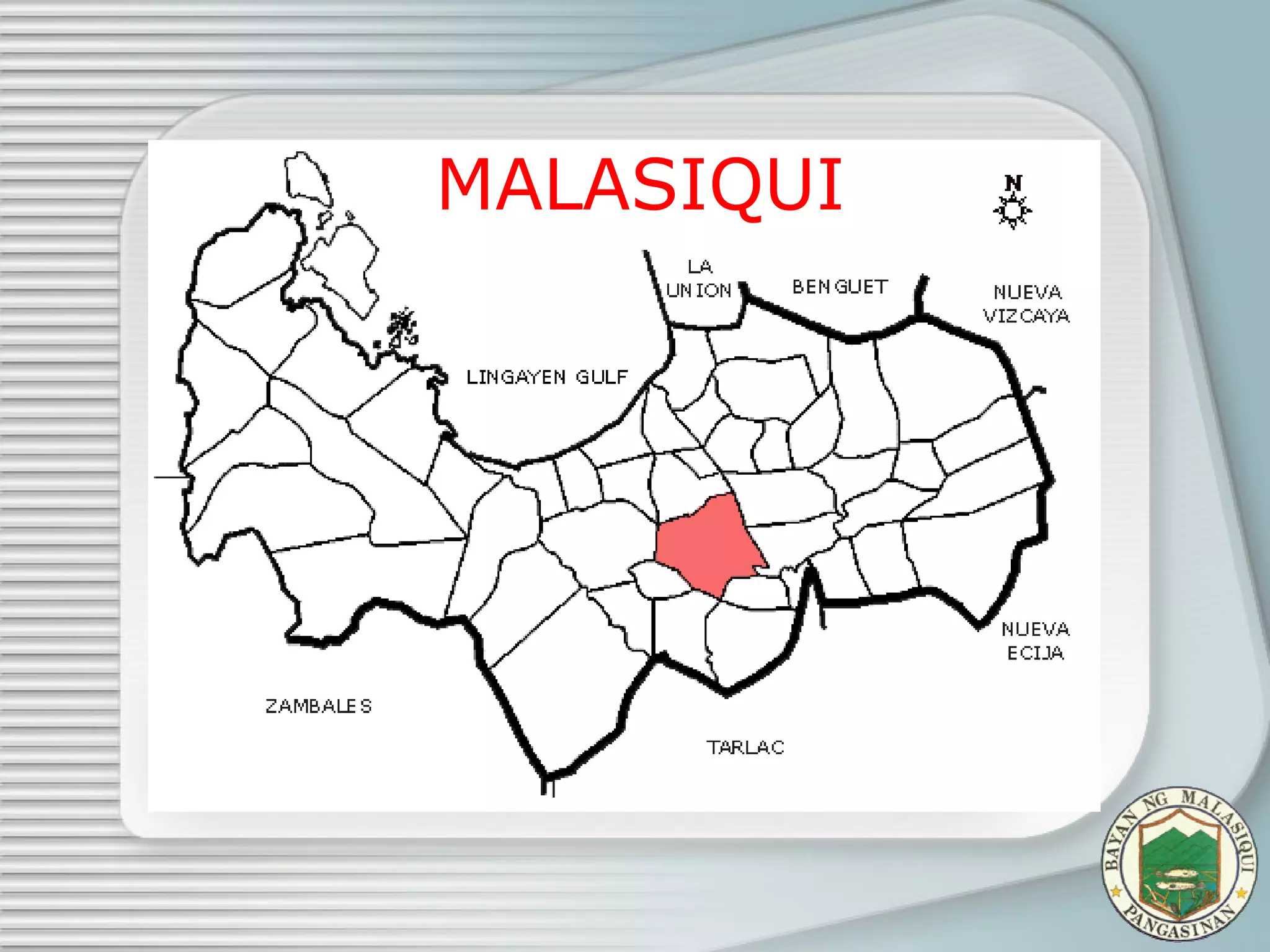

UPH-DJGTH PTM are Doctors & Patients (children, elderly & ill) Who want to be healthy. Competitors are Dagupan or San Carlos hospitals. The opportunity is others focus on profits over quality. The market size is P2.6 million, with UPHDJGT niche as P1 million. UPH-DJGTH is a secondary hospital with tertiary capabilities, located nationwide. It uses CSR activities and premium pricing in a niche strategy to dominate the secondary hospital market.