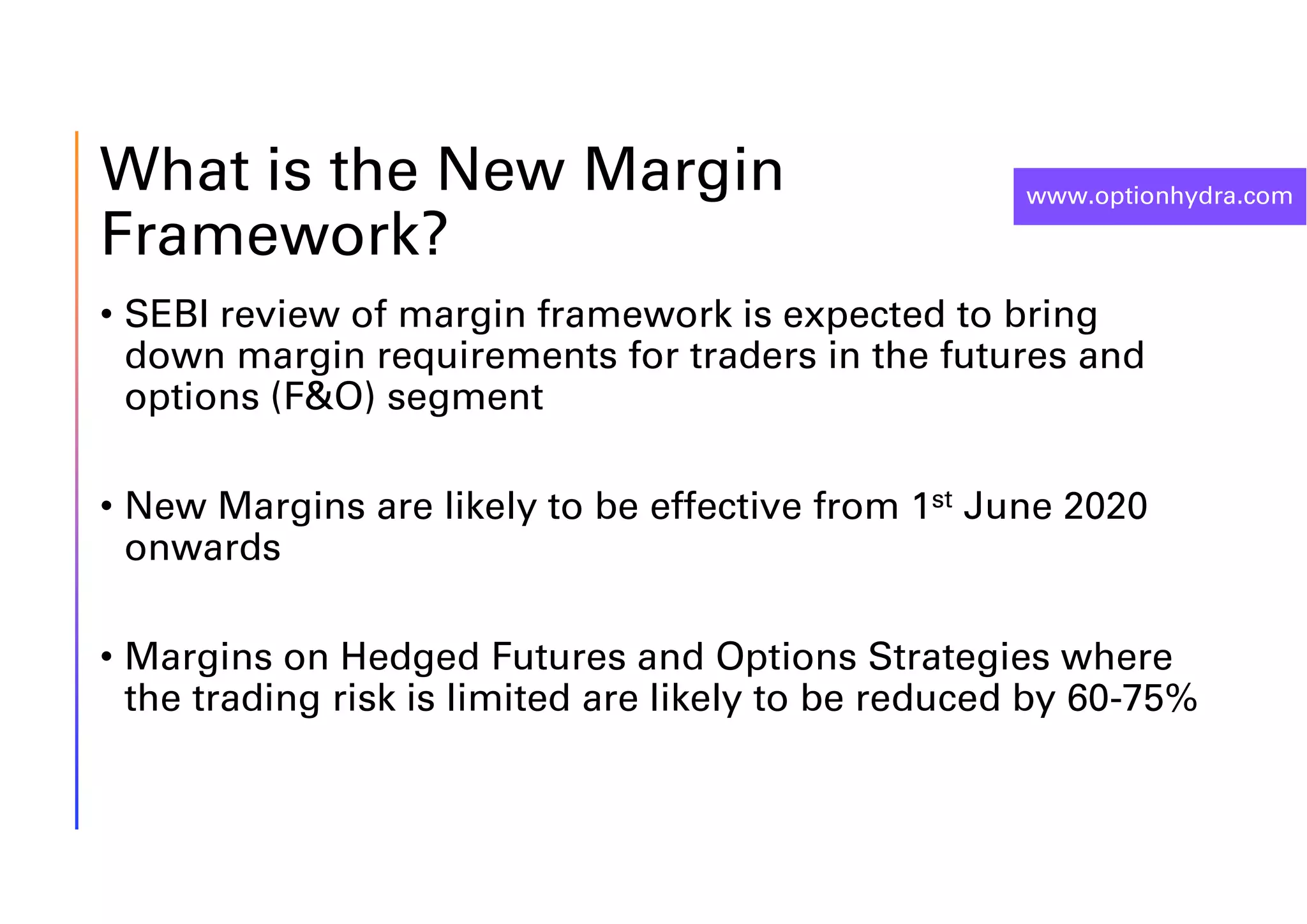

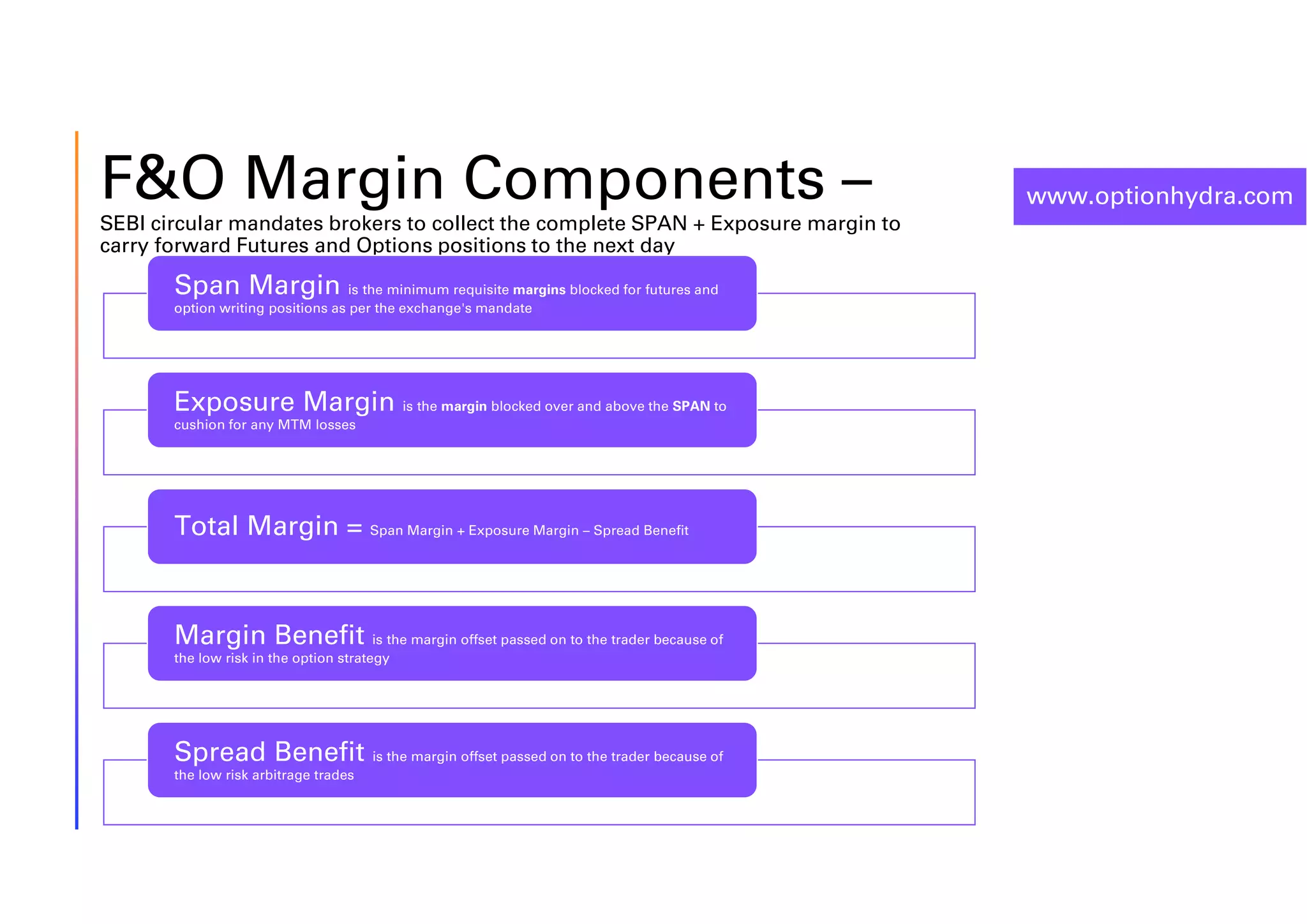

The document discusses upcoming changes to margin requirements for futures and options strategies in India. The key points are:

