The Asia Green Development Bank (AGD Bank) is a private commercial bank in Myanmar, founded on July 2, 2010, and headquartered in Yangon. It was one of the first new banks established after a long hiatus since 1997 and offers a range of financial services, including international banking. The bank became a public company in 2013 and has expanded to 70 branches across the country by September 2017.

![10/16/2017 Asia Green Development Bank - Wikipedia

https://en.wikipedia.org/wiki/Asia_Green_Development_Bank 1/2

Asia Green Development

Bank (AGD)

Native name အာ စိမ်းလန်းမ

ဖွံ့ဖြိုးရေးဘဏ်

Industry Financial

services

Founded July 2, 2010

Headquarters Yangon, Burma

Services Banking

Total assets 366 billion kyat

(US$366 million)

Website www.agdbank

.com (http://ww

w.agdbank.com)

Asia Green Development Bank

Asia Green Development Bank (Burmese: အာ စိမ်းလန်းမဖွံ့ဖြိုးရေးဘဏ် ; abbreviated AGD Bank) is a private

commercial bank in Burma (Myanmar).[1] It was one of 4 private banks to commence operations in August 2010, the

first new financial institutions in the country since the establishment of Innwa Bank in 1997.[2] Its head office is

situated at Yangon, Burma. The bank announced it would become a public company when Yangon Stock Exchange is

formed in 2015.[3] The bank was founded by Tay Za and the Htoo Group of Companies, whose 15% stake was sold to

new shareholders, the most prominent of whom is Kyaw Ne Win, the grandson of Ne Win, the country's former

dictator.[4]

The AGD Bank’s Head Office and first branch was successfully opened on August 6, 2010 in Nay Pyi Taw under the

organization of Htoo Group of Companies. At first, AGD bank is 100% owned and operated by “Htoo Group of

Companies” which is engaged in trading, energy and mining, construction, agriculture, hotel, travel and tourism

business. In February 18, 2013 with a new slogan “We, all Myanmar will develop together”, AGD bank was converted

to Public Company, shares capital stands at 30.0873 billion kyats of 601746 shares in the fiscal year.

AGD Bank has been 70 branches across the country until September 2017. With establish an International Banking

Department, authorized as Dealer and Money Changer Licenses 65 foreign exchange counters services to the general

public.

List of banks

List of banks in Burma

1. The Banker Database (http://www.thebankerdatabase.com/index.cfm/banks/all/?letter=A)

2. Cheesman, Nick; Monique Skidmore; Trevor Wilson (2012). Myanmar's Transition: Openings, Obstacles, and Opportunities. Institute of Southeast Asian Studies.

p. 147.

Brief Info

See also

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-1-320.jpg)

![10/16/2017 Ayeyarwady Bank - Wikipedia

https://en.wikipedia.org/wiki/Ayeyarwady_Bank 1/2

AYA Bank

AYA Bank

Native name ဧရာဝတီဘဏ်

Type Private

Founded 2010

Founder Zaw Zaw

Headquarters Yangon, Myanmar

Number of

locations

225 branches (August

2017)

Key people Zaw Zaw

(Group Chairman)

Myint Zaw (Managing

Director)

Products Financial services

Number of

employees

8300[1] (2017)

Website www.ayabank.com (htt

p://www.ayabank.co

m)

Ayeyarwady Bank

Ayeyarwady Bank Ltd. (Burmese: ဧရာဝတီဘဏ် ; AYA Bank) is a private bank in Myanmar. AYA Bank

was established on 2 July 2010 with the permission of the Central Bank of Myanmar. The AYA Bank's head

office is located in the Rowe Building Kyauktada Township of Yangon.

AYA Bank had 225 branches as of August 2017. Ayeyarwady Bank offers retail and commercial banking

products and services.

Ayeyarwady Bank received its banking license from the Central Bank of Myanmar on 2 July 2010 and began

operations on 11 August 2010. The bank is authorized to operate as an investment or development bank for

the domestic market and the approved banking activities include:

Borrowing or raising of money

Lending or advancing of money either secured or unsecured

Receiving securities or valuables for safe custody

Collecting and transmitting money and securities

Cash management system

Internet banking

Provision of international banking services including international remittance, payment and trade

services

Mobile Banking

1. "The Myanmar Times Bank Survey 2014" (http://www.mmtimes.com/index.php/special-features/194-y

our-money-2014/11033-bank-survey-2014.html?start=2). Myanmar Times. 15 July 2014. Retrieved

8 February 2015.

Retrieved from "https://en.wikipedia.org/w/index.php?title=Ayeyarwady_Bank&oldid=805370571"

History

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-5-320.jpg)

![10/16/2017 Central Bank of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Central_Bank_of_Myanmar 1/5

Central Bank of Myanmar

မြန်မာနိုင်ငံတော် ဗဟိုဘဏ်

Seal

Headquarters

Headquarters Naypyidaw

Established 3 April 1948 (as

Union Bank of

Burma)

Governor Kyaw Kyaw

Maung[1]

Central bank of Myanmar

(Burma)

Currency Myanmar kyat

MMK (ISO

4217)

Preceded by Union Bank of

Burma

People’s Bank

Central Bank of Myanmar

The Central Bank of Myanmar (Burmese: ြမန်မာ ိင်ငံေတာ်ဗဟိဘဏ်; MLCTS: myan

ma naing ngam taw ba ho bhan IPA: [mjəmà nàinŋàndɔ̀ bəhòʊbàn]; abbreviated

CBM) is the central bank of Myanmar (formerly Burma).

Contents

1 Organisation

2 History

3 Role

4 Members

5 See also

6 References

6.1 Footnotes

Organisation

Its headquarter located in Naypyidaw, and it has branches in Yangon and

Mandalay. The Governor is Kyaw Kyaw Maung and three Vice Governors are Set

Aung, Khin Saw Oo and Soe Min. The Central Bank of Myanmar became an

Coordinates: 19.7915°N 96.1441°E](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-7-320.jpg)

![10/16/2017 Central Bank of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Central_Bank_of_Myanmar 2/5

of Union Bank

of Burma

Website www.cbm.gov

.mm (http://ww

w.cbm.gov.mm)

autonomous and independent regulatory body by the Central Bank of Myanmar

Law which was enacted by the Myanmar Parliament in 2013.

History

The Central Bank of Myanmar was founded as "the Union Bank of Burma" on 3rd April 1948 by the Act of Union

Bank of Burma 1947 and took over the functions of the Rangoon branches of the Reserve Bank of India.[2]The

Union Bank of Burma was opened at the corner of Merchant Road and Sule Pagoda Road and had a sole right of

currency issue.

Role

CBM has liberalised the financial organisations for competition, efficiency and integration into the regional

financial system. As of the end of December 2007, there are 15 domestic private banks and 13 representative

offices of foreign banks and three representative offices of foreign insurance companies in Myanmar. According to

the changes in the economic requirements of the country, the Central Bank rate has been increased from 10

percent to 12 percent since 1 April 2006.

Agricultural liberalisation speeded up after the elimination of the government procurement system of the main

agricultural crops such as rice, pulses, sugarcane, cotton, etc., in 2003–04. The state also reduced the subsidised

agricultural inputs, especially fertiliser. With an intention to enhance private participation in trade of agricultural

products and inputs, the government is now encouraging export of crops which are in surplus in domestic

markets or grown on fallow or waste land, giving opportunities to farmer and private producers.

Upon the guidance of the Ministry of Finance & Revenue, the CBM is responsible for financial stability and

supervision of the financial sector in Myanmar. The institutional coverage of the financial supervisory authority

includes state-owned banks and private banks in Myanmar. Two main approaches (on-site examination and off-

site monitoring) are currently used for supervision, regulation and monitoring of financial stability.](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-8-320.jpg)

![10/16/2017 Central Bank of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Central_Bank_of_Myanmar 3/5

On-site examination involves assessing banks’ financial activities and internal management, to identify areas

where corrective action is required and to analyse their banking transactions and financial conditions, ensuring

that they are in accordance with existing laws, rules and regulations and the instructions of the CBM by using

CAMEL. Off-site monitoring operations are normally based on the weekly, monthly, quarterly and annual reports

which are submitted by the banks to the CBM.

The Central Bank has also issued guidelines on the statutory reserve requirement, capital adequacy, liquidity,

classification of N.P.L. and provision for bad and doubtful debts, single lending limit, etc. The reserve

requirement, liquidity and capital adequacy required to be maintained by financial institutions have been

prescribed according to the standards of the Bank for International Settlements (BIS). However, the

implementation of Basel II will still take a few more years.

