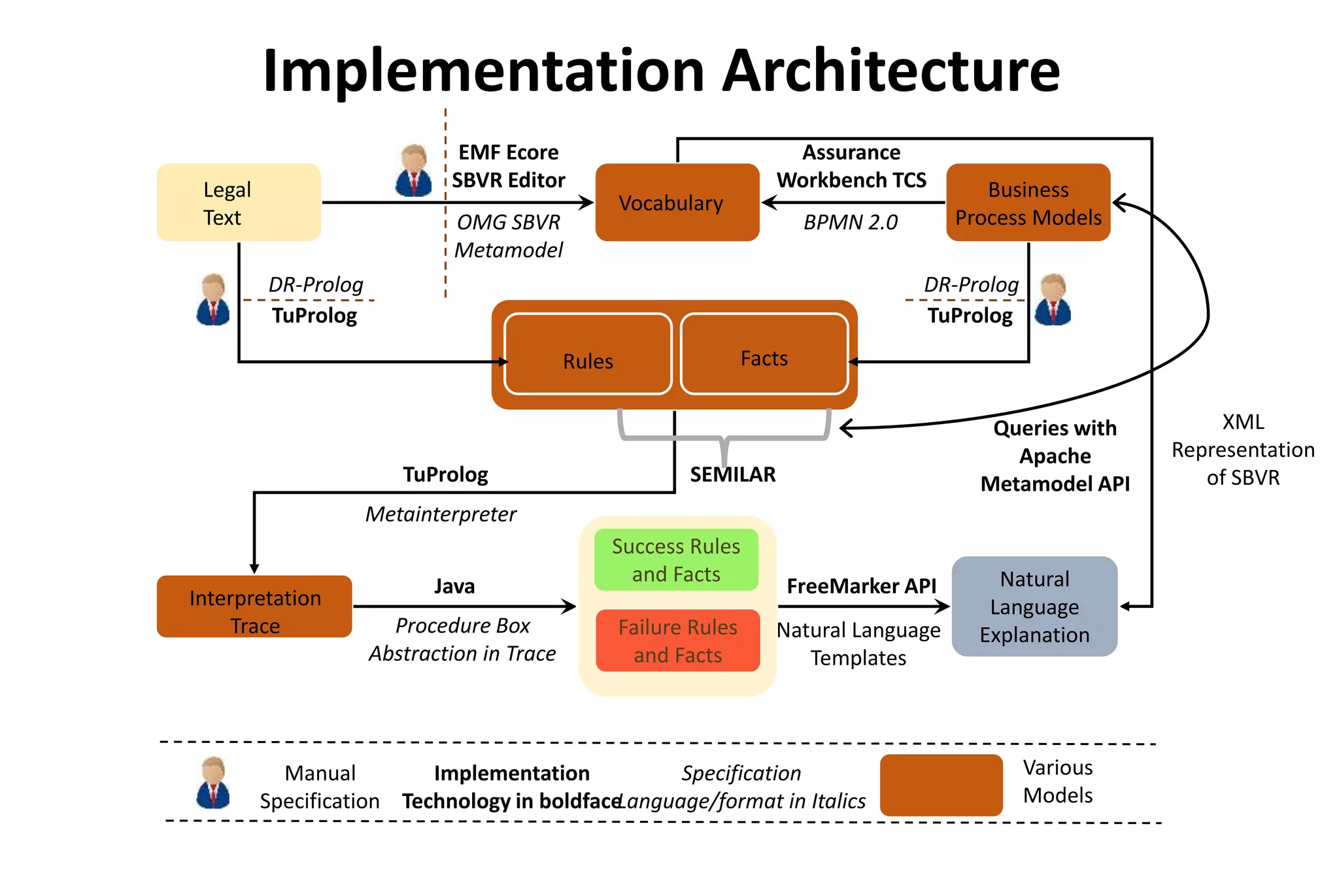

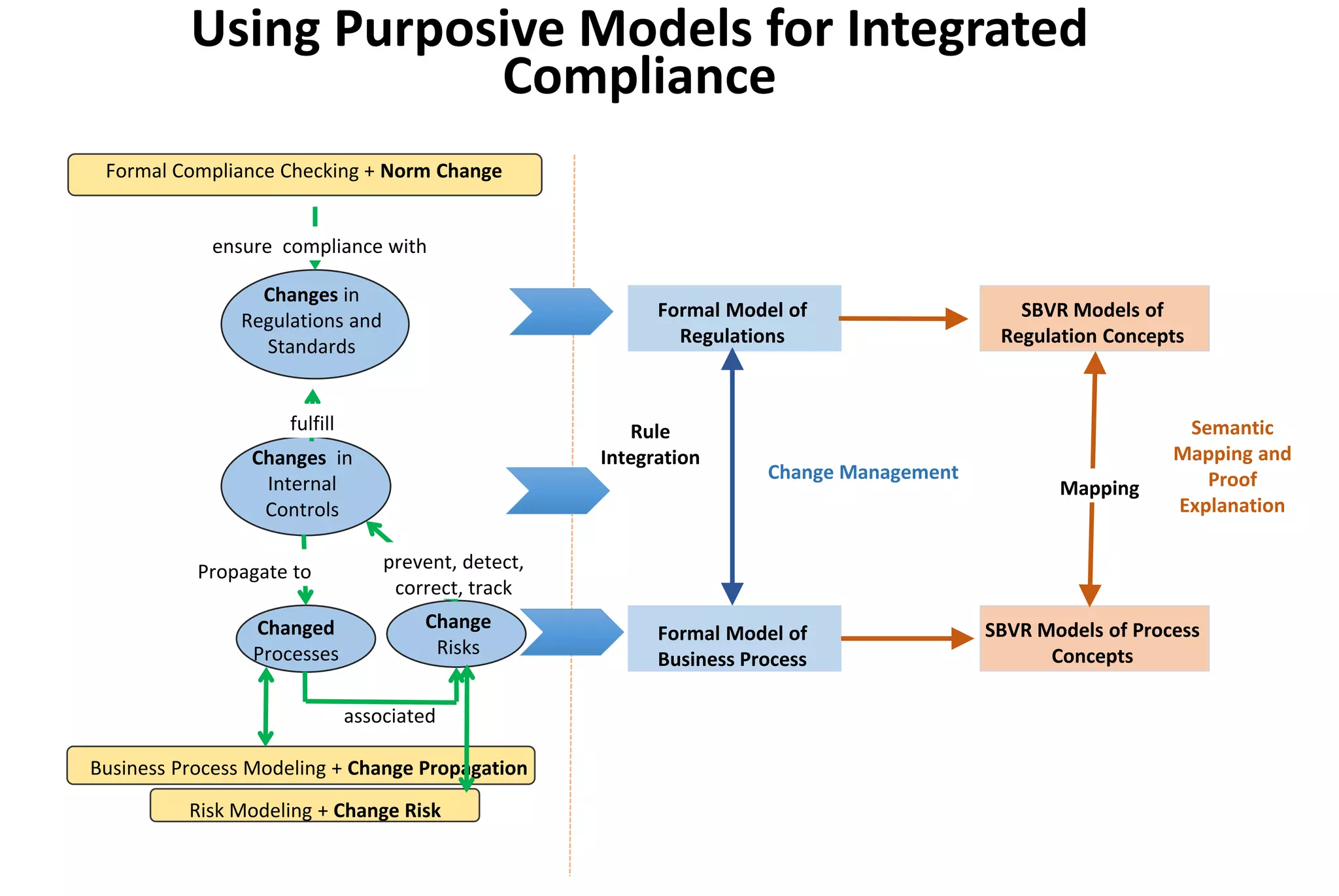

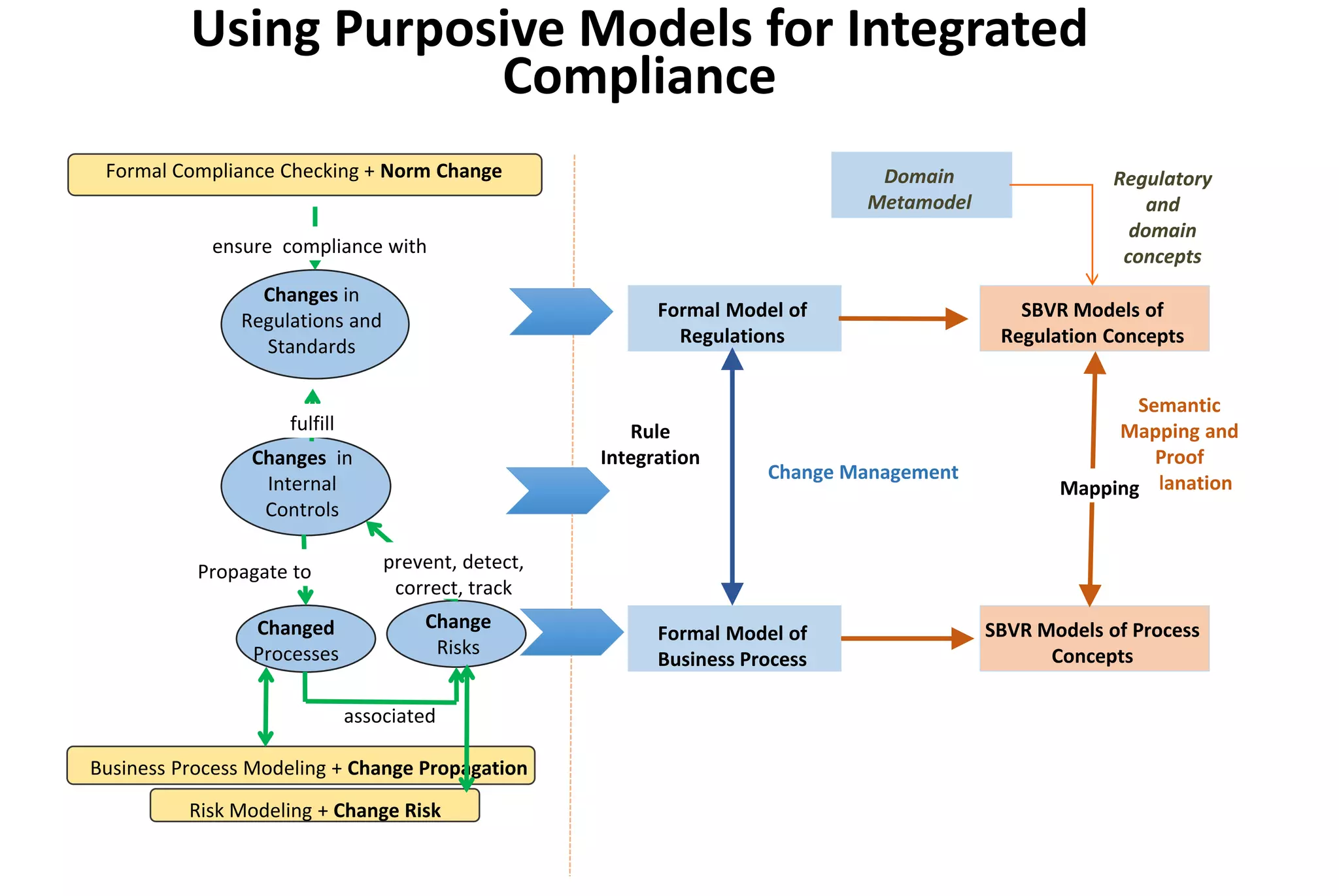

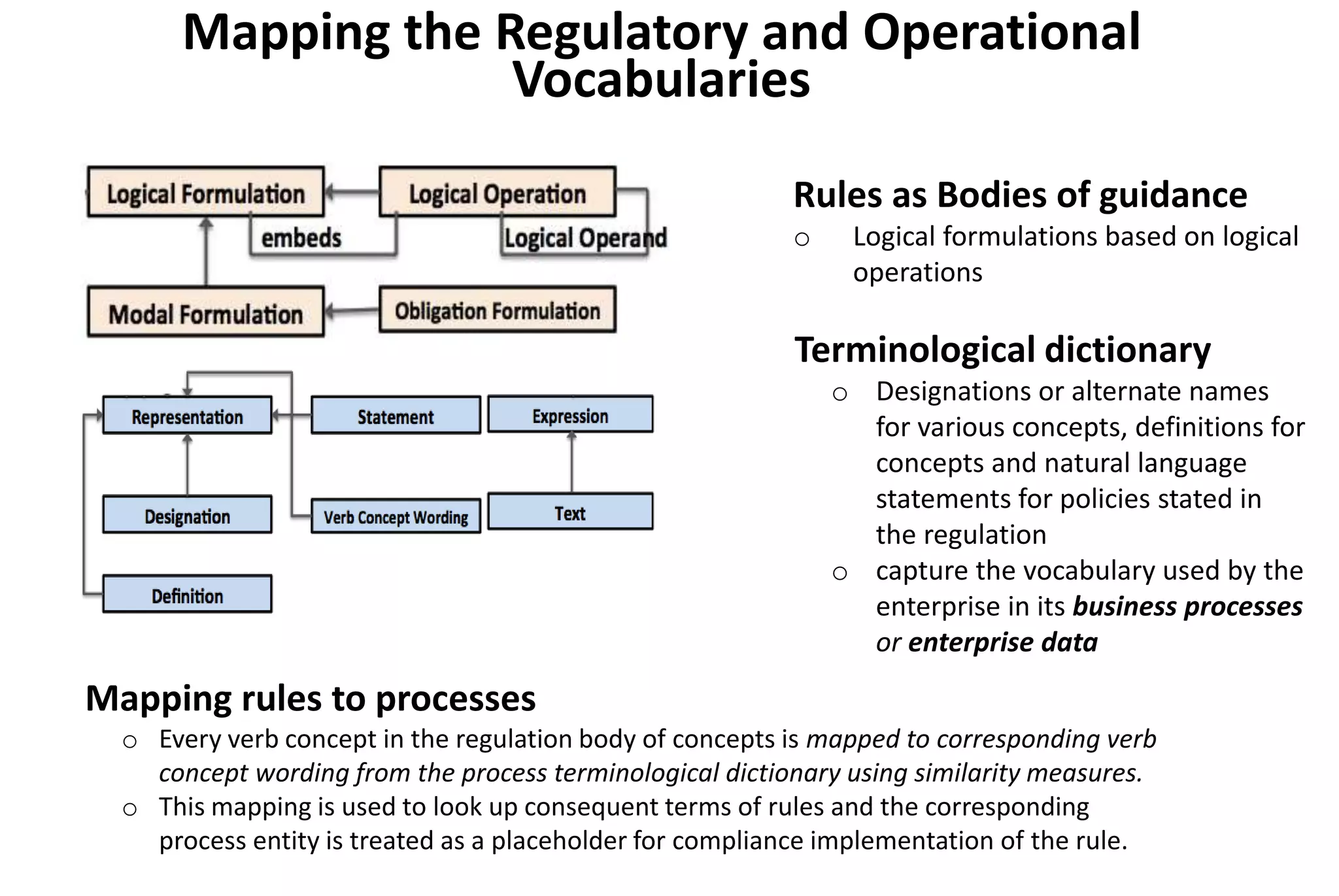

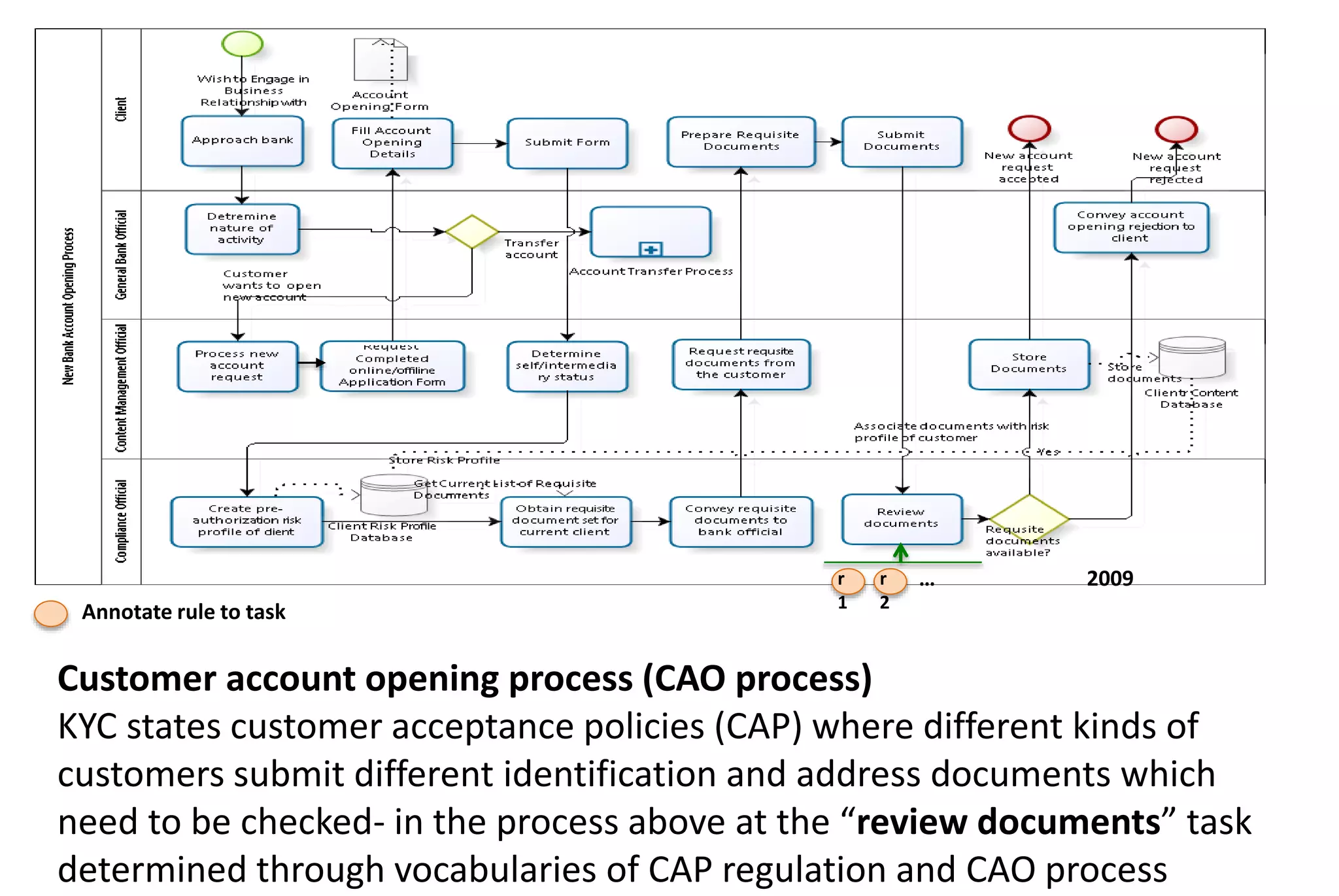

This document discusses model-driven regulatory compliance using a case study of "Know Your Customer" banking regulations. It outlines key challenges in compliance such as semantic disparity between formal regulations and business operations, generating explanations of compliance proofs, and managing changes to regulations over time. The authors propose addressing these challenges by developing formal vocabularies of regulatory and business concepts, mapping the vocabularies to address semantic differences, and using the mapped models to reason about compliance and regulatory changes. A banking example is provided to illustrate mapping KYC regulations to customer account opening processes. The proposed approach aims to help organizations more rigorously and cost-effectively ensure ongoing regulatory compliance.

![Compliance is adherence to policies and decisions. Policies may originate in

internal directives as well as external regulations.

Cost of Compliance

o Increasing spend on compliance- in Billions of $ and expeceted to rise

o Several regulations across various domains

Banking KYC [Know Your Customer], FATCA [Foreign Account Tax

Compliance Act], BASEL III [Bank Capital Adequacy and Market Liquidity]

Mortgage CFPB [Consumer Financial Protection Bureau]

Healthcare HIPPA [Federal Health Insurance Portability and

Accountability Act]

o Compliance is difficult to achieve

o It is uncertain in many cases what constitutes compliance

o It is not clear how it will affect the business

o It changes with time and space [geography-specific]

Non-compliance is penalized severely

Regulatory Compliance Context](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-2-2048.jpg)

