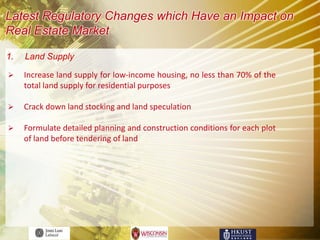

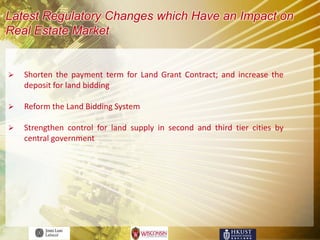

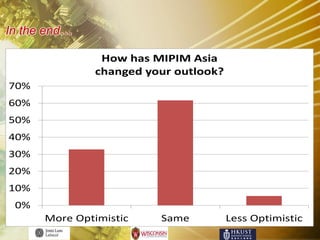

The document summarizes MIPIM Asia real estate conferences from 2009-2011. It finds that while 2009 had cautious optimism due to Asia weathering the financial crisis, 2010 saw strong optimism with China leading growth. In 2011, China is seen as driving Asian real estate, but there are mixed short-term views due to global economic concerns and government policy risks. Overall, Asian real estate markets are still seen as opportunities, though investors are becoming more discerning in targeting markets and assets.