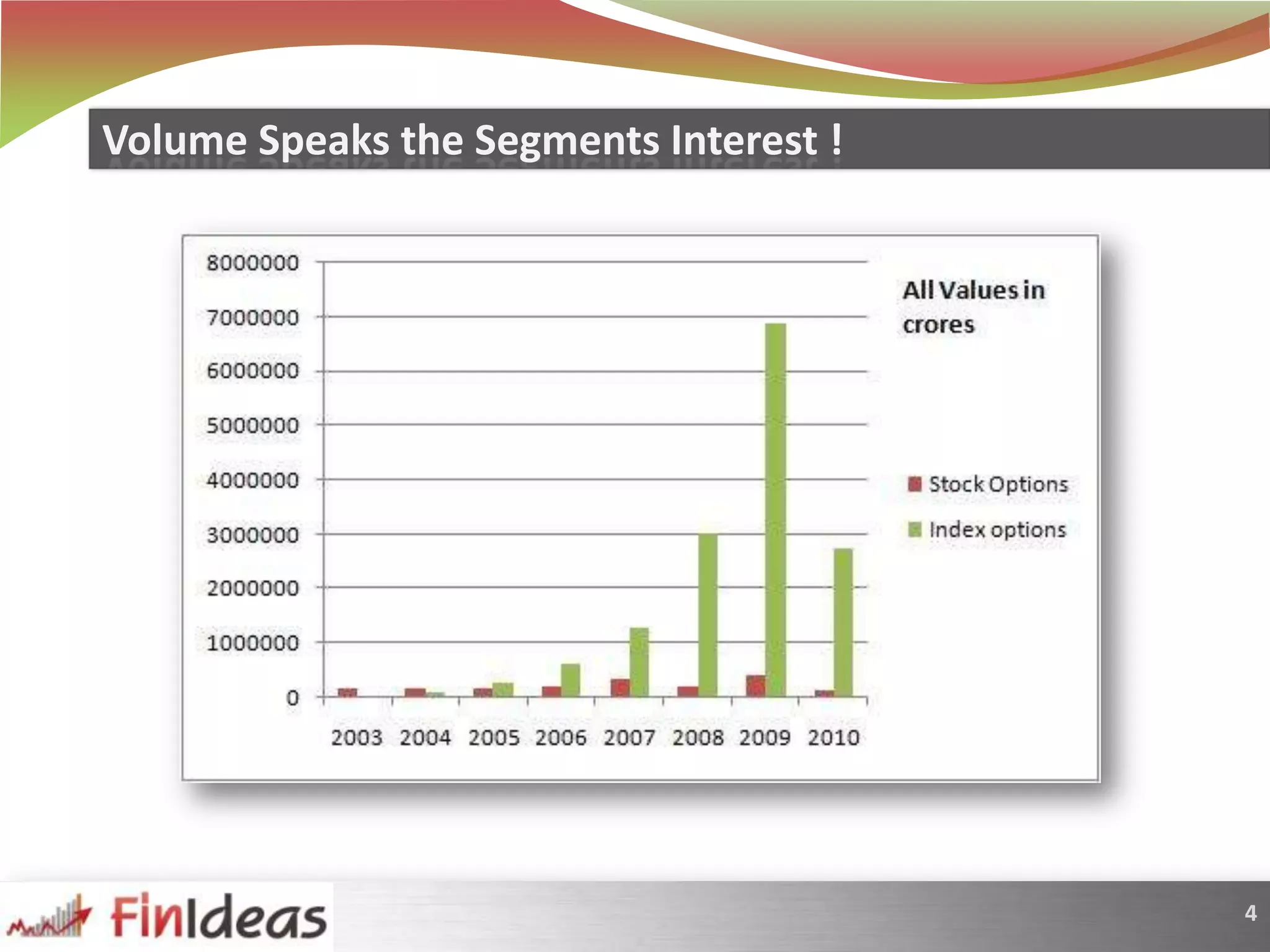

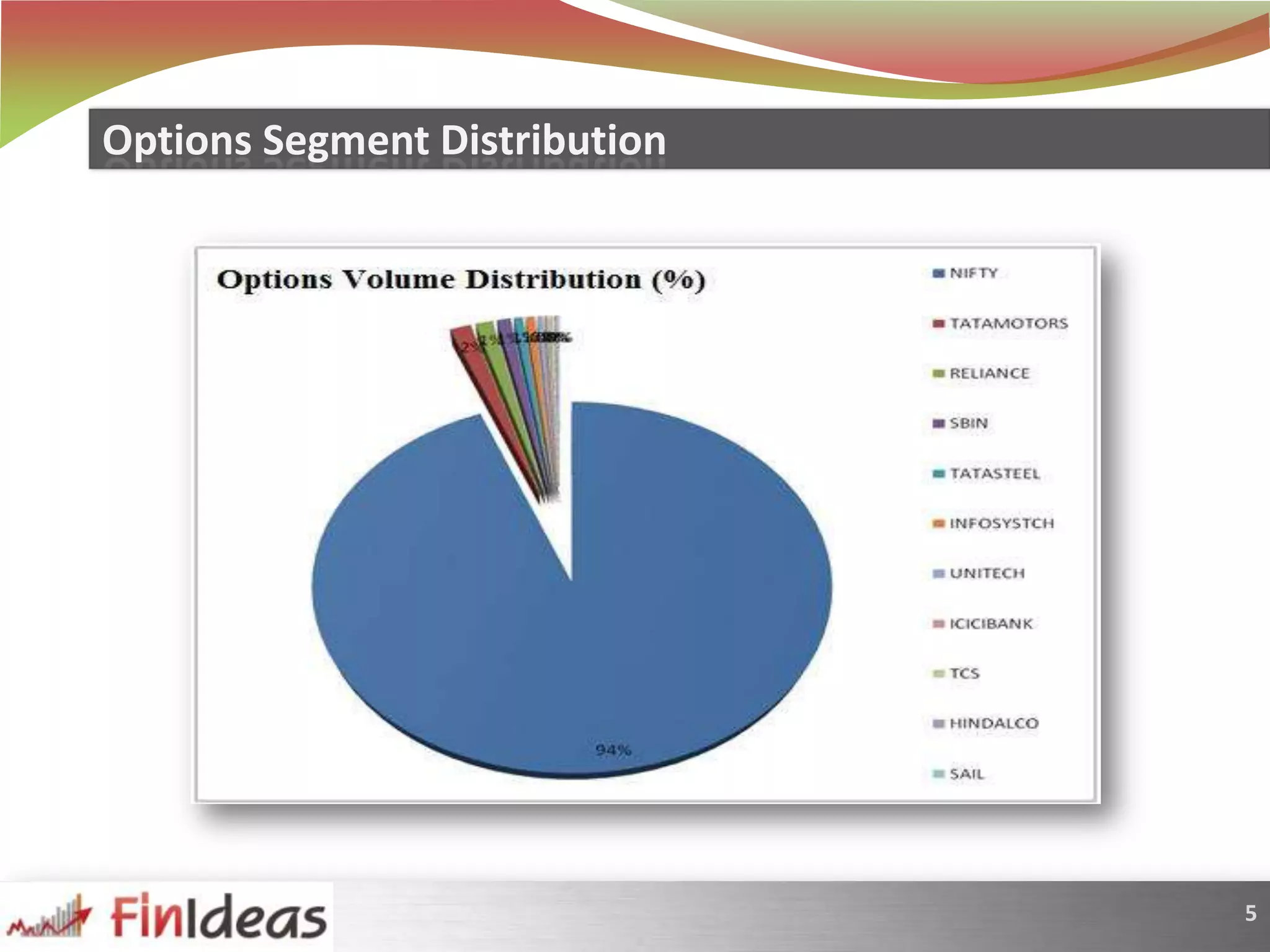

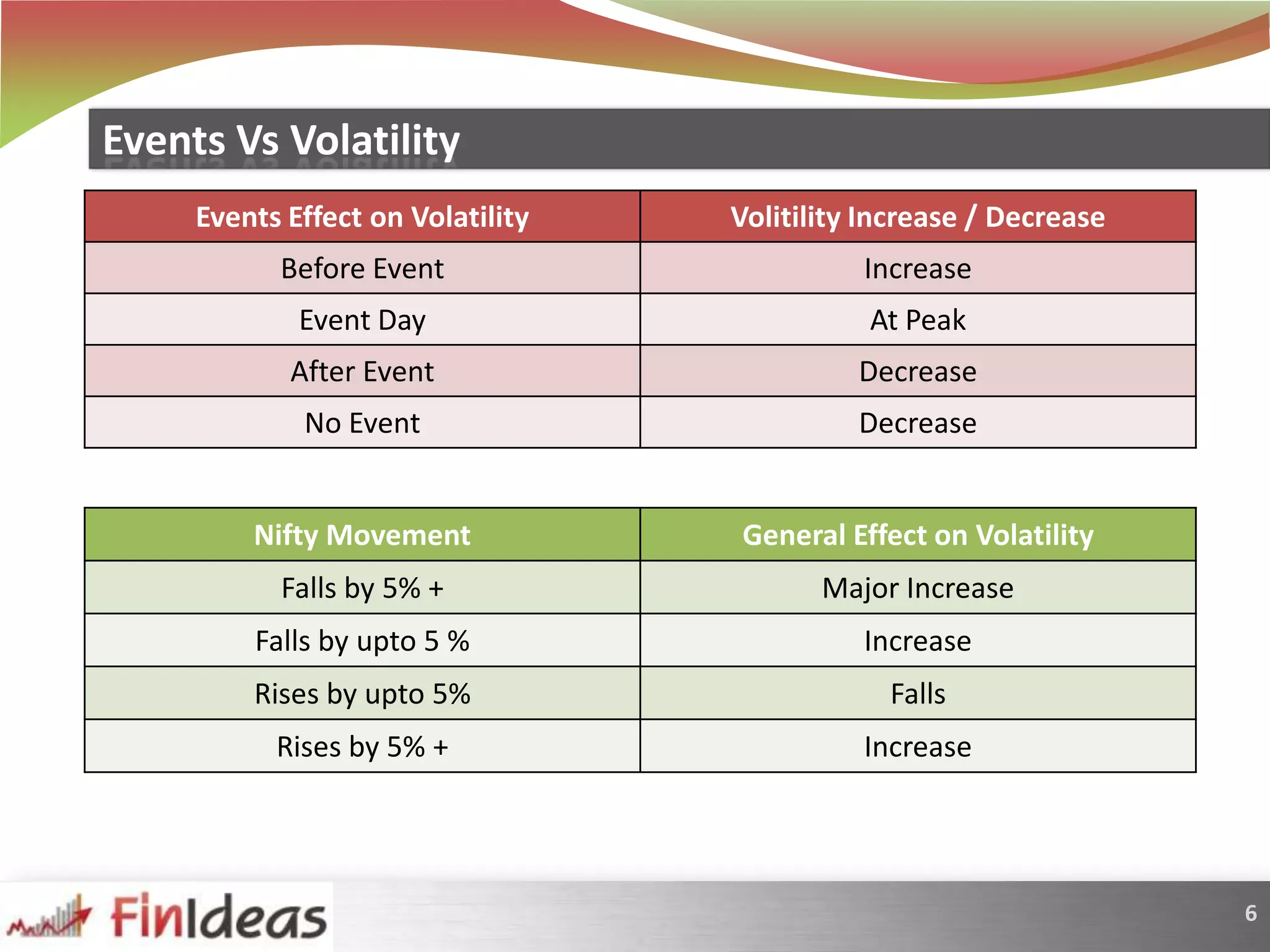

