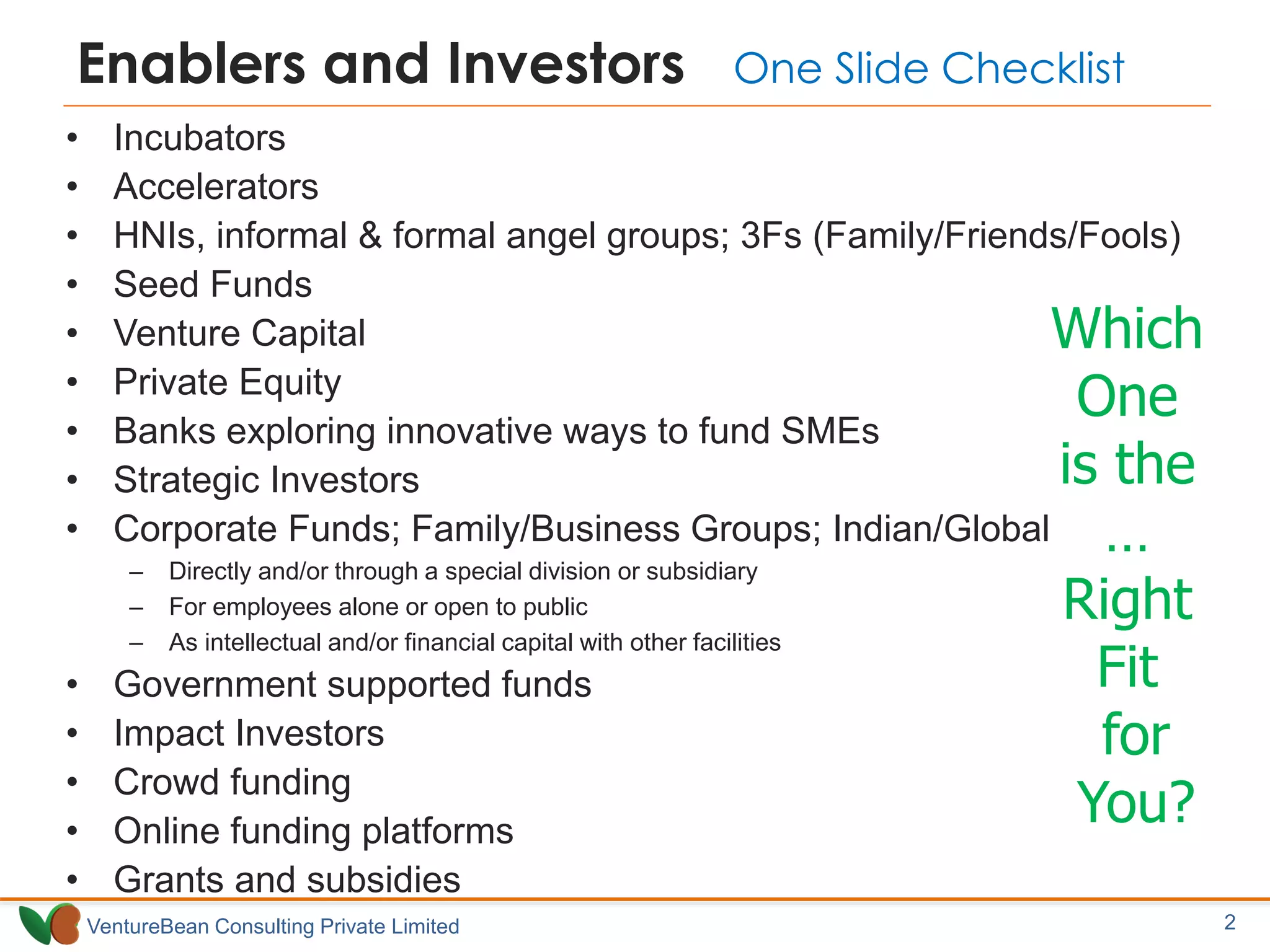

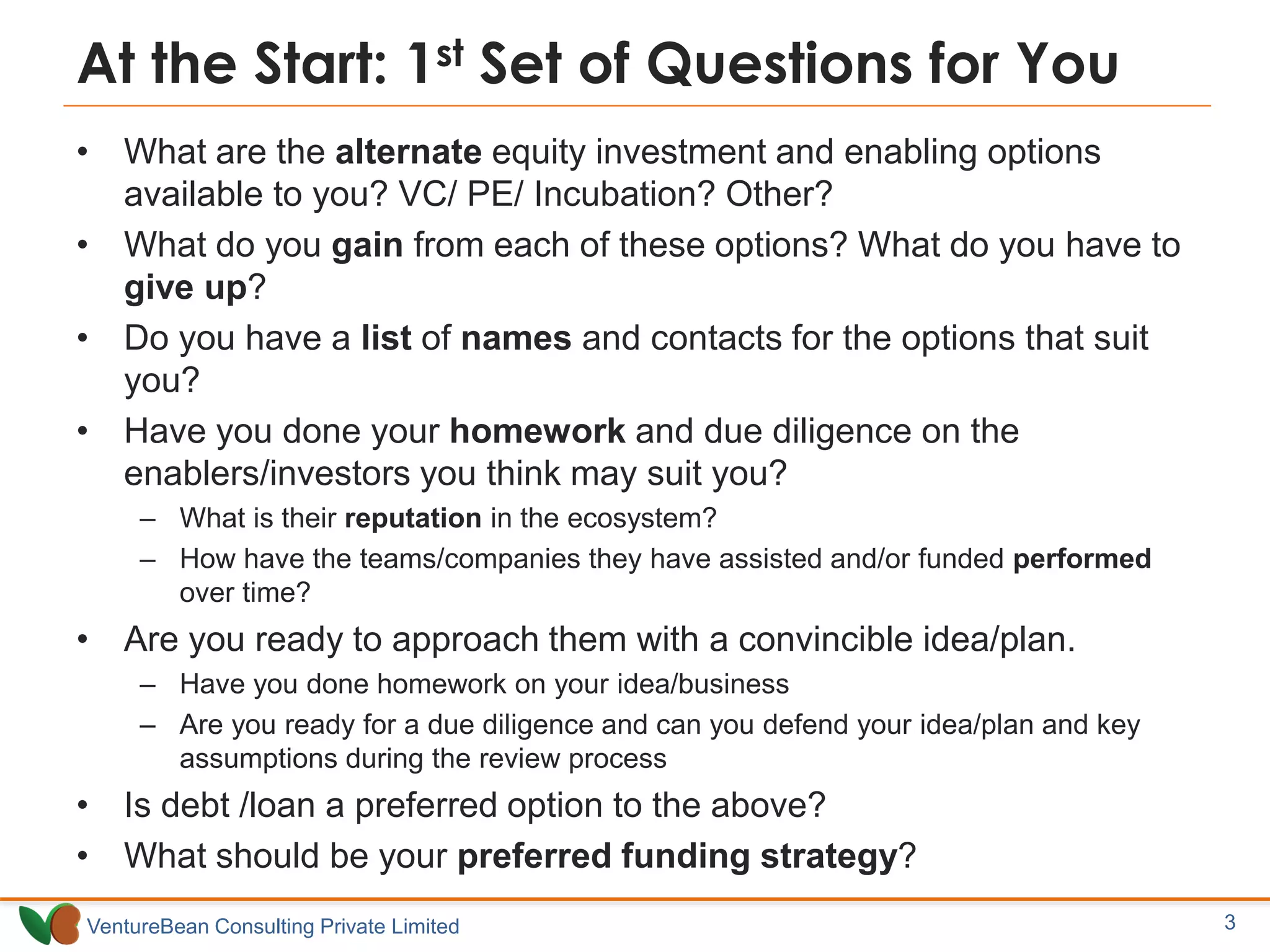

The document serves as a checklist for evaluating various funding options for startups, including incubators, accelerators, angel groups, venture capital, and crowdfunding. It outlines key questions to consider for entrepreneurs when selecting the right investors or enablers to approach for funding. The emphasis is on doing due diligence on potential investors and being prepared with a solid business plan before seeking funding.