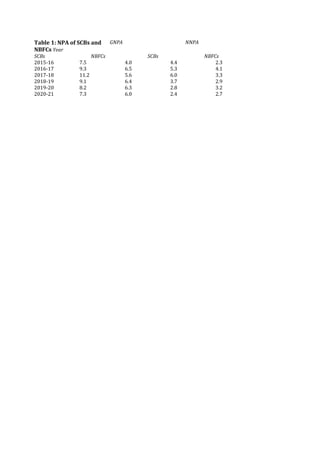

The document discusses lending to Non-Banking Financial Companies (NBFCs) in India. It outlines the regulatory framework established by the Reserve Bank of India (RBI) to govern NBFC lending. This includes prudential norms on capital adequacy, asset classification, exposure limits, and more. It also describes the different types of NBFCs and their activities. Major lenders to NBFCs include banks, other NBFCs, and institutional investors. Lenders conduct due diligence on NBFCs and consider factors like credit ratings, collateral, and regulatory compliance before providing loans. The RBI also sets prudential exposure limits to manage concentration risks.