries.

Distributor An intermediary distributing shares to underlying investors or executing orders as global custodian.

IntroducingAgent An introducing agent.

ProductPackager A product packager, such as a life company or a structured product manufacturer.

InstitutionalInvestor An institutional investor, investing for its own account.

Typology and constraints

CounterpartyCapacityCode is an enumerated type implemented as the following four-letter codes:

'PLFM' | 'DIST' | 'INAG' | 'PKGR' | 'INIV' | 'PLMA' | 'CENA'.

User guide

Counterparty should select the role that it considers to be most representative of the capacity in which it will act.

These capacity descriptions are intended to be generally accepted industry roles. They are not meant to be precise legal defintions. If general

roles would be unsatisfactory or if the parties want more definition than is provided by this rule, they may adopt proprietary capacity codes with

attendant definitions in as much detail as they wish (see the rule CounterpartyCapacity → Proprietary).

Rule

CreditTransferDetails = [Reference], Currency, [IntermediaryAgent1], [IntermediaryAgent1Account], [IntermediaryAgent2],

[IntermediaryAgent2Account], [CreditorAgent], [CreditorAgentAccount], [Creditor], CreditorAccount, AgreementSectionCrossReference,

{AgreementSectionCrossReference};

Synopsis

Describes one or more bank accounts to which a party will make credit transfers in respect of the charges due under the terms of the

agreement:

Reference An operational reference that the parties have agreed to attach to each payment.

Currency The currency of the CreditorAccount.

IntermediaryAgent1 The first intermediary agent's identity.

IntermediaryAgent1Account The first intermediary agent's account.

IntermediaryAgent2 The second intermediary agent's identity.

IntermediaryAgent2Account The second intermediary agent's account.

CreditorAgent The creditor agent's identity.

CreditorAgentAccount The creditor agent's account.

Creditor The creditor's identity.

CreditorAccount The creditor's account.

AgreementSectionCrossReference Cross references to the related transaction charge and periodic charge mandates.

Typology and constraints

Reference ISO 20022 Max35Text.

Currency ISO 20022 CurrencyCode.

IntermediaryAgent1 ISO 20022 FinancialInstitutionIdentification7Choice.

IntermediaryAgent1Account ISO 20022 AccountIdentificationAndName3.

IntermediaryAgent2 ISO 20022 FinancialInstitutionIdentification7Choice.

IntermediaryAgent2Account ISO 20022 AccountIdentificationAndName3.

CreditorAgent ISO 20022 FinancialInstitutionIdentification7Choice.

CreditorAgentAccount ISO 20022 AccountIdentificationAndName3.

Creditor PartyIdentificationChoice, defined in this document.

CreditorAccount ISO 20022 AccountIdentificationAndName3.

AgreementSectionCrossReference Defined in this document.

User guide

This rule defines the creditor side of a payment chain.

AgreementSectionCrossReferences define the relationship between a credit transfer mandate and the charge-earning mandates (e.g., one or

several TransactionCharges and PeriodicCharges) of the agreement.

AgreementSectionCrossReferences are not intended to be quoted directly within a SWIFT credit transfer message but they may be quoted in

the charge statements and reports that are transmitted between the parties to an agreement. If the parties wish to agree to use operational

references in their SWIFT payment messages to help trace the payment to the agreement and the underlying TransactionCharges and/or

PeriodicCharges, they should define them in Reference. Parties who wish to use Reference in SWIFT FIN messages should limit the length of

the field to 16 characters. Parties should also take care to ensure that the destination system that will process the message payload is capable

of handling the character set used within the message. For example, many systems need special configuration to support character sets other

than Latin-1.

Payments could be made through several mandates according to the parties' preferences for arranging their business functionally,

geographically or by product, or to keep periodic charges separate from transaction charges, or for any other reason that the parties choose.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-29-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 31

Rule

DirectDebitDetails = [Reference], Currency, [Debtor], DebtorAccount, AgreementSectionCrossReference, {AgreementSectionCrossReference};

Synopsis

Describes the debtor's bank account from which the creditor can directly debit the charges due under the terms of the agreement:

Reference An operational reference that the parties have agreed to attach to each payment.

Currency The currency of the DebtorAccount.

Debtor The debtor's identity.

DebtorAccount The debtor's account.

