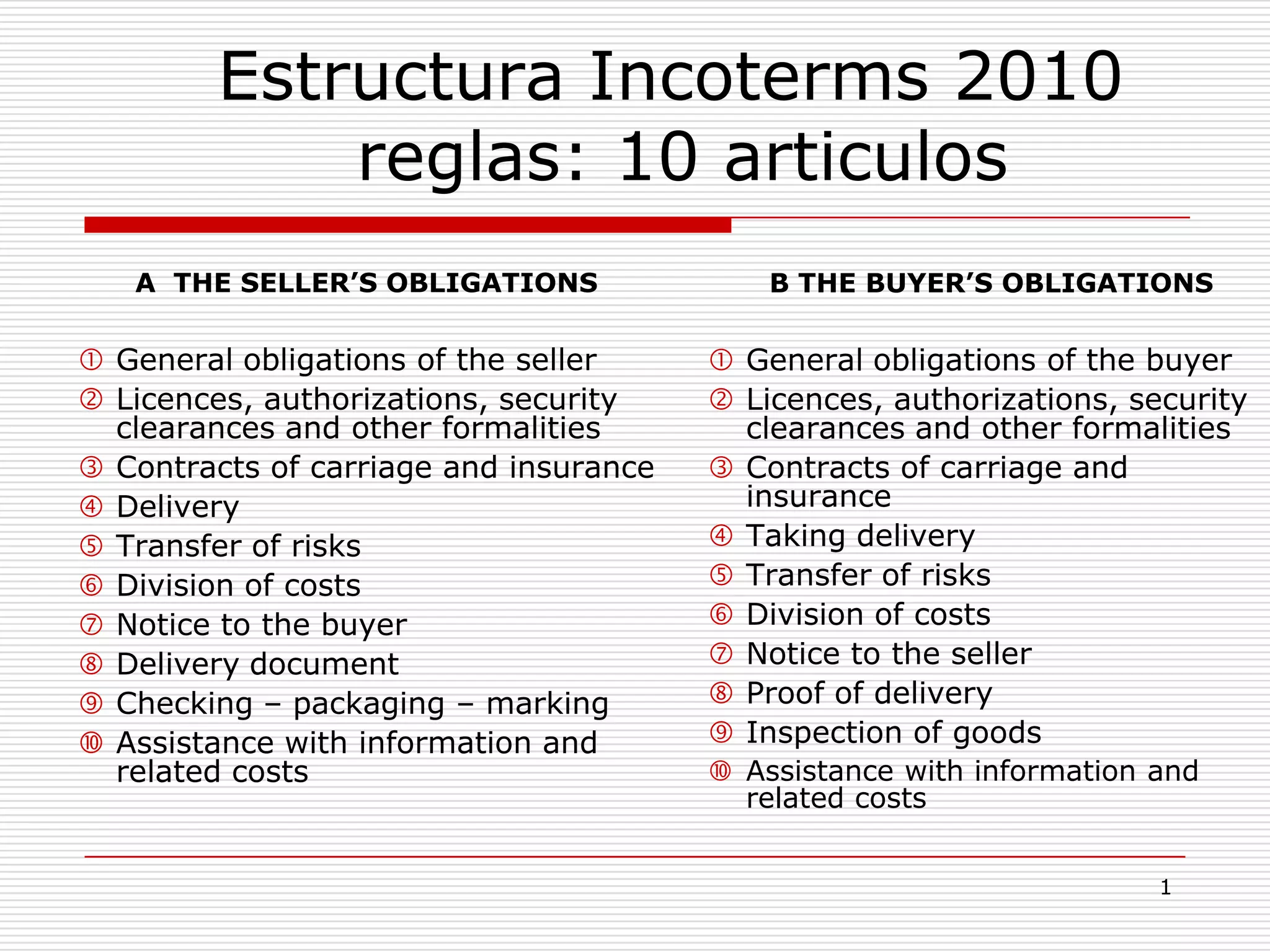

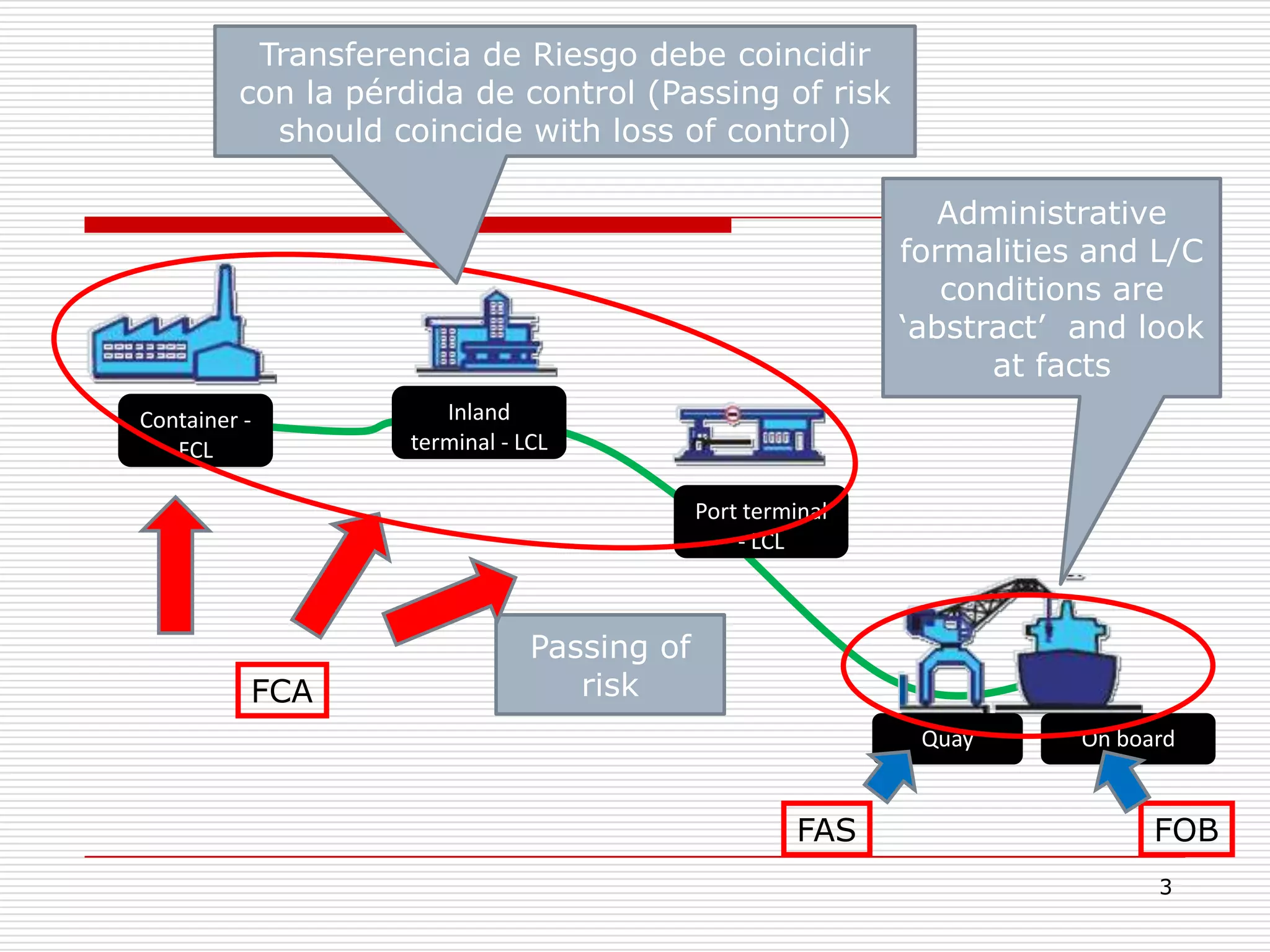

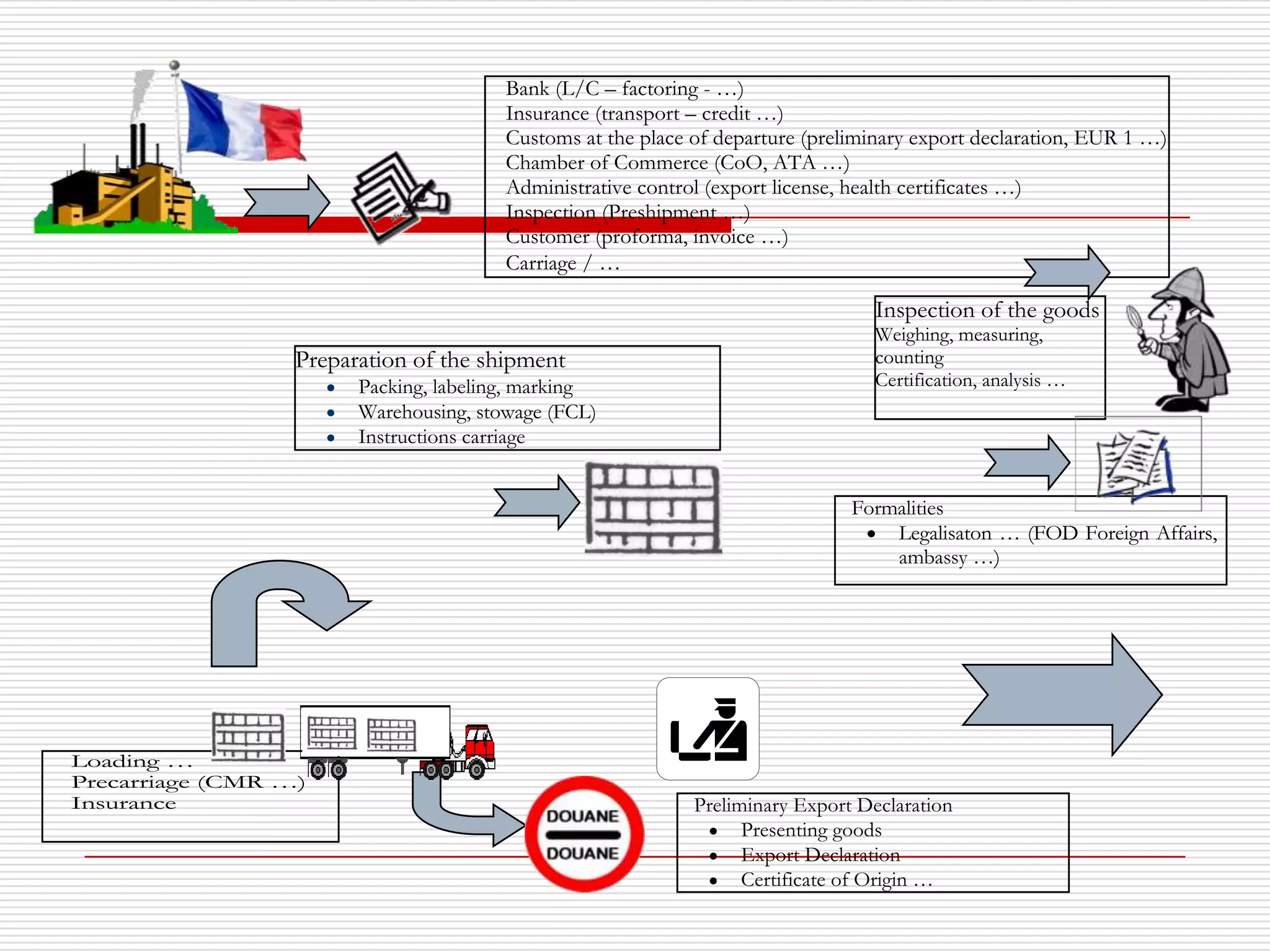

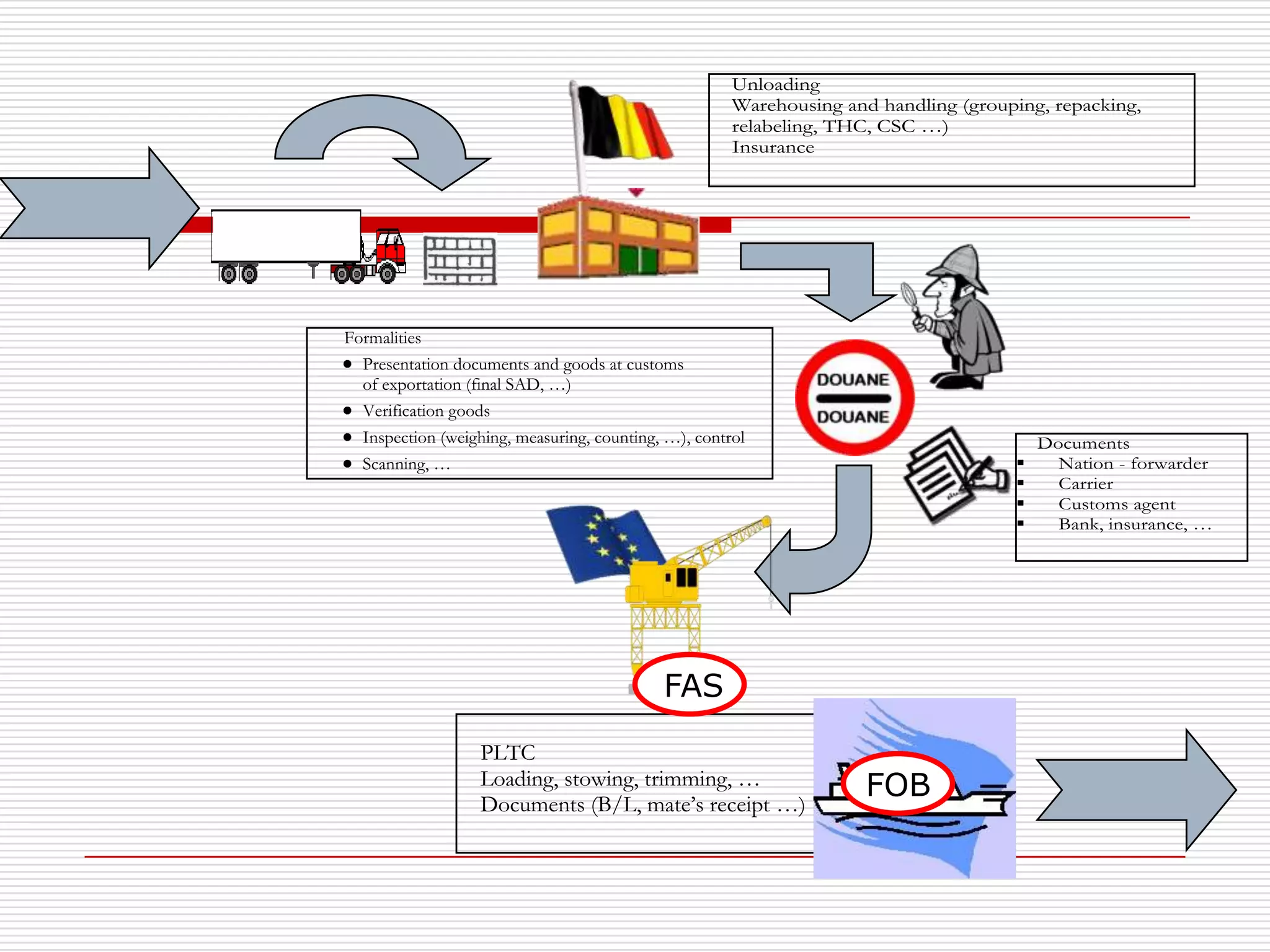

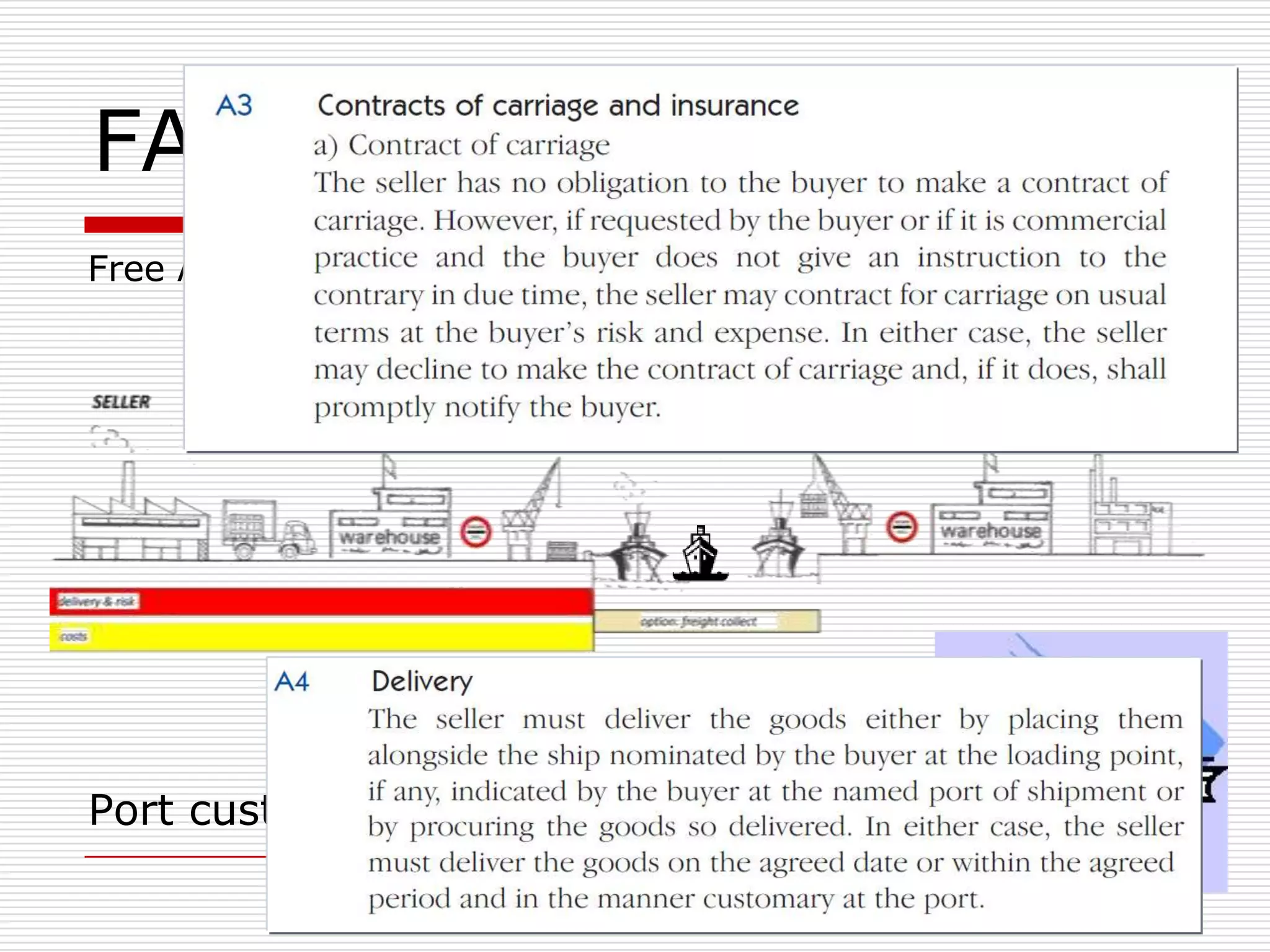

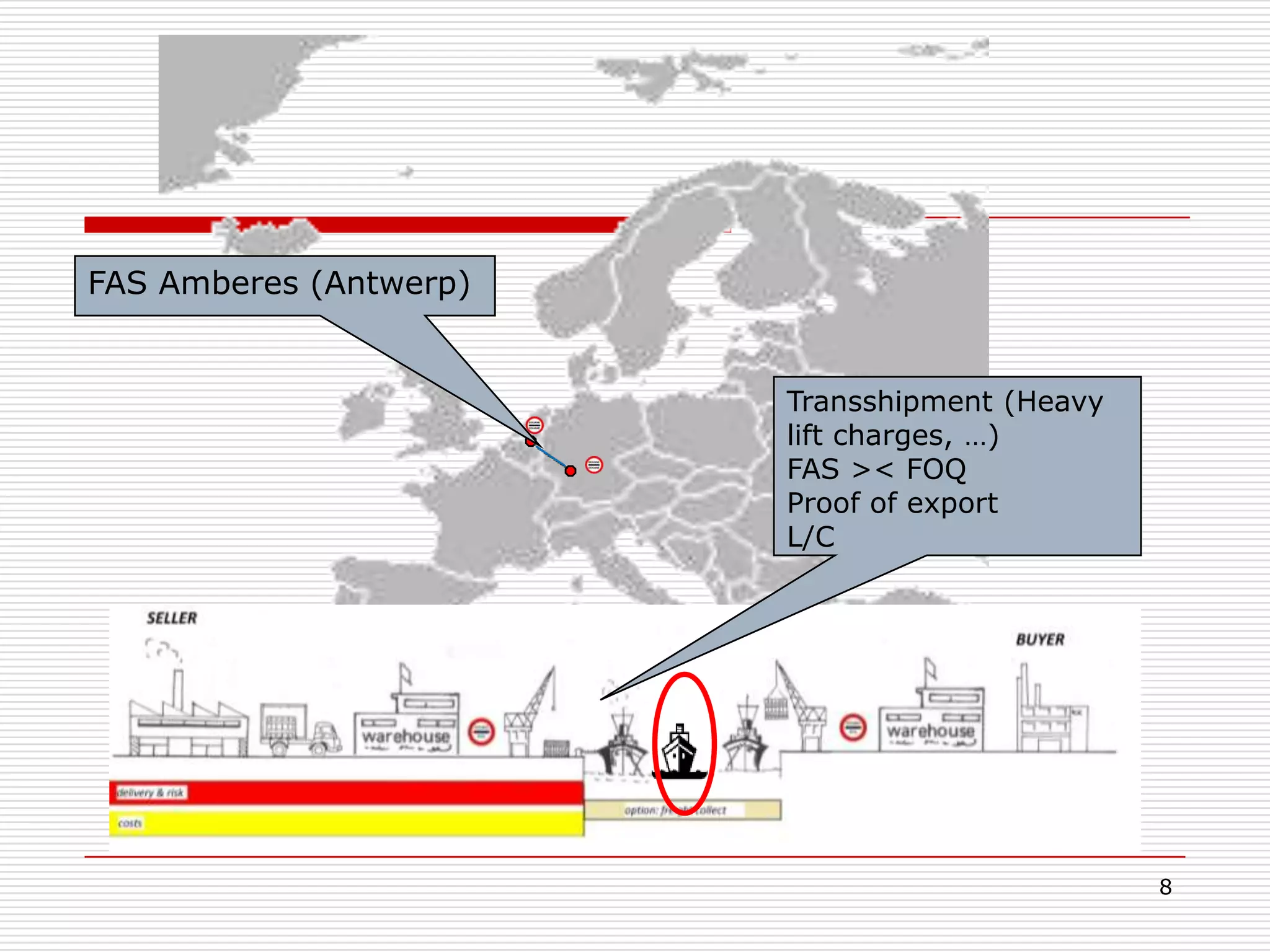

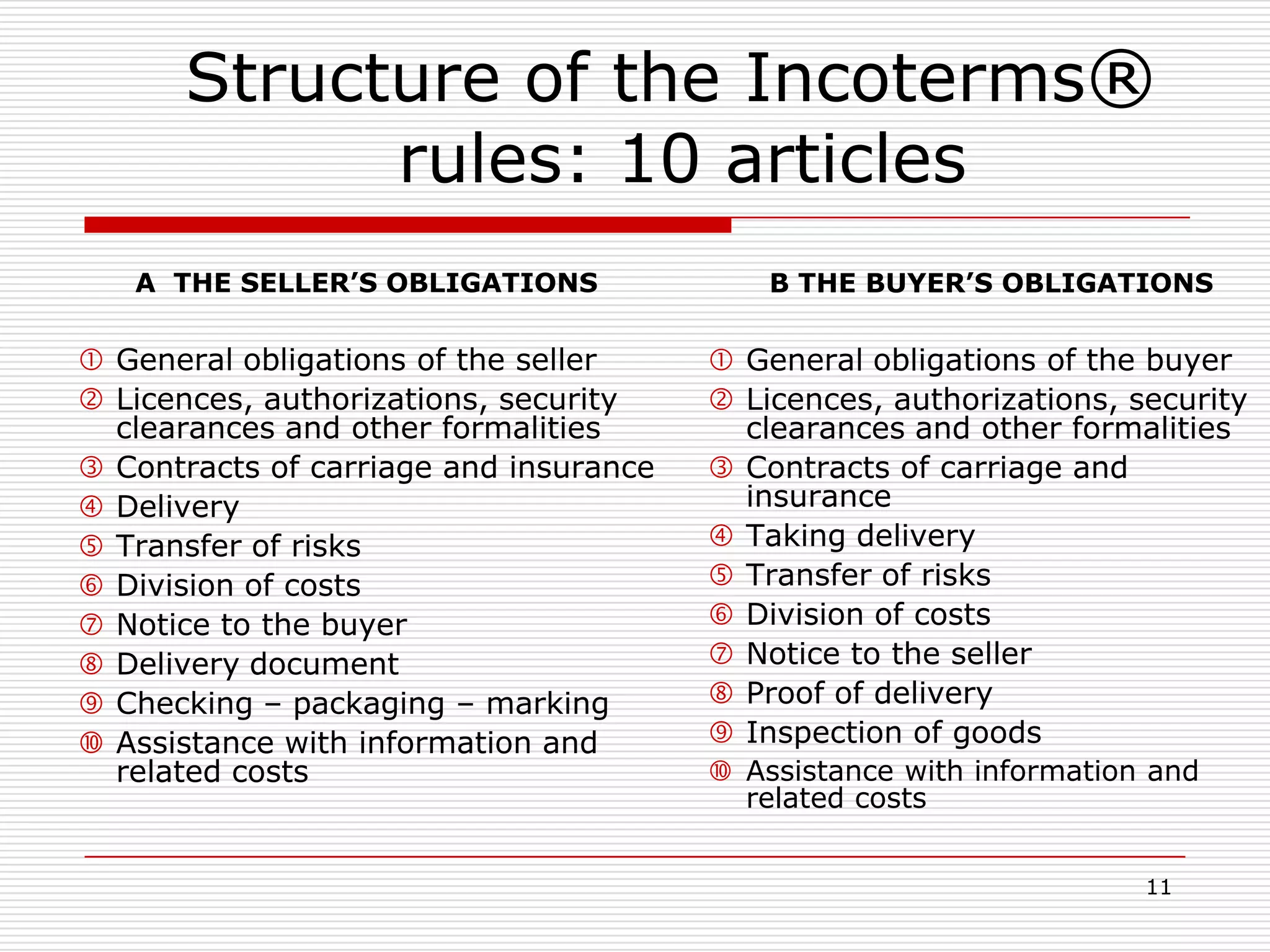

The document discusses Incoterms 2010 rules, which govern international commercial terms. It is