Macro

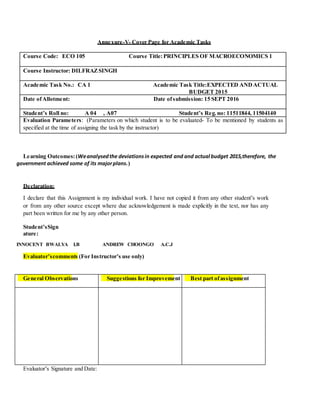

- 1. Annexure-V- Cover Page for Academic Tasks Course Code: ECO 105 Course Title:PRINCIPLES OF MACROECONOMICS 1 Course Instructor: DILFRAZSINGH Academic Task No.: CA 1 Academic Task Title:EXPECTED ANDACTUAL BUDGET 2015 Date ofAllotment: Date ofsubmission: 15 SEPT 2016 Student’s Roll no: A 04 , A07 Student’s Reg.no: 11511844, 11504140 Evaluation Parameters: (Parameters on which student is to be evaluated- To be mentioned by students as specified at the time of assigning the task by the instructor) Learning Outcomes:(Weanalysedthe deviationsin expected and and actual budget 2015,therefore, the government achieved some of its majorplans.) Declaration: I declare that this Assignment is my individual work. I have not copied it from any other student‟s work or from any other source except where due acknowledgement is made explicitly in the text, nor has any part been written for me by any other person. Student’sSign ature: INNOCENT BWALYA I.B ANDREW CHOONGO A.C.J Evaluator’scomments (For Instructor’s use only) General Observations Suggestions for Improvement Best part ofassignment Evaluator‟s Signature and Date:

- 2. Marks Obtained: Max. Marks: ………………………… CATEGORY 1 2 3 4 5 Points awarded Introduction (topic sentence)(5marks) The topic sentence is an excellent introduction to the paragraph. It tells the main idea and gives the big picture(5) The topicsentence is a good introduction to the paragraph. It may too broad or have a detail included. (4) Introduces the paragraph. It does not introduce the topicvery well and it includes too many details. (3) The topicsentence does not introduce the paragraph. (2) Does not display an understanding of the topic. Not in line with the topic. (1) Sequencing (Organization)(5marks) Details are placed in a logical order and the way they are presented effectively keeps the interest of the reader.(5) Details are placed in a logical order, but the way in which they are introduced sometimes makes the writing less interesting.(4) Some details are not in a logical or expected order, and this distracts the reader.(3) Many details are not in a logical or expected order. There is little sense that the writing is organized(2) All topics are not in logical and expected order. There is very little sense that writing is organized. (1) Ideas , (5 marks) The topichas been discussed from different angles and Student has given excellent grasp of the topic. (5) The topichas been discussedproperly and Student has a good grasp of the subject. (4) Student knows the subject but not related it with different angles (3) Student uses just the facts to relay thoughts. There is not much of the student's own personality in the writing (2) Information is gathered from electronic sources but the student does not know its relevance and importance (1) Grammar & Spelling (Conventions)(5 marks) Student makes no errors in grammar or spelling that are grade level appropriate(5) Student makes a couple of errors in grammar or spelling that are grade level appropriate.(4) Student makes several errors in grammar or spelling that are grade level appropriate(3) Student makes many errors in grammar or spelling that are grade level appropriate.(2) Student makes more than ten errors in grammar or spelling that are grade level appropriate.(1)

- 3. 1.DEVIATIONS IN EXPECTED AND ACTUAL BUDGET 2015 WITH RESPECT TO HOUSEHOLDS AND IMPLICATIONS OF ACTUAL BUDGET TO THE SECTION OF THE ECONOMY ? The end of every fiscal year marks the beginning of a new one and in this case for the finance minister in question arun jaitely the pressure was on.The country was experiencing an exhilarating growth rate but was developing economically at a slow pace as many of indians were still in abject poverty EXPECTATIONS 1.OPENNING THE ECONOMY THROUGH FDI'S This wish has been lingering on for quite some time now. The previous year, saw an increase in FDI for a number of sectors, but some of them still remain. It would do real good to encourage full FDI in the retail sector, though the biggest fear has been that it will crumple the small vendors. But many market experts are of the opinion that it may help small vendors by attracting international funding. It will also help small vendors to supply goods to e-commerce sites. 30% OF INDIA WAS STILL IN ABJECT POVERTY(SOCIAL SECURITIES) Many expected and hoped that the need for social protection measures for the poorest is not given up. The Modi goverment had already been fighting for the poor but the household sector still expected an increase in the substantial amount allotted to programmes like MNREGA ; the last budget had token Practical application and relating concepts with Real World and Conclusion (10 mark) Student makes no errors in appropriate practical application and Detailed conclusions are reached from the facts offered 10 Student makes little error to relate the concepts practically and Clear conclusion is reached from the facts offered.(8) Student has tried to relate the concepts practically and Clear conclusion is reached from the facts offered. (6) Student makes many errors in practical application and no clear conclusion can be formed from the facts offered.(4) Student has not related with practical applications and no conclusion can be formed.(2)