AgreementSectionCrossReference Cross references to the related transaction charge and periodic charge mandates.

Typology and constraints

Reference ISO 20022 Max35Text.

Currency ISO 20022 CurrencyCode.

Debtor PartyIdentification, defined in this document.

DebtorAccount ISO 20022 AccountIdentificationAndName3.

AgreementSectionCrossReference Defined in this document.

User guide

Not defined

Rule

EligiblePosition = IncrementalTrade, DecrementalTrade, [SpecialInstructions];

Synopsis

Determine a convention for measuring positions with respect to trade date or settlement date, and whether to include or exclude certain

positions from a charge calculation:

IncrementalTrade Trades that increase the Counterparty's positions (subscriptions, switches in, transfers in).

DecrementalTrade Trades that decrease the Counterparty's positions (redemptions, switches out, transfers out).

SpecialInstructions Instructions to include or exclude certain positions.

Typology and constraints

IncrementalTrade: Defined in this document.

DecrementalTrade: Defined in this document.

SpecialInstructions: ISO 20022 Max2000Text.

User guide

The parties should set the trade date and settlement date parameters consistently for all trades that increase the Counterparty's position and for

all trades that decrease the Counterparty's position. Therefore, these are the possible combinations for incremental and decremental trades:

IncrementalTrade: TRAD TRAD SETT SETT

DecrementalTrade: TRAD SETT TRAD SETT

For the purposes of this rule the German concept of "valuta" is considered to be equivalent to 'SETT'.

The SpecialInstructions field may be used to include or exclude certain positions when calculating periodic charges. For example:

(1) When transferring accounts from one or more central transfer agents onto a consolidating platform, positions that existed before the

consolidation date can be identified and treated separately.

(2) If a promoter / fund manager wishes to make a special promotion, in which the special rate persists for assets that are raised during the

promotional period, the positions can be identified and treated separately.

The ability to identify positions with respect to time is a function of the system in which the shares are registered (not every system can do it).

The SpecialInstructions free text field provides the flexibility to identify positions in a way that is compatible with the underlying system.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-31-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 32

Rule

FeeSharePeriodicCharge = FeeSharePeriodicChargeCode | Proprietary, RateTable, [LookupFrequency];

Synopsis

Determine:

FeeSharePeriodicChargeCode The type of fee share periodic charge by reference to a standard code.

Proprietary The type of fee share periodic charge by reference to a proprietary code.

RateTable The rate at which the periodic charge should be applied.

LookupFrequency How often the rate should be looked up.

Typology and constraints

FeeSharePeriodicChargeCode: Defined in this document.

Proprietary: ISO 20022 GenericIdentification30.

RateTable: Defined in this document.

LookupFrequency: Defined in this document.

User guide

PeriodicCharge → PeriodicChargePeriod <= LookupFrequency <= PeriodicCharge → CalculationFrequency, where the symbol "<=" means that

the term on the left hand side must be equal to or less frequent than the term on the right hand side.

If LookupFrequency is not defined then it is equal to CalculationFrequency.

Rule

FeeSharePeriodicChargeCode = 'ManagementFee' | 'DistributionFee' | 'Management+DistributionFee' | 'TotalExpenseRatio' | 'OngoingCharge' |

'TotalExpenseRatioCap' | 'OngoingChargeCap';

Synopsis

A fee share periodic charge is based upon the rate of a fund's management fee, the distribution fee, the sum of the two, the fund's total expense

ratio (TER), the ongoing charge (OGC), a total expense ratio cap or an ongoing charge cap.

Typology and constraints

FeeSharePeriodicChargeCode is an enumerated type implemented as the following four-letter codes:

'MANF' | ''DISF' | 'MADF' | 'TERF' | 'OGCF' | 'TERC' | 'OGCC'.

User guide

FeeSharePeriodicChargeCode is intended for use in pooled funds, which publish the relevant rates in their prospectuses or their financial

reports.

The fund's total expense ratio will be calculated according to the methodology used by the fund's management company. Counterparty should

inform itself of that methodology before using that option. The fund's ongoing charge will be calculated according to the methodology imposed

upon the fund by its home state regulations governing the calculation of ongoing charges for use in point-of-sales materials (e.g., key

information documents in the European Union).

