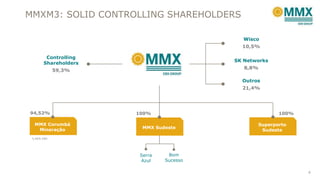

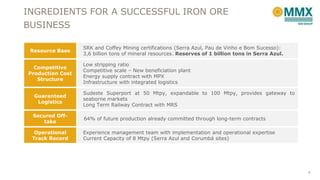

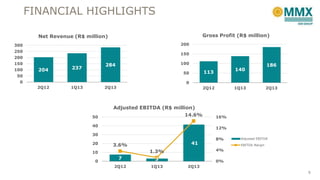

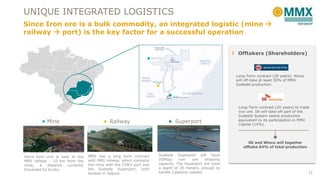

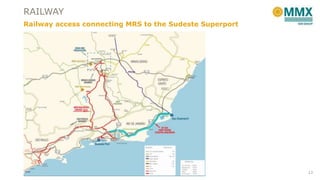

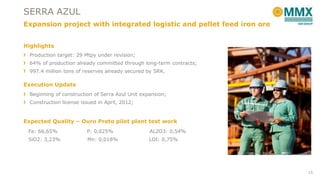

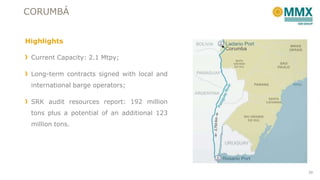

MMX is a Brazilian iron ore mining company with operating mines in Minas Gerais and Mato Grosso do Sul states, as well as the Sudeste Superport export facility. They have long-term supply contracts in place for over 60% of production and are expanding operations with the goal of reaching 40 million metric tons per year of iron ore production. The document provides an overview of MMX's assets and projects, operating results, and strategic partnerships.