Most Trusted Insurance Companies In India.pdf

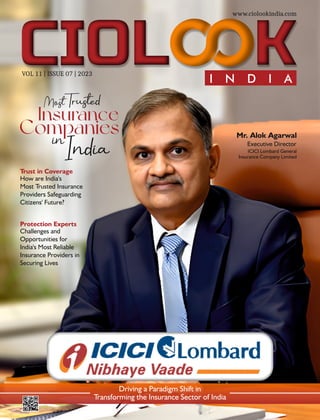

- 1. I N D I A VOL 11 | ISSUE 07 | 2023 www.ciolookindia.com Mr. Alok Agarwal Executive Director ICICI Lombard General Insurance Company Limited MoTrued Insurance Companies in India Trust in Coverage How are India's Most Trusted Insurance Providers Safeguarding Citizens' Future? Protection Experts Challenges and Opportunities for India's Most Reliable Insurance Providers in Securing Lives Driving a Paradigm Shift in Transforming the Insurance Sector of India

- 3. In the face of life's uncertainties, insurance serves as a beacon of hope and protection. It offers families and individuals a safety net, a shield against unforeseen events that can disrupt financial stability and dreams. In India, a land of diverse needs and aspirations, choosing the right insurance partner is more crucial than ever. From securing families' financial futures to protecting businesses from unforeseen perils, insurance companies play a pivotal role in ensuring peace of mind and a sense of security. In this evolving landscape, certain insurance companies have earned the trust and admiration of millions through their unwavering commitment to customer service, ethical practices, and innovative solutions. These companies understand that insurance is not merely a product; it's a promise–a promise to stand by their customers in times of need. Building a Legacy of Trust: 'The Most Trusted Insurance Companies in India' share certain key characteristics that set them apart: Unwavering Customer Focus: They place the customer at the heart of everything they do, prioritizing service excellence, transparency, and a commitment to resolving customer concerns promptly and effectively. Financial Stability: They possess a strong financial footing, ensuring their ability to meet policy obligations and provide customers with peace of mind knowing their claims will be honored. Product Innovation: They continuously adapt and evolve, offering innovative insurance solutions tailored to the changing needs of customers and addressing emerging risks in the contemporary world. Ethical Conduct: They adhere to the highest ethical standards, fostering trust through transparency, fair claim settlements, and a commitment to responsible business practices. Safeguarding Lives and Dreams EDITOR’S VIEW Community Engagement: They recognize their social responsibility, actively engaging with communities and contributing to initiatives that improve lives and promote social well-being. A Symbol of Resilience and Support In a world where unforeseen events can strike at any moment, the role of trusted insurance companies becomes even more significant. They serve as a symbol of resilience and support, offering individuals and families the comfort of knowing that they are not alone. They stand by their customers, providing financial assistance during challenging times and ensuring that dreams can continue to be pursued even in the face of adversity. As the insurance landscape in India continues to evolve, CIOLook India's choices of this exclusive edition will remain at the forefront, leading the way with their dedication to customer service, innovation, and ethical conduct. They will continue to be recognized not only for their financial strength but also for their unwavering commitment to safeguarding lives and dreams, leaving a lasting legacy of trust and support in their wake. Have a wonderful read ahead! Gaurav PR Wankhade Managing Editor

- 4. 14 22 A R T I C L E S CONTENT PAGE P R O F I L E S 18 Delivering Future-ready, Digitally Accelerated Insurance A Pioneer, making India Inc. healthy Trust in Coverage How are India's Most Trusted Insurance Providers Safeguarding Citizens' Future? Protection Experts Challenges and Opportunities for India's Most Reliable Insurance Providers in Securing Lives 26