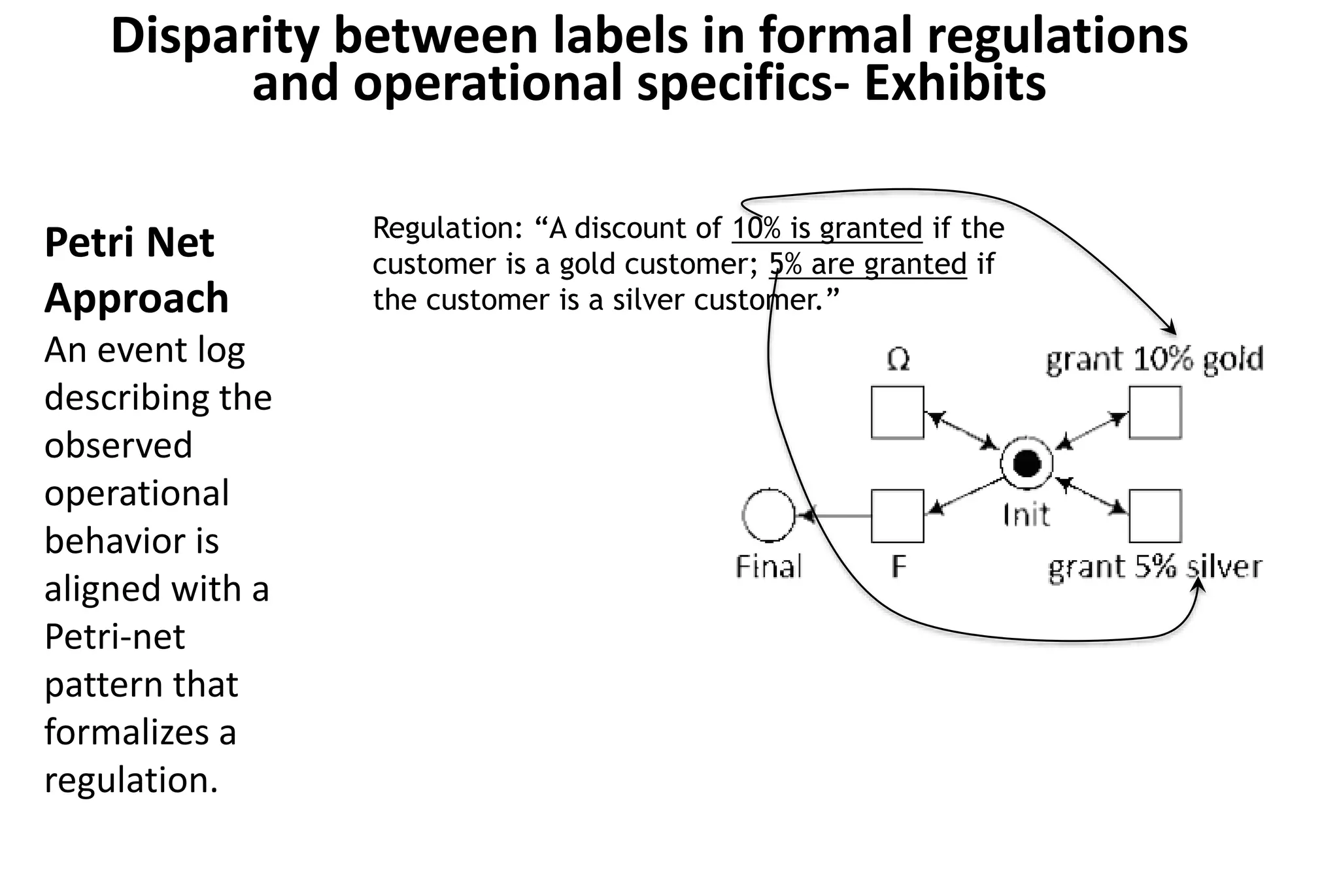

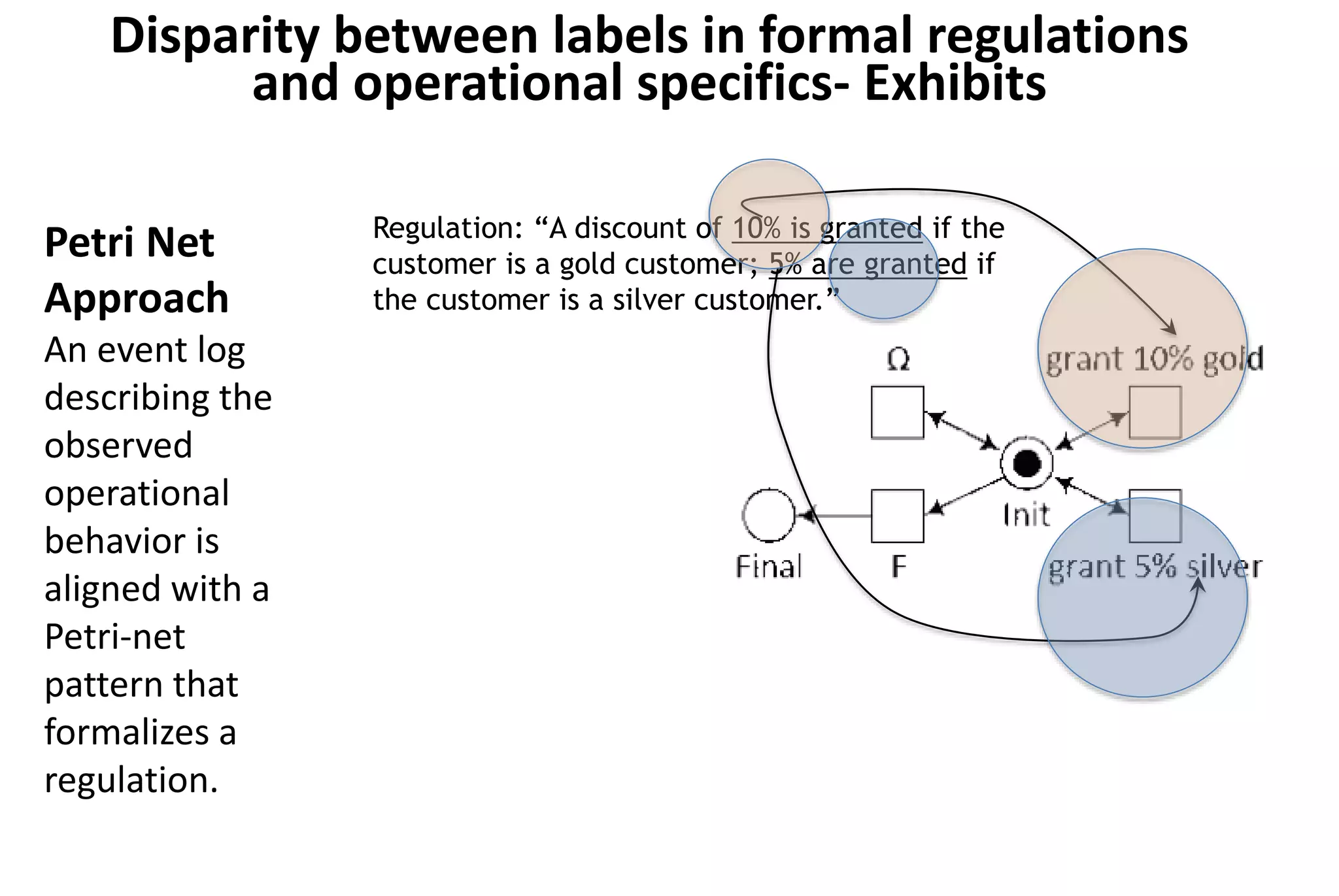

![ Semantic Disparity

o Before checking compliance, need to map regulatory concepts to

enterprise operational concepts to find out to “what” in enterprise data a

regulation is applicable to [in business processes “where” it is applicable]