TotalExpenseRatioCap and OngoingChargeCap differ from the other types of this charge in that the charge payable is the monetary value of the

TER or OCG (calculated monthly using unaudited data) in excess of the TER or OGC cap described in the rate table. See also rule

RateTableRow.

Rule

FixedCharge = FixedChargeType, Amount, Currency;

Synopsis

A PeriodicCharge or a TransactionCharge may be a fixed amount:

FixedChargeType The description of the charge.

Amount The financial amount of the charge.

Currency The currency in which Amount is expressed.

Typology and constraints

FixedChargeType: Defined in this document.

Amount: ISO 20222 Number, > 0.

Currency: ISO 20022 CurrencyCode.

User guide

Not defined.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-32-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 33

Rule

FixedChargeType = FixedChargeDescription | FixedChargeCode | Proprietary;

Synopsis

A fixed charge may be described using a text description, a standard charge code or a proprietary charge code.

Typology and constraints

FixedChargeDescription: ISO 20022 Max2000Text.

FixedChargeCode: Defined in this document.

Proprietary: ISO 20022 GenericIdentification30.

User guide

Standard charge codes are defined by FixedChargeCode. New codes can be defined as proprietary codes provided that the parties to the

agreement agree upon their definition.

Rule

FixedChargeCode = 'BenchmarkChange' | 'MinimumPeriodicChargeAmount';

Synopsis

Fixed charges may be applied for the following reasons:

BenchmarkChange When the parties to the agreement change the benchmark that they use to measure the

performance of a Product.

MinimumPeriodicChargeAmount To ensure that the PeriodicCharges applicable in a PeriodicChargePeriod are not less than a

defined amount.

Typology and constraints

FixedChargeCode is an enumerated type implemented as the following four-letter codes:

'BMCH' | 'MPCA'.

User guide

A BenchmarkChange charge is the fixed charge applicable when the Counterparty requests the Company to change the benchmark that is used

to measure the performance of a product, whether or not the benchmark is used in a performance fee. The charge is applied to each product;

for example, five products measured to a common benchmark 'A' will give rise to five fixed charges when they change to a common benchmark

'B'.

A MinimiumPeriodicChargeAmount is the total PeriodicCharge that shall be applied in the event that the sum of all PeriodicCharges (excluding

PerformanceBasedCharges) calculated in a PeriodicChargePeriod are less than the MinimiumPeriodicChargeAmount.

Rule

HoldingAddress = HoldingAddressType, HoldingAddressNumber, SharedAccount, [SharedAccountHoldingUpdateFrequency], [EligiblePosition];

Synopsis

Describe the addresses at which the Counterparty's investments are held:

HoldingAddressType The address refers to a holding at a transfer agency or a custodian or an internal accounting system

or at Clearstream, Euroclear or FundSettle.

HoldingAddressNumber The address number.

SharedAccount The HoldingAddressType is an account-level address type and the account is shared with one

or more other beneficial owners.

SharedAccountHoldingUpdateFrequency The frequency at which the Counterparty's interest in a shared account will be analysed.

EligiblePosition Positions are to be measured by trade date or settlement date and optionally included or excluded.

Typology and constraints

HoldingAddressType: Defined in this document.

HoldingAddressNumber: ISO 20022 Max35Text.

SharedAccount: ISO 20022 YesNoIndicator.

SharedAccountHoldingUpdateFrequency: Defined in this document.

EligiblePosition: Defined in this document.

SharedAccountHoldingUpdateFrequency must only be used if SharedAccountFlag is set to 'Yes' or 'True'.

User guide

Some parties prefer explicitly to define the SharedAccountHoldingUpdateFrequency for shared accounts, but it is not compulsory and charge

calculation agents will infer a frequency from HoldingValue. Shared accounts are not normally analysed more frequently than monthly.

In some circumstances, the Counterparty may wish to include in the agreement an iCSD account number (e.g., Clearstream or Euroclear)

whereas the Company's charge calculation agent may need to know the agent code that will be issued by the Company's transfer agent. Both

are valid HoldingAddresses, although they point to the same holdings. It is acceptable to include both in the agreement provided that the charge

calculation agent ensures that the holdings are not double-counted when calculating charges.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-33-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 36

Rule

ISINAndDescription = ISIN, [Description];

Synopsis

An international securities identification number and a descriptor (typically the full name of the share class).

Typology and constraints

ISIN: ISO 20022 ISINIdentifier.