Members

As of end of July 2016, its current members are as follows:

Governor

Kyaw Kyaw Maung[3]

Deputy Governors

Set Aung[4]

Khin Saw Oo

Soe Min

Director Generals

Myint Myint Kyi (Governor's Office)

Aung Aung (Administration and Human Resource Development Department)

May Malar Maung Gyi (Monetary Policy Affairs and Banking Regulation Department)

Thida Myo Aung (Financial Institutions Supervision Department)](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-9-320.jpg)

![10/16/2017 Co-operative Bank Ltd - Wikipedia

https://en.wikipedia.org/wiki/Co-operative_Bank_Ltd 1/2

CB Bank

Type Public

Industry Banking

Founded August 21, 1992

Headquarters Yangon, Myanmar

Number of

locations

183 branches

(2016)[1]

Key people Khin Maung Aye

(Chairman)

Kyaw Lynn

(Executive Vice

Chairman & CEO)

Products Financial services

Number of

employees

7000 (2016)

Website www.cbbank.com

.mm (http://www.c

bbank.com.mm)

Co-operative Bank Ltd

Co-operative Bank Ltd. (CB Bank) (Burmese: သမဝါယမဘဏ် လီမိတက် ) is one of the largest private banks in

Myanmar. The CB Bank was established on 21 August 1992 with the permission of the Central Bank of

Myanmar. The CB Bank's head office is located in the Botahtaung township area of Yangon. CB Bank has 183

local branches which offers a range of banking services in consumer banking and business banking. CB Bank

launched the first ATM in Myanmar on 1 November 2011. The bank named the ATM service as EASI Banking.

The bank has the largest network of ATM (525) and Foreign Exchange Counters (73) in Myanmar.[2][3][4][5]

1. "CB Bank: Branches Location" (http://www.cbbank.com.mm/aboutus/aboutus_network_branches.aspx).

www.cbbank.com.mm. Retrieved 16 June 2017.

2. "C B Bank - About Us" (http://www.cbbank.com.mm/about.php?l=e). Cbbankmm.com. Retrieved

2012-01-28.

3. "GRG Helps Myanmar Public to Have ATM Again After 8 Year of Waiting" (http://www.grgbanking.com/en/

show_news.asp?id=1699&type_id=21). Grgbanking.com. 2011-11-01. Retrieved 2012-01-28.

4. 4-traders (2011-11-01). "GRG Banking Equipment Co., Ltd. : GRG Helps Myanmar Public to Have ATM

Again After 8 Year .." (http://www.4-traders.com/GRG-BANKING-EQUIPMENT-CO-6499814/news/GRG-BA

NKING-EQUIPMENT-CO-LTD-GRG-Helps-Myanmar-Public-to-Have-ATM-Again-After-8-Year-13884878/). 4-

Traders. Retrieved 2012-01-28.

5. "ATMs find favour with users" (http://www.mmtimes.com/2011/business/602/biz60202.html).

Mmtimes.com. Retrieved 2012-01-28.

Official website (http://www.cbbank.com.mm/)

Retrieved from "https://en.wikipedia.org/w/index.php?title=Co-operative_Bank_Ltd&oldid=793968293"

This page was last edited on 5 August 2017, at 00:35.

References

External links](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-14-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 2/21

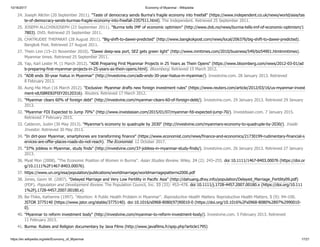

poverty line

Labour force 32.53 million (2011 est.)

Labour force

by occupation

agriculture: 70%, industry: 7%, services: 23% (2001)

Unemployment 37% (2012)

Main industries agricultural processing; wood and wood products; copper, tin, tungsten, iron; cement,

construction materials; pharmaceuticals; fertiliser; petroleum and natural gas; garments, jade

and gems

Ease-of-doing-

business rank

170th (2017)[1]

External

Exports $10.49 billion (2016 est.)

note: official export figures are grossly underestimated due to the value of timber, gems,

narcotics, rice, and other products smuggled to Thailand, China, and Bangladesh

Export goods natural gas, wood products, pulses, beans, fish, rice, clothing, jade and gems

Main export

partners

China 37.7%

Thailand 25.6%

India 7.7%

Japan 6.2% (2015 est.)[2]

Imports $13.96 billion (2016 est.)

note: import figures are grossly underestimated due to the value of consumer goods, diesel

fuel, and other products smuggled in from Thailand, China, Malaysia, and India

Import goods fabric, petroleum products, plastics, fertiliser, machinery, transport equipment, cement,

construction materials, crude oil; food products, edible oil

Main import

partners

China 42.2%](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-19-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 3/21

Thailand 18.5%

Singapore 11%

Japan 4.8%

(2015 est.)[3]

Public finances

Public debt $11 billion (2012)[4]

Revenues $2.016 billion

Expenses $4.272 billion (2011 est.)

Economic aid recipient: $127 million (2001 est.)

Foreign

reserves

$8 billion (as of January 2013)[5]

Main data source:

CIA World Fact Book (https://www.cia.gov/library/publications/resources/the-world-factbook/geos/bm.html)

All values, unless otherwise stated, are in US dollars.

Myanmar (also known as Burma) is an emerging economy with a nominal GDP of $66.324 billion dollars in 2016 and an estimated purchasing power adjusted

GDP of $334.85 billion dollars in 2016.

1 History

1.1 Classical era

1.2 British Burma (1885–1948)

1.3 Post-independence (1948-)

1.4 Military rule (1988–2011)

1.5 Economic liberalisation (2011–present)

2 Still unresolved internal problems

Contents](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-20-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 4/21

3 Industries

3.1 Garment production

3.2 Illegal drug trade

3.3 Oil and gas

3.4 Gemstones

3.5 Tourism

4 External trade

5 Macro-economic trends

5.1 Foreign investment

5.2 Foreign aid

6 Other statistics

7 External References

8 Footnotes

9 Further reading

10 External links

Historically, Burma was the main trade route between India and China since 100 BC. The Mon Kingdom of lower Burma served as important trading centre in the

Bay of Bengal.

According to Michael Adas, Ian Brown, and other economic historians of Burma, Burma's pre-colonial economy in Burma was essentially a subsistence economy,

with the majority of the population involved in rice production and other forms of agriculture.[6] Burma also lacked a formal monetary system until the reign of

King Mindon Min in the middle 19th century.[6]

History

Classical era](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-21-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 5/21

All land was technically owned by the Burmese monarch.[7] Exports, along with oil wells, gem mining and teak production were controlled by the monarch.[7]

Burma was vitally involved in the Indian Ocean trade.[6] Logged teak was a prized export that was used in European shipbuilding, because of its durability, and

became the focal point of the Burmese export trade from the 1700s to the 1800s.[8]

After Burma was conquered by the British, it became the wealthiest country in Southeast Asia, after the Philippines. It was also once the world's largest exporter of

rice. During British administration, Burma supplied oil through the Burmah Oil Company. This supplying market received a setback through the great depression

in the 1930s. Burma suffered, like other countries in this region, from the decline in the total level of global trade.[9] Burma also had a wealth of natural and labour

resources. It produced 75% of the world's teak and had a highly literate population.[7] The country was believed to be on the fast track to development.

After a parliamentary government was formed in 1948, Prime Minister U Nu embarked upon a policy of nationalisation. He attempted to make Burma a welfare

state by adopting central planning measures. The government also tried to implement a poorly thought out Eight-Year plan. By the 1950s, rice exports had fallen by

two thirds and mineral exports by over 96%. Plans were partly financed by printing money, which led to inflation.[10]The 1962 coup d'état, was followed by an

economic scheme called the Burmese Way to Socialism, a plan to nationalise all industries, with the exception of agriculture. The catastrophic program turned

Burma into one of the world's most impoverished countries.[11][12] Burma's admittance to least developed country status by the United Nations in 1987

highlighted its economic bankruptcy.[13]

After 1988, the regime retreated from totalitarian socialism. It permitted modest expansion of the private sector, allowed some foreign investment, and received

much needed foreign exchange.[14] The economy is rated in 2009 as the least free in Asia (tied with North Korea).[15] All fundamental market institutions are

suppressed.[15][16] Private enterprises are often co-owned or indirectly owned by state. The corruption watchdog organisation Transparency International in its

2007 Corruption Perceptions Index released on 26 September 2007 ranked Burma the most corrupt country in the world, tied with Somalia.[17]

The national currency is the kyat. Burma currently has a dual exchange rate system similar to Cuba.[18] The market rate was around two hundred times below the

government-set rate in 2006.[16] In 2011, the Burmese government enlisted the aid of International Monetary Fund to evaluate options to reform the current

exchange rate system, to stabilise the domestic foreign exchange trading market and creates economic distortions.[19] The dual exchange rate system allows for the

government and state-owned enterprises to divert funds and revenues, but also gives the government more control over the local economy and temporarily subdue

inflation.[20][21]

Inflation averaged 30.1% between 2005 and 2007.[15] Inflation is a serious problem for the economy. In April 2007, the National League for Democracy organised

a two-day workshop on the economy. The workshop concluded that skyrocketing inflation was impeding economic growth. "Basic commodity prices have increased

from 30% to 60% since the military regime promoted a salary increase for government workers in April 2006," said Soe Win, the moderator of the workshop.

