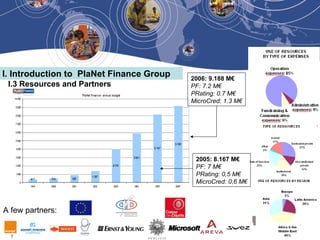

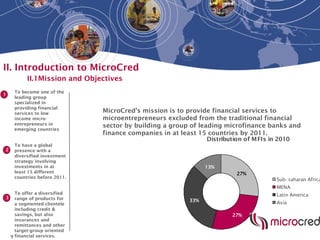

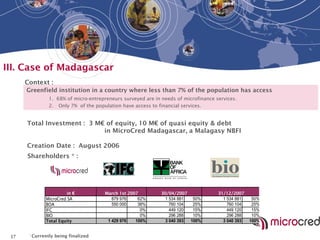

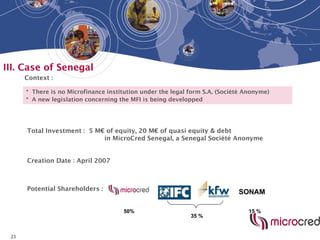

The document discusses the role of Planet Finance and its subsidiary Microcred in promoting microfinance across various countries, including Mexico, Madagascar, China, Senegal, and Algeria. It highlights their missions to enhance financial access for excluded micro-entrepreneurs, the challenges posed by inadequate regulatory frameworks in these regions, and the efforts to develop financial institutions that meet local needs. Key issues such as the lack of specific microfinance regulations and bureaucratic hurdles are identified as impediments to growth in this sector.