- 5. Driving a Paradigm Shift in Transforming the Insurance Sector of India 06

- 6. FOLLOW US ON www.twitter.com/ciolookindia www.facebook.com/ciolookindia/ WE ARE ALSO AVAILABLE ON Email : sales@ciolookindia.com For Subscription www.ciolookindia.com Contact : 7410079888 / 8956487819 CONTACT US ON Copyright © 2023 CIOLOOK India, All rights reserved. The content and images used in this magazine should not be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission from CIOLOOK India. Reprint rights remain solely with CIOLOOK India. November, 2023 Visualizer : Sandeep Tikode Art & Design Director : Rashmi Singh Associate Designer : Sameen Arif Asst. Vice President : Swapnali Vasaikar Sr. Sales Manager : Tejaswini Whaval Team Lead : Suraj Gadekar Business Development Exec : Meera Patel Technical Head : Rajeshwari Avhad Technical Consultant : Prachi Mokashi Pooja M. Bansal Editor-in-Chief Research Analyst : Ravindra Kadam SEO Lead : Renuka A Kulkarni Managing Editor : Gaurav PR Wankhade Assisting Editor : Prajakta Zurale CONTENT DESIGN SALES TECHNICAL SME-SMO CREDIT PAGE

- 7. Description PAGE Description Cogitate is a leading provider of innovative and transformative digital tech products to the insurance industry. Cogitate Arvind Kaushal, Co-founder and CEO Company ekincare Future Generali India Insurance Company Featuring Dr Noel Coutinho, Co-founder and Chief Business Officer Anup Rau, MD & CEO ekincare is a new-age, AI-driven integrated health benefits platform helping organizations save up to 90% in healthcare costs and lowering their employees' health insurance premium. Future Generali is a total insurance solutions company offering protection and saving solutions that are designed putting you right at the heart of our business. Go Digit General Insurance Kamesh Goyal, Chairman Go Digit General Insurance Limited is one of the leading digital full-stack insurance companies. ICICI Lombard General Insurance Company Limited Mr Alok Agarwal, Executive Director ICICI Lombard GIC Ltd is an Indian private sector general insurance company and one of the largest private sector non-life insurers in India. MoTrued Insurance Companies in India

- 8. During his 30- year tenure with the ICICI Group, Mr. Agarwal has witnessed remarkable growth in both the industry and the company. C o v e r S t o r y Driving a Paradigm Shift in Transforming the Insurance Sector of India

- 9. Mr. Alok Agarwal, Executive Director ICICI Lombard General Insurance Company Limited The Most Trusted Insurance Companies in India

- 10. The insurance sector of India has undergone significant changes due to regulatory reforms, technological advancements, and evolving consumer preferences. These changes have led to a customer-centric and technologically advanced industry, improving accessibility, transparency, and efficiency. ICICI Lombard, a leading private general insurance company in the country, has been recognized for its customer-centric approach and innovative solutions. The company has received numerous awards 'Emerging Company of the Year' at ET Corporate Excellence Awards, th 'Highest Growth GI' at the Assocham 14 Global Insurance Awards, National Training Awards at the Golden Peacock Awards, Best Insurance Company in Non-Life Insurance sector at the Dun & Bradstreet BFSI Fintech Awards, ET Business Leadership Awards for #SalaamMSME Campaign, Special Jury recommendation for EGS initiatives at the FICCI Insurance Industry Awards, ET Ascent National Awards for CSR initiatives, Vigyan Bhawan National CSR Awards for Caring Hands & Niranjali initiatives, Guinness World Record for its CSR initiatives and many more. The awards are a testament to the trust reposed in the Company by its customers, partners and other stakeholders. The Unique Significance of General Insurance Unlike many other industries, general insurance sector offers a wide range of products that cater to various needs. Mr. Agarwal believes that the sector is exceptionally unique within the realm of financial services. These products include property protection, logistics coverage, legal liability insurance, as well as health and accident coverage. General insurance encompasses a vast spectrum of protection. The general insurance sector also holds far-reaching social relevance. Insurance is typically sought when individuals find themselves in distressing situations. Therefore, it serves as a means of social benefit. Recognizing its importance, the Government of India has introduced various schemes over the past two decades to address the needs of the society. These schemes aim to provide insurance coverage on a large scale, especially for individuals from economically disadvantaged backgrounds. Safeguarding Interests and Enhancing Convenience Mr. Agarwal emphasizes that the insurance industry has been at the forefront of working with large data, even a century ago. It was the first industry to extensively utilize and develop data science, which became the foundation of insurance practices. However, recent advancements in technology, such as AI and ML, have further revolutionized the industry. Mr. Agarwal provides several examples to illustrate these developments. In the logistics sector, tracking vehicles using embedded chips has become a standard practice. If a vehicle deviates from its designated route, immediate actions are triggered, including reporting to the police. This enables timely intervention and potential apprehension of culprits. IoT devices are utilized, such as pressure gauges in fire hydrant systems. These devices raise an alarm if the pressure falls below a certain threshold. This ensures that fire hydrants are operational when needed as they tend remain unused and unmaintained for extended periods of time. AI and machine learning are employed extensively in the settlement of health insurance claims. Past data is analysed to identify potential fraudulent claims. Based on this analysis, the system triggers investigations into suspicious cases, thus aiding in determining their validity. Mr. Agarwal emphasizes that the emerging market in India holds immense potential for the future.