structured in two main sections (A and B) that define the obligations of the seller and buyer. Section A covers topics for the seller like delivery, transfer of risks, costs, and notices. Section B covers the buyer's obligations regarding taking delivery, proof of delivery, and inspection of goods. The document also discusses how Incoterms rules define delivery but not legal ownership, and how passage of title and risk are important for accounting, customs, and VAT purposes.

![Incoterms and

transfer of title

Delivery vs. legal ownership

Delivery Incoterms ® Rules

Legal ownership contract national law

Legal title – economic ownership (title –

property – ownership)

B/L’s

Leasing - retention of title – consignment

stock

Contract – Accounting – Customs – VAT

- …

Product sales will be recorded as revenue upon passage of title of

goods from the company to a third party customer. All sales should be

made on shipping terms of "FOB shipping point". Accordingly,

passage of title is deemed to occur upon physical delivery of goods to

a common carrier. All invoices should specify in the conditions of sale

that title to the goods shall pass to the buyer upon delivery to the

carrier (i.e., shipping terms are FOB shipping point). In international

markets, the terms utilized to convey "FOB shipping point" may be

different (e.g. CIF, EXW, FCA). We should not sell products on terms

that are legally considered to be "FOB destination point."

VAT art. 14.1 Directive 2006/112/EC.

"Supply of goods" shall mean the transfer of the right to dispose

of tangible property as owner.

IAS 18.14:

Revenue arising from the sale of goods should be recognised when

all of the following criteria have been satisfied: [IAS 18.14]

1. the seller has transferred to the buyer the significant risks and

rewards of ownership

2. the seller retains neither continuing managerial involvement to

the degree usually associated with ownership nor effective

control over the goods sold

3. the amount of revenue can be measured reliably

4. it is probable that the economic benefits associated with the

transaction will flow to the seller, and

5. the costs incurred or to be incurred in respect of the transaction

can be measured reliably](https://image.slidesharecdn.com/masterclassfasfobdraft1-130508110828-phpapp02/75/Masterclass-fasfo-bdraft-1-13-2048.jpg)