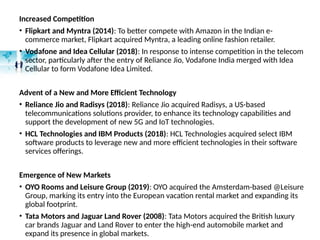

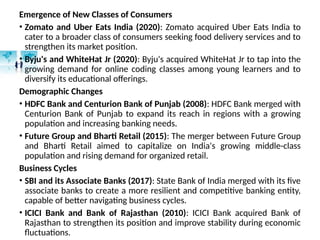

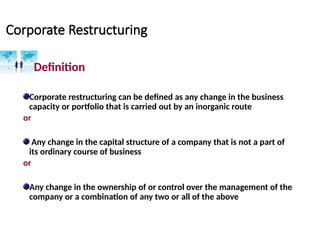

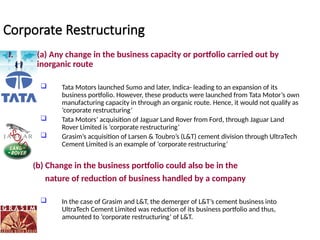

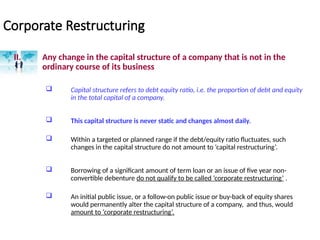

Corporate restructuring is a strategic response to increased competition, technological advancements, emerging markets, and demographic changes, defined as significant changes in business capacity, capital structure, or ownership. Examples of corporate restructuring include mergers like Vodafone and Idea Cellular, and acquisitions such as Reliance Jio's purchase of Radisys. Activities not classified as corporate restructuring encompass organizational changes like reengineering, downsizing, and business process changes.