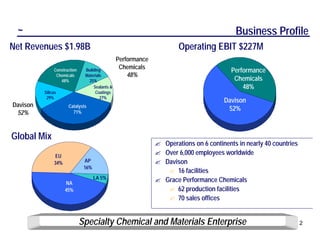

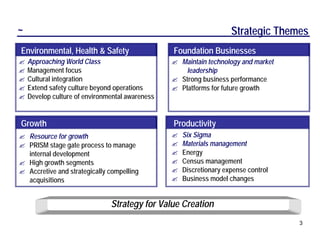

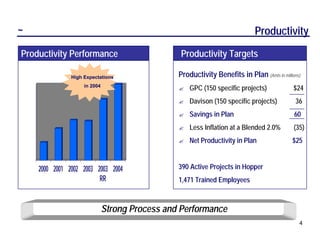

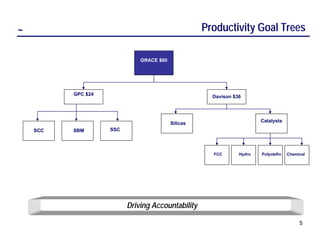

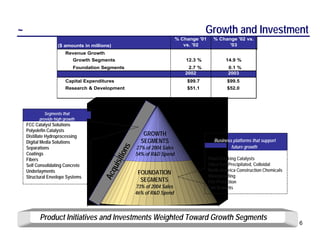

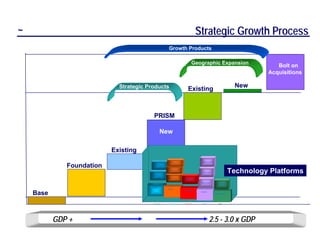

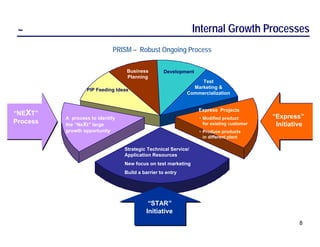

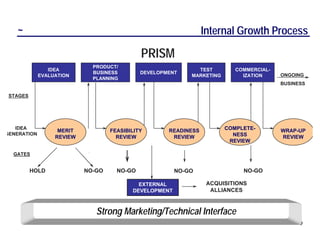

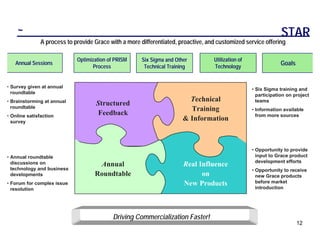

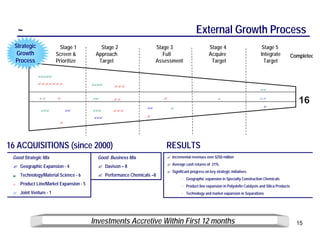

W.R. Grace & Co. manages a portfolio of businesses to balance growth and profitability. It generates $1.98 billion in annual revenue across construction chemicals, catalysts, and performance chemicals. Grace uses processes like PRISM and acquisitions to drive internal and external growth, focusing on high-growth segments. It aims to strengthen productivity through initiatives like Six Sigma while maintaining leadership in foundation businesses.