- 4. increases which put the outlay lower than previous years in real terms once inflation was accounted for. It was also expected that the food security interventions should continue. TAX Simplification (DST & GST);THE EASE OF DOING BUSINESS Today every business house has been disturbed by the complications arising due to taxation. Income Tax and Companies Act- both have been a major concern to all the businesses. The government was proposing 10,000 start-up warehouses, allotting major VCs is going to be of little use if the tax structure makes it difficult to do business in India. Many reports pointed out start-ups migrating to Singapore and US, this could only be only stopped if the complications are erased. The government also had been postponing the introduction of DTC (Direct Tax Code) and GST (Goods and Services Tax) for a long time. Elaborative and simplified taxation must be implemented soon. Investors tend to feel less inclined if doing business like in India is strict and full of red taping. Infrastructure The modi goverment came in with a very fancy slogan called "Make in India" and would remain one unless, inter alia, infrastructure genuinely improved. An increase in investment in infrastructure: roads, railways, irrigation and power was liable to make a promising dream a reality. Most of that would come through the public private partnerships which meant that there would be need to institute measures to fast track these and make them more attractive. MAT impact Though PM Modi started the “Make In India” programme, most manufacturers were not very happy about the Minimum Alternate Tax stationed at 18.5%, when most countries have MAT at just 15%. Also with tax holidays given to SEZs (Special Economic Zone), MAT still posed a big threat to development. As a whole, the manufacturing industry is affected adversely by confusing laws clinging on for many years . E-commerce specific The tax officials have been giving the e-commerce portals a hard time. Especially the south Indian VAT Authorities have been levying e-commerce giants like Flipkart, Amazon and Snapdeal heavy fines and penalties for tax evasion. Most of these companies blamed the law for the confusing tax scheme.

- 5. The e-commerce businesses also wish they are given tax incentives so that some newly established e- commerce businesses can use the tax savings to plough back into the business. The biggies like Flipkart, Amazon and Snapdeal enjoy a fair deal of profits unlike the newly born e-commerce businesses. IT Sector The importance of the Information Technology sector is unquestionable. It has been triggering growth in the economy for three decades. Of late, most of the companies are laying off substantial number of employees like IBM, TCS etc. It was very unfortunate to see that most of the software industry only functions as “the doers” for “the creators”. The solving of a problem was taught but not how to erase the problem itself. As a remedial measure, it would be ideal for the government to help big IT corporates setup their R&D here and provide grants. Exemption list The employed had been enjoying a Basic Exemption limit of Rs. 2,50,000. Many wanted it move to Rs. 3,00,000 or higher. Though the government increased the deduction section 80 C by Rs. 50,000, many say it has only been a breezer but doesn’t really help much. So yes, something above that would make it better. Ease the Companies Act of 2013 Talk to any CA practitioners and they’ll enumerate why the forming a company is a tedious and expensive task. And existing corporates have in no way found any relief under the new Companies Act,2013. The penalties for petty negligence are excruciating for newly formed companies. This act was the SATYAM inspired law, wherein every little transaction was looked at with a skeptical view. Allow private participation in education sector it was known that the amount that goes in for primary education by the government hardly suffices the children’s needs. So it would be most encouraging if private participation in the education sector would be encouraged to help in improvising the existing standard of education.

