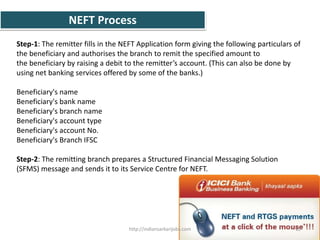

The document discusses the transformation of the banking sector in India over the past decade. With the entry of private players and focus on consumers, banking underwent significant changes with the introduction of new technologies and channels like ATMs, internet banking, and mobile banking. This allowed customers to conduct transactions outside of traditional branch banking. The Reserve Bank of India has introduced new payment systems like NEFT and RTGS to modernize transactions. Going forward, RBI is looking to develop new real-time payment systems like "India MoneyLine" to allow 24/7 funds transfers.