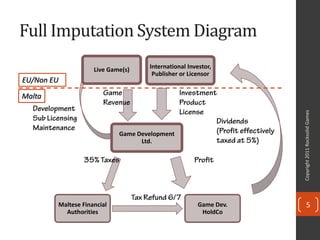

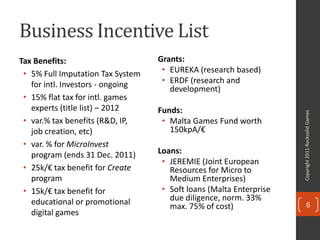

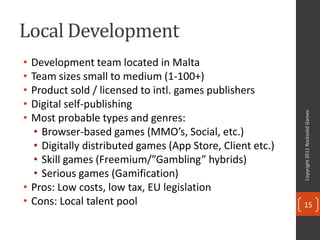

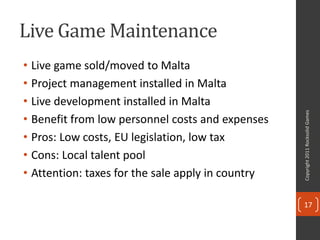

Malta offers several benefits for game development companies, including a favorable tax system and membership in the EU. The tax system allows for a maximum 5% corporate tax rate for international investors. Malta also has a growing game development community with several international studios located there and educational programs to build a talent pool. Some common business models for Maltese game companies include local development of games for international publishers, licensing intellectual property to take advantage of the tax system, and providing outsourced game services to international developers.