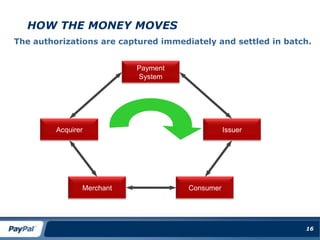

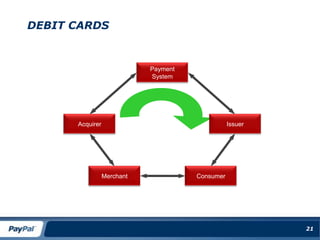

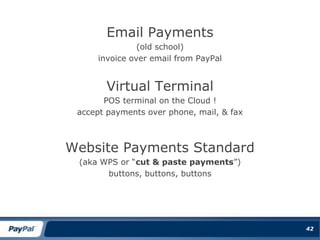

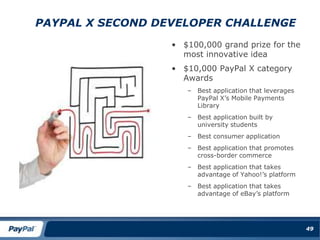

This document provides an overview of payments for developers, including why payments are important, how different payment methods work, and how to integrate payments into applications. It discusses various monetization strategies and payment networks like credit cards, debit cards, and ACH transfers. The document also describes payment gateways versus payment providers, and how PayPal can help with its global payments platform and APIs that enable many monetization models and payment types, including its Express Checkout and Adaptive Payments solutions.