British Burma (1885–1948)

Post-independence (1948-)

Military rule (1988–2011)](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-22-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 6/21

"Inflation is also correlated with corruption." Myint Thein, an NLD spokesperson, added: "Inflation is the critical source of the current economic crisis."[22]

In recent years, both China and India have attempted to strengthen ties with the government for economic benefit. Many nations, including the United States and

Canada, and the European Union, have imposed investment and trade sanctions on Burma. The United States banned all imports from Burma, though this

restriction was since lifted.[16] Foreign investment comes primarily from People's Republic of China, Singapore, South Korea, India, and Thailand.[23]

In 2011, when new President Thein Sein's government came to power, Burma embarked on a major policy of reforms including anti-corruption, currency exchange

rate, foreign investment laws and taxation. Foreign investments increased from US$300 million in 2009-10 to a US$20 billion in 2010-11 by about 6567%.[24]

Large inflow of capital results in stronger Burmese currency, kyat by about 25%. In response, the government relaxed import restrictions and abolished export

taxes. Despite current currency problems, Burmese economy is expected to grow by about 8.8% in 2011.[25] After the completion of 58-billion dollar Dawei deep

seaport, Burma is expected be at the hub of trade connecting Southeast Asia and the South China Sea, via the Andaman Sea, to the Indian Ocean receiving goods

from countries in the Middle East, Europe and Africa, and spurring growth in the ASEAN region.[26][27]

In 2012, the Asian Development Bank formally began re-engaging with the country, to finance infrastructure and development projects in the country.[28] The

$512 million loan is the first issued by the ADB to Myanmar in 30 years and will target banking services, ultimately leading to other major investments in road,

energy, irrigation and education projects.[29]

In March 2012, a draft foreign investment law emerged, the first in more than 2 decades. This law oversees unprecedented liberalisation of the economy. It for

example stipulates that foreigners no longer require a local partner to start a business in the country, and are able to legally lease land.[30] The draft law also

stipulates that Burmese citizens must constitute at least 25% of the firm's skilled workforce, and with subsequent training, up to 50-75%.[30]

On 28 January 2013, the government of Myanmar announced deals with international lenders to cancel or refinance nearly $6 billion of its debt, almost 60 per

cent of what it owes to foreign lenders. Japan wrote off US$3 Billion, nations in the group of Paris Club wrote off US$2.2 Billion and Norway wrote off US$534

Million. [31]

Myanmar's inward foreign direct investment has steadily increased since its reform. The country approved US$4.4 billion worth of investment projects between

January and November 2014. [32]

According to one report released on 30 May 2013, by the McKinsey Global Institute, Burma's future looks bright, with its economy expected to quadruple by 2030

if it invests in more high-tech industries.[33] This however does assume that other factors (such as drug trade, the continuing war of the government with specific

ethnic groups, ...) do not interfere.

As of October 2017, less than 10% of Myanmar‘s population has a bank account.[34]

Economic liberalisation (2011–present)

Still unresolved internal problems](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-23-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 7/21

In a first ever countrywide study the Myanmar government found that 37 per cent of the nation’s population are unemployed and an average of 26 per cent live in

poverty. [35]

The current state of the Burmese economy has also had a significant impact on the demographics of Burma, as economic hardship results in extreme delays of

marriage and family building. The average age of marriage in Burma is 27.5 for men, 26.4 for women, almost unparalleled in the region, with the exception of

developed countries like Singapore.[36][37]

Burma also has a low fertility rate, of 2.07 children per woman (2010), especially as compared to other Southeast Asian countries of similar economic standing, like

Cambodia (3.18) and Laos (4.41), representing a significant decline from 4.7 in 1983, despite the absence of a national population policy.[38] This is at least partly

attributed to the economic strain that additional children place on the family income, and has resulted in the prevalence of illegal abortions in the country, as well

as use of other forms of birth control.[39]

The 2012 foreign investment law draft, included a proposal to transform the Myanmar Investment Commission from a government-appointed body into an

independent board. This could bring greater transparency to the process of issuing investment licenses, according to the proposed reforms drafted by experts and

senior officials.[40] However, even with this draft, it will still remain a question on whether corruption in the government can be addressed (links have been shown

between certain key individuals inside the government and the drug trade, as well as many industries that use forced labour -for example the mining industry-).[41]

Many regions (such as the Golden Triangle) remain off-limits for foreigners, and in some of these regions, the government is still at war with certain ethnic

groups.[41][42]

The major agricultural produce is rice which covers about 60% of the country's total cultivated land area. Rice accounts for 97% of total food grain production by

weight. Through collaboration with the International Rice Research Institute (IRRI), 52 modern rice varieties were released in the country between 1966 and 1997,

helping increase national rice production to 14 million tons in 1987 and to 19 million tons in 1996. By 1988, modern varieties were planted on half of the country's

rice fields, including 98% of the irrigated areas.[43] In 2011, Myanmar's total milled rice production accounted for 10.26 million tons, an increase from the 1.8 per

cent back in 2010.[44]

In northern Burma opium, bans have ended a century old tradition of growing poppy. Between 20,000 and 30,000 ex-poppyfarmers left the Kokang region as a

result of the ban in 2002.[45] People from the Wa region, where the ban was implemented in 2005, fled to areas where growing opium is still possible. Other ex-

poppyfarmers are being relocated to areas near rubber plantations. These are often mono-plantations from Chinese investors.

Rubber plantations are being promoted in areas of high elevation like Mong Mao. Sugar plantations are grown in the lowlands such as Mong Pawk District.[45]

The lack of an educated workforce skilled in modern technology contributes to the growing problems of the economy.[46]

Industries](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-24-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 8/21

Today, the country lacks adequate infrastructure. Goods travel primarily across the Thai border (where most illegal drugs are exported) and along the Ayeyarwady

River. Railroads are old and rudimentary, with few repairs since their construction in the late nineteenth century.[47] Highways are normally unpaved, except in

the major cities.[47] Energy shortages are common throughout the country including in Yangon. More than 45 million of the country's population is without

electricity, with 70 per cent of people living in rural areas.[48]

Burma is also the world's second largest producer of opium, accounting for 8% of entire world production and is a major source of illegal drugs, including

amphetamines.[49] Other industries include agricultural goods, textiles, wood products, construction materials, gems, metals, oil and natural gas.

The private sector dominates in agriculture, light industry, and transport activities, while the military government controls energy, heavy industry, and rice trade.

The garment industry is a major job creator in the Yangon area, with around 200,000 workers employed in total in mid-2015.[50] The Myanmar Government has

introduced minimum wage of MMR 3,600 (US$2.80) per day for the garment workers from 1 September 2015.[51]

The Myanmar garments sector has seen significant influx of foreign direct investment, if measured by the number of entries rather than their value. In March 2012,

six of Thailand's largest garment manufacturers announced that they would move production to Burma, principally to the Yangon area, citing lower labour

costs.[52] In mid-2015, about 55% of officially registered garment firms in Myanmar were known to be fully or partly foreign-owned, with about 25% of the foreign

firms from China and 17% from Hong Kong.[53] Foreign-linked firms supply almost all garment exports, and these have risen rapidly in recent years, especially

since EU sanctions were lifted in 2012.[54]

Burma (Myanmar) is the largest producer of methamphetamines in the world, with the majority of ya ba found in Thailand produced in Burma, particularly in the

Golden Triangle and Northeastern Shan State, which borders Thailand, Laos and China.[55] Burmese-produced Ya ba is typically trafficked to Thailand via Laos,

before being transported through the northeastern Thai region of Isan.[56]

In 2010, Burma trafficked 1 billion tablets to neighbouring Thailand.[55] In 2009, Chinese authorities seized over 40 million tablets that had been illegally

trafficked from Burma.[57] Ethnic militias and rebel groups (in particular the United Wa State Army) are responsible for much of this production; however, the

Burmese military units are believed to be heavily involved in the trafficking of the drugs.[55]

Burma is also the 2nd largest supplier of opium (following Afghanistan) in the world, with 95% of opium grown in Shan State.[58][59] Illegal narcotics have

generated $1 to $2 billion USD in exports annually, with estimates of 40% of the country's foreign exchange coming from drugs.[55][60] Efforts to eradicate opium

cultivation have pushed many ethnic rebel groups, including the United Wa State Army and the Kokang to diversify into methamphetamine production.

