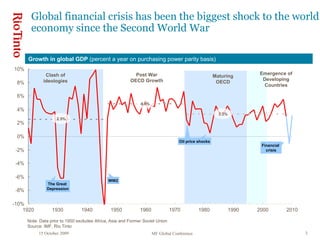

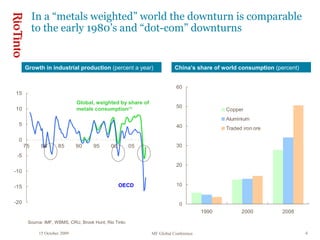

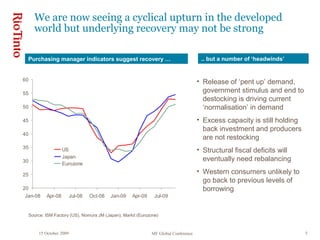

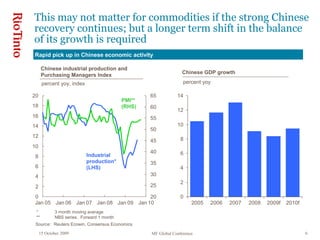

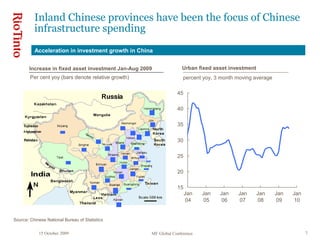

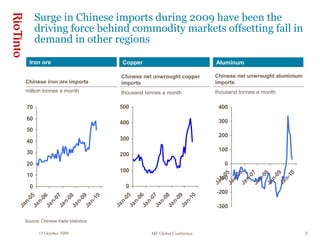

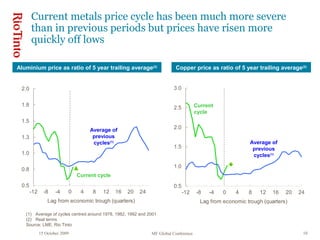

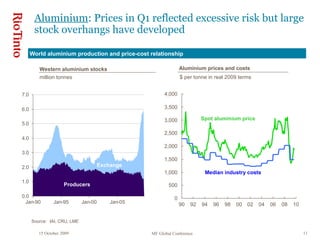

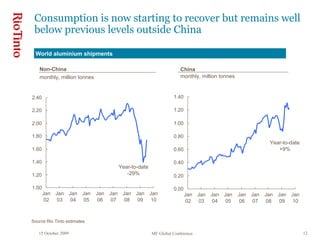

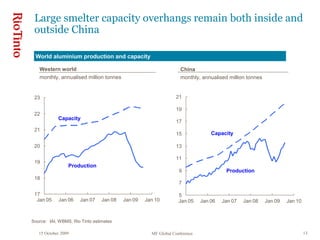

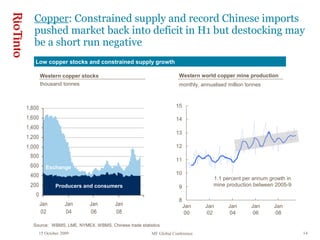

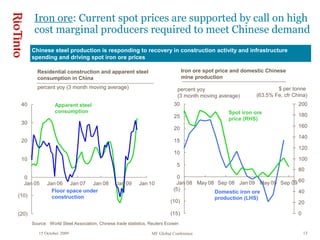

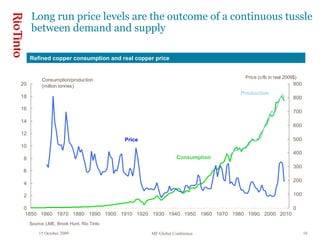

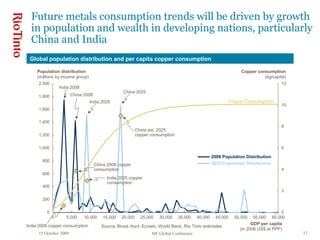

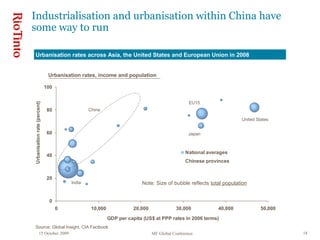

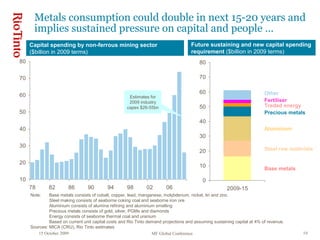

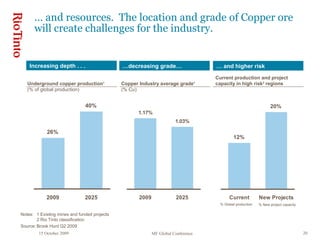

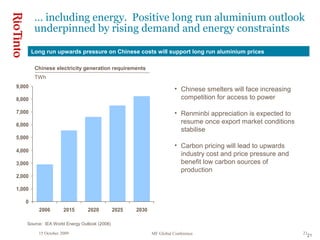

This document provides an overview and outlook of commodity markets from Neal Brewster of Rio Tinto Economics Department. It summarizes that the global financial crisis caused the largest economic shock since WWII but commodity prices have rebounded strongly from lows. While developed economies are in recovery, underlying growth may be limited. Chinese demand has been the main driver of commodities, with imports and investment surging, but long-term Chinese growth relies on a shift to domestic consumption. Various commodity markets are discussed, including excess aluminum and iron ore capacity balanced by constrained copper supply and Chinese demand. Future metals consumption growth depends on developing world population and wealth increases.