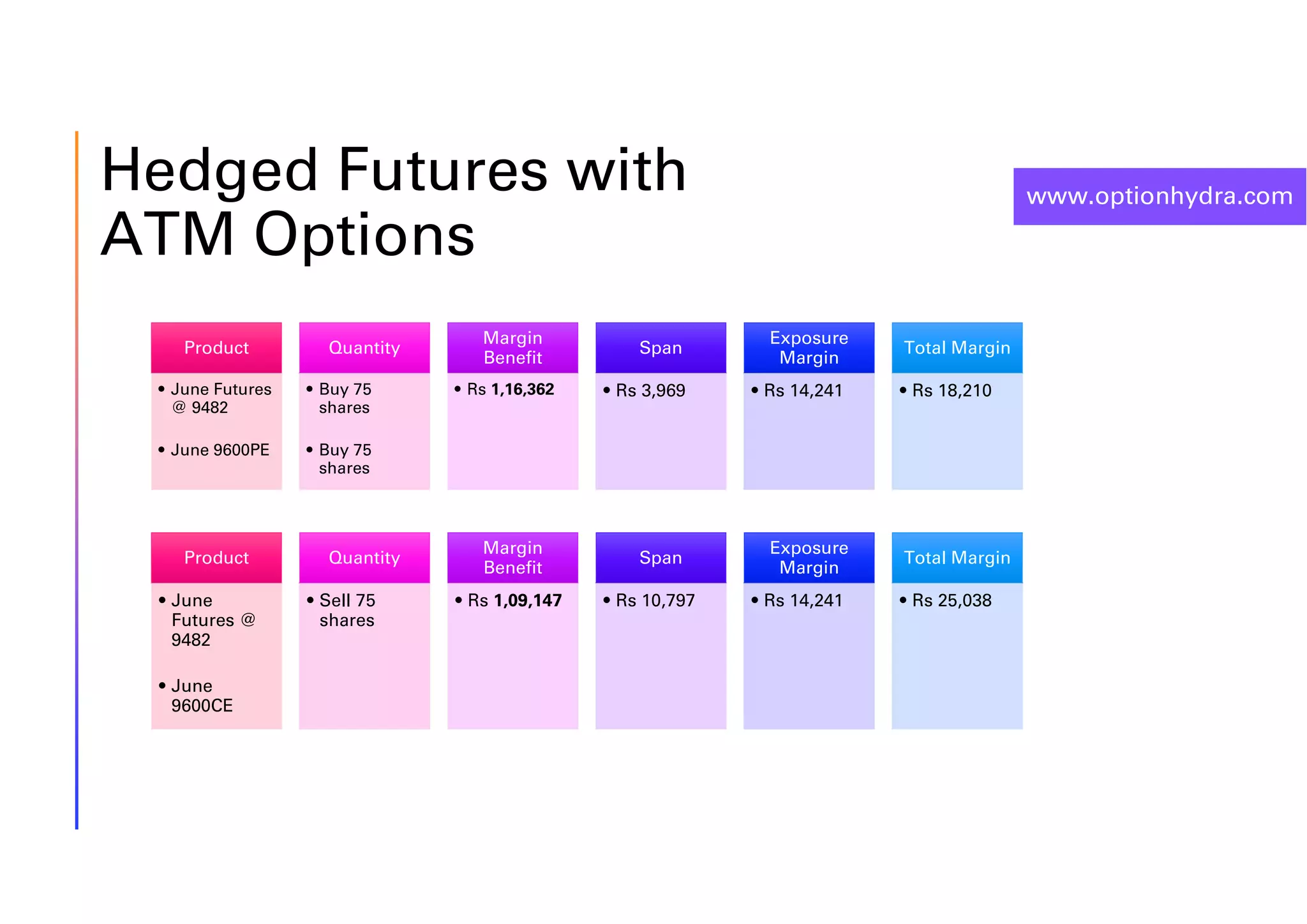

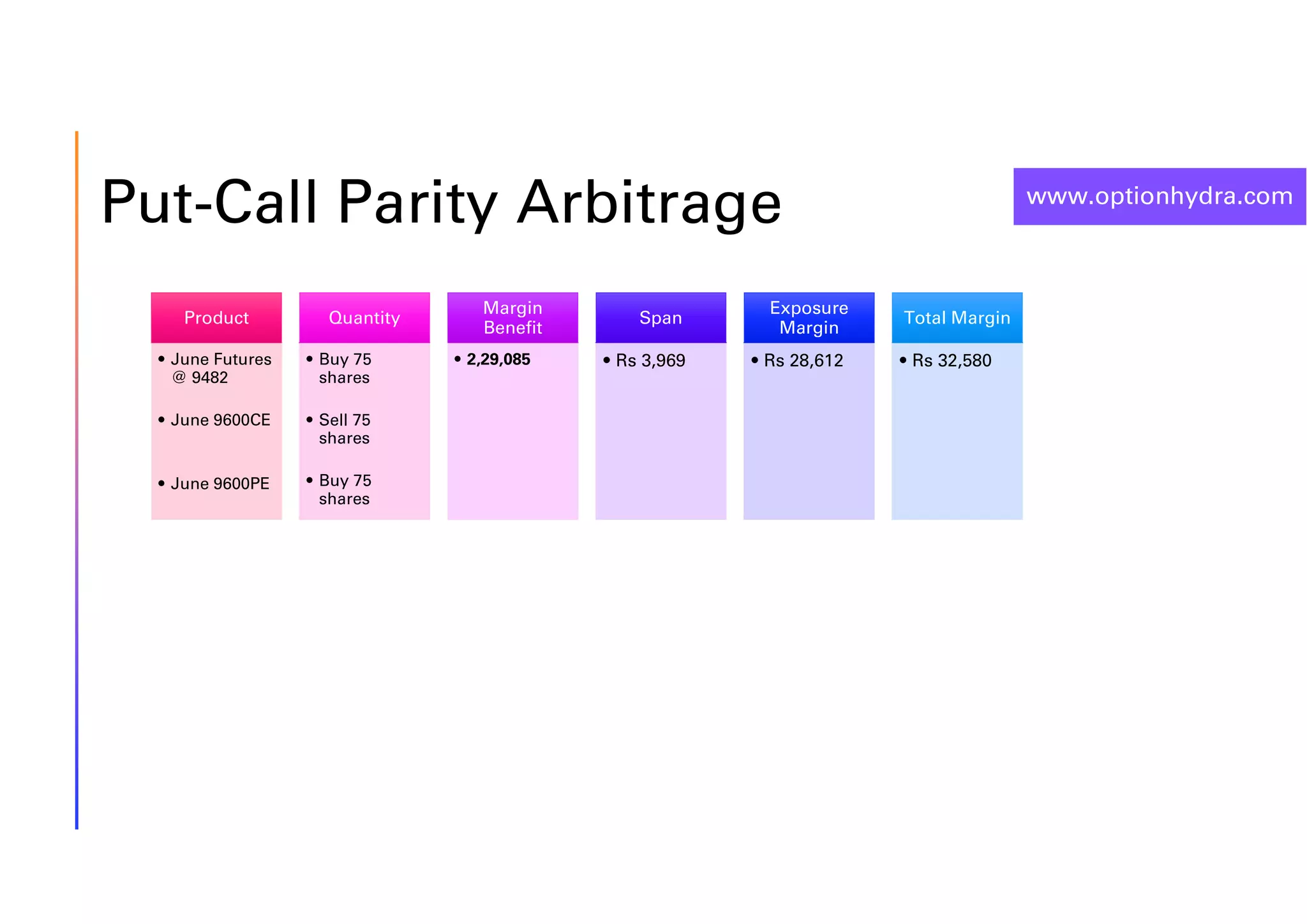

