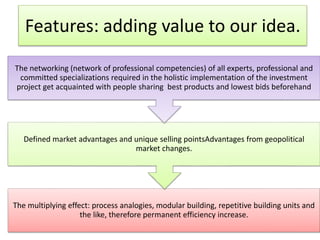

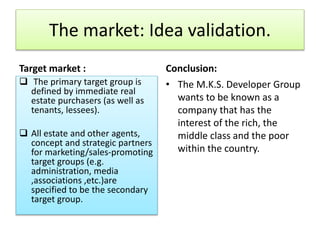

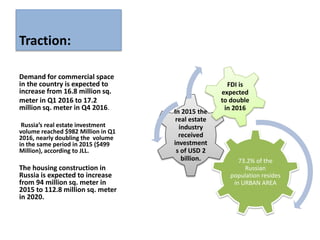

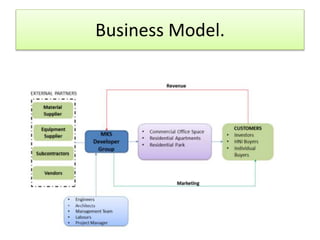

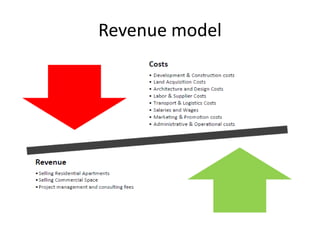

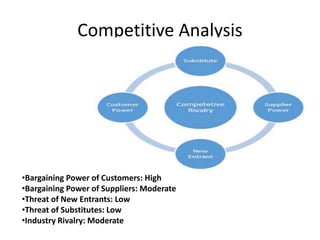

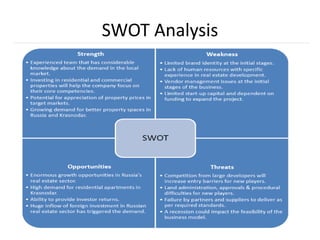

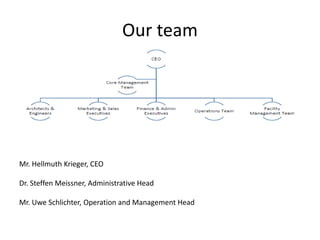

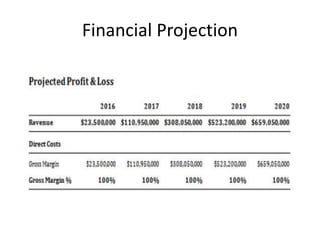

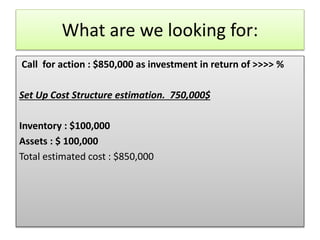

MKS Developers Group is committed to developing living areas through a respectful and thoughtful process that provides privacy, amenities, and preserves natural beauty. Their solution is to handle all project phases in-house for reduced costs, long-term subcontractor relationships to ensure quality and deadlines, and using modular and repetitive building processes for increased efficiency. They aim to target both wealthy and middle/lower class individuals and families through developing residential and commercial properties in urban areas of Russia, where real estate demand and investment are increasing. The presentation seeks $850,000 in investment in exchange for equity, to cover set-up, inventory, and asset costs to launch the development business.