Embed presentation

Download as PDF, PPTX

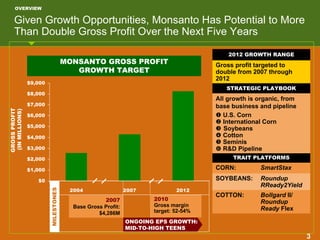

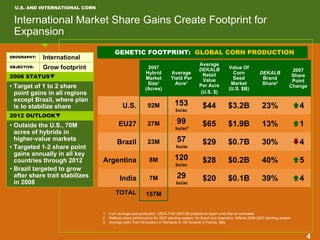

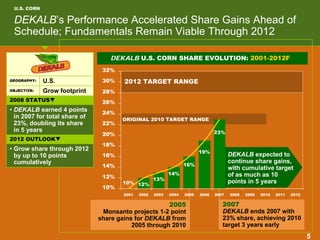

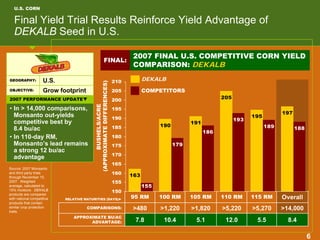

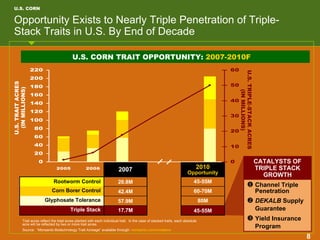

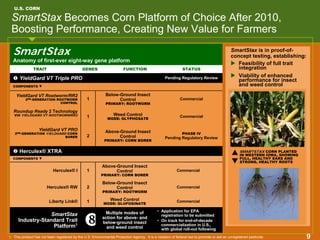

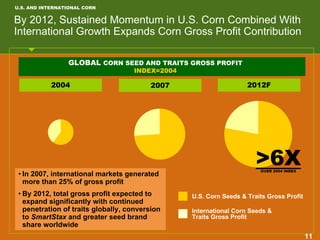

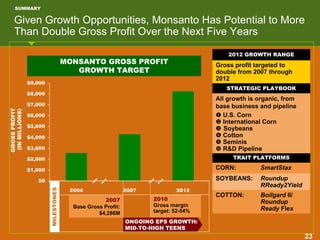

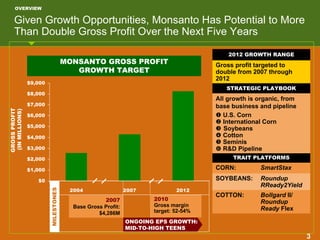

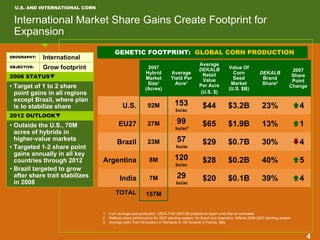

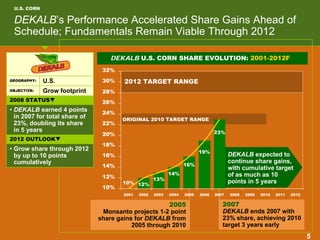

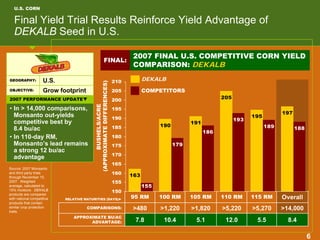

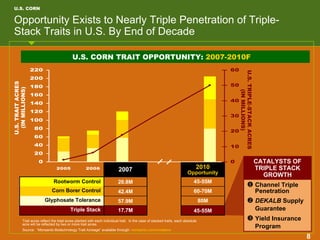

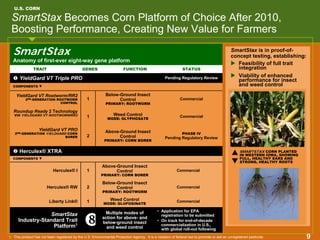

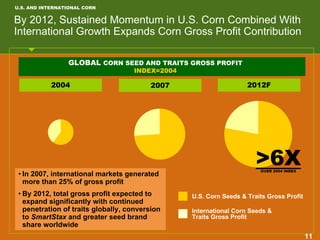

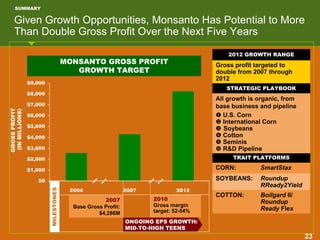

Brett Begeman discussed Monsanto's strategy to more than double gross profit from corn by 2012 through organic growth of their existing business and pipeline. Key points include: - Growing U.S. and international corn market share through new hybrids and traits like SmartStax corn which could reset the industry standard after 2010. - Nearly tripling U.S. penetration of triple-stack traits from 17.7 million acres in 2007 to 45-55 million acres by 2010 through new products and programs. - Maintaining a strong yield advantage of DEKALB hybrids in the U.S., including 8.4 bushels/acre over competitors in 2007, to drive continued share gains. -