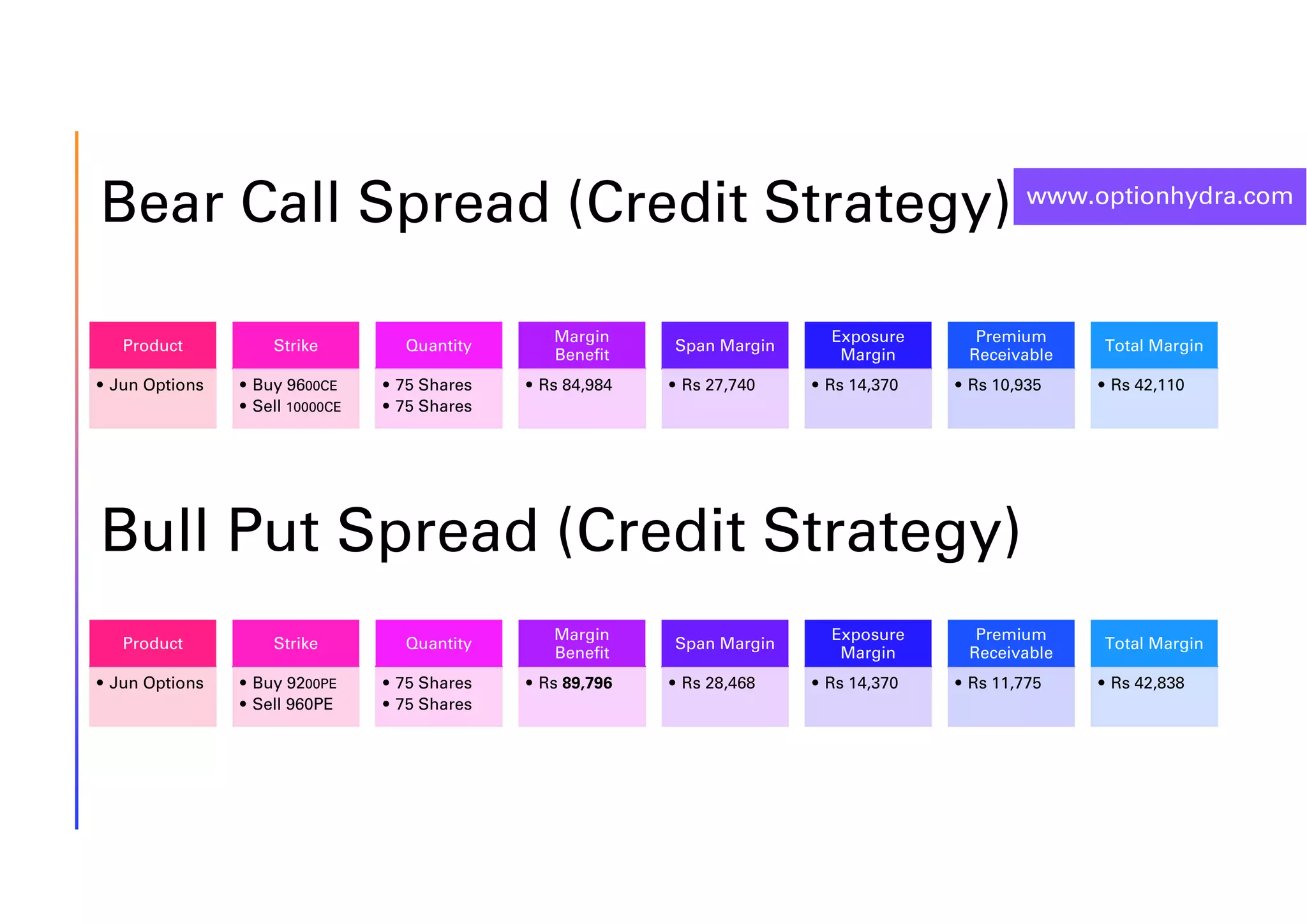

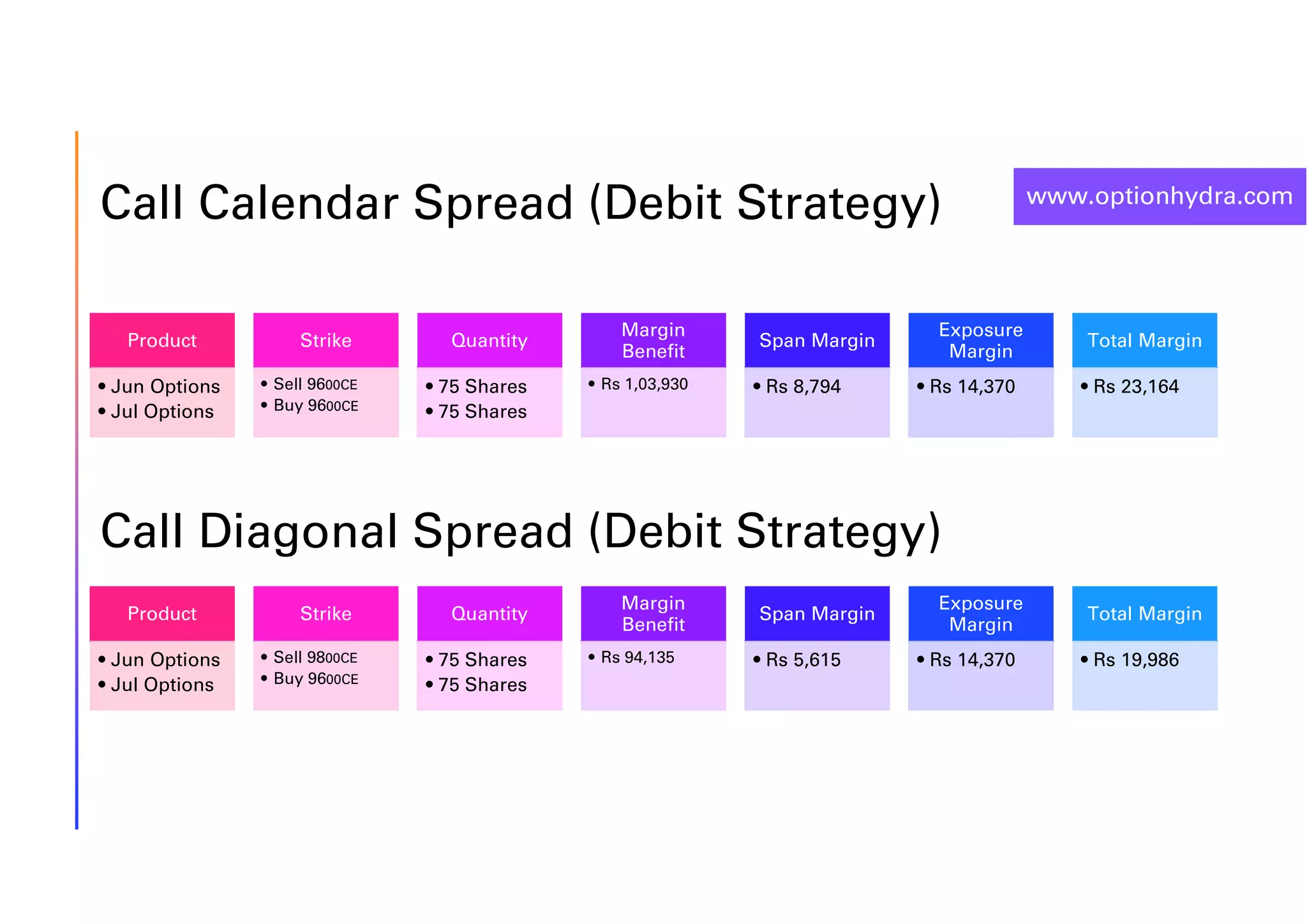

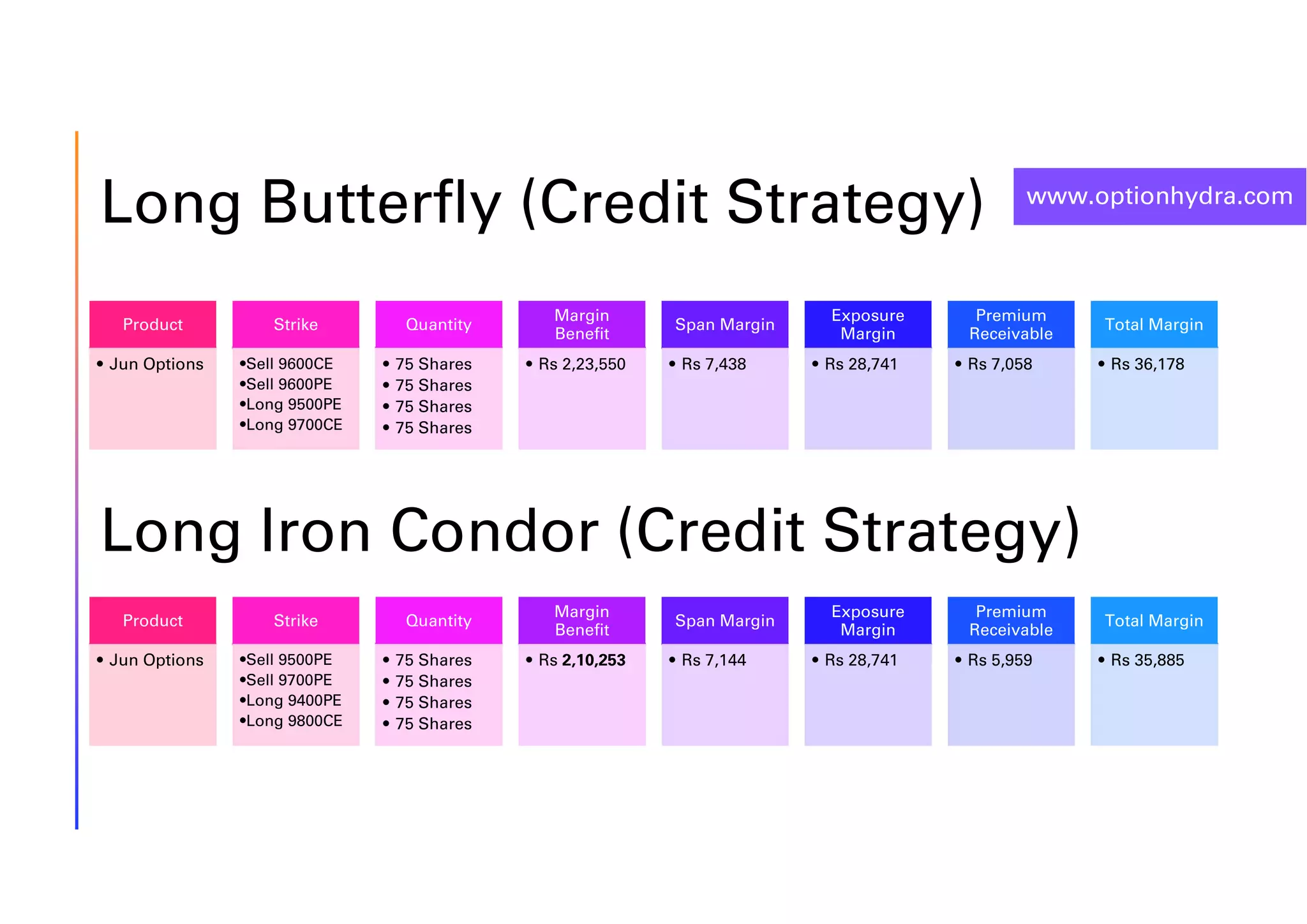

