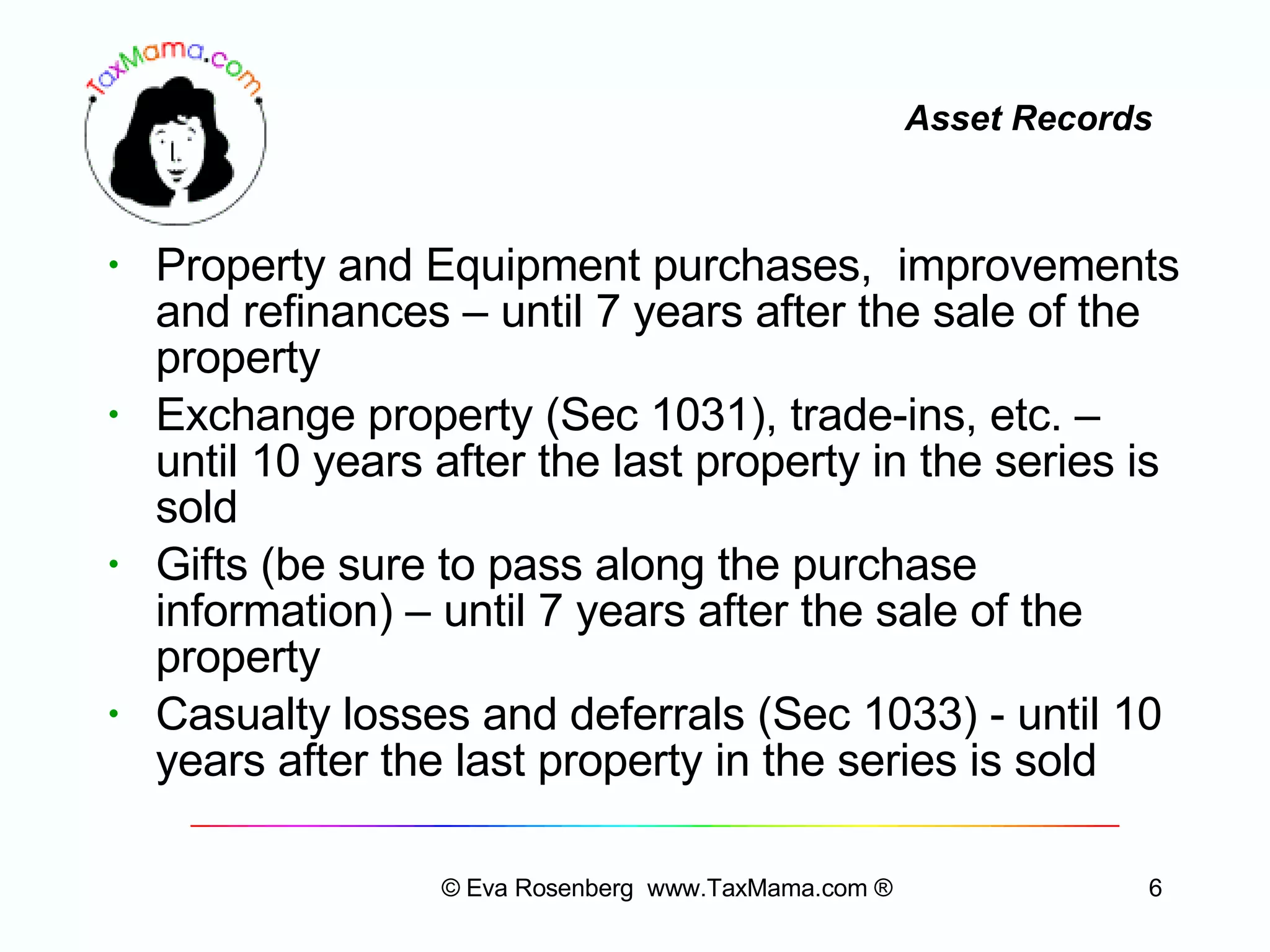

The document provides guidelines on how long to retain various personal and business tax records, emphasizing different time periods for different types of documents, such as indefinitely for tax returns and forever for certain payroll records, while most other documents should be kept for 7 to 10 years. It also includes advice on storage solutions and the importance of securely disposing of records when they are no longer needed. Overall, it aims to help individuals and businesses maintain proper record-keeping to comply with tax regulations.