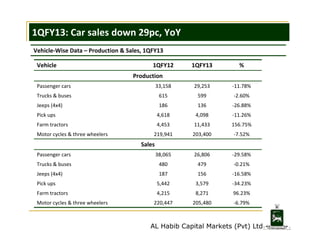

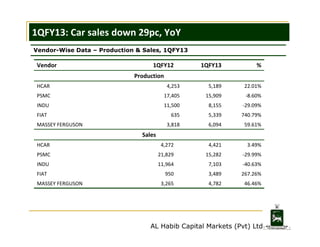

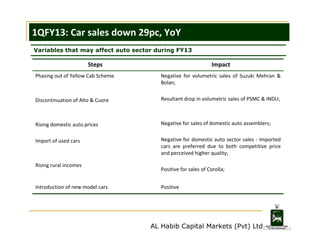

Passenger car sales in Pakistan plummeted 29% year-over-year to 26,806 units during the first quarter of FY2013 according to data from PAMA. Rising imports of used cars and increasing prices of domestically assembled cars negatively impacted sales. Discontinuation of popular models like the Suzuki Alto and Daihatsu Cuore also affected sales at PSMC and INDU. The auto industry faces additional challenges from the phasing out of tax incentives for certain models and the overall rise in domestic auto prices.