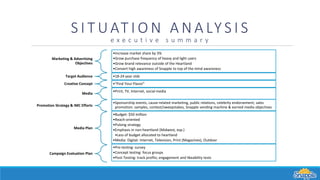

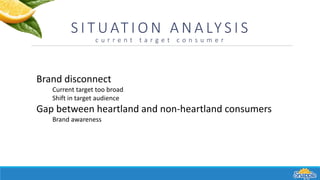

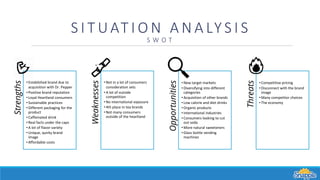

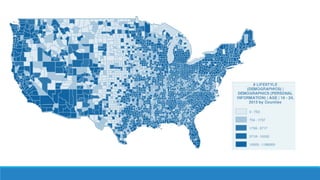

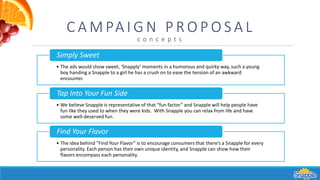

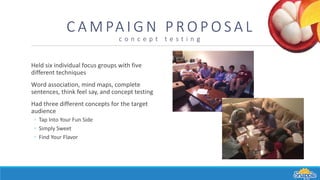

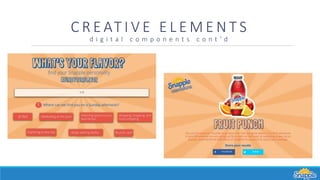

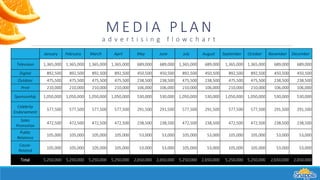

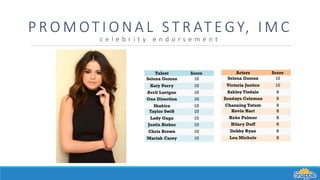

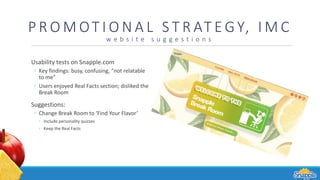

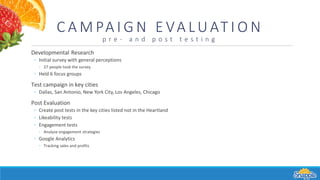

The proposal outlines a campaign to increase Snapple's market share among 18-24 year olds outside of its core Midwest region. The "Find Your Flavor" concept will showcase unique personalities through humorous ads. Focus groups chose this concept over "Simply Sweet" and "Tap Into Your Fun Side". The media plan allocates most of the $50 million budget to TV, sponsorships, and digital. Promotional strategies include sponsoring festivals, cause-related honey bee preservation, and celebrity endorsements. Pre- and post-testing will evaluate the campaign's effectiveness.