Description: ISO 20022 Max140Text.

User guide

Not defined.

Rule

Jurisdiction = Country, [Name];

Synopsis

The courts of the jurisdiction to which the parties will submit in respect of the agreement.

Typology and constraints

Country: ISO 20022 CountryCode.

Name: ISO 20022 Max70Text.

User guide

Not defined.

Rule

LatePaymentPenalty = PenaltyRate, BaseRate;

Synopsis

Determines any late payment penalties that may be agreed between the parties:

PenaltyRate The penalty rate of interest to be applied, set as an annual equivalent rate.

BaseRate The base rate of interest with respect to which penalty interest should be calculated.

Typology and constraints

PenaltyRate: ISO 20022 PercentageRate, >= 0.

BaseRate: ISO 20022 Max350Text.

User guide

LatePayment penalties should become payable from the day following the expiry of the payment deadline set by the term SettlementWithin and

be calculated daily using the day count convention actual/actual.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-36-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 37

Rule

LegalAspects = LegalTerms, {LegalVariation}, ApplicableLawAndJurisdiction, [MostFavouredTerms];

Synopsis

The essential legal framework for the agreement:

LegalTerms The legal terms of the agreement (industry standard terms or proprietary terms).

LegalVariation Any variation to the LegalTerms.

ApplicableLawAndJurisdiction The law which will govern the agreement and the courts to which the parties will submit.

MostFavouredTerms The Company has most favoured nation status and in what respect.

Typology and constraints

LegalTerms: ISO 20022 Max350Text.

LegalVariation: ISO 20022 Max350Text.

ApplicableLawAndJurisdiction: Defined in this document.

MostFavouredTerms: ISO 20022 Max2000Text.

User guide

LegalTerms is a text field that can contain the name of a model agreement, such as a model fund sales agreement or the Swiss Funds

Association model distribution agreement, or a reference to a proprietary legal agreement.

An agreement may have several legal variations. For example:

(1) A generic model fund sales agreement may be extended by a model support annex that is relevant to a specific sector, such as the

structured products sector, the life sector or the platform sector.

(2) A model agreement may be amended by the parties, the amendments being recorded in a legal variation document.

(3) An enabling agreement may be applied, such as may happen when a Counterparty gives a Company notice of a new sub-distributor's

appointment.

(4) A proprietary agreement may be modified by a side letter.

LegalVariation is a free text field, which allows the parties to describe the legal variation in natural language. It may take the form of a reference

to a document containing one or more statements of variation from the contracted legal terms of the agreement. It may also be a reference to a

model document (e.g., a sector-specific extension of a master model agreement) or a proprietary document drawn up by the contracting parties.

For example: "Amendment to the Agreement between ABC Promoter and XYZ Distributor dated 10 May 2011."

Rule

LookupFrequency = 'Daily' | 'Weekly' | 'Monthly' | 'Quarterly' | 'HalfYearly' | 'Yearly';

Synopsis

How often in a period the Counterparty's total holding values should be used to look up the Rate:

Daily Upon each calendar day.

Weekly On the last day of a calendar week (Sunday).

Monthly On the last day of a calendar month (31 January, 28/29 February, 31 March, 30 April, etc).

Quarterly On the last day of a calendar quarter (31 March, 30 June, 30 September, 31 December).

HalfYearly On the last day of a calendar half-year (30 June, 31 December).

Yearly On the last day of a calendar year (31 December).

Typology and constraints

LookupFrequency is an enumerated type implemented as the following four-letter codes:

'DAIL' | 'WEEK' | 'MNTH' | 'QUTR' | 'SEMI' | 'YEAR'.

User guide

The start of a calendar week is each Monday (ISO 8601). If LookupFrequency is not defined, RateTable lookup will happen at the same

frequency as CalculationFrequency.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-37-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 40

Rule

OutPerformBenchmark = Description, [TickerIdentifier], CompareMethod;

Synopsis

Defines the benchmark that is used in performance fee calculations:

Description Free text description of the benchmark used to determine the performance of a portfolio.

TickerIdentifier Free text short representation of the benchmark description, given by its sponsor.

CompareMethod Describes how the outperformance of a portfolio is calculated with respect to the benchmark.

Typology and constraints

Description: ISO 20022 Max350Text.

TickerIdentifier: ISO 20022 TickerIdentifier (which is ISO 20022 Max35Text).

