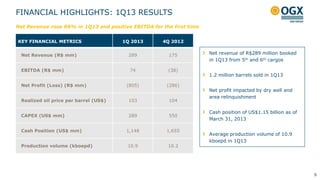

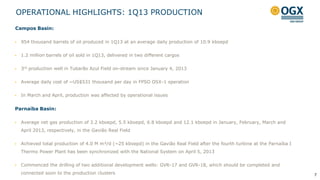

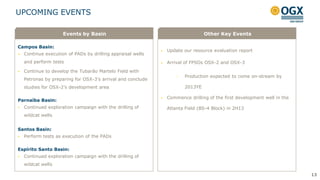

OGX posted higher net revenues and positive EBITDA in the first quarter of 2013 compared to the previous quarter. Production volumes from the Tubarão Azul Field increased 5.1% sequentially. Important advances were made in exploration, including four new fields declared commercial. However, production in Tubarão Azul was affected by operational issues in March and April. OGX also established a strategic partnership with Petronas to jointly develop two blocks containing the Tubarão Martelo Field.