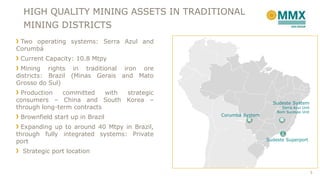

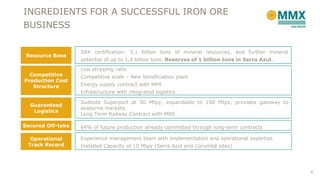

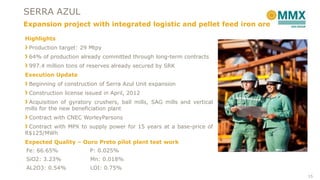

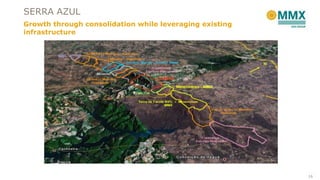

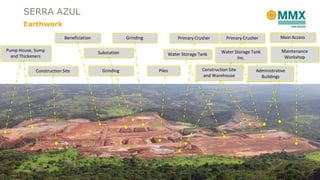

MMX is developing iron ore mining assets in Brazil with the goal of becoming a major exporter of seaborne iron ore. Their key assets include the Serra Azul mine and the Sudeste Superport. Serra Azul has over 1 billion tons of reserves and is undergoing an expansion to reach 29 Mtpy of production capacity. The Sudeste Superport near Rio de Janeiro has approval for 50 Mtpy and is being expanded to 100 Mtpy to serve as an export hub for MMX's production via rail. MMX has also secured long-term offtake agreements for over 60% of production with strategic partners in China and South Korea.