- 11. Alok Agarwal graduated from IIM Calcutta in 1993 and began his career at ICICI Bank, focusing on corporate finance for eight years. In 2001, he joined ICICI Lombard, where he has remained ever since. His work at ICICI Lombard has primarily been in corporate and government business, with a brief stint in overseeing the SME sector. Recently, he has been involved in the retail business, specifically targeting emerging markets beyond 20 cities for motor insurance and beyond 40 cities for health and SME insurance. During his 30-year tenure with the ICICI Group, Mr. Agarwal has witnessed a remarkable growth in both the industry and the company. The general insurance sector, which had 10,000 policyholders when he joined, has now expanded to over 32.7 million policies as on March 31, 2023. ICICI Lombard itself has achieved a premium of approximately 20,000 units, reflecting the industry's evolution. Initially, the general insurance sector had four public sector companies and two niche companies like IRCTC. Currently, there are 31 companies in the sector, with pending licenses awaiting approval from IRDAI. This significant growth reflects the industry's rapid expansion and notable changes. Health insurance has undergone a substantial transformation over the past two decades, becoming the largest segment in the industry and surpassing motor insurance. Technological advancements have played a significant role in shaping the industry during Mr. Agarwal's active involvement. A VISIONARY LEADER

- 12. Digital platforms are utilized for inspecting vehicles when insurance is due. Customers capture photographs of specific points in their vehicles, and the system utilizes AI to determine the insurability of the vehicle. This streamlines the process and improves efficiency. ICICI Lombard, along with the industry, has been pioneering various technological innovations in these areas, utilizing technology extensively to enhance operations and provide better services. Client Assistance Initiatives Mr. Agarwal highlights several ways in which ICICI Lombard assists its clients. Firstly, by identifying and eliminating fraudulent clients, the company ensures that honest customers do not bear the burden of fraudulent claims, resulting in lower prices for them. This service aims to protect the interests of genuine policyholders. Secondly, ICICI Lombard offers convenience through virtual vehicle and factory inspections. By utilizing technology, customers no longer have to wait for physical inspections by surveyors, significantly reducing turnaround time. ICICI Lombard also offers value- added services such as IoT and telematics-based solutions.