o Largely ignored/implicitly assumed in research approaches, industrial

GRC solutions depend on domain experts

Explanation of Proofs of Compliance

o An explanation which compliance officers/internal auditors and business

stakeholders can use in a legally defensible way

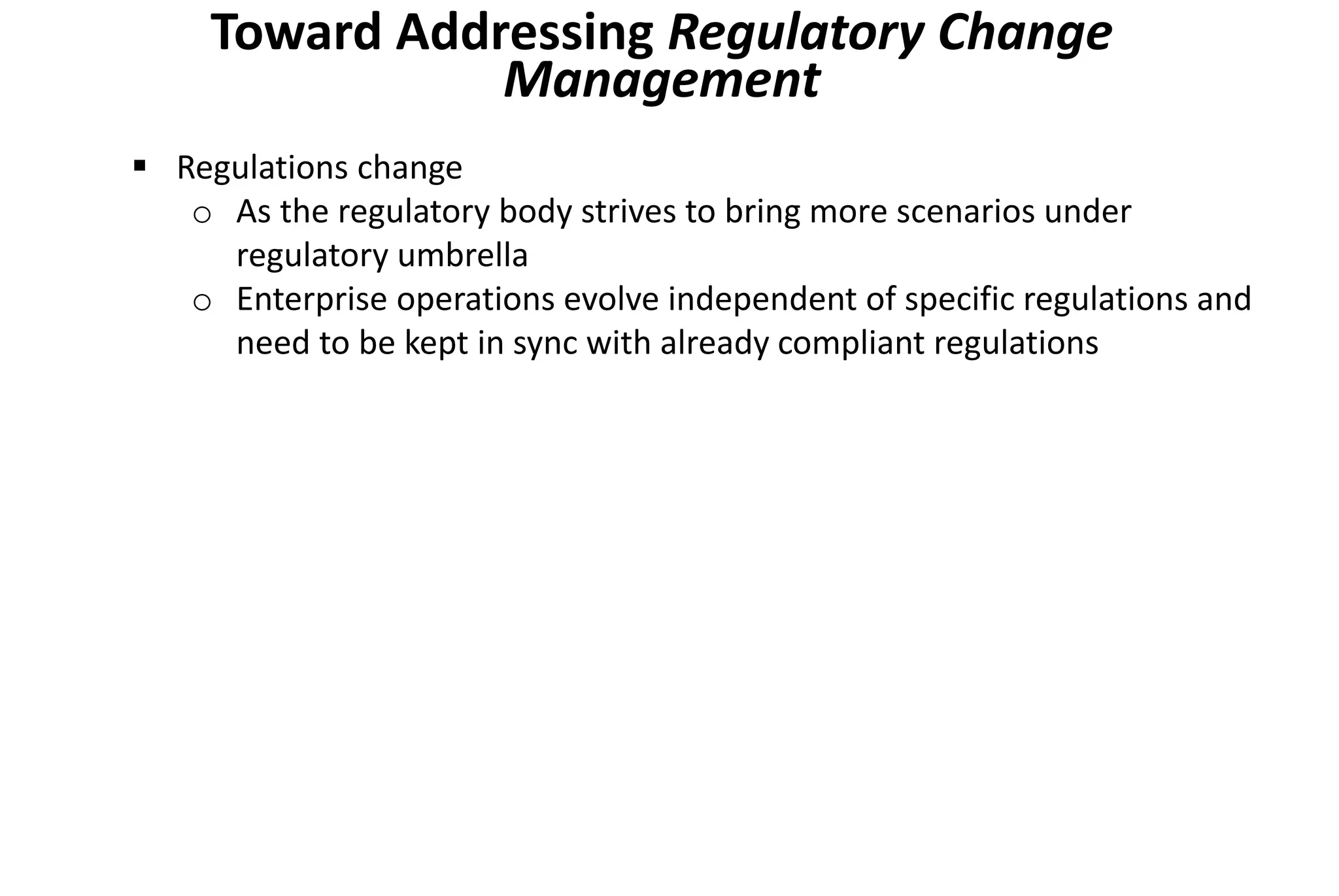

Change Management for Regulations

o Regulations change over time and with geography- need to keep

operations compliant with changing regulations

o Operations may change and need to re-comply with existing regulations

Key Challenges](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-4-2048.jpg)

![ Create formal vocabularies regulatory and operational concepts and

map them to address Semantic Disparity

Use the vocabularies [specifically terminological dictionary] to

capture natural language representation to address generation of

Proof Explanation

Rematch/retag regulations to operational specifics using vocabulary

and mappings, use formal representation of regulations to reason

about Regulatory Change

Addressing Regulatory Challenges with

Model-driven Integrated GRC Architecture](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-10-2048.jpg)