Garment production

Illegal drug trade](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-25-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 9/21

Prior to the 1980s, heroin was typically transported from Burma to Thailand,

before being trafficked by sea to Hong Kong, which was and still remains the

major transit point at which heroin enters the international market. Now, drug

trafficking has circumvented to southern China (from Yunnan, Guizhou,

Guangxi, Guangdong) because of a growing market for drugs in China, before

reaching Hong Kong.[61]

The prominence of major drug traffickers have allowed them to penetrate other

sectors of the Burmese economy, including the banking, airline, hotel and

infrastructure industries.[62] Their investment in infrastructure have allowed

them to make more profits, facilitate drug trafficking and money

laundering.[63]

Myanma Oil and Gas Enterprise (MOGE) is a national oil and gas company

of Burma. The company is a sole operator of oil and gas exploration and production, as well as domestic gas

transmission through a 1,900-kilometre (1,200 mi) onshore pipeline grid.[64][65]

The Yadana Project is a project to exploit the Yadana gas field in the Andaman Sea and to carry natural gas to

Thailand through Myanmar.

Sino-Burma pipelines refers to planned oil and natural gas pipelines linking the Burma's deep-water port of

Kyaukphyu (Sittwe) in the Bay of Bengal with Kunming in Yunnan province, China.

The Norwegian company Seadrill owned by John Fredriksen is involved in offshore oildrilling, expected to give

the Burmese Military Junta oil and oil export revenues.

Myanmar exported $3.5 billion worth of gas, mostly to Thailand in the fiscal year up to March 2012.[66]

Initiation to bid on oil exploration licenses for 18 of Myanmar’s onshore oil blocks has been released on 18

January 2013.[66]

The Union of Myanmar's rulers depend on sales of precious stones such as sapphires, pearls and jade to fund their regime. Rubies are the biggest earner; 90% of

the world's rubies come from the country, whose red stones are prized for their purity and hue. Thailand buys the majority of the country's gems. Burma's "Valley

of Rubies", the mountainous Mogok area, 200 km (120 mi) north of Mandalay, is noted for its rare pigeon's blood rubies and blue sapphires.[67]

A world map of the world's primary opium or heroin producers. The Golden

Triangle region, which Burma is part of, is pinpointed in this map.

Oil and gas

A private petrol station in the Inle

lake region, Myanmar

Gemstones](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-26-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 10/21

In 2007, following the crackdown on pro-democracy protests in Myanmar, human rights organisations, gem dealers, and US First Lady Laura Bush called for a

boycott of a Myanmar gem auction held twice yearly, arguing that the sale of the stones profits the dictatorial regime in that country.[68] Debbie Stothard of the

Alternative ASEAN Network on Burma stated that mining operators used drugs on employees to improve productivity, with needles shared, raising the risk of HIV

infection: "These rubies are red with the blood of young people." Brian Leber (41-year-old jeweller who founded The Jewellers' Burma Relief Project) stated that:

"For the time being, Burmese gems should not be something to be proud of. They should be an object of revulsion. It's the only country where one obtains really top

quality rubies, but I stopped dealing in them. I don't want to be part of a nation's misery. If someone asks for a ruby now I show them a nice pink sapphire."[69]

Richard W. Hughes, author of Ruby and Sapphire, a Bangkok-based gemologist who has made many trips to Burma makes the point that for every ruby sold

through the junta, another gem that supports subsistence mining is smuggled over the Thai border.[70] Burma's gemstone industry is a cornerstone of the Burmese

economy with exports topping $1 billion.[71]

The permits for new gem mines in Mogoke, Mineshu and Nanyar state will be issued by the ministry according to a statement issued by the ministry on 11

February. While many sanctions placed on the former regime were eased or lifted in 2012, the US has left restrictions on importing rubies and jade from Myanmar

intact. According to recent amendments to the new Myanmar foreign investment law, there is no longer a minimum capital requirement for investments, except in

mining ventures, which require substantial proof of capital and must be documented through a domestic bank. Another important clarification in the investment

law is the dropping of foreign ownership restrictions in joint ventures, except in restricted sectors, such as mining, where FDI will be capped at 80 per cent. [72]

Since 1992, the government has encouraged tourism. Until 2008, fewer than 750,000 tourists entered the country annually,[73] but there has been substantial

growth over the past years. In 2012, 1.06 million tourists visited the country,[74] and 1.8 million are expected to visit by the end of 2013.

Tourism is thus a growing sector of the economy of Burma. Burma has diverse and varied tourist attractions and is served internationally by numerous airlines via

direct flights. Domestic and foreign airlines also operate flights within the country. Cruise ships also dock at Yangon. Overland entry with a border pass is

permitted at several border checkpoints. The government requires a valid passport with an entry visa for all tourists and business people. As of May 2010, foreign

business visitors from any country can apply for a visa on arrival when passing through Yangon and Mandalay international airports without having to make any

prior arrangements with travel agencies.[75] Both the tourist visa and business visa are valid for 28 days, renewable for an additional 14 days for tourism and 3

months for business. Seeing Burma through a personal tour guide is popular. Travelers can hire guides through travel agencies.

[76] Aung San Suu Kyi has requested that international tourists not visit Burma. The junta's forced labour programmes were focused around tourist destinations

which have been heavily criticised for their human rights records. Even disregarding the obviously governmental fees, Burma’s Minister of Hotels and Tourism

Major-General Saw Lwin recently admitted that the government receives a significant percentage of the income of private sector tourism services. Not to mention

the fact that only a very small minority of impoverished ordinary people in Burma ever see any money with any relation to tourism.[77]

Before 2012, much of the country was completely off-limits to tourists, and the military very tightly controlled interactions between foreigners and the people of

Burma. Locals were not allowed to discuss politics with foreigners, under penalty of imprisonment, and in 2001, the Myanmar Tourism Promotion Board issued an

order for local officials to protect tourists and limit "unnecessary contact" between foreigners and ordinary Burmese people. Since 2012, Burma has opened up to

Tourism](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-27-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 11/21

more tourism and foreign capital, synonymous with the country's transition to democracy.[78]

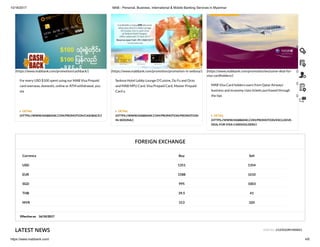

2006-2007 Financial Year Trade volume (in US$000,000)

Sr. No. Description

2006–2007 Budget Trade Volume 2006–2007 Real Trade Volume

Export Import Trade Volume Export Import Trade Volume

1 Normal Trade 4233.60 2468.40 6702.00 4585.47 2491.33 7076.80

2 Border Trade 814.00 466.00 1280.00 647.21 445.40 1092.61

Total 5047.60 2934.40 7982.00 5232.68 2936.73 8169.41

External trade

Burmese exports in 2006](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-28-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 12/21

Total Trade Value for Financial year 2006-2007 to Financial year 2009-2010

No Financial Year Export Value Import Value Trade Value (US$, 000,000)

1 2006–2007 5222.92 2928.39 8151.31

2 2007–2008 6413.29 3346.64 9759.93

3 2008–2009 6792.85 4563.16 11356.01

4 2009–2010 7568.62 4186.28 11754.90

This is a chart of trend of gross domestic product of Burma at market prices estimated (http://www.econstats.com/IMF/IFS_Mya1_99B__.htm#Year) by the

International Monetary Fund and EconStats with figures in millions of Myanma kyats.

