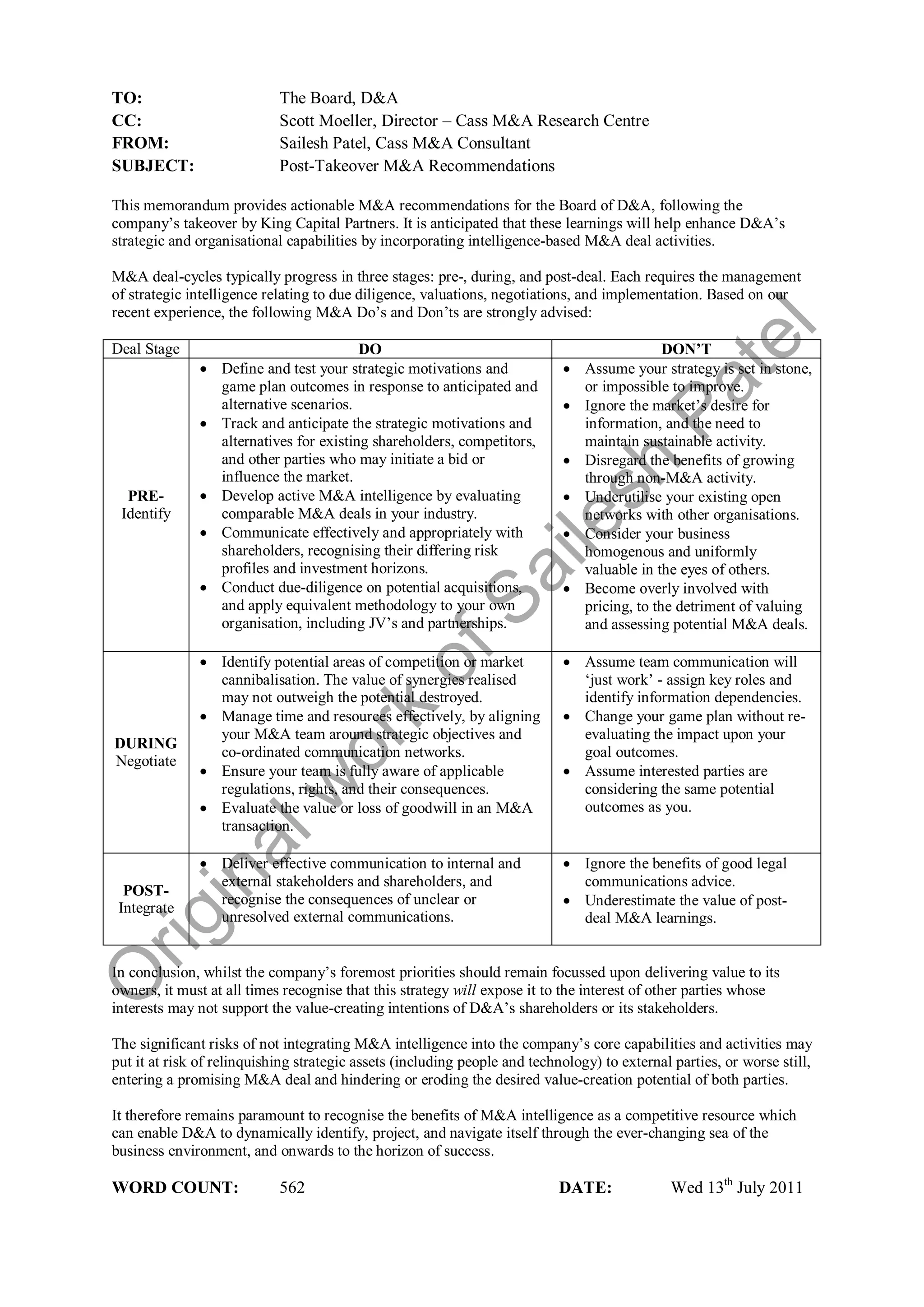

This memorandum outlines post-takeover M&A recommendations for D&A following its acquisition by King Capital Partners. It highlights the importance of integrating M&A intelligence into the company's strategy to enhance its organizational capabilities and navigate market challenges. Key dos and don'ts are provided for each stage of the M&A deal cycle to improve outcomes and mitigate risks.