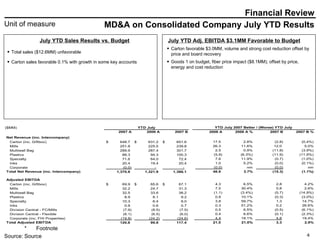

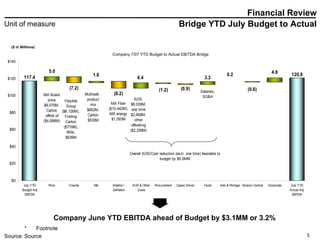

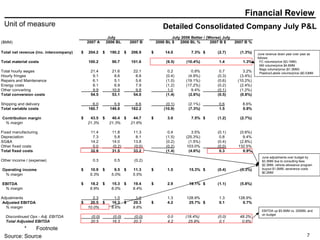

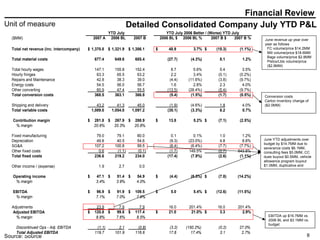

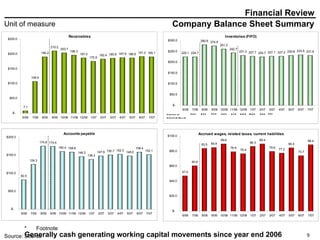

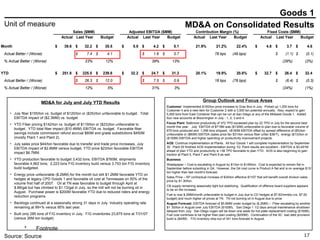

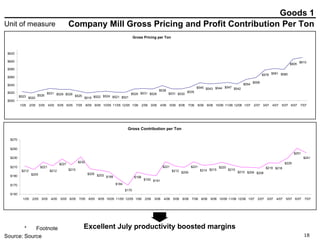

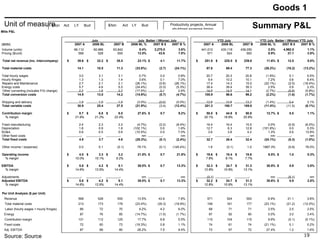

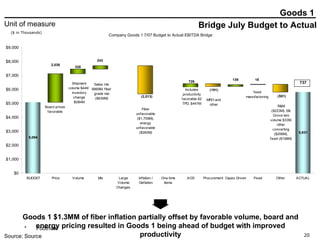

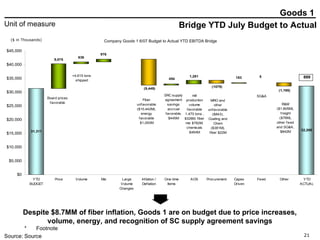

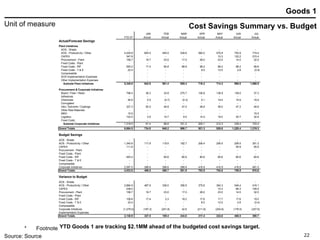

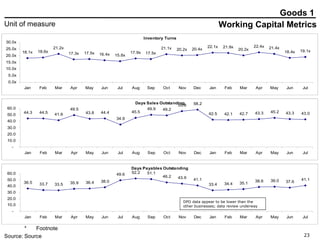

The document provides a financial summary for Company, LLC for July and July year-to-date (YTD). It includes consolidated results, results by business unit, and highlights for Goods 1. Goods 1 sales were unfavorable to budget due to higher fiber costs, but favorable pricing offset some of this. Production and shipments were favorable for Goods 1 YTD.