Year Gross Domestic Product US dollar exchange[79] Inflation index (2000=100)

1965 7,627

1970 10,437

1975 23,477

1980 38,608

1985 55,988

1990 151,941

1995 604,728

Though foreign investment has been encouraged, it has so far met with only moderate success. This is because foreign investors have been adversely affected by the

junta government policies and because of international pressure to boycott the junta government. The United States has placed trade sanctions on Burma. The

European Union has placed embargoes on arms, non-humanitarian aid, visa bans on military regime leaders, and limited investment bans. Both the European

Macro-economic trends

Foreign investment](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-29-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 13/21

Union and the US have placed sanctions on grounds of human rights violations in the country. Many nations in Asia, particularly India, Thailand and China have

actively traded with Burma. However, on 22 April the EU suspended economic and political sanctions against Burma.[80]

The public sector enterprises remain highly inefficient and also privatisation efforts have stalled. The estimates of Burmese foreign trade are highly ambiguous

because of the great volume of black market trading. A major ongoing problem is the failure to achieve monetary and fiscal stability. Due to this, Burma remains a

poor country with no improvement of living standards for the majority of the population over the past decade. The main causes for continued sluggish growth are

poor government planning, internal unrest, minimal foreign investment and the large trade deficit. One of the recent government initiatives is to utilise Burma's

large natural gas deposits. Currently, Burma has attracted investment from Thai, Malaysian, Filipino, Russian, Australian, Indian, and Singaporean companies.[81]

Trade with the US amounted to $243.56 million as of February 2013, accounting for 15 projects and just 0.58 per cent of the total, according to government

statistics.[82]

The Economist special report on Burma points to increased economic activity resulting from Burma's political transformation and influx of foreign direct

investment from Asian neighbours.[83] Near the Mingaladon Industrial Park, for example, Japanese-owned factories have risen from the "debris" caused by

"decades of sanctions and economic mismanagement."[83] Japanese Prime Minister Shinzo Abe has identified Burma as economically attractive market that will

help stimulate the Japanese economy.[83] Among its various enterprises, Japan is helping build the Thilawa Port, which is part of the Thilawa Special Economic

Zone, and helping fix the electricity supply in Yangon.[83]

Japan isn’t the largest investor in Myanmar. "Thailand, for instance, the second biggest investor in Myanmar after China, is forging ahead with a bigger version of

Thilawa at Dawei, on Myanmar’s Tenasserim Coast. . . Thai rulers have for centuries been toying with the idea of building a canal across the Kra Isthmus, linking

the Gulf of Thailand directly to the Andaman Sea and the Indian Ocean to avoid the journey round peninsular Malaysia through the Strait of Malacca."[83]

Dawei would give Thailand that connection. China, by far the biggest investor in Burma, has focused on constructing oil and gas pipelines that "crisscross the

country, starting from a new terminus at Kyaukphyu, just below Sittwe, up to Mandalay and on to the Chinese border town of Ruili and then Kunming, the capital

of Yunnan province."[83] This would prevent China from "having to funnel oil from Africa and the Middle East through the bottleneck around Singapore."[83]

According to the CIA World Factbook,[84]

Burma, a resource-rich country, suffers from pervasive government controls, inefficient economic policies, and rural poverty. The junta took steps in the

early 1990s to liberalize the economy after decades of failure under the "Burmese Way to Socialism," but those efforts stalled, and some of the

liberalization measures were rescinded. Burma does not have monetary or fiscal stability, so the economy suffers from serious macroeconomic

imbalances - including inflation, multiple official exchange rates that overvalue the Burmese kyat, and a distorted interest rate regime. Most overseas

development assistance ceased after the junta began to suppress the democracy movement in 1988 and subsequently refused to honor the results of the

1990 legislative elections. In response to the government of Burma's attack in May 2003 on Aung San Suu Kyi and her convoy, the US imposed new

economic sanctions against Burma - including a ban on imports of Burmese products and a ban on provision of financial services by US persons. A poor

investment climate further slowed the inflow of foreign exchange. The most productive sectors will continue to be in extractive industries, especially oil

and gas, mining, and timber. Other areas, such as manufacturing and services, are struggling with inadequate infrastructure, unpredictable](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-30-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 14/21

import/export policies, deteriorating health and education systems, and corruption. A major banking crisis in 2003 shuttered the country's 20 private

banks and disrupted the economy. As of December 2005, the largest private banks operate under tight restrictions limiting the private sector's access to

formal credit. Official statistics are inaccurate. Published statistics on foreign trade are greatly understated because of the size of the black market and

unofficial border trade - often estimated to be as large as the official economy. Burma's trade with Thailand, China, and India is rising. Though the

Burmese government has good economic relations with its neighbors, better investment and business climates and an improved political situation are

needed to promote foreign investment, exports, and tourism.

Financing Geothermal projects in Myanmar use an estimated break even power cost of 5.3-8.6 U.S cents/kWh or in Myanmar Kyat 53-86K per kWh. This pegs a

non-fluctuating $1=1000K, which is a main concern for power project funding. The main drawback with depreciation pressures, in the current FX market. Between

June 2012 and October 2015, the Myanmar Kyat depreciated by approximately 35%, from 850 down to 1300 against the US Dollar. Local businesses with foreign

denominated loans from abroad suddenly found themselves rushing for a strategy to mitigate currency risks. Myanmar’s current lack of available currency hedging

solutions presents a real challenge for Geothermal project financing.[85]

The level of international aid to Burma ranks amongst the lowest in the world (and the lowest in the Southeast Asian region)[86]—Burma receives the $4 per capita

in development assistance, as compared to the average of $42.30 per capita.[87][88]

In April 2007, the US Government Accountability Office (GAO) identified the financial and other restrictions that the military government places on international

humanitarian assistance in the Southeast Asian country. The GAO report, entitled "Assistance Programs Constrained in Burma," outlines the specific efforts of the

Burmese government to hinder the humanitarian work of international organisations, including by restricting the free movement of international staff within the

country. The report notes that the regime has tightened its control over assistance work since former Prime Minister Khin Nyunt was purged in October 2004.

Furthermore, the reports states that the military government passed guidelines in February 2006, which formalised Burma's restrictive policies. According to the

report, the guidelines require that programs run by humanitarian groups "enhance and safeguard the national interest" and that international organisations co-

ordinate with state agents and select their Burmese staff from government-prepared lists of individuals. United Nations officials have declared these restrictions

unacceptable.

The shameful behavior of Burma's military regime in tying the hand of humanitarian organizations is laid out in these pages for all to see, and it must

come to an end," said U.S. Representative Tom Lantos (D-CA). "In eastern Burma, where the military regime has burned or otherwise destroyed over

3,000 villages, humanitarian relief has been decimated. At least one million people have fled their homes and many are simply being left to die in the

jungle."

Foreign aid](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-31-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 15/21

US Representative Ileana Ros-Lehtinen (R-FL) said that the report "underscores the need for democratic change in Burma, whose military regime arbitrarily

arrests, tortures, rapes and executes its own people, ruthlessly persecutes ethnic minorities, and bizarrely builds itself a new capital city while failing to address the

increasingly urgent challenges of refugee flows, illicit narcotics and human trafficking, and the spread of HIV/AIDS and other communicable diseases." [89]

Electricity - production: 5.961 billion kWh (2006 est.)

Electricity - consumption: 4.298 billion kWh (2006 est.)

Electricity - exports: 0 kWh (2007)

Electricity - imports: 0 kWh (2007)

Agriculture - products: rice, pulses, beans, sesame, groundnuts, sugarcane; hardwood; fish and fish products

Currency: 1 kyat (K) = 100 pyas

Exchange rates: kyats per US dollar - 1,205 (2008 est.), 1,296 (2007), 1,280 (2006), 5.82 (2005), 5.7459 (2004), 6.0764 (2003) note: unofficial exchange rates

ranged in 2004 from 815 kyat/US dollar to nearly 970 kyat/US dollar, and by year end 2005, the unofficial exchange rate was 1,075 kyat/US dollar; data shown for

2003-05 are official exchange rates

Foreign Direct Investment In the first nine months of 2012-2013, Myanmar has received investment of USD 794 million. China has biggest of investment

commitments for this fiscal.[90]

Foreign Trade Total foreign trade for 2012 was recorded to USD 13.3 billion. It was 27% of Myanmar's GDP.[90]

Google Earth Map of oil and gas infrastructure in Myanmar (http://www.oilandgasinfrastructure.com/home/oilandgasasia/myanmar)

1. "Ease of Doing Business in Myanmar" (http://www.doingbusiness.org/data/exploreeconomies/myanmar). Doingbusiness.org. Retrieved 2017-01-23.

2. "Export Partners of Burma (Myanmar)" (https://www.cia.gov/library/publications/the-world-factbook/fields/2050.html#bm). CIA World Factbook. 2012.

Retrieved 23 July 2013.

3. "Import Partners of Burma (Myanmar)" (https://www.cia.gov/library/publications/the-world-factbook/fields/2061.html#bm). CIA World Factbook. 2012.

Retrieved 23 July 2013.

Other statistics

External References

Footnotes](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-32-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 19/21

60. Sun Wyler, Liana (21 August 2008). "Burma and Transnational Crime" (https://fas.org/sgp/crs/row/RL34225.pdf) (PDF). CRS Report for Congress.

Congressional Research Service.

61. Chin, Ko-lin; Sheldon X. Zhang (April 2007). "The Chinese Connection: Cross-border Drug Trafficking between Myanmar and China" (https://www.ncjrs.gov/p

dffiles1/nij/grants/218254.pdf) (PDF). U.S. Department of Justice: 98.

