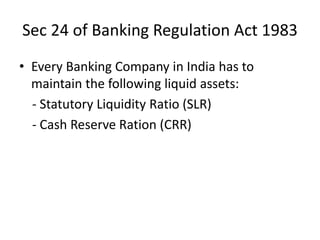

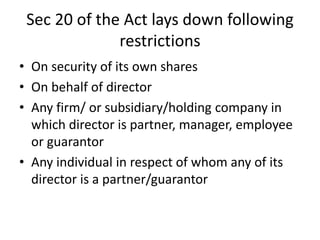

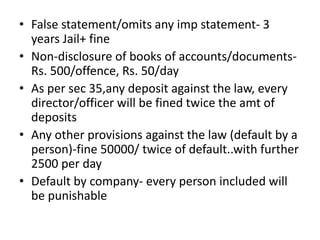

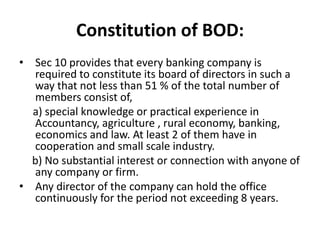

This document summarizes key regulations for banks in India regarding liquid asset maintenance, statutory liquidity ratio (SLR), cash reserve ratio (CRR), restrictions on loans and advances, penalties for non-compliance, bank liabilities, and management requirements. It states that banks must maintain 25% of their time and demand liabilities as liquid assets like gold or government securities (SLR), and a specified fraction of total deposits as reserves with the Reserve Bank of India (CRR). It also outlines penalties for banks, restrictions on certain types of loans, required disclosures, and composition of the board of directors.