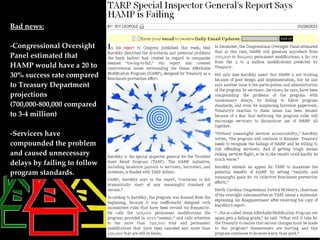

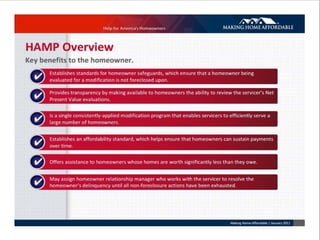

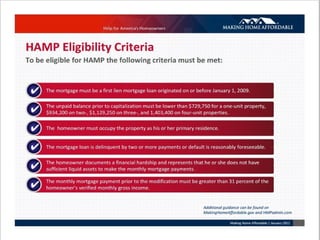

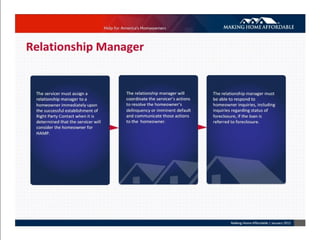

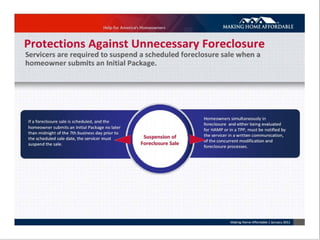

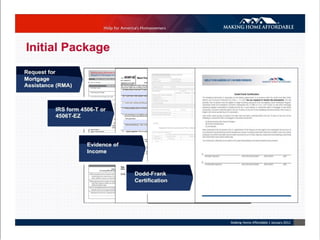

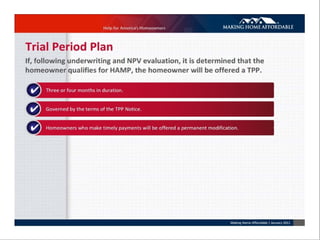

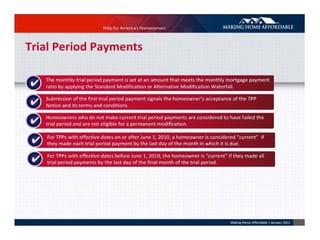

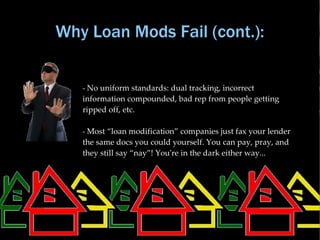

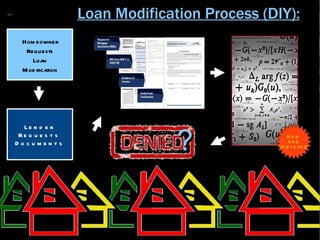

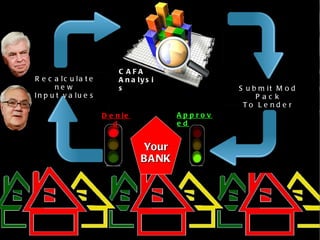

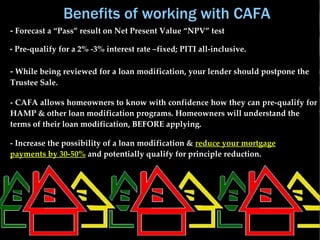

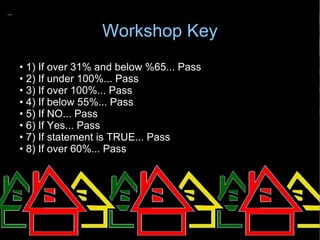

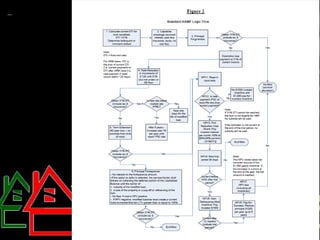

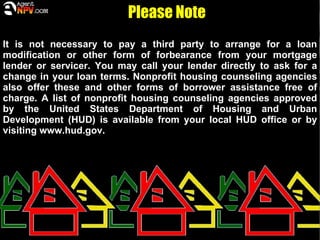

This document provides an overview of a loan modification information session presented by David Wilhite. The session agenda includes an overview of the Home Affordable Modification Program (HAMP), how California Foreclosure Assistance (CAFA) differs from other loan modification companies, and an exercise for homeowners. Key points made are that HAMP has had a lower success rate than projected, CAFA provides scenario-based analysis to determine eligibility for HAMP and other programs, and homeowners should be cautious of paying third parties for assistance that may be available for free.

![WELCOME:>]

to th e

Loan M od ification Info-S e s s ion](https://image.slidesharecdn.com/mycafapresentation-120611214047-phpapp01/75/My-CAFA-Presentation-1-2048.jpg)