- 13. Thirdly, the company provides a seamless experience to customers by offering both digital and physical channels. Customers can choose the virtual channel for insurance purchase and servicing, with the option of receiving physical assistance if needed. This approach enhances convenience and accessibility for clients. ICICI Lombard also offers value-added services such as IoT and telematics-based solutions. These services leverage technology to enhance coverage and provide additional benefits to customers. Overcoming Distribution Challenges Mr. Agarwal identifies the major challenge faced by ICICI Lombard when entering the insurance industry. They had to compete with four public sector companies that had extensive distribution networks through their own offices, making it difficult for ICICI Lombard to establish a comparable presence without incurring excessive costs. To overcome this challenge, the company implemented various initiatives. They introduced an e-channel for sourcing business, allowing customers to access insurance services through virtual platforms. Additionally, claims were processed remotely to enhance convenience for policyholders. ICICI Lombard also established virtual offices, enabling employees to work from home while being equipped with the necessary technological facilities and gadgets. Currently, the company operates 305 branches, providing a distribution footprint that matches that of public sector companies. Recognizing connectivity issues in rural areas, ICICI Lombard devised an offline/online mode known as the ILPOS system. This system enables agents to work offline throughout the day and synchronize their data with the company's system once a day. This approach addresses challenges such as power cuts and unreliable internet connectivity prevalent in smaller towns and cities. Transforming Customer Experience ICICI Lombard has introduced personalized services to enhance the customer experience, such as IL TakeCare (ILTC), a health app with multiple features. One notable feature is the ability to provide vital parameters like blood pressure, pulse rate, heart rate, and oxygen content with just a face scan within two minutes. ILTC also enables users to schedule appointments with doctors, conduct video and teleconsultations, purchase medicines virtually through e- medicine facilities, and arrange home-based blood tests and sample collection. Its one stop digital solution IL TakeCare app has over 5.6 million downloads till date, making it a significant technological offering in the insurance industry. Additionally, ICICI Lombard allows customers to purchase other policies such as motor and travel insurance through the app, which continues to evolve and expand its capabilities. Another noteworthy initiative undertaken by ICICI Lombard is the migration of their core systems to the cloud, making them the first large company in the insurance industry to do so. This cloud migration has resulted in reduced system downtime, increased stability, and enhanced agility, significantly improving the reliability and speed of their operations. In terms of claim approvals for health insurance, ICICI Lombard employs an AI-powered system that approves estimates sent by hospitals in approximately 85% of cases. This automated approval process, based on the provided hospital data, often takes minutes or even seconds, minimizing turnaround time and providing added convenience for customers. Through these technological advancements and streamlined processes, ICICI Lombard aims to provide personalized and efficient services to its customers, prioritizing their health and well-being while ensuring a seamless experience. Unleashing Potential While there is already a significant amount of business in the top 20 cities in India, the penetration of insurance products like motor insurance, health insurance, and travel

- 14. insurance is increasing rapidly in smaller regions and rural areas. Mr. Agarwal emphasizes that the emerging market in India holds immense potential for the future. Companies that perform well in this segment have the opportunity to become market leaders in the future. Therefore, it is crucial for any company aspiring to be a significant player to have a strong presence in rural areas. India has over 700 districts, and each district headquarter represents distinctive business potential. Even remote areas like hilly states, Jammu and Kashmir, and the north-eastern regions have shown promising business potential. The key is to reach out to people where they are, irrespective of their wealth status. While some may opt for small-ticket insurance, with a population of over 1.4 billion, there is substantial opportunity for insurance penetration. Globally speaking, even poorer countries have higher insurance penetration rates compared to India. Therefore, it is important to penetrate deep into the hinterlands to tap into India's demographic dividend, reaching the masses in the most remote areas. This approach has become a significant part of ICICI Lombard's overall momentum. Expanding insurance coverage in rural and emerging markets not only benefits the insurance industry but also contributes to the development of healthcare infrastructure. When people have access to affordable healthcare through insurance, the overall health infrastructure tends to improve. Currently, more than 60% of health expenditures in India are out-of-pocket expenses, mainly focused on outpatient care. This indicates a significant opportunity for health insurance and outpatient services in the country. By establishing a robust distribution network in emerging markets, insurance companies can effectively cater to this segment. To successfully distribute insurance products in these markets, various channels need to be developed. This includes traditional channels like agencies and brokers, as well as partnerships with regional NBFCs (Non-Banking Financial Companies), regional cooperative banks, and agricultural societies. A diversified approach is necessary to get across to these markets successfully and provide insurance coverage to the underserved populations in rural and emerging areas. Revitalizing the Insurance Landscape Mr. Agarwal acknowledges the recent reforms introduced by IRDA and highlights their significance. He mentions the following key reforms: • Bima Sugum App: The launch of an app provides a convenient platform for individuals to purchase various types of insurance policies such as motor insurance, health insurance, and travel insurance. This digital platform has the potential to be transformative, similar to the Unified Payments Interface (UPI) in the banking sector. • Expansion of Corporate Agents and Insurance Marketing Firms: Previously, corporate agents could work with a maximum of three insurance companies, and insurance marketing firms could work with two insurance companies. The reform now allows them to work with up to nine and six insurance companies, respectively. This expansion enhances market access for these intermediaries, fostering greater competition and consumer choice. • Rural Penetration Initiatives: IRDA has allocated states to insurance companies to focus on increasing penetration in rural areas. A specific product called "Bima Vistar" has been introduced, which combines life insurance, critical illness insurance, accident insurance, and property insurance. The recruitment criteria for intermediaries called "Bima Vahak" has been broadened, allowing individuals with a class 5 pass qualification to become agents. This reform is expected to significantly increase insurance penetration in the rural market. • Expense Management and Commission Guidelines: IRDA has introduced expense management guidelines and revised commission guidelines for insurers. The guidelines provide a single expense management limit of 30% or 35% (without sub-limits for each business segment) based on the type of insurance business.

