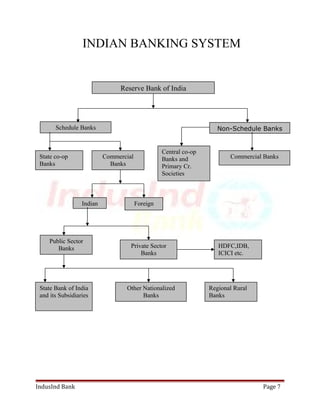

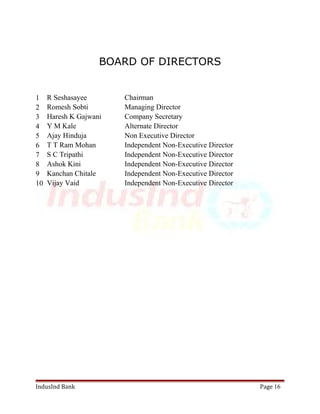

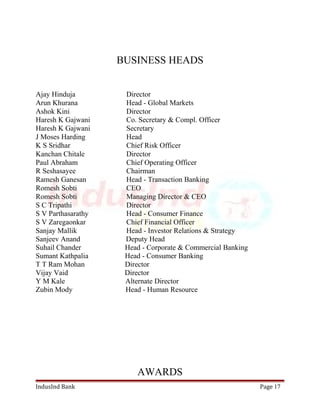

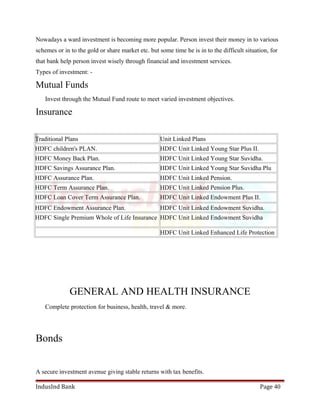

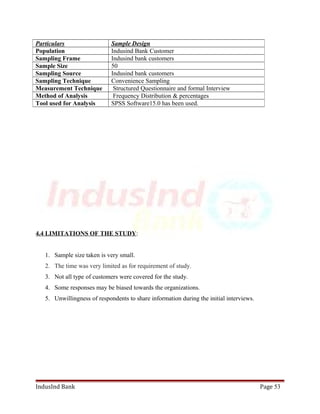

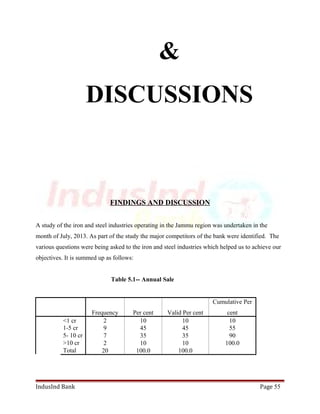

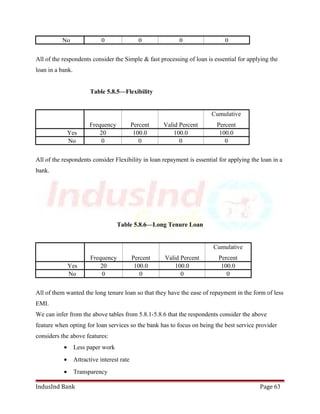

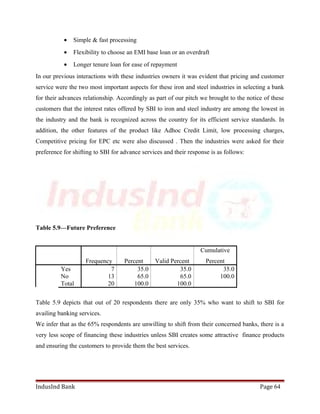

This document provides an overview of a project report on customer satisfaction at IndusInd Bank Ltd. It includes sections on the declaration, acknowledgements, contents, introduction to banking history and structure in India, IndusInd Bank's history and mission/vision. It also provides details on IndusInd Bank's major competitors, products, departments, and bibliography. The document serves as the report for a study on customer satisfaction conducted at IndusInd Bank.