CompareMethod: Defined in this document.

User guide

Not defined.

Rule

PartialChargePeriodConvention = 'Long' | 'Short';

Synopsis

Determine how to calculate charges in the event that a PeriodicCharge does not align to the end of a calendar month, quarter, half-year or year:

Long Extend the adjacent period to create a long period.

Short Calculate charges for the partial period separately from the adjacent period.

Typology and constraints

PartialChargePeriodConvention is an enumerated type implemented as the following four-letter codes:

'LONG' | 'SHOR'

User guide

In the example where a PeriodicCharge starts on 12 December in an agreement with quarterly calculation periods:

A long calculation period would run from 12 December to 31 March inclusive.

A short calculation period would run from 12 to 31 December inclusive.

Rule

PartyIdentification = AnyBIC | LEIIdentifier | ProprietaryID | NameAndAddress;

Synopsis

Identify a party by reference to:

AnyBIC Its business identifier code (ISO 9362).

LEIIdentifier Its legal entity identifier (ISO 17442).

ProprietaryID A proprietary identifier.

NameAndAddress A name and address.

Typology and constraints

AnyBIC ISO 20022 AnyBICIdentifier.

LEIIdentifier ISO 20022 LEIIdentifier.

ProprietaryID ISO 20022 GenericIdentification1.

NameAndAddress ISO 20022 NameAndAddress5.

User guide

Not defined.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-40-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 41

Rule

Payee = 'Company' | 'Counterparty';

Synopsis

Determine who the beneficiary of a PeriodicCharge is:

Company The Company (e.g., in the case of a segregated management fee).

Counterparty The Counterparty (e.g., in the case of a pooled fund periodic charge).

Typology and constraints

Payee is an enumerated type implemented as the following four-letter codes:

'CPNY' | 'CPTY'

User guide

Not defined.

Rule

Payment = PaymentNumber, [PaymentName], PaymentInstrument;

Synopsis

Payment mandates contain a mandate PaymentNumber, a PaymentName (a short name given by the Company for ease of reference) and a

PaymentInstrument.

Typology and constraints

PaymentNumber: ISO 20022 Max3NumberNonZero, > 0.

PaymentName: ISO 20022 Max70Text.

PaymentInstrument: Defined in this document.

The PaymentNumber assigned to each Payment section should be unique within the scope of the agreement. For good administration, these

numbers should be assigned in a contiguous sequence starting with '1'.

User guide

The PaymentNumber enables the parties to an agreement to uniquely refer to a payment mandate in their correspondence.

Rule

PaymentCurrency = PaymentCurrencyBasis | Currency;

Synopsis

Determine in what currency transaction charges and/or periodic charges will be paid:

PaymentCurrencyBasis In multiple currencies.

Currency In a single currency.

Typology and constraints

PaymentCurrencyBasis: Defined in this document.

Currency: ISO 20022 CurrencyCode.

User guide

If the Currency option is selected, all payments will be converted into that currency in accordance with the Company's normal operating

procedures (i.e., auto FX is enabled).](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-41-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 42

Rule

PaymentCurrencyBasis = 'BaseCurrency' | 'ShareClassCurrency' | 'MandateCurrency' | 'InvestmentCurrency';

Synopsis

Payables for transaction charges and periodic charges should be:

BaseCurrency Paid in the fund's base currency (with automatic FX as necessary).

ShareClassCurrency Paid in the currency of the share class in respect of which they were calculated.

MandateCurrency Paid in the currency of the sub-mandate in respect of which they were calculated.

InvestmentCurrency Paid in the currency in which the investments are denominated.

Typology and constraints

PaymentCurrencyBasis is an enumerated type implemented as the following four-letter codes:

'BCCY' | 'SCCY' | 'MCCY' | 'ICCY'.

User guide

The payment basis applies to pooled funds and segregated mandates as follows:

Basis Pooled fund Segregated mandate

BCCY The base currency of each fund (sub-fund within an umbrella) The reporting currency of the top-level mandate

SCCY The currency of each share class Not applicable

MCCY Not applicable The reporting currency of the sub-mandate

ICCY Not applicable The investment currency of the assets within a mandate

If the parties wish to ensure auto FX to a single currency they should use the option Currency in the rule PaymentCurrencyBasis.

