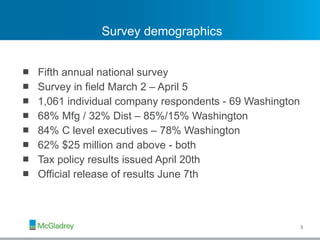

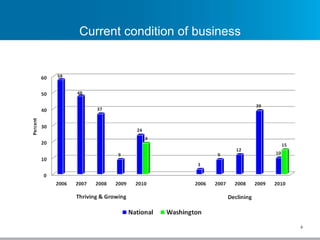

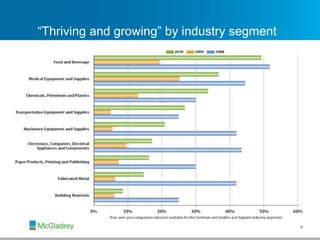

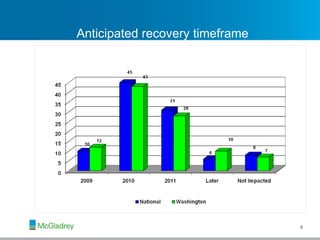

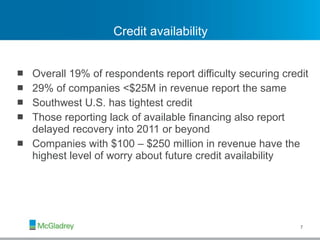

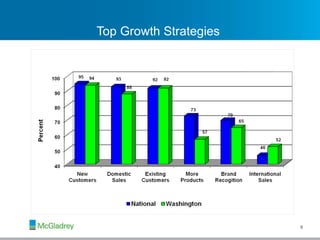

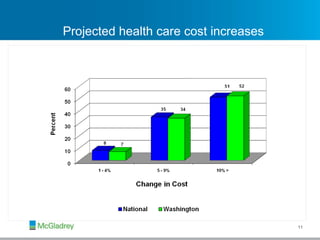

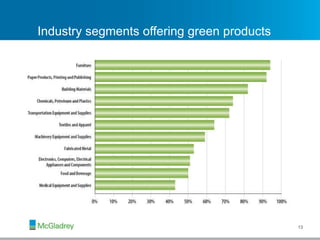

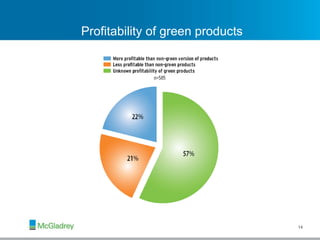

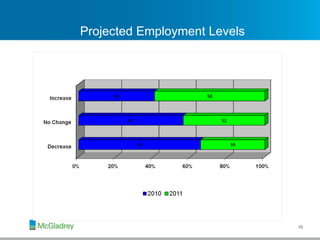

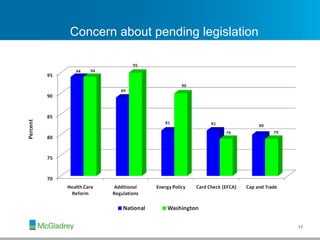

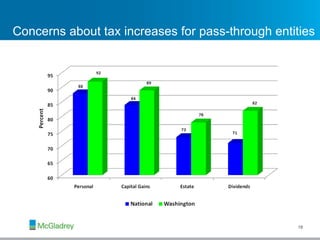

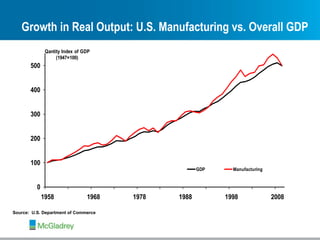

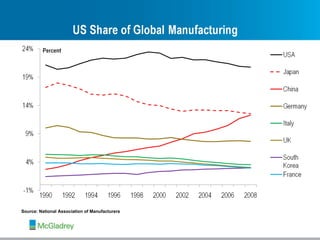

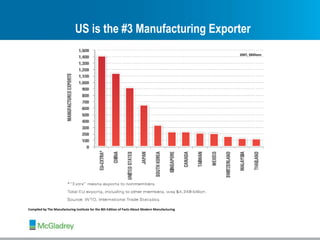

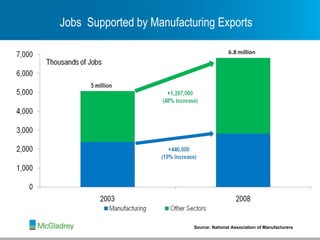

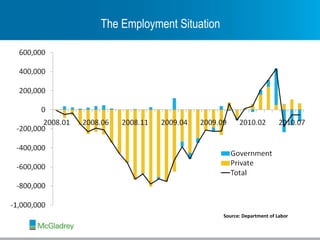

The document summarizes the results of a survey of manufacturing and distribution companies. It finds that while business conditions have improved, some companies still face limited credit availability, especially small companies. New export markets are driving international sales growth. Companies developing new products tend to have higher profit margins. The manufacturing sector continues to face challenges around workforce skills shortages and policy concerns.

![Questions Tom Murphy Executive Vice President RSM McGladrey, Inc. 612-376-9226 [email_address]](https://image.slidesharecdn.com/mcgladreysurvey-110125120935-phpapp02/85/Manufacturing-Survey-38-320.jpg)