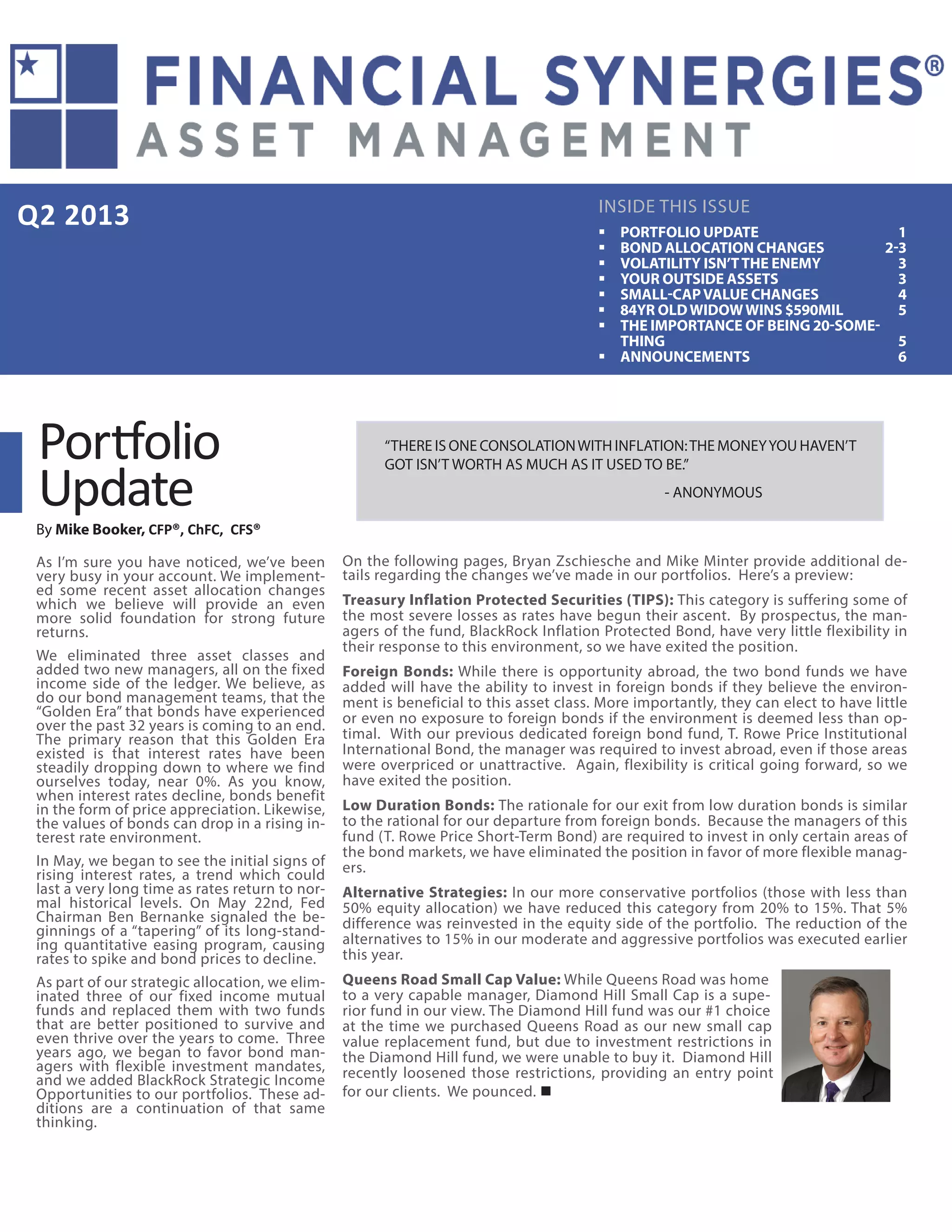

This document provides a portfolio update from an investment advisor. It discusses changes made to bond fund allocations in client portfolios. Specifically, it eliminated three bond funds (focused on foreign bonds, TIPS, and short-term bonds) and replaced them with two new funds that have more flexible investment mandates. This was done to improve chances of success in a rising interest rate environment. It also discusses replacing an existing small-cap value fund with a new fund that has a strong long-term track record and is managed by an experienced team with a classic value investing approach.