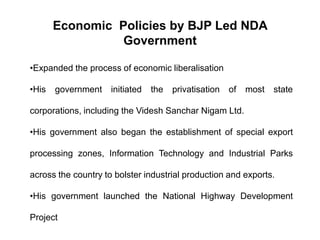

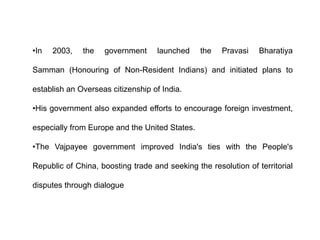

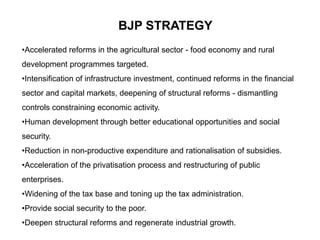

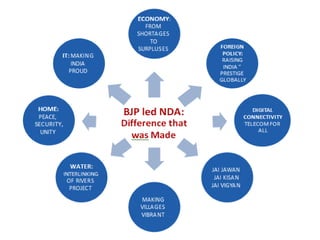

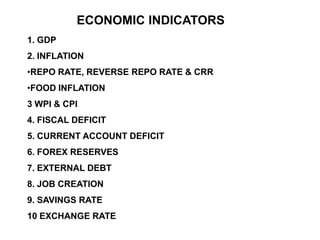

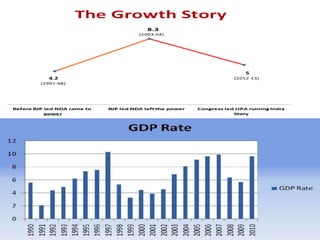

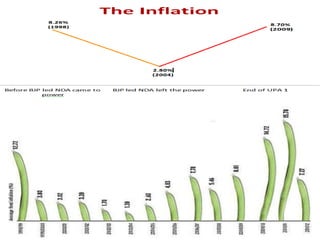

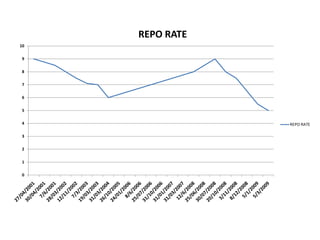

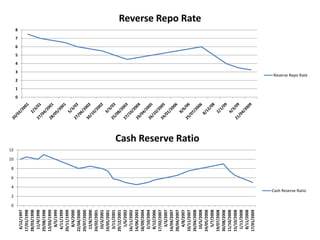

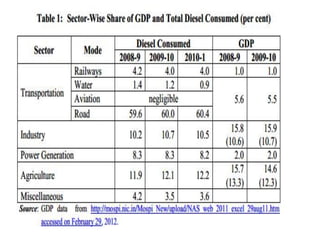

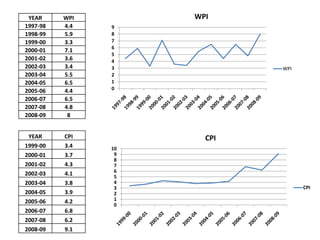

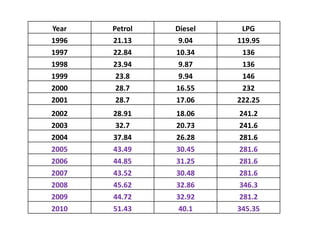

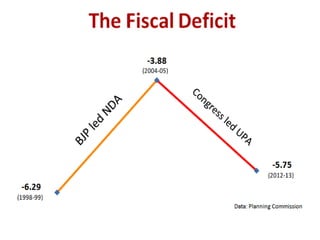

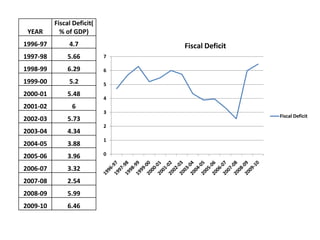

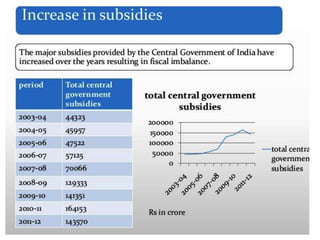

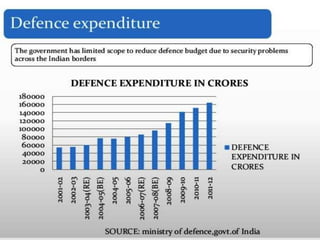

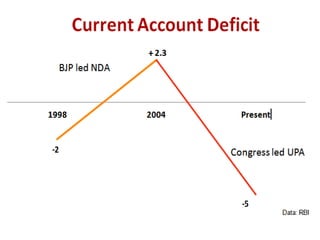

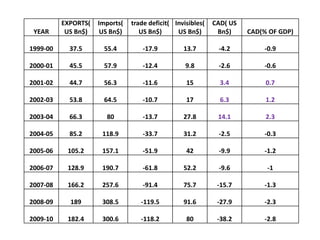

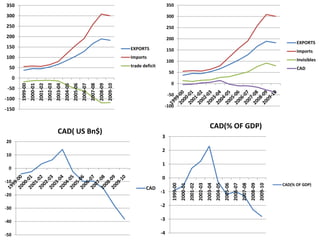

