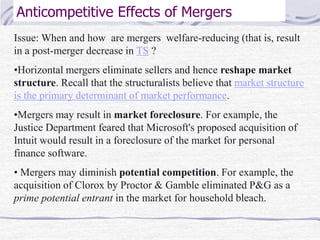

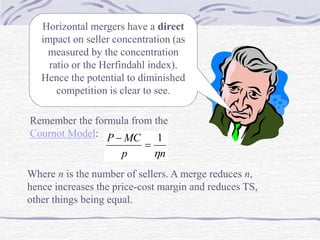

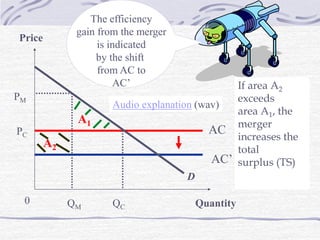

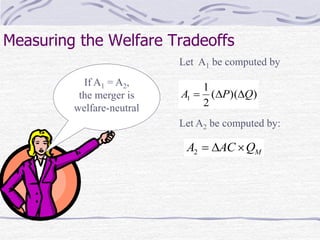

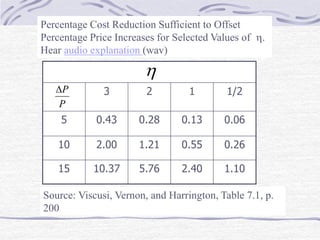

This document defines and provides examples of three types of mergers: horizontal, vertical, and conglomerate. Horizontal mergers combine direct competitors, vertical mergers join firms that have buyer-seller relationships, and conglomerate mergers consolidate unrelated firms. While horizontal mergers directly impact market concentration, all mergers could potentially have anticompetitive effects by eliminating competition or limiting potential competition. However, horizontal mergers may increase total surplus if efficiency gains from cost reductions outweigh negative impacts of higher prices from reduced competition.