Rule

PaymentInstrument = PayThruFund | CreditTransferDetails | ChequeDetails | DirectDebitDetails, [SpecialInstructions];

Synopsis

Payments of charges due can be made in four ways:

PayThruFund Through a purchase or sale of securities for or from a specific holding account.

CreditTransferDetails Paying cash to one or more bank accounts.

ChequeDetails Issuing one or more cheques.

DirectDebitDetails Directly debiting the debtor's bank account.

SpecialInstructions Any special instruction that might aid the understanding or application of the payment instruction.

Typology and constraints

PayThruFund: Defined in this document.

CreditTransferDetails: Defined in this document.

ChequeDetails: Defined in this document.

DirectDebitDetails: Defined in this document.

SpecialInstructions: ISO 20022 Max2000Text.

User guide

If a payment is by the Company to the Counterparty (e.g., in the case of a pooled fund commission) and the payment instrument is

PayThruFund then the payment will be made as a purchase of shares or units the Company's funds indicated in that instrument.

If a payment is by the Counterparty to the Company (e.g., in the case of management fees for a pooled account) and the payment instrument is

PayThruFund then the Company will take payment by selling the investments indicated in that instrument and retaining the proceeds.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-42-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 43

Rule

PaymentMechanism = 'Company' | 'Counterparty';

Synopsis

Determine how periodic charge payments are initiated at the end of a charging period:

Company The Company will initiate the process.

Counterparty The Counterparty will initiate the process.

Typology and constraints

PaymentMechanism isan enumerated type implemented as the following four-letter codes:

'CPNY' | 'CPTY'.

User guide

In the case of a segregated account it will be normal for the Company to initiate the process by sending an invoice to the Counterparty. In the

case of pooled funds it is normal for the Company to initiate the process by preparing and paying charges and automatically, sending a

statement to the Counterparty. However, sometimes the Counterparty prefers to initiate the payment of pooled fund periodic charges by sending

an invoice to the Company, and in some markets this is common.

Rule

PayThruFund = PayThruFundType, [Reference], AgreementSectionCrossReference, {AgreementSectionCrossReference};

Synopsis

Payment of a transaction charge and/or a periodic charge is to be made through a purchase or sale of securities for or from one or several

holding accounts:

PayThruFundType The accounts and securities through which the payment is to be made.

Reference The operational references that the parties have agreed to attach to each related purchase or sale of

securities.

AgreementSectionCrossReference The transaction charges and periodic charges for which this PayThruFund mandate is to be used.

Typology and constraints

PayThruFundType: Defined in this document.

Reference: ISO 20022 Max35Text.

AgreementSectionCrossReference: Defined in this document.

User guide

Not defined.

Rule

PayThruFundFundSet = HoldingAddressPath, HoldingAddressNumber, PayThruFundPayment, {PayThruFundPayment};

Synopsis

Payment of a transaction charge and/or a periodic charge is to be made through a purchase or sale of one or several specific securities for or

from a single specific holding account:

HoldingAddressPath Where the account is.

HoldingAddressNumber The number of the account.

PayThruFundPayment The purchase or sale instruction.

Typology and constraints

HoldingAddressPath: ISO 20022 Max350Text.

HoldingAddressNumber: ISO 20022 Max35Text.

PayThruFundPayment: Defined in this document.

User guide

Not defined.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-43-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 44

Rule

PayThruFundPayment = ISINAndDescription, [Ratio];

Synopsis

A security through the purchase or sale of which the payment of a transaction charge or a periodic charge may be made. The Ratio is used to

allocate the payment when this security is one of several through which the payment is to be made.

Typology and constraints

ISINAndDescription: Defined in this document.

Ratio: ISO 20022 Max3NumberNonZero, > 0.

User guide

If Ratio is provided it must be provided for every security in the PayThruFundSet. For example, if three securities are provided with Ratios 3, 6

and 5 respectively, the total value of the payment should be allocated to them in the ratio 3:6:5. If Ratio is not provided then the total value

should be allocated equally to each security.

Rule

PayThruFundSingleAccount = HoldingAddressPath, HoldingAddressNumber;

Synopsis

Payment of a transaction charge and/or a periodic charge is to be made through a purchase or sale of one or several securities for or from this

specific account.

Typology and constraints

HoldingAddressPath: ISO 20022 Max350Text.