- 6. Given the present constraint in fiscal deficit in revenue (as can be seen above) it's a challenging and difficult opportunity for the government. But special steps need to be taken as far as public investment is concerned. Development of Agriculture Indian economy is still primarily agrarian, and sadly continues to depend on the vagaries of the monsoon even after nearly seven decades of independence. While the much lauded Liberalization, Privatization, and Globalization, with more stress on FDI have undoubtedly made some positive impact on the others sectors of the economy, like services, their salutary effect on Agriculture is nil, and in some cases even

- 7. negative. the budget should have a holistic approach to all sectors of economy, and provide impetus for modernization/up gradation of agriculture, so as to make agriculture a viable proposition. Better balanced income and expenditure This is how the rupee came and went in 2014-15 One can see that borrowings and subsequent interest burden is very high. Just imagine - the revenue from customs duties and excise is not adequate to even cover interest payments! Given that there is need to take measures to to reduce debt & interest burden, I expect to see no sops on the duties and taxes offered to individuals and industries. In fact it was expected that there would be a push to increasing revenues through

- 8. Widening the income tax net: no sops in medium terms to either individuals or industry Increase in services that come under the 'service tax net' Fast tracking public private partnerships in key infrastructure areas. ACTUAL BUDGET Fiscal deficit * Fiscal deficit was seen at 3.9 per cent of GDP in 2015/16 * They met the challenging fiscal target of 4.1 per cent of GDP * Remained committed to meeting medium term fiscal deficit target of 3 per cent of GDP * Current account deficit below 1.3 per cent of GDP * Jaitley said had to keep fiscal discipline in mind despite need for higher investment Growth * GDP growth seen at between 8 per cent and 8.5 per cent y/y * Aiming double digit growth rate, achievable soon Inflation * Expected consumer inflation to remain close to 5 per cent by March, opening room for more monetary policy easing * Monetary policy framework agreement with the RBI clearly states objective of keeping inflation below 6 per cent Revenues * Revenue deficit was seen at 2.8 per cent of GDP

- 9. * Non tax revenue was seen at Rs 2.21 trillion * Agricultural incomes were under stress Disinvestment * Government targets Rs 410 billion from stake sales in companies * Total stake sale in 2015/16 seen at Rs 695 billion Market reforms * Propose to merge commodities regulator with SEBI * To bring a new bankruptcy code * Jaitley sais wouldl move to amend the RBI act in 2015, and provide for a monetary policy committee * To set up public debt management agency * Proposes to introduce a public contract resolution of disputes bill * To establish an autonomous bank board bureau to improve management of public sector banks Policy reforms * To enact a comprehensive new law on black money * Propose to create a universal social security system for all Indians * To launch a national skills mission soon to enhance employability of rural youth * To raise visa-on-arrival facility to 150 countries from 43 * Allocates Rs 346.99 billion for rural employment guarantee scheme Borrowing * Gross market borrowing was seen at Rs 6 trillion

- 10. * Net market borrowing was seen at Rs 4.56 trillion General anti-avoidance rules (GAAR) * Government defers rollout of anti-tax avoidance rules GAAR by two years * GAAR to apply prospectively from April 1, 2017 * Retrospective tax provisions will be avoided Taxation * To abolish wealth tax * Replaces wealth tax with additional 2 per cent surcharge on super rich * Proposes to cut to 25 per cent corporate tax over next four years * Corporate tax of 30 per cent is uncompetitive * Net gain from tax proposals seen at Rs 150.68 billion * Jaitley proposed modification of permanent establishment norms so that the mere presence of a fund manager in India would not constitute a permanent establishment of the offshore fund, resulting in adverse tax consequences. * Proposes to rationalise capital gains tax regime for real estate investment trusts * Expected to implement goods and services tax by April 2016 * To reduce custom duty on 22 items * Basic custom duty on commercial vehicle doubled to 20 per cent * Proposes to increase service tax rate and education cess to 14 per cent from 12.36 per cent * Plans to introduce direct tax regime that is internationally competitive on rates without exemptions * Exemptions for individual tax payers to continue