62. Chin, Ko-lin (2009). The Golden Triangle: inside Southeast Asia's drug trade. Cornell University Press. pp. 239–240. ISBN 978-0-8014-7521-4.

63. Lyman, Michael D.; Gary W. Potter (14 October 2010). Drugs in Society: Causes, Concepts and Control. Elsevier. ISBN 978-1-4377-4450-7.

64. "Oil and Gas in Myanmar" (https://web.archive.org/web/20031212060349/http://burma.total.com/en/contexte/p_1_2.htm). Total S.A. Archived from the

original (http://burma.total.com/en/contexte/p_1_2.htm) on 12 December 2003. Retrieved 20 January 2009.

65. Ye Lwin (21 July 2008). "Oil and gas ranks second largest FDI at $3.24 billion" (https://web.archive.org/web/20100104083636/http://mmtimes.com/feature/

energy08/eng002.htm). The Myanmar Times. Archived from the original (http://www.mmtimes.com/feature/energy08/eng002.htm) on 4 January 2010.

Retrieved 20 January 2009.

66. "Myanmar opens bids for 18 oil blocks" (http://investvine.com/myanmar-opens-bids-for-18-oil-blocks/). Investvine.com. 23 January 2013. Retrieved

24 January 2013.

67. Gems of Burma and their Environmental Impact (http://www.uvm.edu/envnr/gemecology/index.html) Archived (https://web.archive.org/web/201005260000

00/http://www.uvm.edu/envnr/gemecology/index.html) 26 May 2010 at the Wayback Machine.

68. CBC - Gem dealers push to ban Burmese rubies after bloody crackdown (http://www.cbc.ca/consumer/story/2007/11/19/rubies.html)

69. Reuters, Move over, blood diamonds (http://features.us.reuters.com/cover/news/MAN51776.html)

70. Richard Hughes. "Burma Embargo & the Gem Trade" (http://www.ruby-sapphire.com/burma-embargo2.htm). Retrieved 3 March 2015.

71. "Myanmar’s Jade Millionaires Fuel Property Surge: Southeast Asia" (http://www.thejakartaglobe.com/business/myanmars-jade-millionaires-fuel-property-surg

e-southeast-asia/548164). The Jakarta Globe. Retrieved 3 March 2015.

72. "Mining block permits issued in Myanmar" (http://investvine.com/mining-block-permits-issued-in-myanmar/). Investvine.com. 20 February 2013. Retrieved

20 February 2013.

73. Henderson, Joan C. "The Politics of Tourism in Myanmar" (http://www.multilingual-matters.net/cit/006/0097/cit0060097.pdf) (PDF). Nanyang Technological

University. Retrieved 17 October 2008.

74. Myanmar tourism statistics, http://www.myanmartourism.org/tourismstatistics.htm

75. {http://www.mmtimes.com/2010/news/522/news01.html}

76. Henderson, Joan C. "The Politics of Tourism in Myanmar" (http://www.channelviewpublications.net/cit/006/0097/cit0060097.pdf) (PDF). Nanyang

Technological University. Retrieved 8 July 2006.

77. "Tayzathuria" (https://web.archive.org/web/20110430235921/http://www.tayzathuria.org.uk/bd/2006/12/24/re.htm). Archived from the original (http://ww

w.tayzathuria.org.uk/bd/2006/12/24/re.htm) on 30 April 2011. Retrieved 3 March 2015.

78. The Tourism Campaign - Campaigns - The Burma Campaign UK (http://www.burmacampaign.org.uk/action_holiday.html) Archived (https://web.archive.org/

web/20090429173300/http://www.burmacampaign.org.uk/action_holiday.html) 29 April 2009 at the Wayback Machine.

79. [1] (http://www.myanmartradenet.com) - MIRT. Team, "Exchange rate between the United States dollar and Myats, 1913 -1999", 2002.

80. Calderon, Justin (24 April 2013). "End of EU sanctions augurs Myanmar rush" (http://investvine.com/end-of-eu-sanctions-augurs-myanmar-rush/). Inside

Investor. Retrieved 29 April 2013.

81. http://www.financialexpress-bd.com/index3.asp?cnd=12/15/2006§ion_id=24&newsid=46742&spcl=no](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-36-320.jpg)

![10/16/2017 Economy of Myanmar - Wikipedia

https://en.wikipedia.org/wiki/Economy_of_Myanmar 21/21

Myanmar Ministry of Commerce (MMC) News, information, journals, magazines related to Burmese business and commerce (http://www.commerce.gov.m

m/)

Myanmar-US Chamber of Commerce [2] (http://www.mmuscc.org/index.html)

Union of Myanmar Federation of Chambers of Commerce and Industry (UMFCCI) [3] (http://www.umfcci.com.mm/)

World Bank Summary Trade Statistics Myanmar (http://wits.worldbank.org/CountryProfile/Country/MMR/Year/2010/Summary)

Retrieved from "https://en.wikipedia.org/w/index.php?title=Economy_of_Myanmar&oldid=805139544"

This page was last edited on 13 October 2017, at 09:34.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this site, you agree to the Terms of Use and

Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

External links](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-38-320.jpg)

![10/16/2017 Innwa Bank - Wikipedia

https://en.wikipedia.org/wiki/Innwa_Bank 1/1

Innwa Bank Limited

Native name အင် းဝဘဏ် လီမိတက်

Type Private

Industry Bank

Founded November 28, 1997

Founder Myanmar Economic

Corporation

Headquarters Kyauktada Township,

Yangon, Myanmar

(Burma)

Total assets 260 billion kyat[1]

(US$2.60 million) (2012-

13)

Website www.ablmm.com (htt

p://www.ablmm.com)

Innwa Bank

Innwa Bank Limited (Burmese: အင် းဝဘဏ် လီမိတက် ) is a private commercial bank in Burma (Myanmar).

Innwa Bank was founded by the Myanmar Economic Corporation (MEC) in 1997, a major conglomerate

owned by serving and retired military officers of the Tatmadaw, affiliated with the Myanmar Ministry of

Defence.[1][2] The bank serves as a financial vehicle for MEC's subsidiaries and affiliates.[2] Innwa Bank is

wholly owned by MEC, which is in turn, owned by the government.[3] Military authorities control the

bank's management.[3]

1. "The Myanmar Times Bank Survey 2014" (http://www.mmtimes.com/index.php/special-features/194-

your-money-2014/11033-bank-survey-2014.html?start=2). Myanmar Times. 15 July 2014. Retrieved

8 February 2015.

2. Turnell, Sean (2009). Fiery Dragons: Banks, Moneylenders and Microfinance in Burma. NIAS Press.

p. 266. ISBN 9788776940409.

3. Fujita, Kōichi; Fumiharu Mieno; Ikuko Okamoto (2009). The Economic Transition in Myanmar After

1988: Market Economy Versus State Control. NUS Press. p. 136. ISBN 9789971694616.

Retrieved from "https://en.wikipedia.org/w/index.php?title=Innwa_Bank&oldid=677336835"

This page was last edited on 22 August 2015, at 15:48.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this site, you agree to the Terms of Use and

Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-42-320.jpg)

![10/16/2017 Kanbawza Bank - Wikipedia

https://en.wikipedia.org/wiki/Kanbawza_Bank 1/2

Kanbawza Bank

Type Private

Industry Banking

Founded 1994

Headquarters Yangon,

Myanmar

Key people Aung Ko Win

(Chairman)

Products Financial

Services

Number of Over 18,000

Kanbawza Bank

Kanbawza Bank (Burmese: ကမ္ဘောဇဘဏ် ; abbreviated as KBZ Bank) is a private commercial bank in Myanmar. The

bank was established on 1 July 1994 in Taunggyi, Shan State. KBZ bank is part of the KBZ Group conglomerate (founded by

Aung Ko Win aka Saya Kyaung).

In February 2010, the bank bought an 80% share in Myanmar Airways International, Myanmar's international airline.[1]

On 1 April 2011, the bank launched Air KBZ, one of four privately owned domestic airlines in Myanmar, with plans to

expand to international flights in the near future.[2]

1. Moe, Wai (2010-02-03). "Western-sanctioned Kanbawza Bank Buys Airline" (http://www.irrawaddy.org/article.php?art

_id=17734). The Irrawaddy. Retrieved 2010-09-14.

2. Zaw Win Than (28 March 2011). "Kanbawza to launch domestic airline on April 1" (http://www.mmtimes.com/2011/n

ews/568/news56805.html). Myanmar Times. Retrieved 25 March 2012.

Kanbawza Bank Limited (KBZ) (http://www.kbzbank.com) Official site

Retrieved from "https://en.wikipedia.org/w/index.php?title=Kanbawza_Bank&oldid=802615307"

This page was last edited on 27 September 2017, at 09:32.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this

site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation,

Inc., a non-profit organization.

