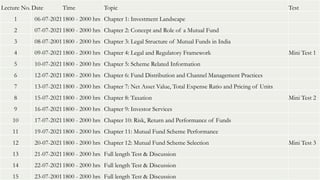

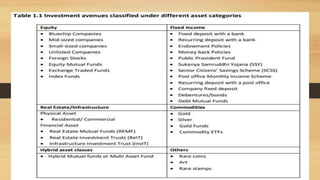

The document outlines the schedule and topics for an NISM VA- Day 1 training program on mutual funds. It includes 15 sessions over 7 days covering various topics related to mutual funds like investment landscape, concept and role of mutual funds, legal structure and regulations, scheme related information, taxation, risk and performance. There will be mini-tests after certain topics as well as full length tests at the end to evaluate learning. The sessions will discuss concepts like different asset classes, risks and returns, behavioral biases, asset allocation strategies, and merits of taking professional investment advice.