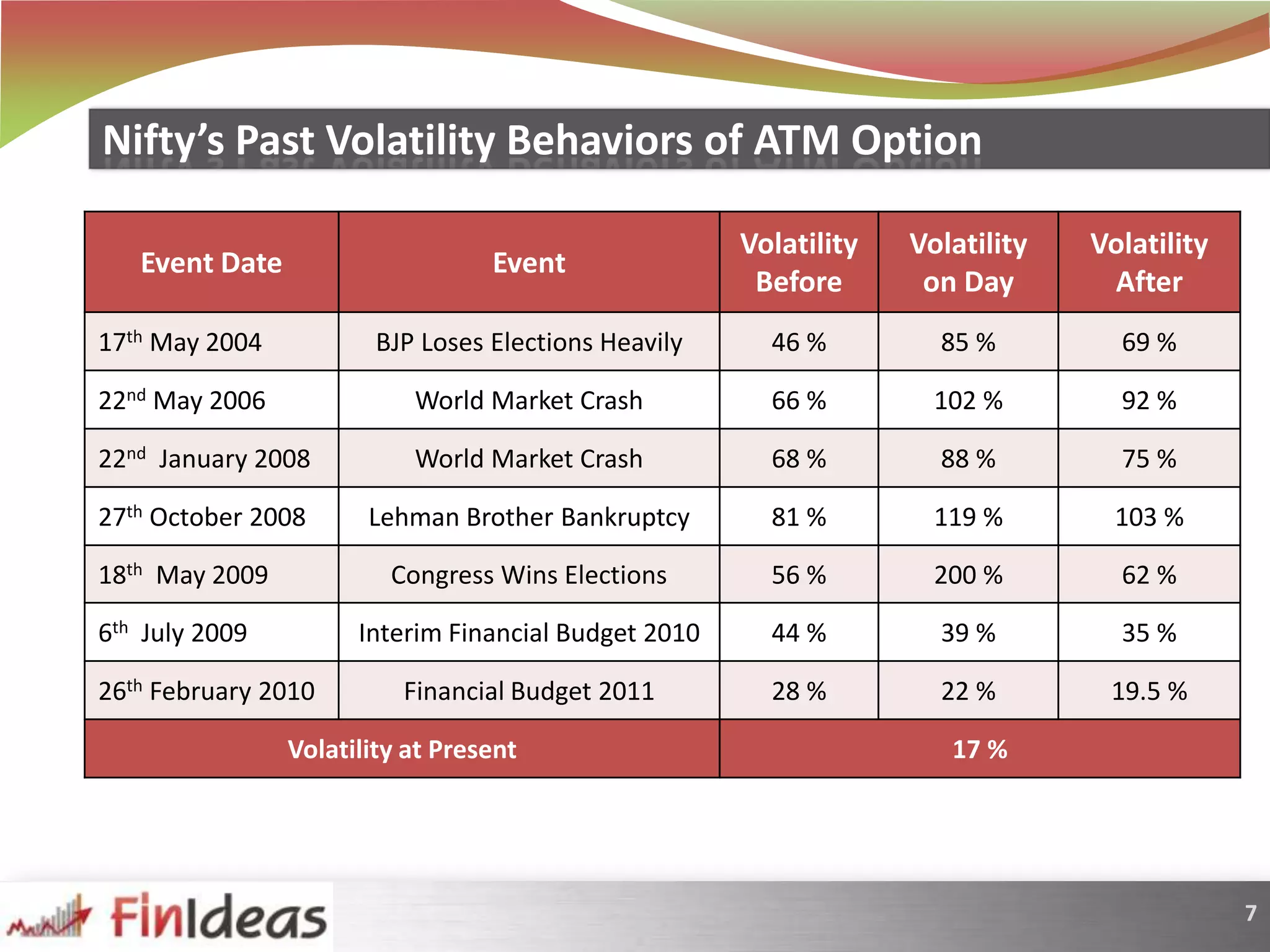

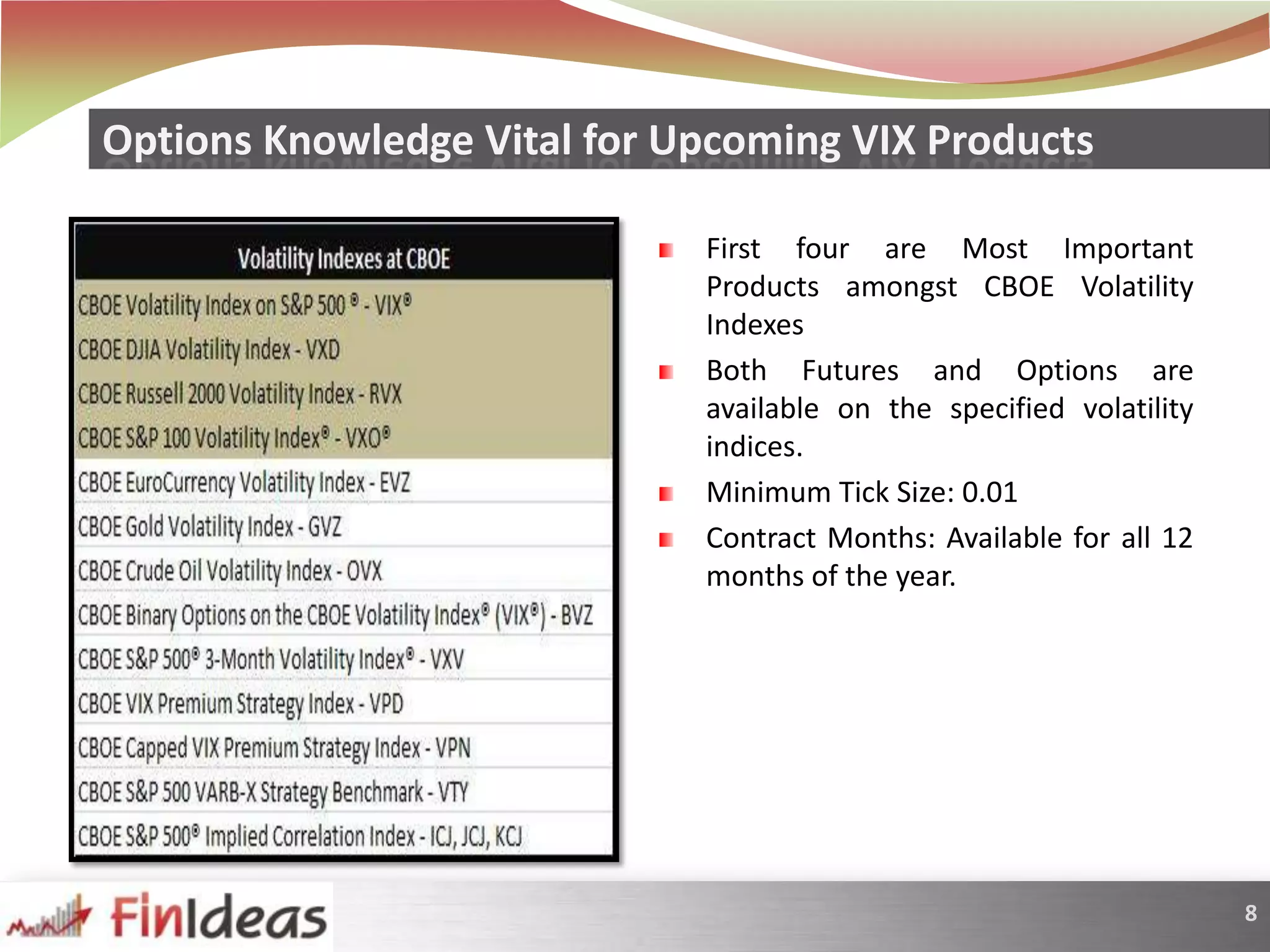

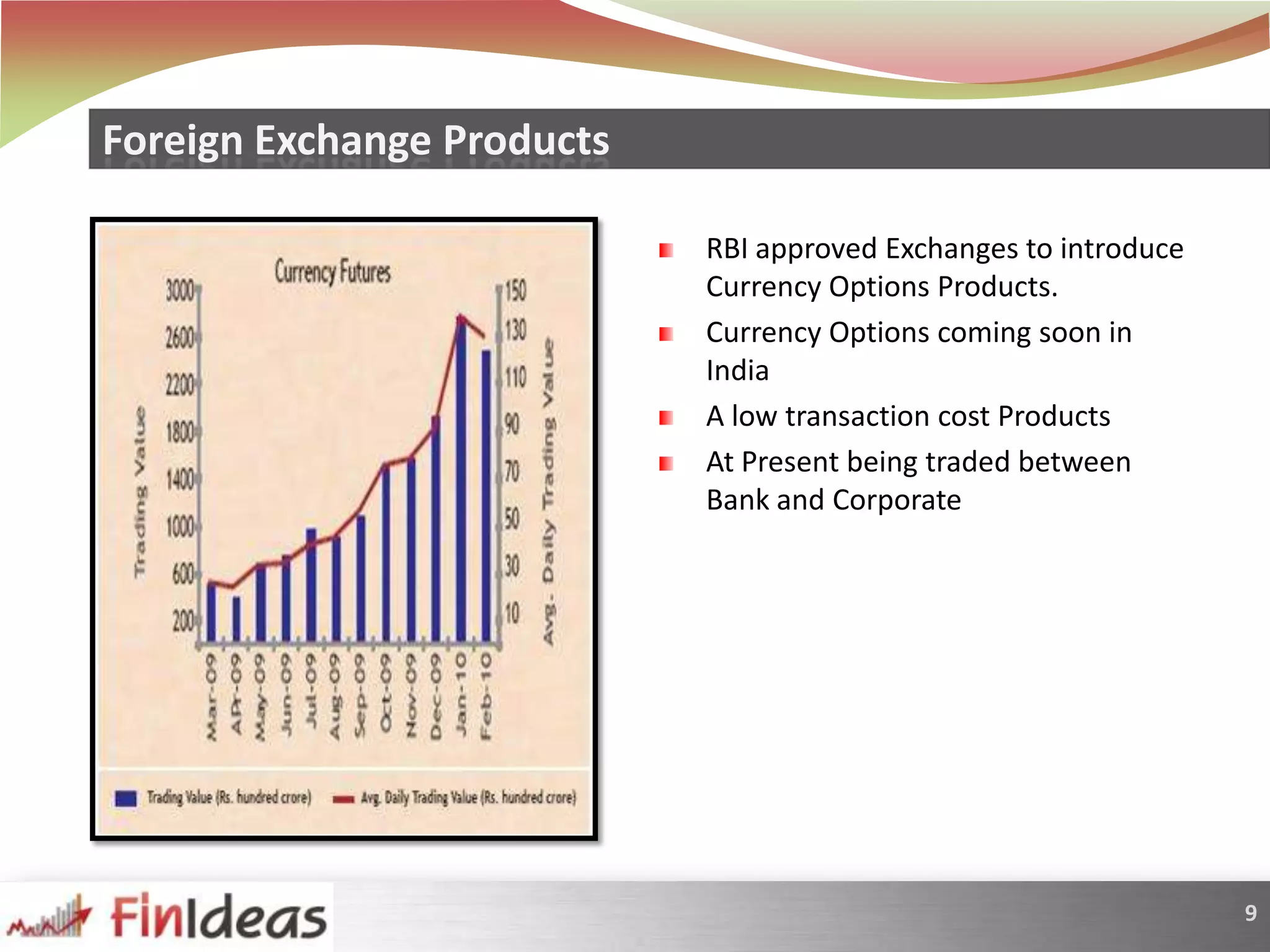