- 15. These guidelines promote ease of doing business and are expected to improve insurance penetration. • Use and File Guidelines: Previously, every insurance product had to be filed with the regulator for approval before it could be used in the market. The reform now allows self-approval by the internal committee called the Product Management Committee, enabling insurers to use the product and subsequently file it with the regulator. This change streamlines the product approval process, facilitating faster product launches. These reforms aim to enhance the insurance sector's ease of doing business, promote competition, expand market access, and improve insurance penetration, both in rural areas and across the country. Fostering Growth and Enhancing Social Welfare Mr. Agarwal expresses optimism regarding the future growth of the insurance sector in India. He acknowledges that the current insurance penetration in the country is relatively low compared to middle-income and poorer countries. However, with the recent reforms and anticipated future reforms, he expects insurance penetration to increase significantly. The insurance sector in India has shown an average growth rate of around 16% over the past two decades. With the recent reforms and the potential for further reforms, Mr. Agarwal believes that the growth of the sector will accelerate. He emphasizes the importance of increasing insurance penetration in India, as the country has been recognized as an underinsured and under-pensioned society. By improving insurance penetration, the social welfare of the community can be enhanced. ICICI Lombard is well positioned to capitalize on the recent reforms and contribute to the growth of the insurance sector. The company will continue to launch new products, expand its distribution network, and invest in technology to serve its customers better. The focus will be on providing customers with ease of doing business, streamlined claim processes, and making a marked positive impact in their lives. Empowering Emerging Leaders in the Insurance Sector Mr. Agarwal advises emerging leaders in the insurance sector to approach the industry with a mindset that focuses on serving people, particularly those in distress. He emphasizes that profitability and growth potential should not be the sole considerations when entering the sector. Instead, aspiring leaders should also evaluate the social impact they can make and their willingness to create that impact. Having a strong technological foundation is crucial in the insurance sector, as it involves working with large amounts of data. Therefore, emerging leaders should be technologically proficient and well-versed in data science. Additionally, Mr. Agarwal highlights the importance of empathy towards customers, as they typically seek insurance assistance during difficult times. Leaders should prioritize serving the needs of customers rather than solely pursuing profits. To download the IL TakeCare app, scan the QR code

- 16. In India's dynamic and ever-evolving landscape, the significance of insurance in safeguarding individuals' and businesses' futures cannot be overstated. Insurance providers across the nation play a pivotal role, not just as financial protectors but as custodians of trust, ensuring security and stability in an uncertain world. Among the myriad of choices available, certain insurance providers have distinguished themselves as paragons of trust, earning the confidence and reliance of the populace through their unwavering commitment to protection, reliability, and customer-centric values. The Bedrock of Trust that underpins these esteemed insurance providers is rooted in their unwavering dedication to meeting the diverse needs of the citizens. These companies have traversed the intricate paths of the insurance industry, adapting and innovating their offerings to cater to the varying requirements of individuals, families, and businesses across the nation. Their commitment to providing comprehensive and tailored insurance solutions has reinforced their reputation as guardians of financial security. In India's vibrant and diverse landscape of financial services, the realm of insurance stands as a beacon of assurance and security for millions of individuals and businesses. Amidst a plethora of choices, certain insurance companies have distinguished themselves as pillars of trust, earning the unwavering confidence of the populace. These esteemed entities stand tall not just for their financial prowess but for their commitment to reliability, transparency, and unwavering support when it matters most. 14 www.ciolookindia.com November 2023 How Are India's Most Trusted InsuranceProviders Safeguarding Citizens' Future? One of the fundamental elements that set apart these trusted insurance providers is their expansive portfolio of insurance products. From life insurance to health, property, vehicle, and even specialized coverages, these companies have curated a diverse array of insurance options to meet the multifaceted needs of their clientele. Their adeptness in customizing insurance products to suit various segments of society underscores their commitment to providing inclusive and accessible coverage for all. Furthermore, these distinguished insurance providers have set themselves apart through their unwavering dedication to swift and hassle-free claim settlements. During moments of distress and uncertainty, when policyholders need support the most, these companies have stood firm in ensuring a seamless and efficient claims process. Their commitment to expeditious and transparent claim settlements has not only fostered trust but has also served as a beacon of reassurance for their policyholders. Transparency and Ethical Conduct are ingrained in the ethos of these trusted insurance providers. They have established clear and concise policies, maintained transparent communication, and adhered to ethical practices, thereby fostering an environment of trust and reliability. Their commitment to integrity not only sets a benchmark within the industry but also ensures that policyholders feel secure and confident in their coverage.