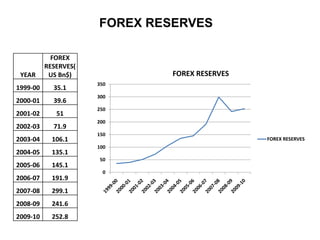

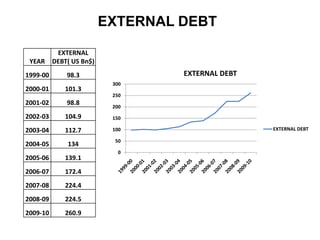

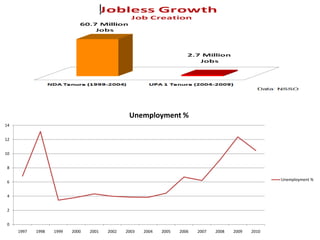

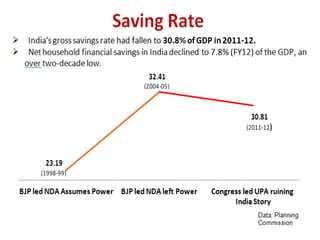

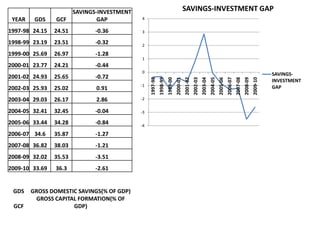

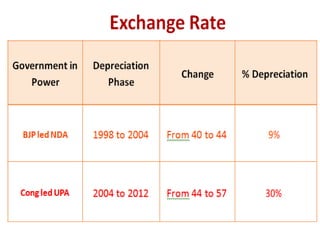

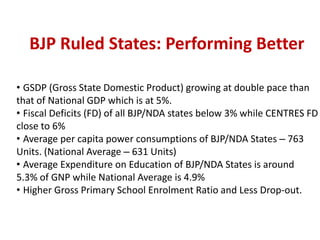

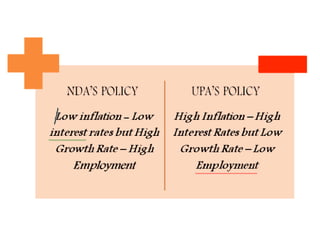

The document summarizes key economic policies and indicators during the BJP-led NDA government from 1999-2004. It discusses policies like economic liberalization, privatization of state corporations, establishment of special economic zones, and expansion of foreign investment. It also outlines various economic indicators like GDP growth, inflation, fiscal deficit, current account deficit, forex reserves, and unemployment rate during this period.