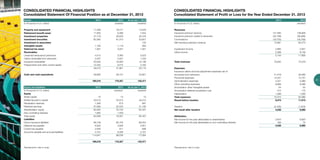

The 2013 annual report for Nagico outlines the company's mission to provide exceptional insurance services and its vision to be the most trusted insurer in the Caribbean. The report highlights financial performance, including pre-tax profits of USD 9.5 million and total assets of USD 199 million, alongside strategic plans for continued growth and improvements in governance and risk management. Noteworthy achievements include successful expansions, product integrations, and a commitment to social responsibility through various initiatives.