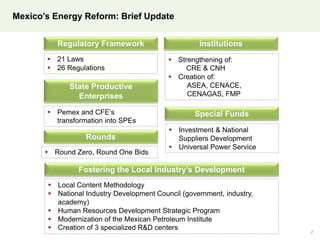

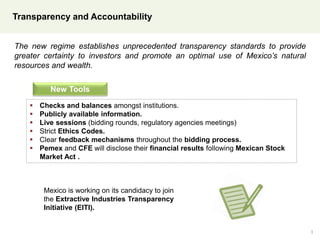

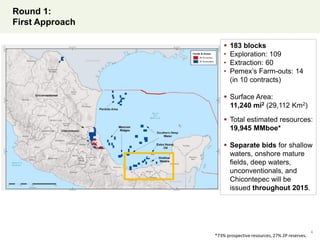

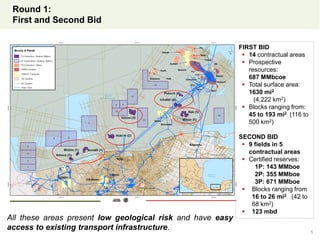

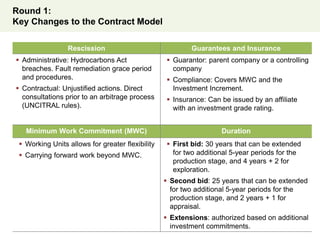

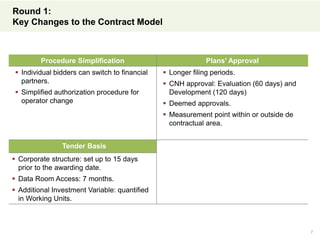

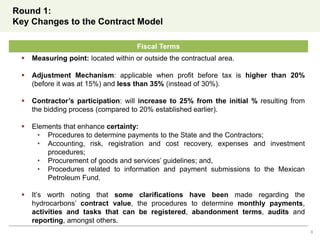

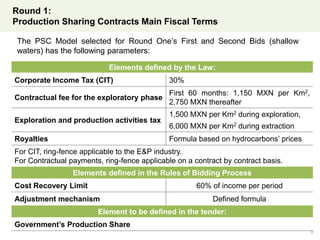

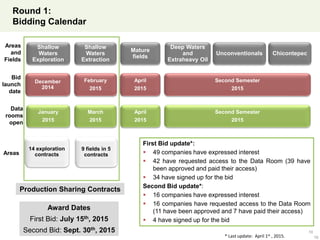

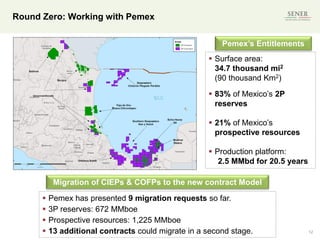

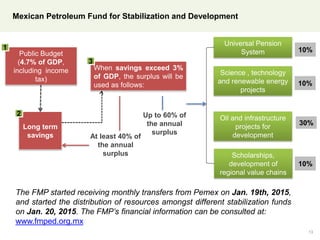

Mexico's energy reform, initiated in April 2015, involves 21 laws and 26 regulations aimed at transforming Pemex and CFE into state productive enterprises while enhancing transparency and investment in the energy sector. The reform includes new bidding rounds, with the first and second rounds offering contractual areas for exploration and extraction, alongside established fiscal terms and compliance measures. Additionally, the Mexican Petroleum Fund has begun distribution of resources, ensuring funding for various development projects as part of the new energy framework.