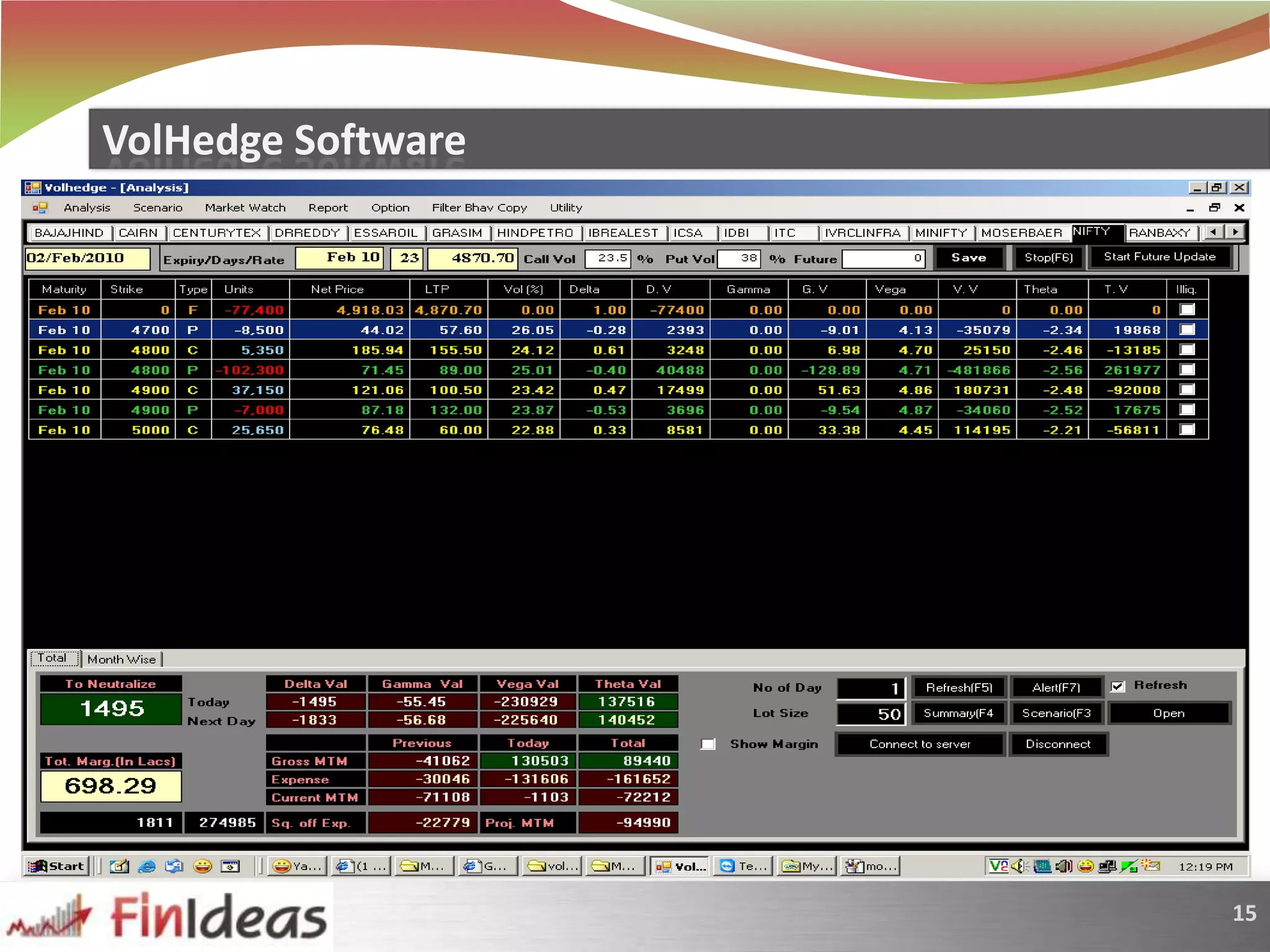

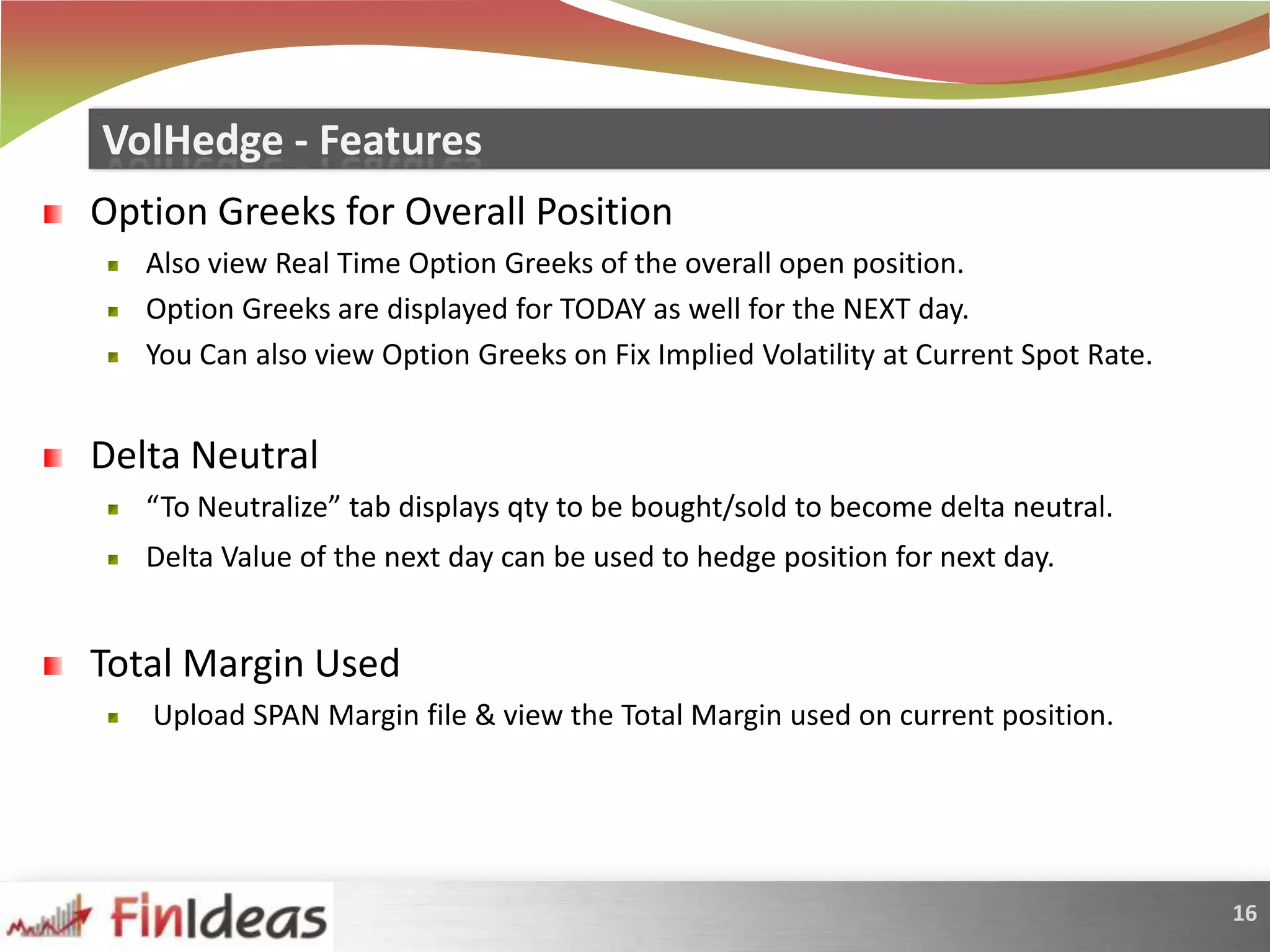

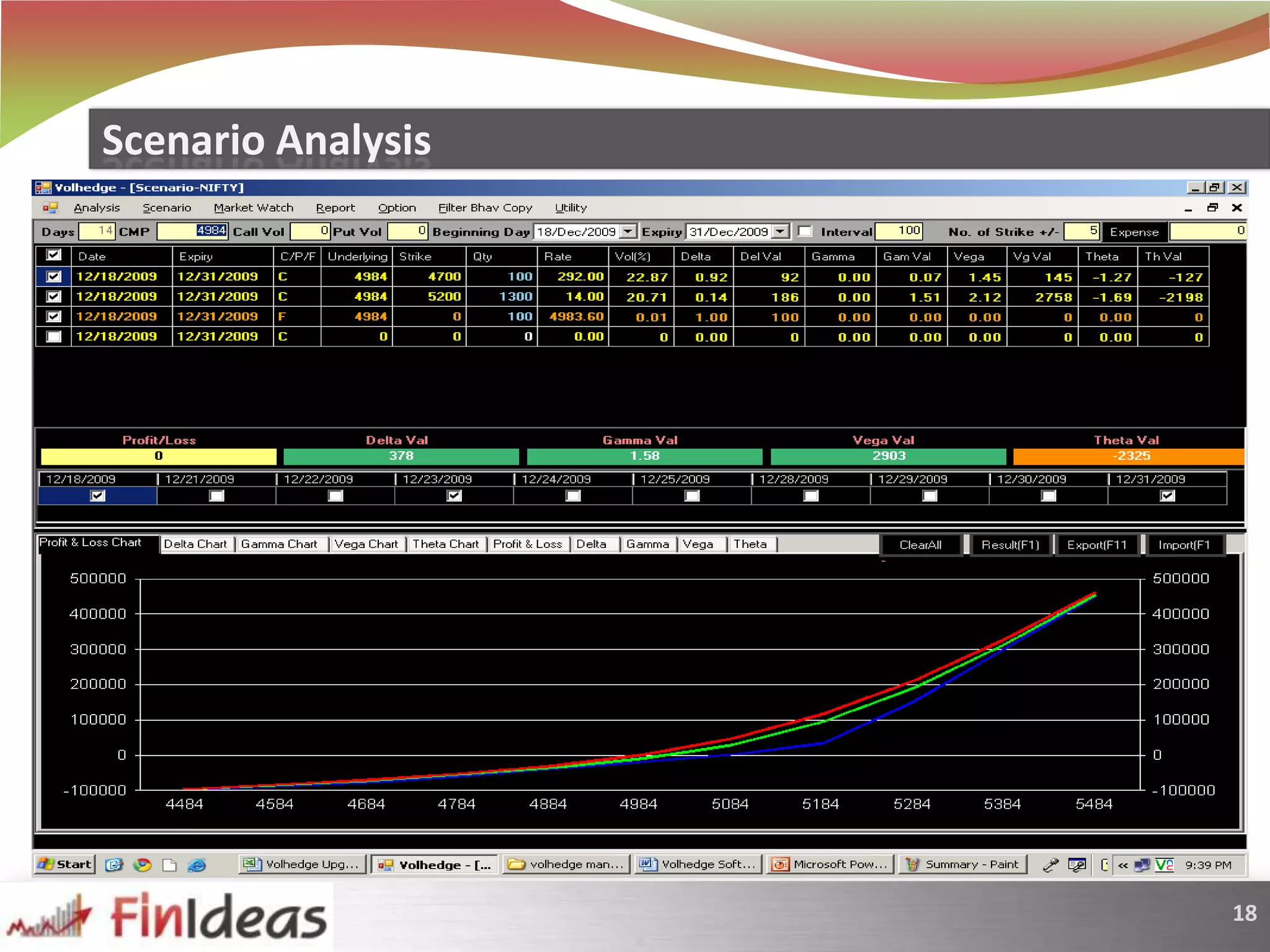

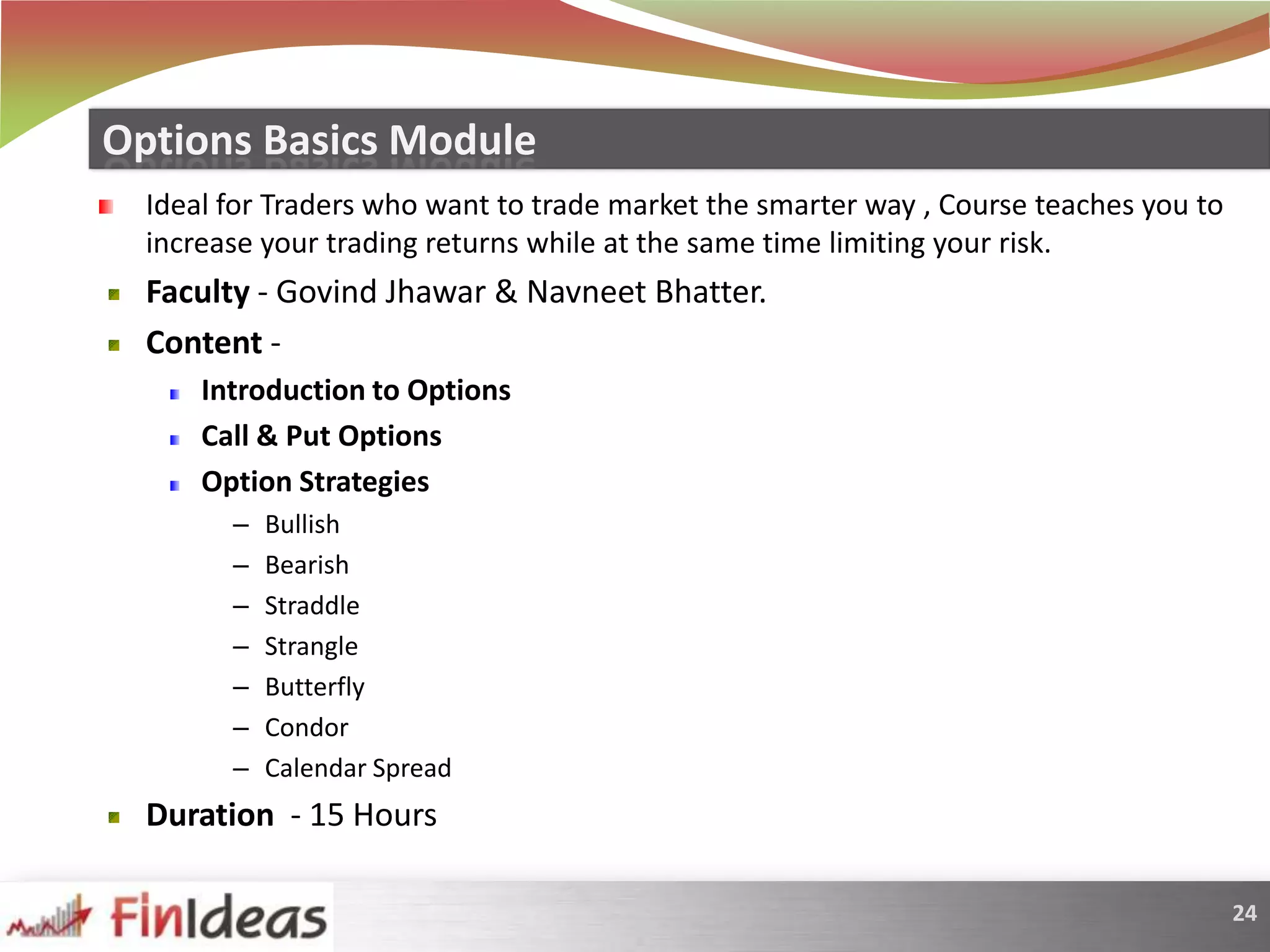

