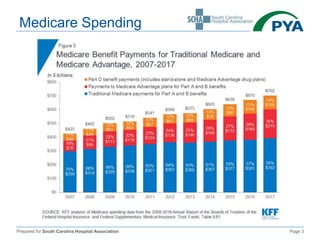

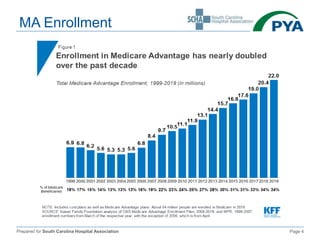

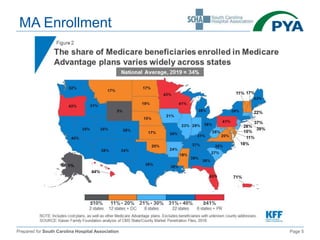

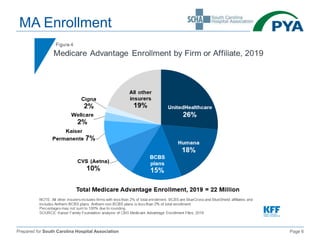

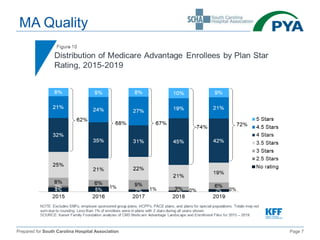

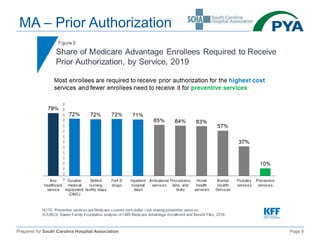

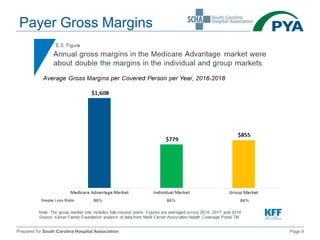

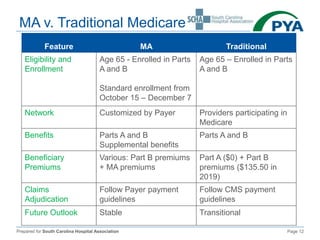

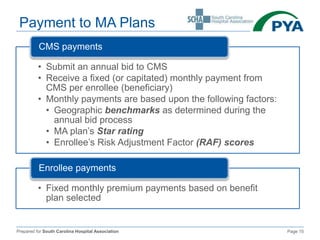

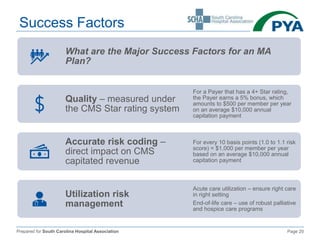

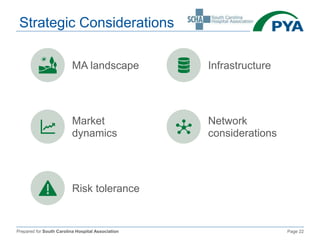

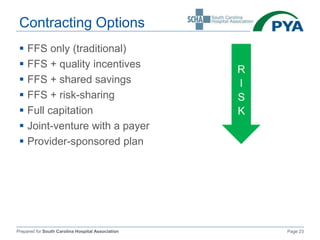

The document outlines the key aspects of Medicare Advantage (MA) plans, focusing on their business model, enrollment, revenue cycles, and provider payments. It compares MA with traditional Medicare, detailing factors such as star ratings, risk adjustment, and payment structures to providers. Additionally, it discusses success factors and strategic considerations for MA plans in the healthcare landscape.