References

External links](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-47-320.jpg)

![10/16/2017 List of banks in Myanmar - Wikipedia

https://en.wikipedia.org/wiki/List_of_banks_in_Myanmar 2/3

1. Myawaddy Bank Ltd

2. Small & Medium Industrial Development Bank Ltd

3. Myanmar Citizens Bank Ltd

4. Global Treasure Bank (former Myanmar Livestock and Fisheries Development Bank Ltd)[1]

5. Yangon City Bank Ltd

6. Innwa Bank Ltd

7. Yadanabon Bank Ltd

8. Rural Development Bank Ltd

9. Naypyitaw Sibin Bank

10. Construction and Housing Development Bank[2]

1. Kanbawza Banks Ltd

2. Co-operative Bank Ltd

3. First Private Bank Ltd

4. Yoma Bank Ltd

5. Asia Green Development Bank Ltd

6. Ayeyarwady Bank Ltd

7. United Amara Bank Ltd

8. Myanma Apex Bank Ltd

9. Myanmar Oriental Bank Ltd

10. Tun Foundation Bank Ltd

11. Asia-Yangon Bank Ltd

12. Shwe Rural and Urban Development Bank

13. Ayeyarwaddy Farmers Development Bank

14. Myanmar Microfinance Bank Limited

Semi-government banks

Private banks](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-50-320.jpg)

![10/16/2017 Myanma Apex Bank - Wikipedia

https://en.wikipedia.org/wiki/Myanma_Apex_Bank 1/2

Myanma Apex Bank

(MAB)

Native name မြန်မာ့

ေ ဆောင်

ဘဏ်

Type Private

Industry Bank

Founded July 2, 2010

Founder Chit Khine

Headquarters Ottarathiri

Township,

Nay Pyi Taw,

Myanmar

(Burma)

Total assets 529 billion

kyat[1] (2012-

13)

Owner Chit Khine

Website www

.mabbank

Myanma Apex Bank

Myanma Apex Bank (Burmese: ြမန်မာ့ေ ဆောင် ဘဏ် ; abbreviated MAB) is a private commercial bank in Burma

(Myanmar). It was one of 4 private banks to commence operations in August 2010, the first new financial institutions in

the country since the establishment of Innwa Bank in 1997.[2]

The bank is owned by Chit Khaing, a prominent Burmese billionaire and owner of Eden Group, who is subject to European

Union, British and American economic sanctions.[3][4][5]

1. "The Myanmar Times Bank Survey 2014" (http://www.mmtimes.com/index.php/special-features/194-your-money-20

14/11033-bank-survey-2014.html?start=2). Myanmar Times. 15 July 2014. Retrieved 8 February 2015.

2. Cheesman, Nick; Monique Skidmore; Trevor Wilson (2012). Myanmar's Transition: Openings, Obstacles, and

Opportunities. Institute of Southeast Asian Studies. p. 147.

3. "Burma Relaxes Banking Regulations" (http://www2.irrawaddy.org/article.php?art_id=18716&Submit=Submit). The

Irrawaddy. 14 June 2010. Retrieved 29 October 2012.

4. "Commission Regulation (EU) No 411/2010" (http://eur-lex.europa.eu/Notice.do?val=515859:cs&lang=en&list=5190

37:cs,515955:cs,515859:cs,515853:cs,515865:cs,512803:cs,511833:cs,505919:cs,505818:cs,499657:cs,&pos=3&pa

ge=1&nbl=116&pgs=10&hwords=Myanmar~&checktexte=checkbox&visu=). European Commission. 10 May 2010.

Retrieved 29 October 2012.

5. "Burma/Myanmar COMMISSION REGULATION (EC) NO 385/2008" (http://www.hm-treasury.gov.uk/d/fin_sanc_bur

ma020508.pdf) (PDF). Financial Sanctions Notification. HM Treasury. 2 May 2008. Retrieved 29 October 2012.

Retrieved from "https://en.wikipedia.org/w/index.php?title=Myanma_Apex_Bank&oldid=754545044"

This page was last edited on 13 December 2016, at 06:41.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this

site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia

Foundation, Inc., a non-profit organization.

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-67-320.jpg)

![10/16/2017 Myanma Economic Bank - Wikipedia

https://en.wikipedia.org/wiki/Myanma_Economic_Bank 1/2

Myanma Economic

Bank

Native name မြန်မာ့

စီးပွားရေးဘဏ်

Formerly

called

Burma

Economic

Bank

Industry Banking

Founded April 2, 1976

in Rangoon,

Burma

Headquarters No. 26, Thiri

Kyaw Swa

Street,

Naypyidaw,

Myanmar

Website meb.gov.mm

(http://meb.

gov.mm)

Myanma Economic Bank

Myanma Economic Bank (Burmese: မြန် မာ့ စီးပွားရေးဘဏ် ; abbreviated MEB) is a commercial public bank in Myanmar

(Burma).

Burma Economic Bank was established as subsidiary of the State Commercial Bank (SCB) on 2 April 1976, under the

Bank Act of 1975. The law reversed a 1967 law (The People's Bank of the Union of Burma Act of 1967), by splitting the

People's Bank into four separate state-owned banks, namely the Union of Burma Bank (UBB), the Burma Economic

Bank (BEB), the Burma Foreign Trade Bank (BFTB) and the Burma Agricultural Bank (BAB).[1] In 1963, all banks were

nationalized as a result of the Burmese Way to Socialism.[1] The Burmese government had previously consolidated all of

these nationalized banks under the People's Bank of the Union of Burma.[1] At its establishment, The Burma Economic

Bank was formed to serve as the primary deposit-taking and general banking institution.[2]

In 1989, the Myanma Investment and Commercial Bank (MICB) was separated from MEB to provide specialized

corporate and investment banking services.[2] In 1993, the Myanma Small Loans Enterprise (MSLE) was separated from

MEB.[2] MEB, along with 4 other Burmese banks, were authorized to deal in foreign banking in March 2004.[3]

In December 2013, Daiwa Securities Group and Japan Exchange Group announced that it had entered into a joint

venture agreement with Myanma Economic Bank to establish the Yangon Stock Exchange.[4]

1. "Myanma Economic Bank" (http://www.mof.gov.mm/en/content/myanma-economic-bank). Ministry of Finance and

Revenue. Retrieved 1 July 2015.

2. Turnell, Sean. "Profiles of Burma’s Banks" (http://www.businessandeconomics.mq.edu.au/our_departments/Econo

mics/Econ_docs/bew/2006/2006_Profiles_of_Burmas_Banks.pdf) (PDF). Macquarie University. Retrieved 1 July

2015.

3. "Background History of Central Bank of Myanmar" (http://www.cbm.gov.mm/content/background-history-central-b

ank-myanmar-0). Central Bank of Myanmar. 2010. Retrieved 1 July 2015.

4. Martin, Alexander; Shibani Mahtani (24 December 2014). "Japan Companies to Help Set Up Myanmar’s First Stock Exchange" (https://www.wsj.com/articles/ja

pan-companies-agree-to-help-establish-myanmars-first-stock-exchange-1419331355). Wall Street Journal. Retrieved 1 July 2015.

History

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-69-320.jpg)

![10/16/2017 Myanma Foreign Trade Bank - Wikipedia

https://en.wikipedia.org/wiki/Myanma_Foreign_Trade_Bank 1/2

Myanma Foreign Trade

Bank

Native name မြန်မာ့ နိုင် ငံခြား

ကန်သွယ်မ

ဘဏ်

Industry Banking

Founded July 4, 1990

Headquarters No. 80-86,

Mahabandoola

Garden

Street,

Kyauktada

Township,

Yangon,

Myanmar

Website www.mmftb

Myanma Foreign Trade Bank

The Myanma Foreign Trade Bank (Burmese: ြမန်မာ့ ိင်ငံြခားကန်သွယ်မဘဏ် ; abbreviated MFTB) is a state-owned

bank specializing in foreign banking.[1] Its provides trade finance and foreign exchange-related banking to the

government, state enterprises, and the international community residing in Myanmar.[2] MFTB also manages Burma's

official foreign currency reserves.[2] Until recent economic reforms, MFTB had a monopoly on foreign exchange and

customer base.[2]

The bank was established under the Financial Institutions of Myanmar Law of 1990.[1]

1. "Myanma Foreign Trade Bank" (http://www.mof.gov.mm/en/content/myanma-foreign-trade-bank-0). Ministry of

Finance and Revenue. 2015. Retrieved 1 July 2015.