- 17. 15 November 2023 www.ciolookindia.com Trust in Coverage

- 18. 16 www.ciolookindia.com November 2023 Embracing technological advancements has been another defining aspect of these insurance providers' strategies. They have invested significantly in digital platforms and innovative tools, providing customers with user-friendly interfaces, seamless online services, and prompt access to policy-related information. This digital evolution has not only streamlined processes but has also enhanced accessibility, making insurance more approachable and convenient for all. Moreover, these insurance providers extend their role beyond just financial protection; they actively participate in social initiatives and contribute to societal well-being. Through various Corporate Social Responsibility (CSR) programs, they support initiatives related to healthcare, education, environmental sustainability, and community welfare. Their commitment to societal welfare resonates with their larger role as responsible corporate citizens. India's Most Trusted Insurance Providers are not merely entities offering financial protection; they are custodians of trust, reliability, and social responsibility. Their dedication to customer-centricity, transparent practices, efficient claim settlements, technological innovation, and societal contributions have solidified their position as the guardians of citizens' financial security. As they continue to evolve and adapt to changing times, their legacy of trust will remain etched in the hearts and minds of countless individuals and businesses they serve, safeguarding citizens' futures with unwavering dedication and integrity. In today's digital age, the most trusted insurance companies have embraced technology as a catalyst for better customer experiences. They have invested substantially in digital platforms and innovative tools, offering customers user- friendly interfaces, seamless online services, and quick access to policy-related information. This technological evolution has not only streamlined processes but has also enhanced accessibility, making insurance more inclusive and approachable for all. The Mantle of being the most trusted in the industry comes with a responsibility to contribute beyond mere insurance services. These companies have often been at the forefront of social initiatives, extending their support to communities through various CSR (Corporate Social Responsibility) programs. Whether it's supporting healthcare initiatives, education, or environmental sustainability, their commitment to societal welfare echoes their dedication to being responsible corporate citizens. The most trusted insurance companies in India are not just entities providing financial protection; they are custodians of trust, reliability, and social responsibility. Their commitment to customer-centricity, transparent practices, efficient claim settlements, technological innovation, and societal contributions have solidified their position as the vanguards of trust in the nation's insurance landscape. As they continue to evolve and adapt to changing times, their legacy of trust will remain etched in the hearts and minds of countless individuals and businesses they

- 19. I N D I A Subscribe to CIOLOOKINDIA Get CIOLOOKINDIA Magazine in Print and Digital on www.ciolookindia.com Stay in the known Subscribe Today

- 20. The Most Trusted Insurance Companies in India 18 www.ciolookindia.com November 2023 In an exclusive interview with Ciolook India, Arvind Kaushal, Co- .