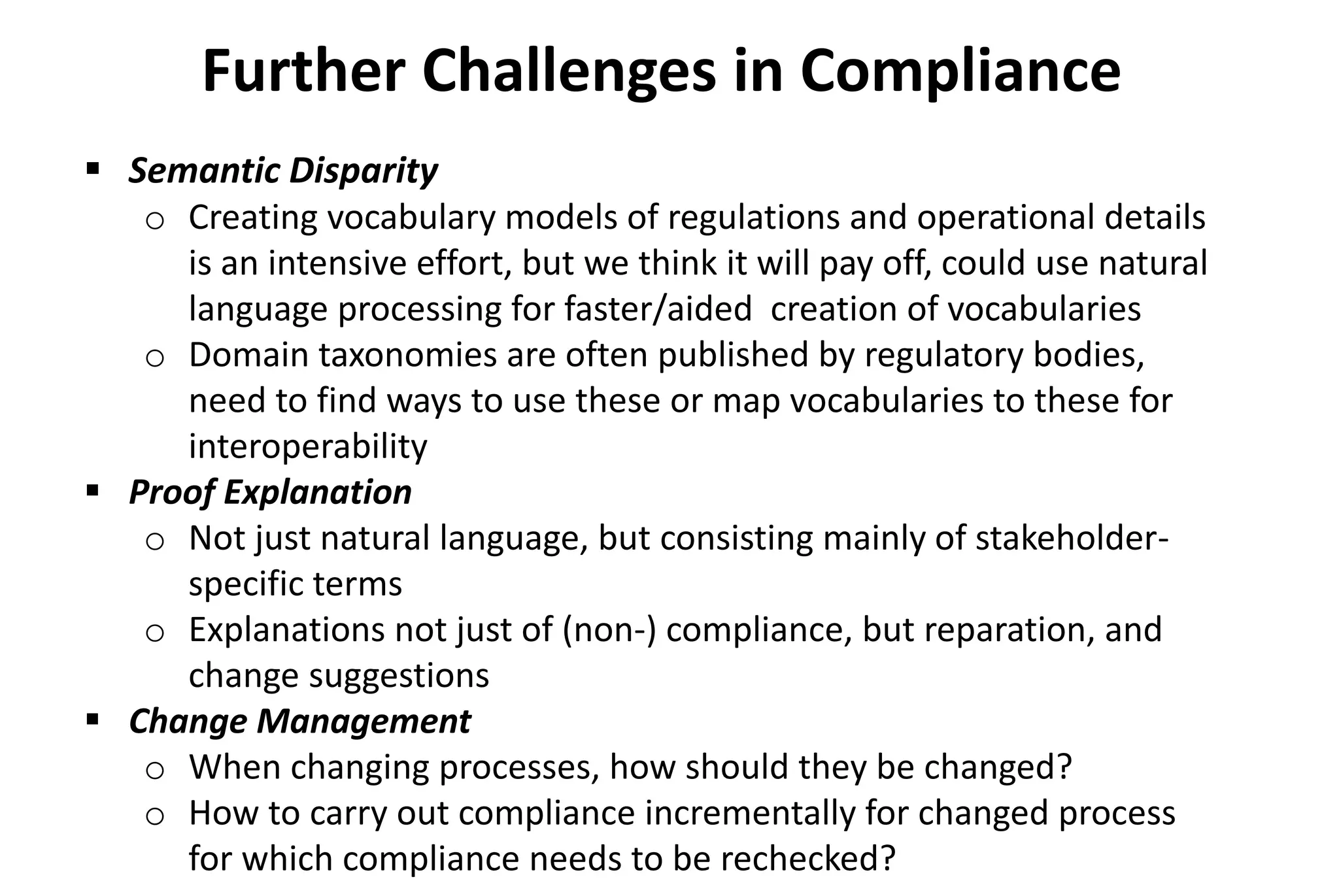

![Reserve Bank of

India’s Know Your

Customer

regulations for a

salaried

employee at a

private employer

opening an

account at an

Indian Bank

Addressing Semantic Disparity- An example of banking

domain regulation mapping to banking process

Formal model [based on deontic, modal, defeasible logic]](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-18-2048.jpg)

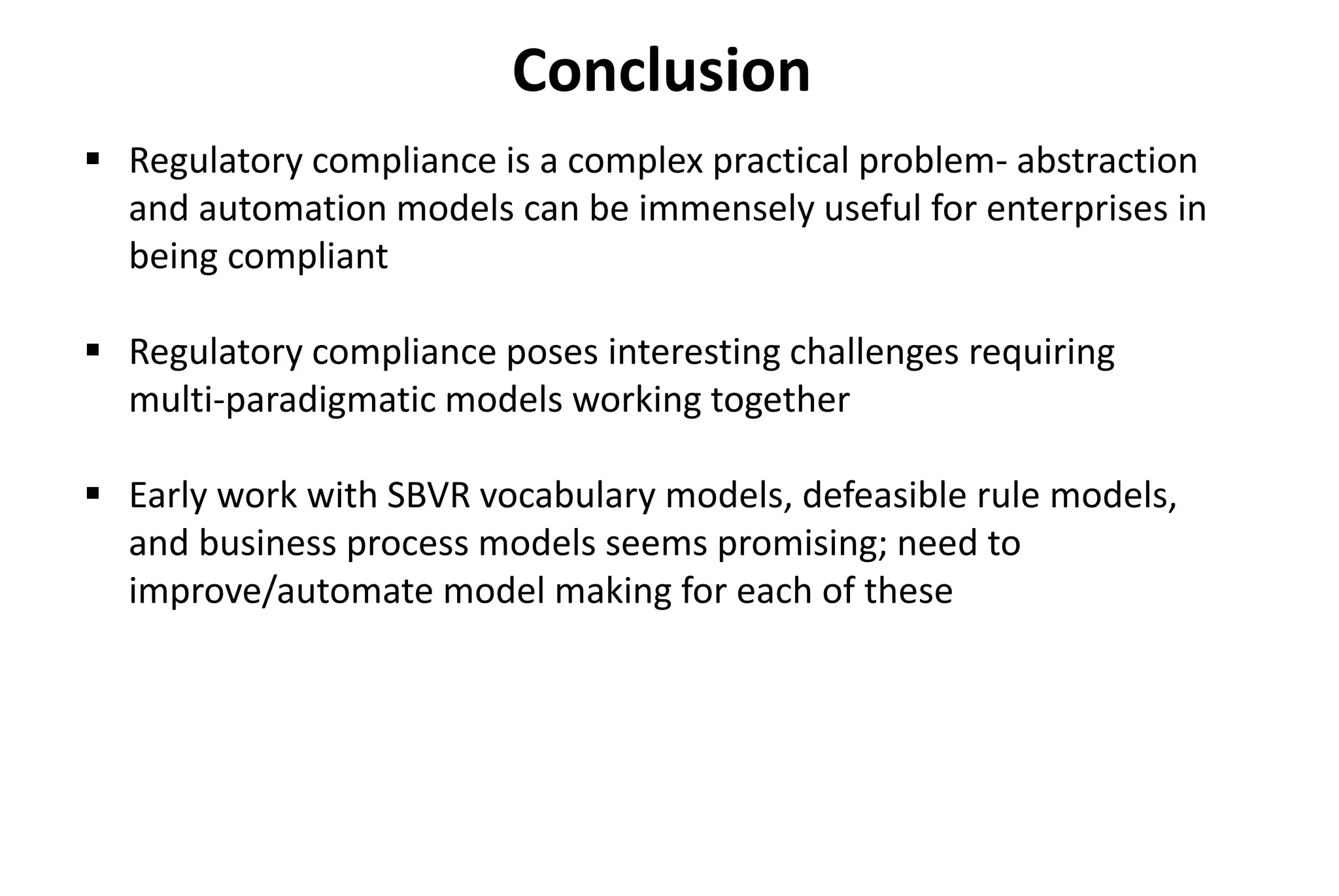

![Success Facts for Client_ID 17

[

fact(client_data(17,ind,pse)).,

fact(pse_data(17,approvedCorporate)).,

fact(pse_KYC_document_data(17,acceptApp

rovedCorpCertificate,pse_kyc_document_set

)).

]

Success Rule r3

Client_ID 17 fulfills all

Obligatory requisites.

The processed trace

shows facts in

the successful invocation of

rule r3.

Addressing Natural Language Proof Explanation](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-20-2048.jpg)

