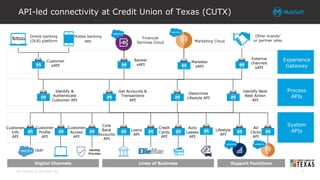

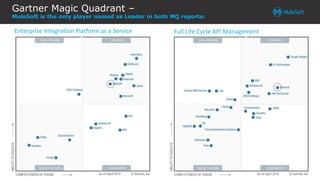

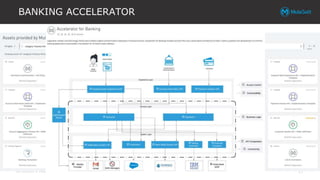

MuleSoft, a Salesforce company, focuses on modernizing financial services through API strategies and legacy integration, aiming to accelerate innovation by connecting applications, data, and devices. The Anypoint Platform serves as a unified solution for designing and managing APIs and integrations, addressing demands in the banking sector by simplifying complex system interactions. Success stories include Wells Fargo and HSBC, which have significantly improved operational efficiencies and customer experiences through API-led connectivity.