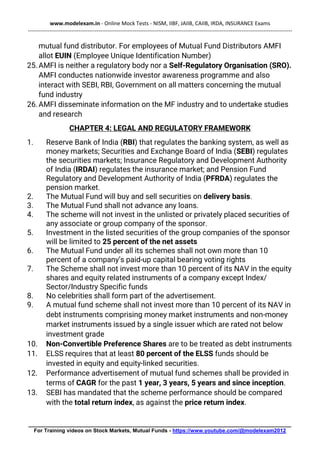

DOWNLOAD STUDY MATERIAL FOR NISM MUTUAL FUND EXAM (EARLIER AMFI). AMFI MOCK TEST AT WWW.MODELEXAM.IN. NISM SERIES VA MUTUAL FUND DISTRIBUTORS EXAMINATION STUDY NOTES.EASY TO STUDY,USEFUL TO PASS,BASED ON LATEST SYLLABUS.NATIONAL INSTITUTE OF SECURITIES MARKETS. NISM MOCK TEST,NCFM MOCK TEST AT WWW.MODELEXAM.IN

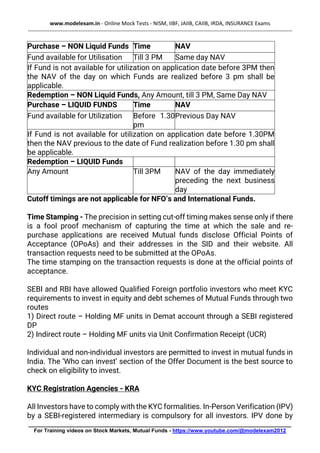

STUDY MATERIAL NISM MUTUAL FUND SERIES 5A VA MUTUAL FUND DISTRIBUTORS CERTIFICATION EXAM