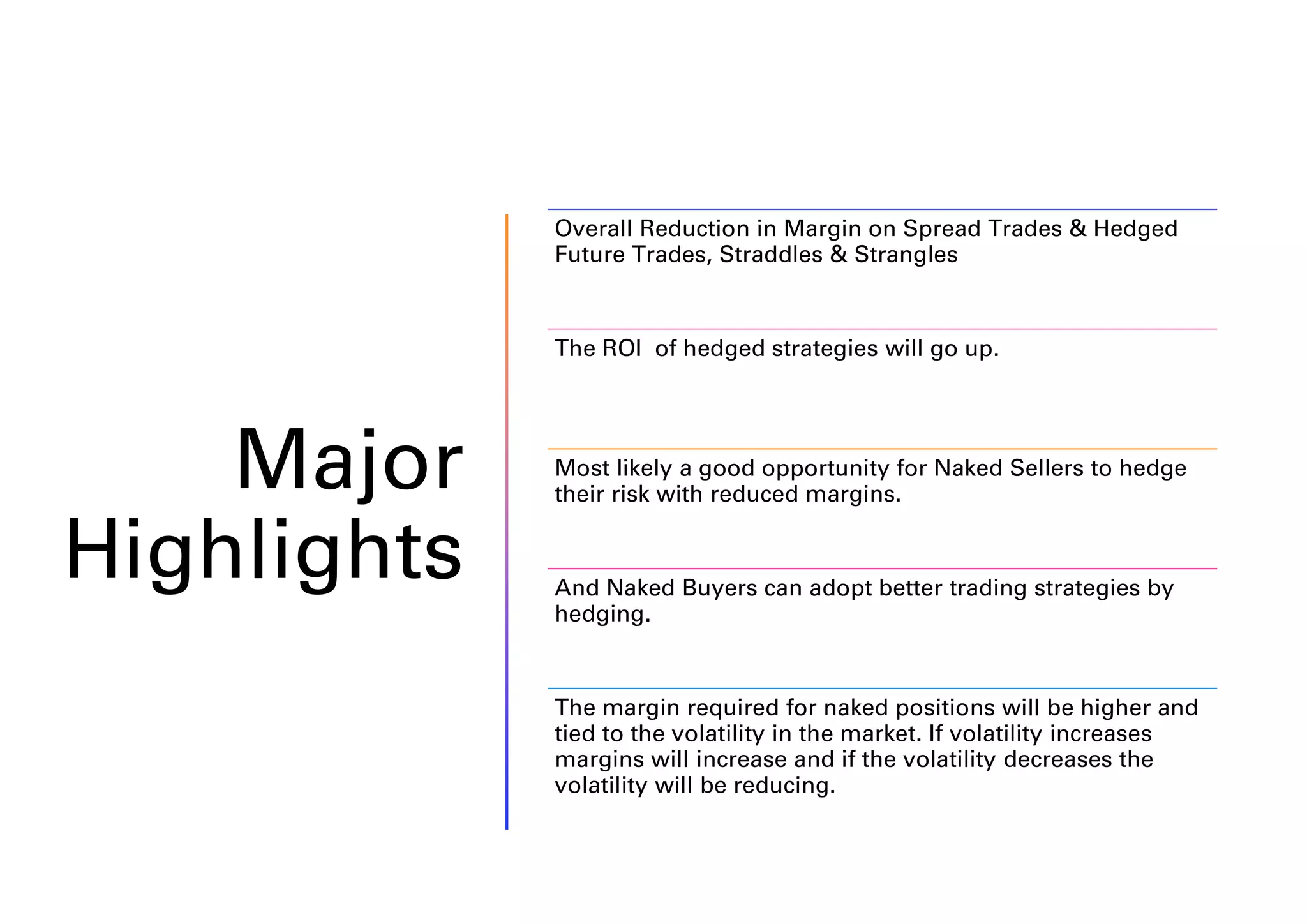

1) Margin requirements for hedged futures and options strategies are expected to be reduced by 60-75% under the new framework.