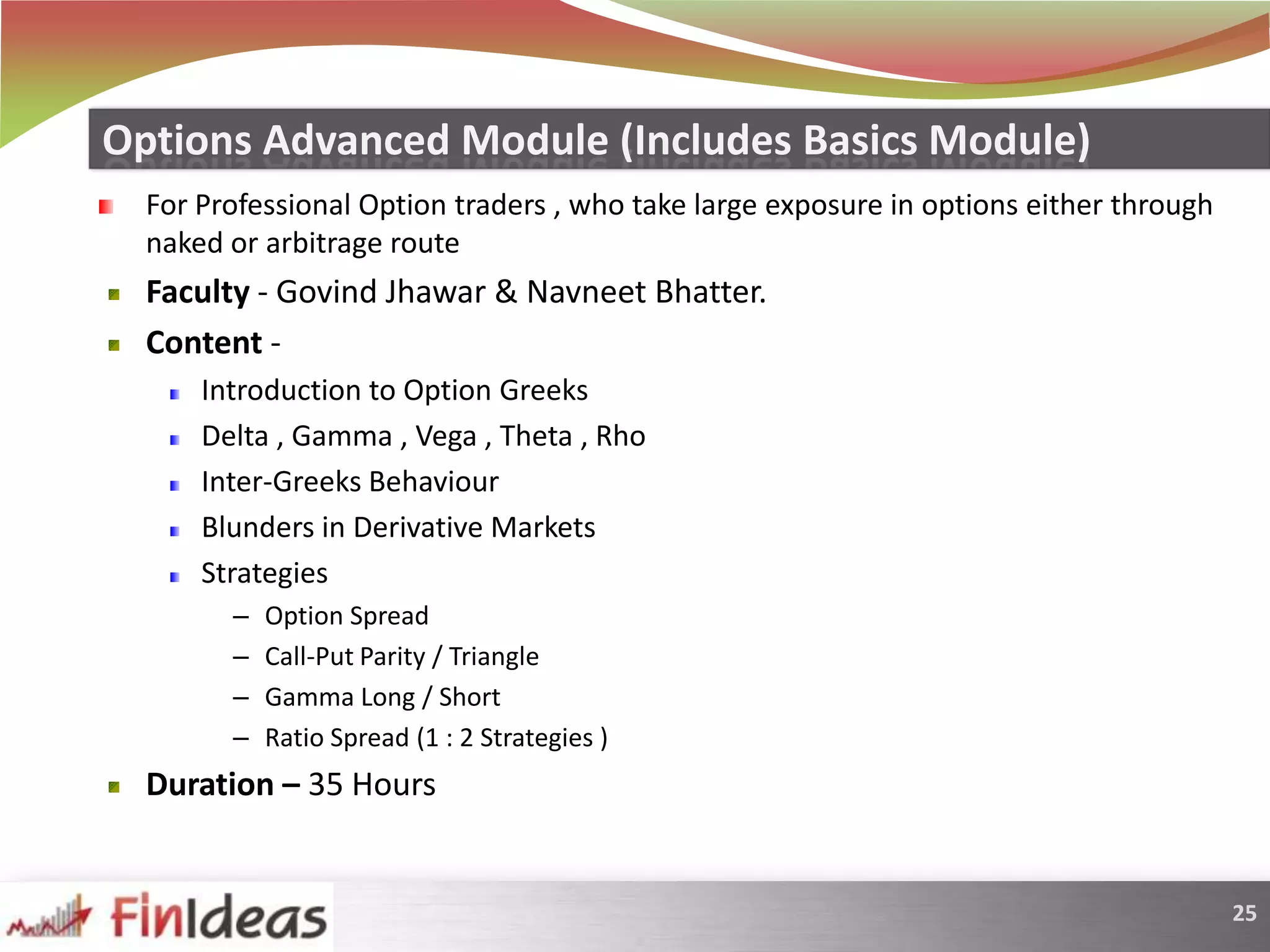

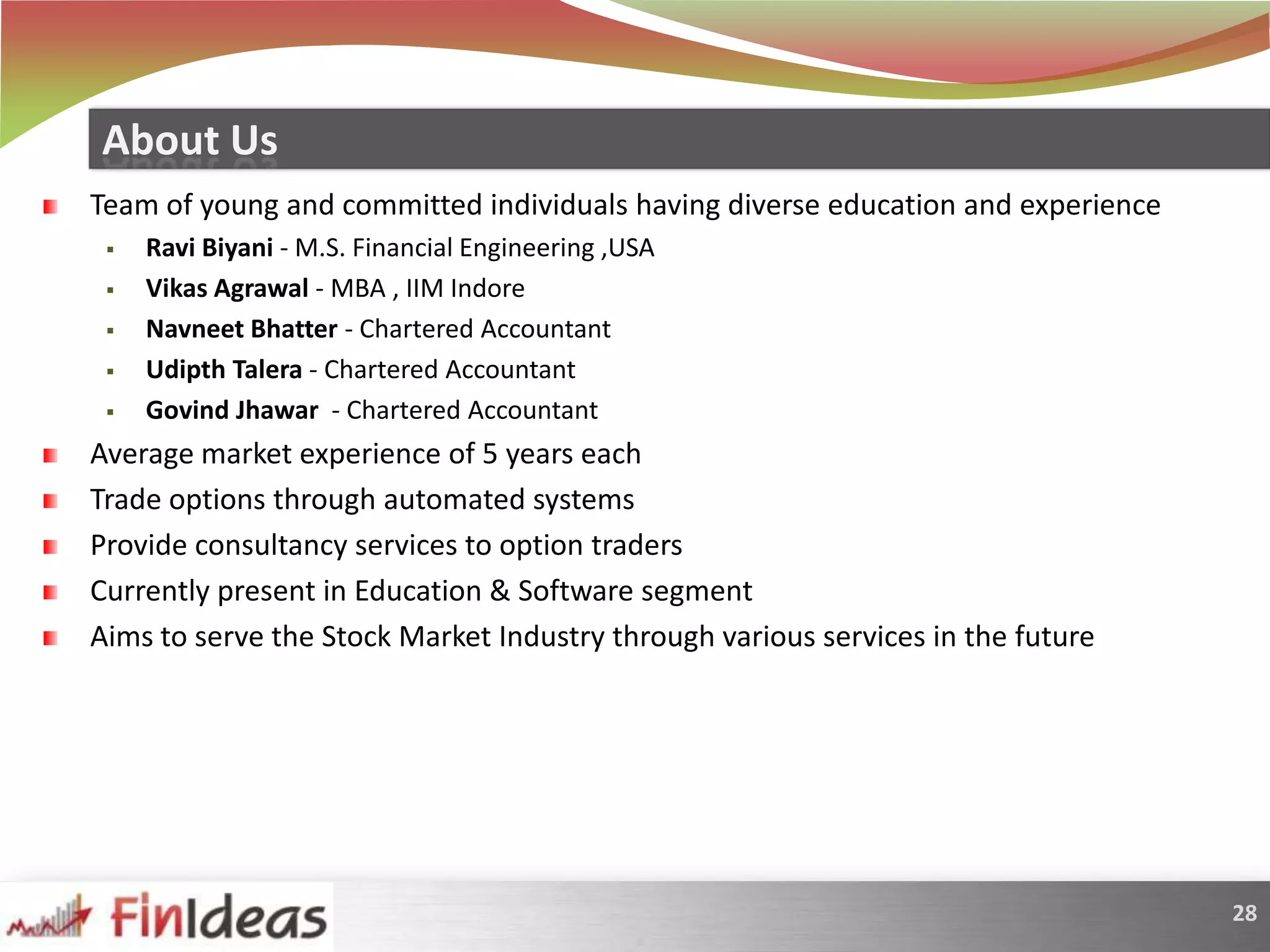

This document provides an overview of FinIdeas, an education company focused on options trading. It discusses the evolving Indian financial markets and opportunities in new products like options. FinIdeas offers options trading courses taught using in-house software to analyze strategies, volatility, and position Greeks. Upcoming topics include currency options launching in India and new exchange developments. The document outlines FinIdeas' team experience, focus on education and software, and goal of serving the stock market industry through various future services.