HoldingAddressNumber: ISO 20022 Max35Text.

User guide

The identity of the securities to purchase or sell is derived from the context of the charge:

If it is a charge payable by the Company to the Counterparty (e.g., a pooled fund periodic charge), purchases are to be made for the account

in the same securities on which the charges were calculated.

If it is a charge payable by the Counterparty to the Company (e.g., a segregated mandate management charge), sales are to be made from all

available securities in the account, equally weighted by value.

Rule

PayThruFundType = 'ProRata' | PayThruFundSingleAccount | (PayThruFundSet, {PayThruFundSet});

Synopsis

The payment of a transaction charge or periodic charge is to be made through a purchase or sale of securities:

ProRata In proportion to the holdings in the securites upon which the charge was earned, and in the same

holding accounts.

PayThruFundSingleAccount Through a purchase or sale of one or several securities for or from a specific account.

PayThruFundSet Through a purchase or sale of one or several specific securities for or from a single specific holding account.

Typology and constraints

ProRata: Literal.

PayThruFundSingleAccount: Defined in this document.

PayThruFundSet: Defined in this document.

User guide

Not defined.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-44-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 46

Rule

PerformancePeriodicCharge = ParticipationRate, [OutPerformBenchmark], PortfolioReturnMeasure, Hurdle, HighWaterMark, [OutPerformCap],

PerformancePeriod, SeriesAccounting, [SpecialConditions];

Synopsis

Defines the parameters for performance-based charges:

ParticipationRate The amount of the outperformance to be paid to the Company.

OutPerformBenchmark The benchmark for measuring outperformance

PortfolioReturnMeasure Whether portolio performance is to be measured net or gross of fees for performance fee calculations.

Hurdle The level of return that the portfolio must achieve before it can apply a performance fee.

HighWaterMark The highest net asset value of the portfolio during a performance period.

OutPerformCap The limit of outperformance at which the ParticipationRate will become zero.

PerformancePeriod The period of time in which the Company is eligible to earn a performance fee.

SeriesAccounting Whether series accounting should be applied (see user guide below).

SpecialConditions Any special conditions to the performance fee that have not been described by these parameters.

Typology and constraints

ParticipationRate: ISO 20022 PercentageRate, > 0.

OutPerformBenchmark: Defined in this document.

PortfolioReturnMeasure: Defined in this document.

Hurdle: ISO 20022 PercentageRate, > 0.

HighWaterMark: ISO 20022 YesNoIndicator.

OutPerformCap: ISO 20022 PercentageRate, > 0.

PerformancePeriod: Defined in this document.

SeriesAccounting: ISO 20022 YesNoIndicator.

SpecialConditions: ISO 20022 Max2000Text.

User guide

Hurdle should be set to zero if no hurdle is required.

If the SeriesAccounting flag is set (= "Yes" or "True"), assets purchased with funding provided by the Counterparty during the performance

period should be measured separately from previously funded assets, as if they were a series of unrelated asset pools. Two or more pools may

subsequently be combined into a single pool in the event that they crystallise a performance fee upon a common

PerformanceMeasurementDate.

Rule

PerformancePeriodStartConvention = PerformancePeriodStartConventionCode | Proprietary;

Synopsis

Determine the convention for starting a rolling period:

PerformancePeriodStartConventionCode Apply a standard convention.

Proprietary Apply a proprietary convention.

Typology and constraints

PerformancePeriodStartConventionCode: Defined in this document.

Proprietary: ISO 20022 GenericIdentification30.

User guide

Not defined.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-46-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 47

Rule

PerformancePeriodStartConventionCode = 'Neutral' | 'Progressive' | 'Adaptive';

Synopsis

Determine the convention for starting a performance period when there is insufficient portfolio performance history to make a complete

comparison with the benchmark:

Neutral For periods in which portfolio performance is not available, simulate it based on benchmark performance.

Progressive Calculate portfolio performance based on a one-year return in year one, a two-year return in year two, a three-year return

in year three etc.

Adaptive Apply the progressive convention and when a full portfolio performance history is available, recalculate the performance fee

for the entire period based on the now-available performance history and adjust the already-billed fees as necessary.

Typology and constraints

PerformancePeriodStartConventionCode is an enumerated type implemented as the following four-letter codes:

'NEUT' | 'PROG' | 'ADAP'.

