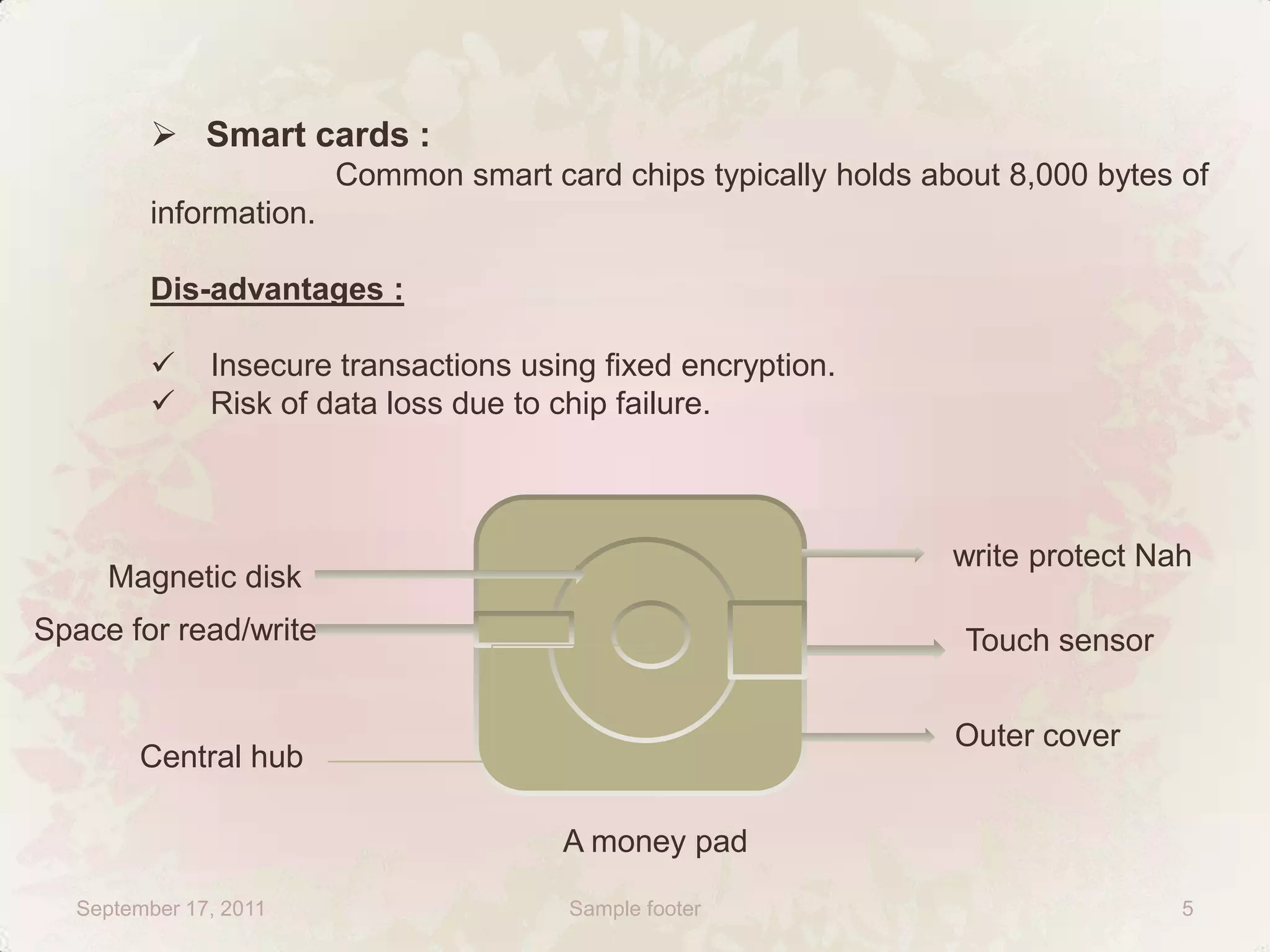

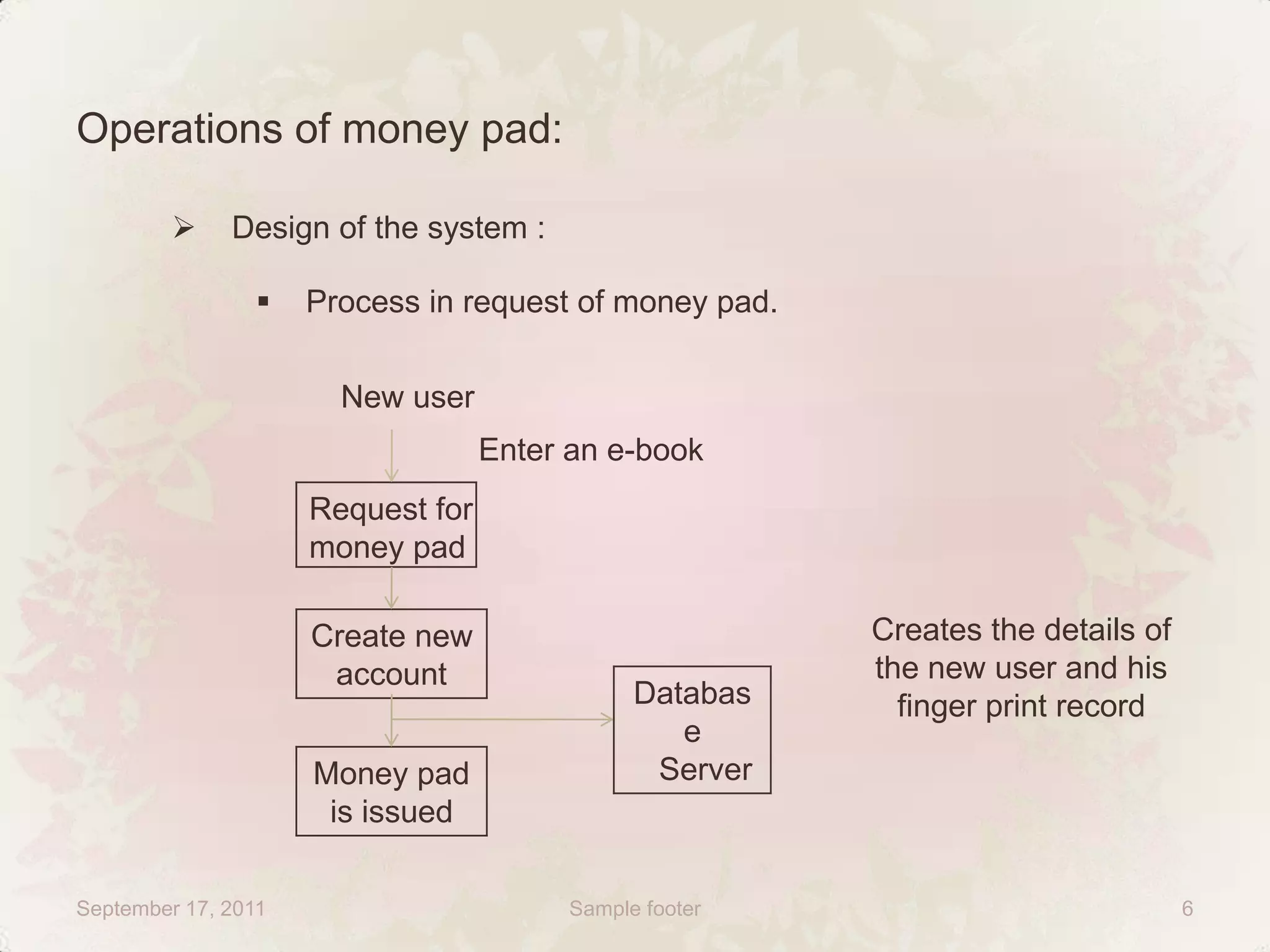

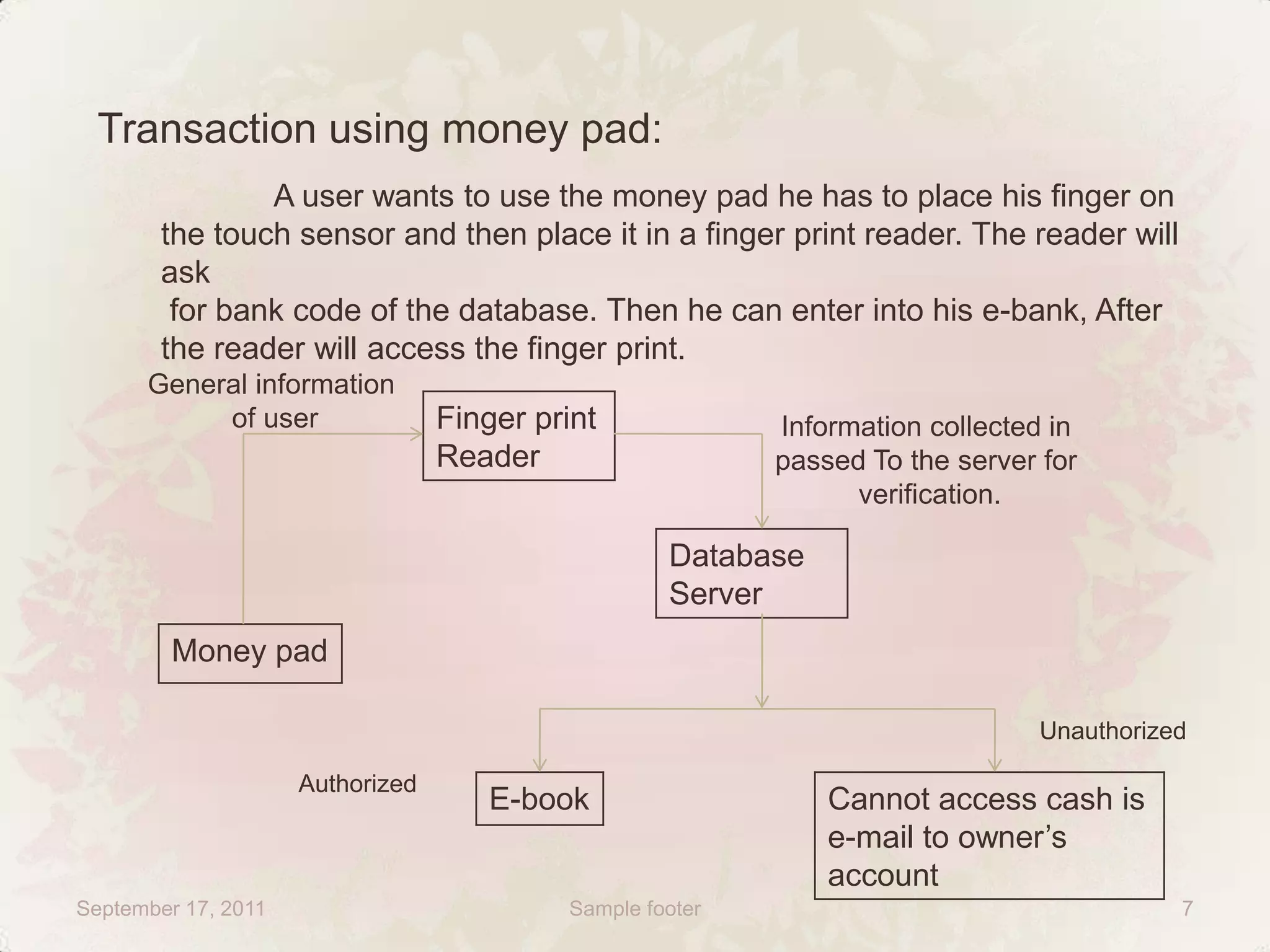

The document discusses the future of digital payments and introduces the "Money pad", a device that will replace physical wallets and allow users to store digital cash and financial information. The Money pad uses biometric fingerprint recognition for secure authentication and can be used to perform remote electronic payments and transactions. It provides advantages over traditional payment methods like credit cards by enabling instant clearing of funds and more secure encryption during transactions. The Money pad is proposed as a solution that meets the future requirements of instant fund transfers, payment security, and elimination of physical payment methods.