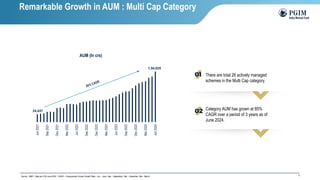

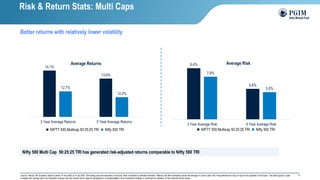

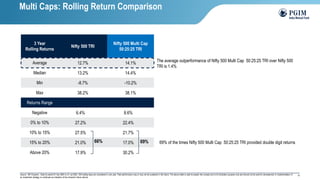

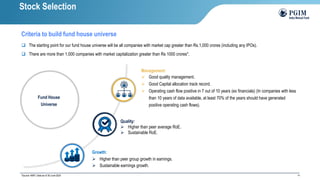

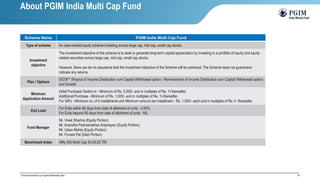

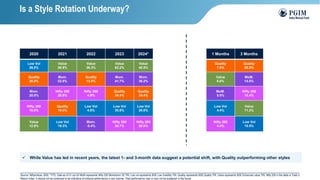

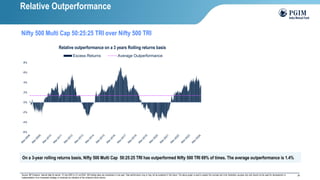

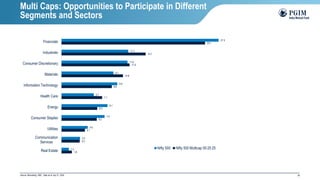

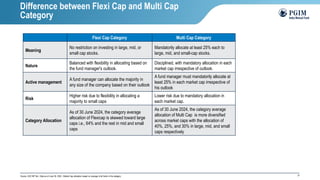

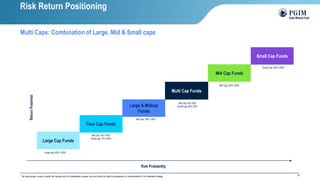

The PGIM India Multi Cap Fund is an open-ended equity scheme that invests across large, mid, and small-cap stocks, aiming for a balanced portfolio with a disciplined allocation of at least 25% in each market cap. As of June 2024, this strategy has shown strong historical performance with a significant growth in assets under management and has provided risk-adjusted returns comparable to broader markets. The fund focuses on capturing growth opportunities across various sectors while managing tax and cost efficiency for investors.