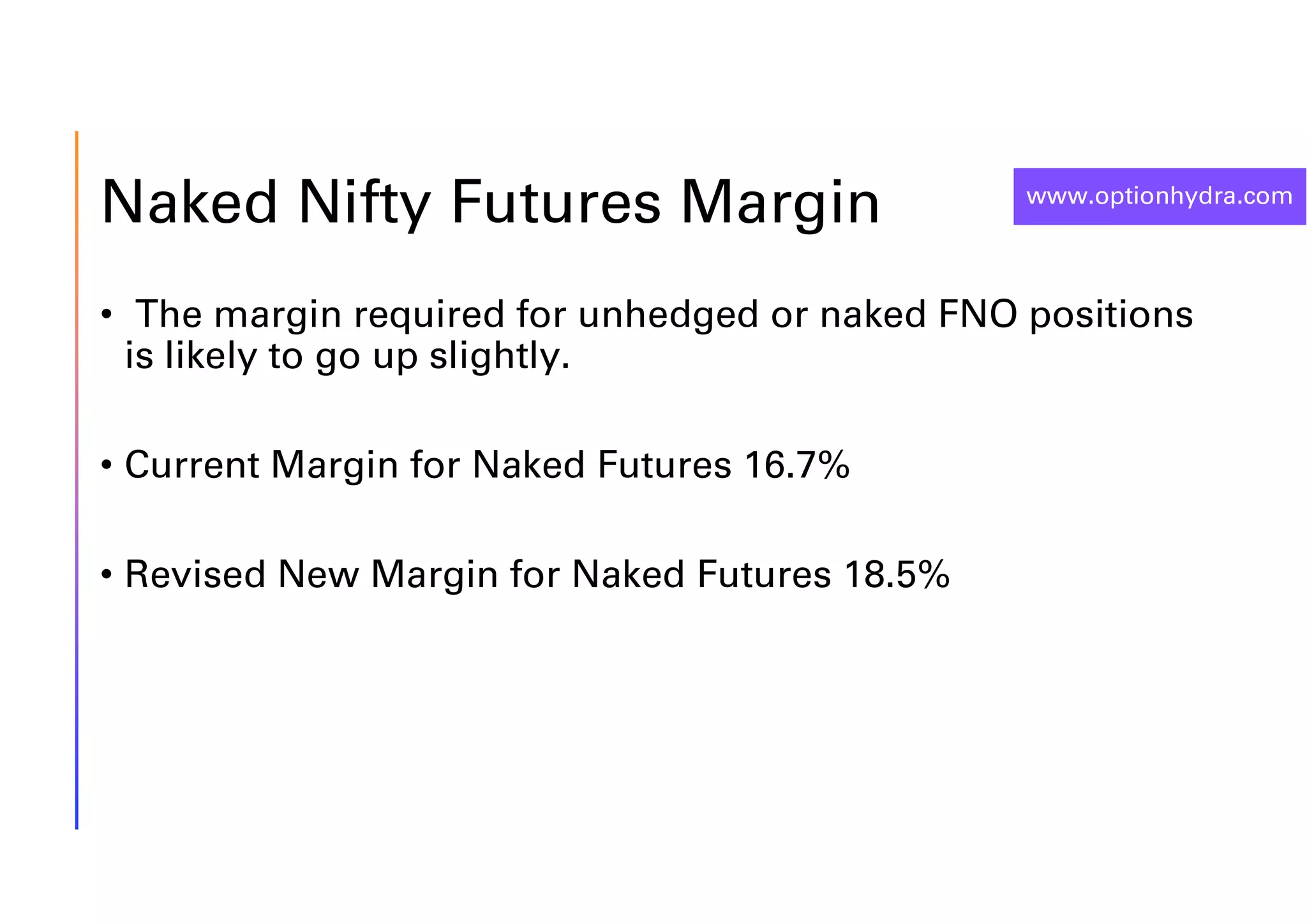

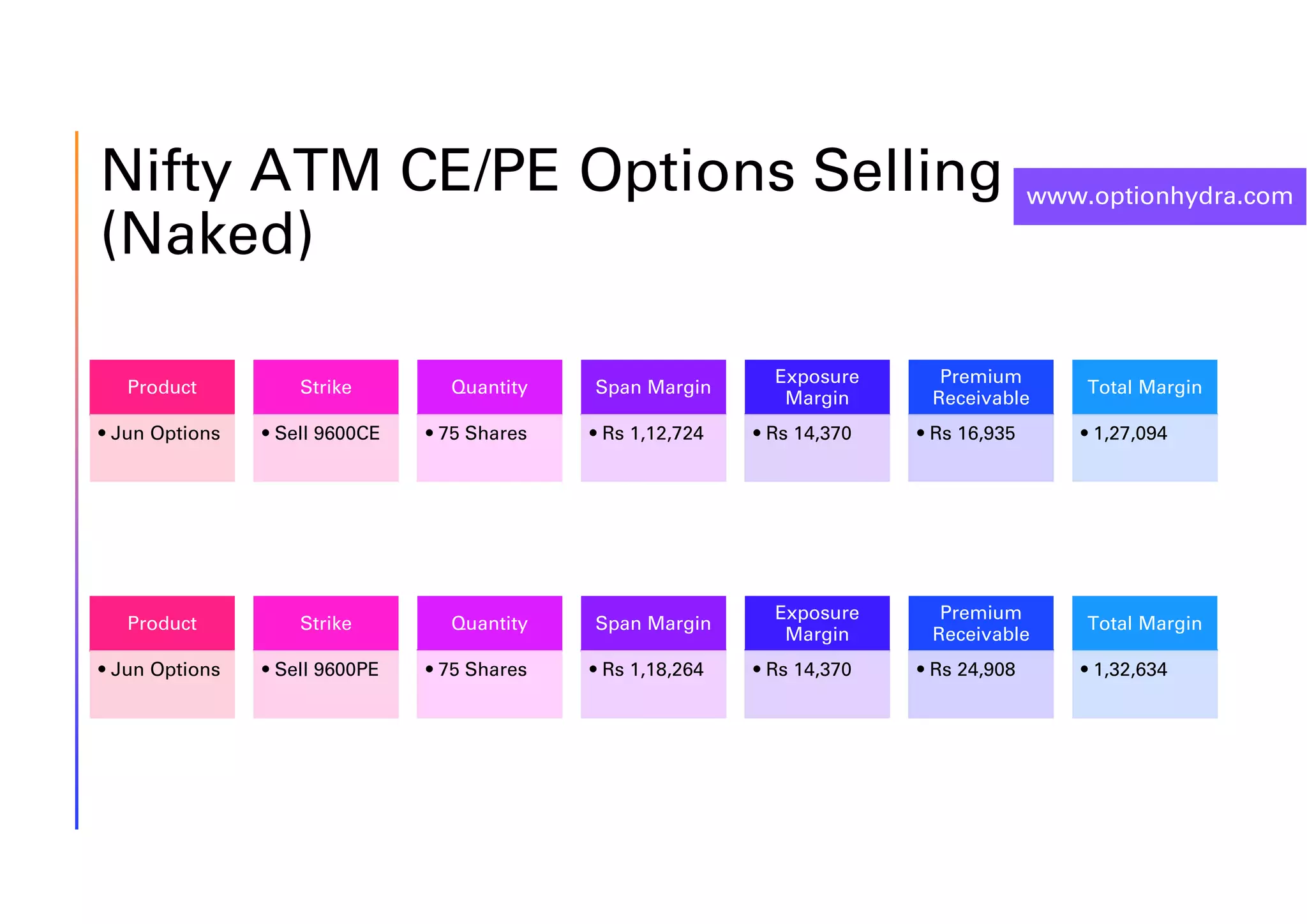

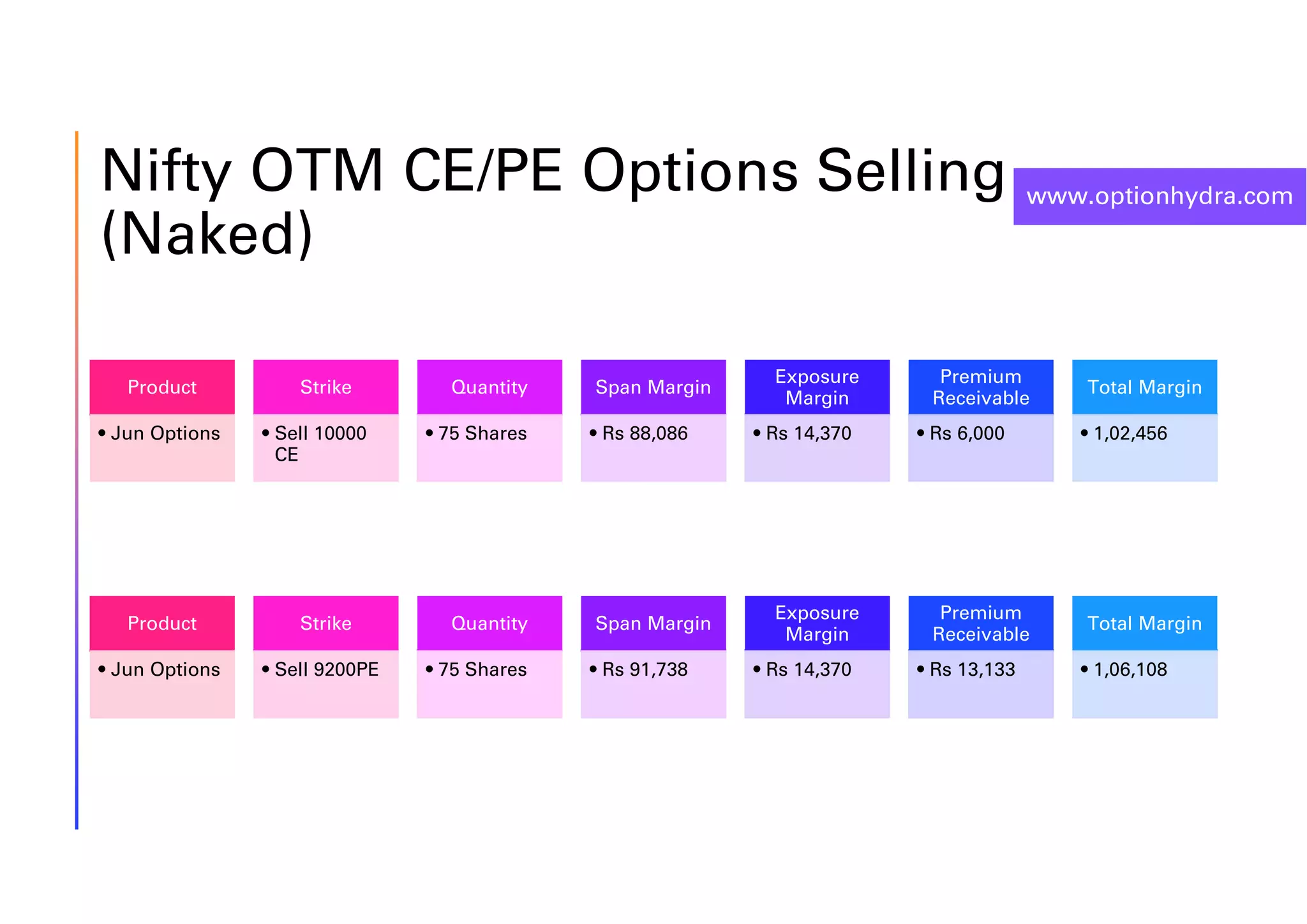

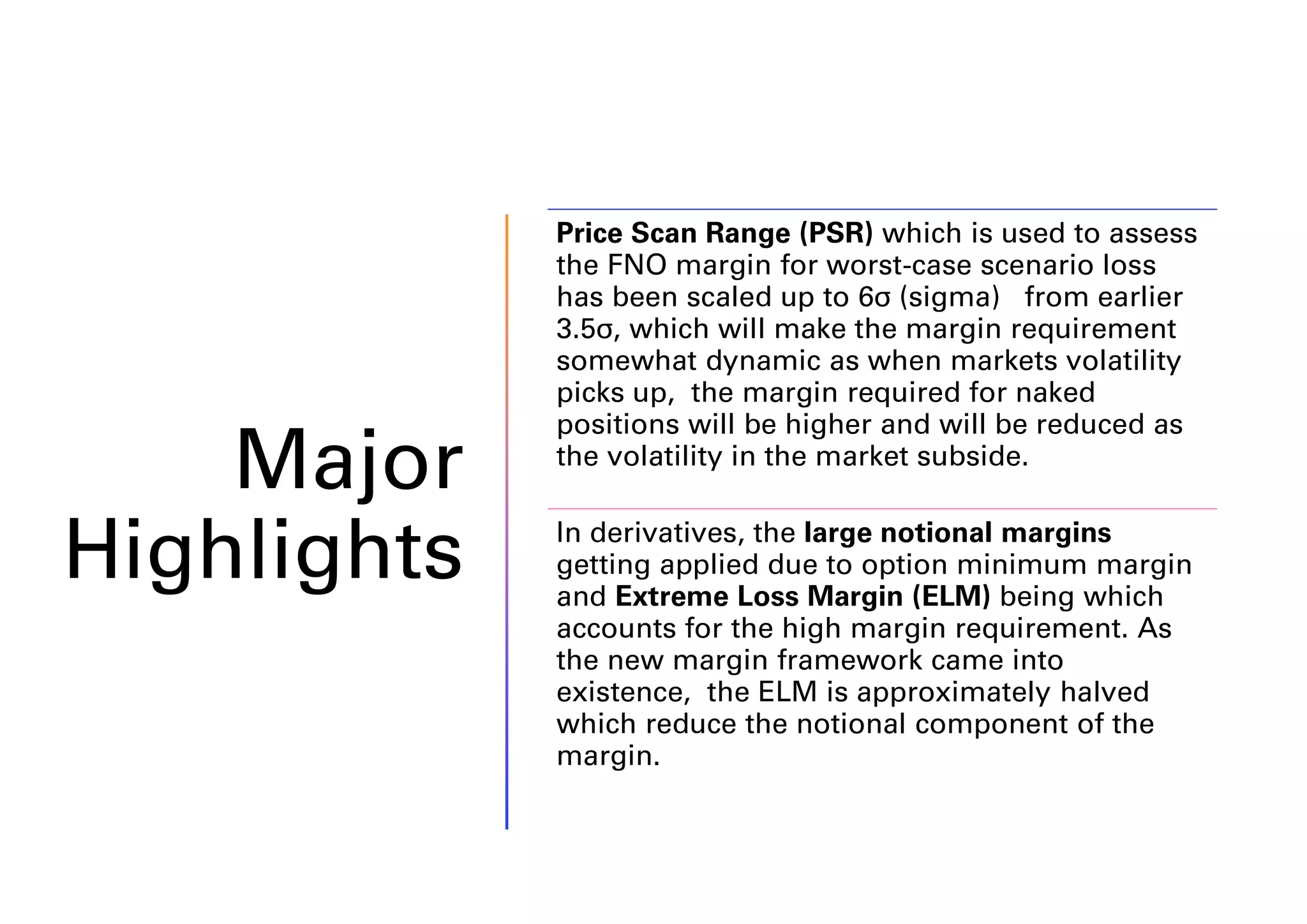

2) Margins on naked futures positions will increase slightly, from the current 16.7% to the new requirement of 18.5%.

3) The changes aim to reduce margins for limited-risk strategies while increasing margins for uncovered positions, making margins more dynamic based on market volatility.