2. Nehru, Vikram (April 2015). "Developing Myanmar’s Finance Sector to Support Rapid, Inclusive, and Sustainable

Economic Growth" (http://www.adb.org/sites/default/files/publication/158497/ewp-430.pdf) (PDF). Asian

Development Bank. Retrieved 1 July 2015.

Retrieved from "https://en.wikipedia.org/w/index.php?title=Myanma_Foreign_Trade_Bank&oldid=677336853"

This page was last edited on 22 August 2015, at 15:48.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this

site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia

Foundation, Inc., a non-profit organization.

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-71-320.jpg)

![10/16/2017 Myanma Investment and Commercial Bank - Wikipedia

https://en.wikipedia.org/wiki/Myanma_Investment_and_Commercial_Bank 1/1

Myanma Investment and

Commercial Bank

Native name ြမန်မာ့ရင်း ီးြမ ပ် ံမ င့်

ကူးသန်းရောင် းဝယ် ရေး

ဘဏ်

Industry Banking

Founded July 4, 1990

Headquarters No. 170-176, Bo

Aung Kyaw Street,

Botataung

Township, Yangon,

Myanmar

Website www.micb.gov.mm

(http://www.micb.g

ov.mm)

Myanma Investment and Commercial Bank

The Myanma Investment and Commercial Bank (Burmese: ြမန်မာ့ရင်း ီးြမ ပ် ံမ င့် ကူးသန် းရောင် းဝယ် ရေးဘဏ် ;

abbreviated MICB) is a state-owned bank.[1] MICB has branches mainly in Yangon and Mandalay and focuses

primarily on business and domestic currency-denominated loans for commercial, investment, and development

activities.[2] MFTB also manages Burma's official foreign currency reserves.[2] MICB also acts as a banking

intermediary for foreign investment activities.[2]

The bank was established under the Financial Institutions of Myanmar Law of 1990, which separated the bank

from Myanma Economic Bank.[1]

1. "Myanma Foreign Trade Bank" (http://www.mof.gov.mm/en/content/myanma-foreign-trade-bank-0).

Ministry of Finance and Revenue. 2015. Retrieved 1 July 2015.

2. Nehru, Vikram (April 2015). "Developing Myanmar’s Finance Sector to Support Rapid, Inclusive, and

Sustainable Economic Growth" (http://www.adb.org/sites/default/files/publication/158497/ewp-430.pdf)

(PDF). Asian Development Bank. Retrieved 1 July 2015.

Retrieved from "https://en.wikipedia.org/w/index.php?

title=Myanma_Investment_and_Commercial_Bank&oldid=677336859"

This page was last edited on 22 August 2015, at 15:48.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By

using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the

Wikimedia Foundation, Inc., a non-profit organization.

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-73-320.jpg)

![10/16/2017 Tun Foundation Bank - Wikipedia

https://en.wikipedia.org/wiki/Tun_Foundation_Bank 1/3

Tun Foundation Bank (TFB)

Type Private

Industry Banking

Founded 1994

Headquarters Myanmar

Key people Thein Tun, Chairman

Products Financial Services

Website www

.tunfoundationbankmyanmar

.com (http://www.tunfounda

tionbankmyanmar.com)

Tun Foundation Bank

The Tun Foundation Bank (Burmese: ထွန်းေဖာင်ေဒး င် းဘဏ် ) is a privately owned bank in

Myanmar that was established on 8 June 1994.[1] All the profits from this bank go into scholarships

for children from poor families.[2]

1 Operations

2 Awards

2.1 Best painting competition

2.2 Literary awards

3 References

4 External links

As of 2000 the bank was run by Thein Tun, Chairman of MGS Group of Companies. It is involved in social, educational and health projects. In 2000 the bank had

recently opened new branches in Bayintnaung and Mandalay.[3] In 2011 Myanmar's financial authorities introduced an online banking network system in six banks,

one being the Tun Foundation Bank.[4]

Coordinates: 16.776328°N 96.164373°E

Contents

Operations

Awards

Best painting competition](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-167-320.jpg)

![10/16/2017 Tun Foundation Bank - Wikipedia

https://en.wikipedia.org/wiki/Tun_Foundation_Bank 2/3

The Tun Foundation Bank has been holding its Best Painting of the Year awards since 2007 to encourage local artists.[5] The Myanmar Traditional Artists and

Artisans Association arranges for the judging committee for the contest. Judges from ASEAN countries and from China have been included, ensuring that quality is in

line with international standards.[6]

On 18 December 2008 the awards were announced at a ceremony at the Myanmar Bankers Association headquarters in Yankin township in Yangon. Ni Po Oo

received the first prize of K3 million for his painting Simeekhwat Aka (Candle dance).[7] The Exhibition and Competition for the Best Paintings of the Year 2010 was

held at Myanmar Banker's Association Building on 11–15 December 2010. 250 artists competed and 300 paintings were selected. These were displayed at Gallery 65

from 18–31 December 2010, where they could be viewed and purchased.[8] In October 2011 it was reported that the bank was looking for location for an art gallery to

house works discovered from the Best Painting of the Year competition.[6]

The bank established the Tun Foundation literary awards in 2006 to promote development of Myanmar literature. The scrutinizing committee gives awards for seven

books, seven manuscripts and two books in English. Winners for books in 2006 included Khin Khin Htoo (history genre), Moe Moe Taraw San (biography), Junior

Win (children literature), Win Maung (culture) Dr Soe Lwin (health), Dr Toe Hla (ancient treaties) and Maung Wun Tha (reference book).[9] The awards complement

the government's National Literature Award and Sarpay Beikman Manuscript Awards and the privately sponsored Sayawun Tin Shwe Award, Pakokku U Ohn Pe

literary award and Thuta Swesone literary award.[10]

On 2 April 2011 the fifth Tun Foundation Literary Award ceremony (2010) was held at the Myanmar Banks Association building. Attendees included the Minister for

Information and for Culture U Kyaw Hsan and Chief Minister of Yangon Region U Myint Swe. U Hla Myaing (Ko Hsaung) won the Tun Foundation life-time literary

award and Tun Oo Tin won the literary award for his book The biography of a diplomat.[11]

1. "Private Banks" (http://www.cbm.gov.mm/index.php?option=com_content&view=article&id=19&Itemid=19&lang=en). Central Bank of Myanmar. Retrieved

2012-02-20.

2. Narayanan Ganesan, Kyaw Yin Hlaing, ed. (2007). Myanmar: state, society, and ethnicity (https://books.google.com/books?id=rRQa0RuucF8C&pg=PA164&lpg

=PA164). Institute of Southeast Asian Studies. ISBN 981-230-434-7.

3. "Burmese Tycoons Part II" (http://www2.irrawaddy.org/print_article.php?art_id=1924). the Irrawaddy. July 2000.

4. "Asia Green Development Bank launches e-banking" (http://www.myanmar-business.org/2011/07/asia-green-development-bank-launches-e.html). Myanmar

Business Network. July 31, 2011. Retrieved 2012-02-20.

5. Yadana Htun (December 21–27, 2009). "Men shine in Tun Foundation art prize" (http://www.mmtimes.com/no502/n004.htm). Myanmar Times. Retrieved

2012-02-20.

6. Nyein Ei Ei Htwe (October 17–23, 2011). "Tun Foundation seeks venue for art gallery" (http://www.mmtimes.com/2011/timeout/597/timeout59702.html).

Myanmar Times. Retrieved 2012-02-20.

7. Yadana Htun. "Artist Ni Po Oo wins Tun Foundation Art prize" (http://www.mmtimes.com/no450/t001.htm). Myanmar Times. Retrieved 2012-02-20.

Literary awards

References](https://image.slidesharecdn.com/myanmarbankcollection-171017055036/85/MYANMAR-BANKS-COLLECTION-168-320.jpg)

![10/16/2017 Union of Myanmar Economic Holdings - Wikipedia

https://en.wikipedia.org/wiki/Union_of_Myanmar_Economic_Holdings 1/3

Myanma Economic

Holdings Limited

Native name ျမန္မာ့

စီးပွားရေး ဦးပိုင်

လီမိတက်

Industry Conglomerate

Founded February 1990

Founder Ministry of

Defence

(Burma)

Headquarters Yangon,

Myanmar

Owner Burmese

military

personnel

(60%)

Directorate of

Defence

Procurement

(40%)

Subsidiaries Myawaddy

Bank

Myawaddy

Tours &

Travel

Union of Myanmar Economic Holdings

The Union of Myanmar Economic Holdings Limited (Burmese: ပြည် ထောင် စု မြန် မာနိုင် ငံ စီးပွားရေး ဦးပိုင် လီမိတက် ;

also called Myanma Economic Holding and abbreviated UMEHL or UMEH) is one of two major conglomerates