- 24. n the ever-uncertain realm of life, insurance companies Istand as pillars of protection, offering individuals and families a shield against unforeseen events that can disrupt financial stability and shatter dreams. In India, a land of diverse needs and aspirations, reliable insurance providers play a crucial role in safeguarding lives, providing families with peace of mind and a sense of security. In the intricate web of life's uncertainties, the role of insurance in securing lives and providing a safety net against unforeseen events is paramount. Across India's diverse landscape, insurance providers stand as guardians of security, entrusted with the responsibility of shielding individuals and families from the unpredictability of the future. Among the plethora of choices available, certain insurance providers have emerged as stalwarts of reliability, earning the unwavering confidence of the populace through their steadfast commitment to protection, resilience, and customer-centric values. At the heart of these esteemed insurance providers lies a steadfast dedication to meeting the diverse needs of citizens. These companies have navigated the complexities of the insurance industry, adapting their offerings to cater to the varying requirements of individuals and families across the nation. Their commitment to providing comprehensive and tailored insurance solutions has solidified their position as custodians of financial security. One of the foundational aspects setting apart these trusted insurance providers is their expansive array of insurance products. Ranging from life insurance to health, property, vehicle, and specialized coverages, these companies have curated a diverse portfolio of offerings to cater to the multifaceted needs of their clientele. Their adeptness in customizing insurance products for various segments of society underlines their commitment to providing inclusive and accessible coverage for all. Furthermore, the hallmark of these distinguished insurance providers lies in their swift and efficient claim settlement processes. During times of uncertainty and distress, these companies have exemplified a commitment to ensuring a smooth and expedited claims experience for their policyholders. Their dedication to a transparent and prompt claims resolution has not only nurtured trust but has also provided a sense of security and reassurance to their clients. However, navigating the complex landscape of insurance presents a unique set of challenges for providers, even the most reliable ones. These challenges are multifaceted, encompassing evolving customer needs, technological disruptions, and a dynamic regulatory environment. Evolving Customer Needs: The insurance industry is witnessing a shift in consumer preferences, with customers demanding tailor-made solutions that cater to their specific needs and risks. This necessitates a more personalized approach, requiring providers to develop innovative products, offer flexible coverage options, and leverage technology to provide seamless customer experiences. Technological Disruptions: The rapid advancements in technology are transforming the insurance landscape, presenting both challenges and opportunities. Insurtech startups are disrupting traditional models, forcing established providers to adapt, embrace digitalization, and leverage data analytics to improve risk assessment, personalize offers, and streamline claims processing. 22 www.ciolookindia.com November 2023 Challenges and Opportunities for India's Most Reliable Insurance Providersin Securing Lives

- 26. Dynamic Regulatory Environment: The Indian insurance sector is subject to a continuously evolving regulatory environment. Regulatory changes aim to improve transparency, enhance consumer protection, and promote competition in the market. However, these changes can add complexity and compliance costs for providers, requiring them to adapt their operations and ensure adherence to the latest regulations. Despite these challenges, India's most reliable insurance providers have the potential to capitalize on several key opportunities: *Untapped Market: India's insurance penetration rate remains significantly lower than developed nations, presenting a vast untapped market. Reliable providers can leverage their expertise and brand trust to reach out to underserved populations and increase insurance awareness, thereby promoting financial inclusion and social security. *Rising Disposable Incomes: As disposable incomes rise in India, individuals are increasingly seeking financial protection. Reliable insurance providers can cater to this growing demand by offering innovative products and services that meet the specific needs of different income groups. *Technological Advancements: Technological advancements can be utilized by reliable providers to improve operational efficiency, reduce costs, and enhance customer experience. By embracing data analytics, artificial intelligence, and blockchain technology, providers can personalize insurance offerings, streamline claims processing, and combat fraudulent activities. *Collaborative Partnerships: Reliable insurance providers can leverage partnerships with fintech companies, technology startups, and other industry stakeholders to create a more efficient and customer-centric insurance ecosystem. These partnerships can lead to the development of innovative products, improved distribution channels, and better risk management practices. *Government Initiatives: The government of India has launched various initiatives to promote insurance penetration and financial inclusion. Reliable insurance providers can actively participate in these initiatives to expand their reach and contribute to the overall development of the insurance sector. India's most reliable insurance providers face a dynamic landscape filled with challenges and opportunities. By embracing innovation, adapting to changing customer needs, and leveraging technology effectively, these providers can continue to play a crucial role in securing lives and ensuring financial stability for millions of individuals and families across India. Their unwavering commitment to ethical practices, customer service, and social responsibility will continue to drive the growth of the insurance sector and ensure its positive impact on the lives of countless individuals. As they continue to evolve and adapt to changing times, their legacy of trust will endure, safeguarding lives and securing futures with unwavering dedication and ethical integrity. 24 www.ciolookindia.com November 2023

- 29. The Most Trusted Insurance Companies in India 27 November 2023 www.ciolookindia.com -

- 32. www.ciolookindia.com I N D I A