User guide

If the initial performance period does not align to the PerformanceMeasurementDate, use PartialChargePeriodConvention.

Rule

PerformancePeriodType = PerformancePeriodTypeCode, [PerformancePeriodStartConvention], [PerformancePeriodHurdleConvention];

Synopsis

Determine whether the performance period is fixed or rolling, how to deal with part periods, and how to manage the hurdle in the case of a

rolling performance period:

PerformancePeriodTypeCode The performance period is fixed, extensible or rolling.

PerformancePeriodStartConvention The convention for starting a performance period.

PerformancePeriodHurdleConvention The convention for managing the hurdle in a performance period.

Typology and constraints

PerformancePeriodTypeCode: Defined in this document.

RollingStartConvention: Defined in this document.

RollingHurdleConvention: Defined in this document.

User guide

Not defined.

Rule

PerformancePeriodTypeCode = 'Fixed' | 'Extensible' | 'Rolling';

Synopsis

A performance period is:

Fixed Fixed to a definite duration expressed in years, after which a new period will begin.

Extensible Fixed to a definite duration expressed in years, but may be extended in the case of under-performance.

Rolling: Expressed as a rolling period of a specified duration.

Typology and constraints

PerformancePeriodTypeCode is an enumerated type implemented as the following four-letter codes:

'FIXD' | 'XTND' | 'ROLL'

User guide

In a fixed performance period, the duration of the period cannot exceed the limit of PerformancePeriodYears and a new performance period will

begin immediately after the limit of the current performance period is reached. In an extensible performance period, if portfolio performance

during the period is negative when the limit of PerformancePeriod is reached, the performance period will be extended until performance

recovers to par, immediately after which a new performance period will begin. In a rolling performance period, the duration of the performance

period is set by PerformancePeriodYears and rolls forward one year upon each PerformanceMeasurementDate.](https://image.slidesharecdn.com/opentermssyntaxissue02-160713172037/85/OpenTerms-Syntax-Issue-02-47-320.jpg)

![OpenTerms syntax and semantic definitions, issue 02, 12 July 2016 Page 49

Rule

PeriodicCharge = PeriodicChargeNumber, [PeriodicChargeName], PeriodicChargeType, TermStartDate, TermEndDate, Product, {Product},

{ProductExclusion}, PeriodicChargeHolding, [PeriodicChargeAggregation], CalculationFrequency, PeriodicChargePeriod,

PartialChargePeriodConvention, PeriodDays, YearDays, Payee, Discount, FeeSharePeriodicCharge | VolumePeriodicCharge |

PerformancePeriodicCharge | FixedCharge;

Synopsis

An agreement may contain several sets of periodic charge terms, each of which is determined by:

PeriodicChargeNumber A unique identifier that allows easy reference to objects of this type in an agreement.

PeriodicChargeName A short name given by the Company for ease of reference.

PeriodicChargeType Whether this is a fee share, a volume-based, or a performance-based charge.

TermStartDate Date on which this periodic charge becomes valid (i.e., valid on and from this date).

TermEndDate Date after which this periodic charge ceases to be valid (i.e., valid on this date but not after).

Product The products to which the periodic charges are to be applied.

ProductExclusion Any members of a set of products to which the periodic charges should not be applied.

PeriodicChargeHolding The holding addresses to which the periodic charges are to be applied.

PeriodicChargeAggregation The products and holding addresses which are to be taken into account when looking up the

periodic charge rate in RateTable.

CalculationFrequency The frequency with which the periodic charges are calculated.

PeriodicChargePeriod The duration of this periodic charge period.

PeriodDays The number of days in the periodic charge period.

YearDays The number of days in the year.

Payee The beneficiary of the periodic charge.

Discount The charge is a deduction from other amounts owed by the payor (see user guide).

FeeSharePeriodicCharge The periodic charge is based on a fee share.

VolumePeriodicCharge The periodic charge is based on asset volume.

PerformancePeriodicCharge The periodic charge is based on outperformance relative to certain conditions.

FixedCharge The periodic charge is a fixed amount.

Typology and constraints

PeriodicChargeNumber: ISO 20022 Max3NumberNonZero, > 0.

PeriodicChargeName: ISO 20022 Max70Text.

PeriodicChargeType: Defined in this document.

TermStartDate: Defined in this document.