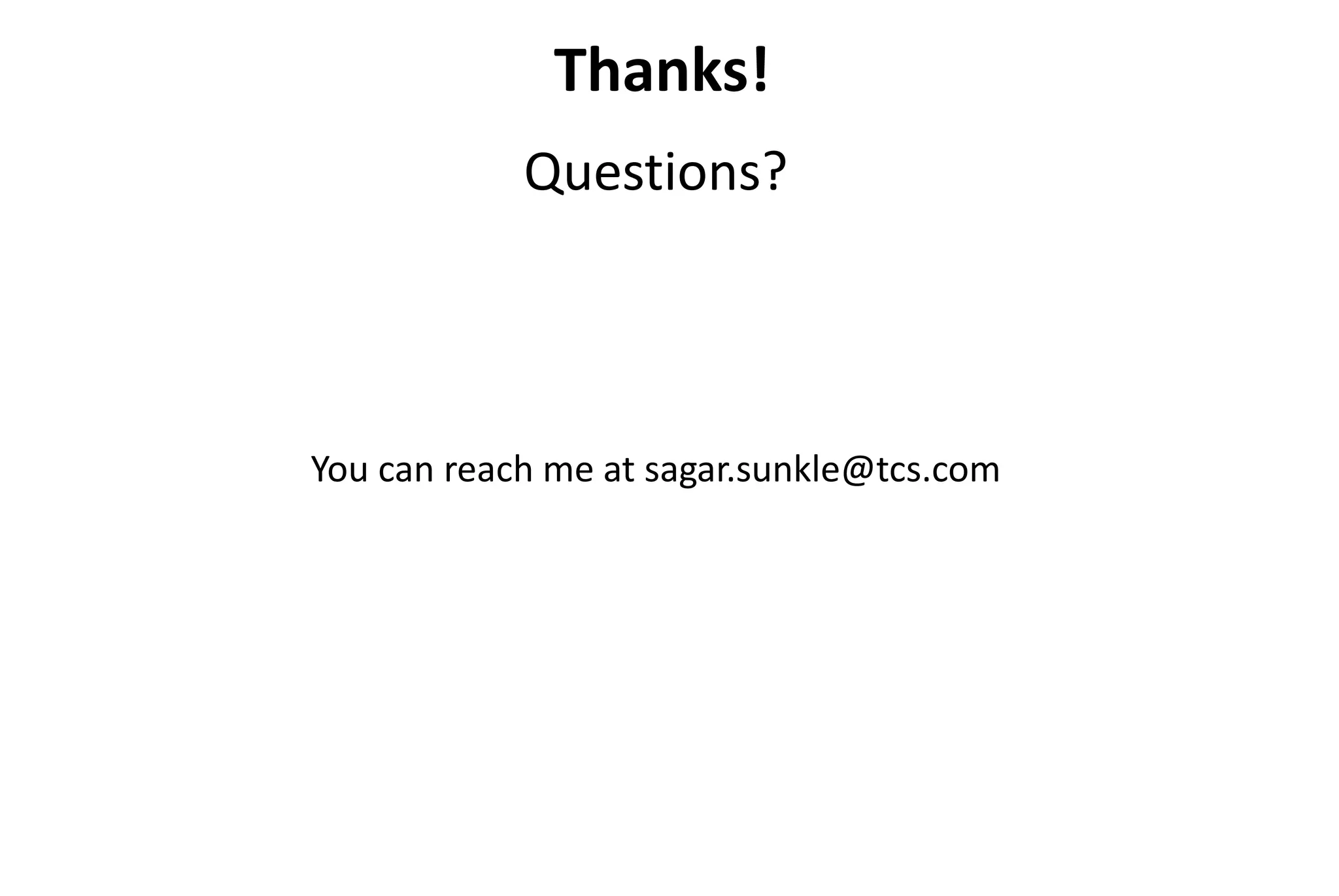

![<containsConcepts

xsi:type="SBVR.MeaningandRepresentationVocabulary:generalconcept">

<Id>pse</Id>

<representation>pse_data</representation>

<characteristic>notApprovedCorporate</characteristic>

<characteristic>approvedCorporate</characteristic>

<moreGeneralConcept>ind</moreGeneralConcept>

</containsConcepts>

</includesBodyOfConcepts>

<includesBodyOfConcepts Id="RBI_KYCRegulationConcepts">

Business Vocabulary

with Characteristics

Concept pse and its

characteristics such as

approvedCorporate are

defined in the business

context and also in the

meaning and

representation

vocabulary.

Success Facts for Client_ID 17

[

fact(client_data(17,ind,pse)).,

fact(pse_data(17,approvedCorporate)).,

fact(pse_KYC_document_data(17,acceptApp

rovedCorpCertificate,pse_kyc_document_set

)).

]

Success Rule r3

Addressing Natural Language Proof Explanation](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-21-2048.jpg)

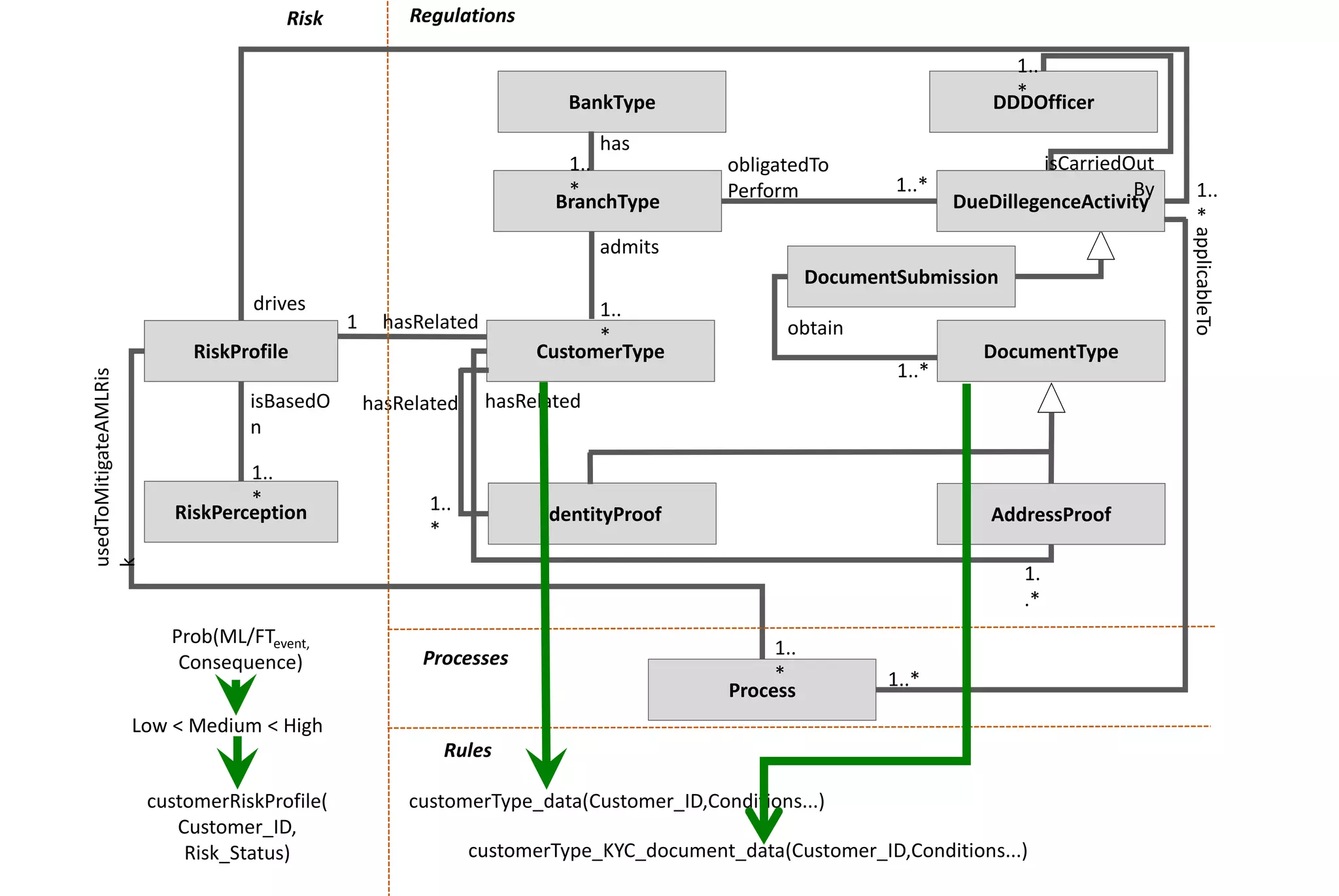

![<includesBodyOfGuidance Id="RBI_KYCRules">

<includesElementsOfGuidance Id="r3">

<Id>r3</Id>

<isMeantBy xsi:type="SBVR.LogicalFormulationofSemanticsVocabulary:obligationformulation">

<antecedent xsi:type="SBVR.LogicalFormulationofSemanticsVocabulary:conjunction">

<logicalOperand xsi:type="SBVR.LogicalFormulationofSemanticsVocabulary:atomicformulation">

<Id>ind</Id>

<isBasedOn>client_is_ind</isBasedOn>

</logicalOperand>

…

</isMeantBy>

</includesElementsOfGuidance>

</includesBodyOfGuidance> Business Rules Vocabulary

The rules vocabulary

notes the rules and

concepts involved.

