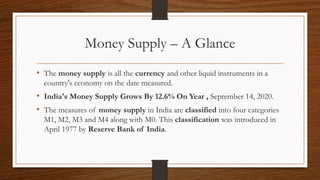

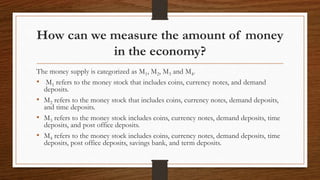

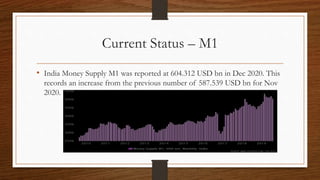

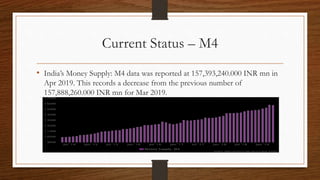

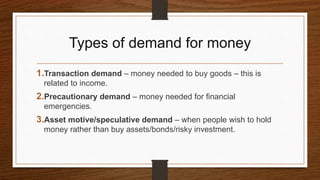

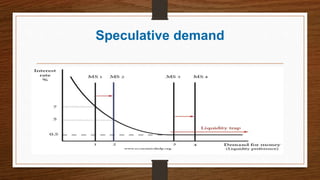

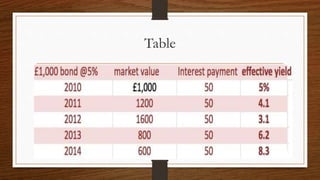

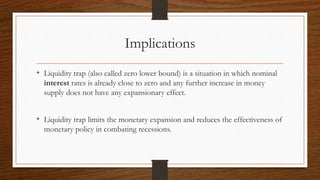

The document discusses the concepts of money supply and demand for money. It defines money supply as the total currency and liquid assets in an economy, which is measured in India using categories M1, M2, M3 and M4. Demand for money refers to how much individuals want to hold their assets in liquid form, and can come from transaction needs, precautionary motives or speculative demands. The implications of money supply and demand include the possibility of hitting a liquidity trap where further monetary expansion has limited effect on the economy.