Success Facts for Client_ID 17

[

fact(client_data(17,ind,pse)).,

fact(pse_data(17,approvedCorporate)).,

fact(pse_KYC_document_data(17,acceptApp

rovedCorpCertificate,pse_kyc_document_set

)).

]

Success Rule r3

Addressing Natural Language Proof Explanation](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-22-2048.jpg)

![<SBVR.VocabularyforDescribingBusinessVocabularies:ComplianceModel>

<contains Id="RBI_reference">

<presentsVocabulary Id="RBI_RegulationVocabulary"/>

<expressesBodyOfMeanings Id="RBI_KYCRegulation"/>

<includes xsi:type="SBVR.VocabularyforDescribingBusinessVocabularies:owneddefinition">

<Id>approvedCorporate</Id>

<expression>Employer_is_a_corporate_approved_by_the_bank</expression>

<meaning>approvedCorporate</meaning>

</includes>

<includes xsi:type="SBVR.VocabularyforDescribingBusinessRules:rulestatement"><Id>r3_stmt</Id

<expression>It_is_obligatory_for_bank_to_obtain_requisite_documents_Including

_approved_employer_certificate_and_additionally_at_least_one_valid_

document_ from_individual_who_is_a_private_salaried_employee

_in_order_to_open_account”

</expression>

<meaning>r3</meaning>

</SBVR.VocabularyforDescribingBusinessVocabularies:ComplianceModel>

Terminological

Dictionary

The terminological

dictionary

contains the

natural language

representation of

the rule in

addition to

process concepts.

Success Facts for Client_ID 17

[

fact(client_data(17,ind,pse)).,

fact(pse_data(17,approvedCorporate)).,

fact(pse_KYC_document_data(17,acceptApp

rovedCorpCertificate,pse_kyc_document_set

)).

]

Success Rule r3

Addressing Natural Language Proof Explanation](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-23-2048.jpg)

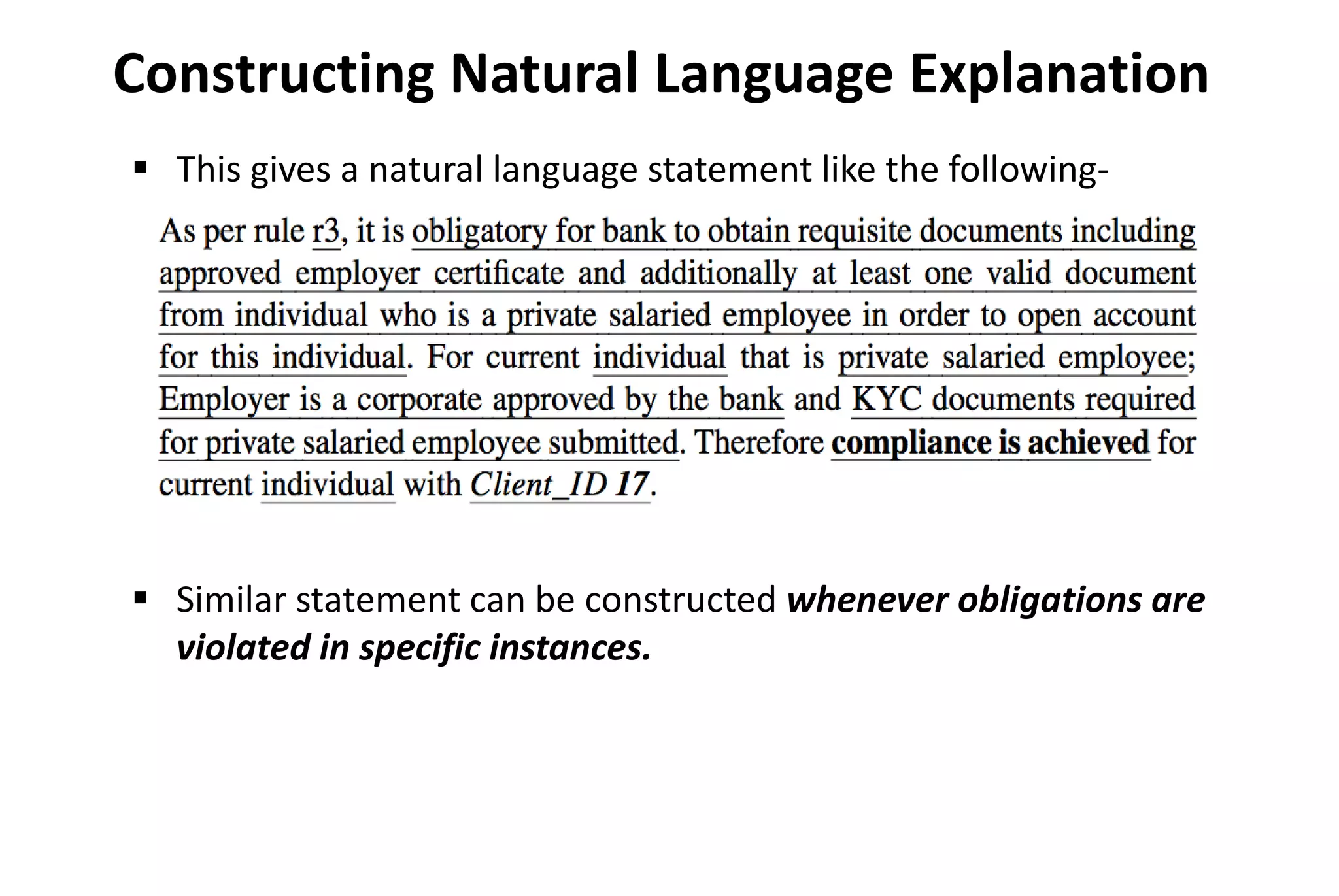

![ Query SBVR model in XML

The projected results are filled into templates

Template above is filled in with

o Rule ID, rule statement [From the terminological dictionary and rules

vocabulary respectively],

o Type of concept (in the case study, a banking customer), specific

instance, description, and its ID [From the business context and

meaning and representation vocabulary]

Constructing Natural Language Explanation

As per rule _, _. For current _that is _; _. Therefore

compliance is achieved for current _ _.](https://image.slidesharecdn.com/models15mdregcompsunkle-180206034014/75/Model-Driven-Regulatory-Compliance-A-Case-Study-of-Know-Your-Customer-Regulations-24-2048.jpg)