- 11. * To enact tough penalties for tax evasion in new bill * Tax department to clarify indirect transfer of assets and dividend paid by foreign firms Infrastructure * Investment in infrastructure will go up by Rs 700 billion in 2015/16 over last year * Plans to set up national investment infrastructure fund * Proposes tax-free infrastructure bonds for projects in roads, rail and irrigation projects * Proposes 5 "ultra mega" power projects for 4,000MW each * Second unit of Kudankulam nuclear power station to be commissioned * Would need to build additional 100,000km of road * Ports in public sector will be encouraged to corporatise under Companies Act Expenditure * Plan expenditure estimated at about Rs 4.65 trillion * Non-plan expenditure seen at about Rs 13.12 trillion * Allocated Rs 2.46 trillion for defence spending * Allocated Rs 331.5 billion for health sector * If revenue improves, hope to raise budgeted allocations for rural job scheme by Rs 50 billion Investment * Propose to do away with different types of foreign investment caps and replace them with composite caps * To allow foreign investment in alternative investment funds

- 12. * Public investment needed to catalyse investment Gold * To develop a sovereign gold bond * To introduce gold monetisation scheme to allow depositors to earn interest * To introduce Indian-made gold coin to reduce demand for foreign gold coins Subsidies * Food subsidy seen at Rs 1.24 trillion * Fertiliser subsidy seen at Rs 729.69 billion * Fuel subsidy seen at Rs 300 billion * We are committed to subsidy rationalisation based on cutting leakages DEVIATIONS REAL ESTATE SECTOR: The Union Budget for 2015/16 is a big disappointment to the real estate sector. There were huge expectations from the government but it did not deliver on what was promised. Prime Minister Narendra Modi had announced 'Housing for all by 2022', however he did not give a roadmap on how to achieve the same, although it is the first time that the target has been set in the union budget. The increase in the service tax to 14 per cent will prove to be quite burdensome as it will affect the purchasing power of home buyers. Overall, the expectation of the housing industry from the government was very high and they have not been met.

- 13. AUTO-MOBILE SECTOR: The automobiles sector, which has been struggling for the past two years, had expected decisive steps from Finance Minister Arun Jaitley to steer them out of the difficult times. However, Budget 2015 had little to offer. The industry wanted the government to announce a cut in excise duty and offer industry-specific incentives to increase demand. The excise duty cut, which was initially implemented across all vehicle segments in February 2014 by the then UPA government, was extended till December 2014. But, in the interim Budget, Jaitely had withdrawn it from January 2015. The resultant excise duty hike has translated into a 4-6 per cent price increase across passenger vehicle categories, affecting demand. The inverted duty structure is yet another pain point for the industry. While excise duty on commercial vehicles is 8 per cent, raw material and engineering inputs are being taxed at 12 per cent. MANUFACTURING SECTOR: It was touted as the 'Make in India' Budget. But at the end of Finance Minister Arun Jaitley's one hour and thirty three minutes speech, peppered with 15 references to "manufacturing", many industry captains were still grappling to pinpoint that one big-bang move. It was a mixed bag for the sector. While many of the policies proposed could stimulate manufacturing demand in the long term, executives were not too sure about the near term. The Indian manufacturing sector has a problem on the demand side - there is more capacity and less demand. The automobile segment is running at about 40 per cent excess capacity, for instance. Until capacity utilisation touches 80-85 per cent, companies are unlikely to invest in new plants and create jobs. IMPLICATIONS OF THE ACTUAL BUDGET In general the budget delivered by arun jaitley was fair and balanced as difficult as it is we will regress the macro economic implications it had.Here are some of them: Personal and corporate Taxes: To simplify the manner in which the affluent are taxed, Jaitley has made a move to abolish the wealth tax. In its place, the Finance Minister is planning to put an additional 2% surcharge for this segment (having annual income of more than Rs. 1 crore) - This could potentially result in increased focus of the IT department on ensuring compliance and widening of the tax base Rate of corporate tax to be reduced to 25% over next four years No change in tax slabs Total exemption of up to Rs. 4,44,200 can be achieved 100% exemption for contribution to Service tax increased to 14 percent

- 14. Financial Sector Forward Markets Commission to be merged with the Securities and Exchange Board of India NBFCs registered with the RBI and having asset size of Rs 500 crore and above to be considered as ‘financial institution’ under Sarfaesi Act, 2002, enabling them to fund SME and mid-corporate businesses Permanent Establishment norms to be modified to that mere presence of offshore fund managers in the country does not lead to “adverse tax consequences.” Agricultural Development: Rs. 25,000 crore for Rural Infrastructure Development Bank Rs. 5,300 crore to support Micro Irrigation Programme to help small farmers in increasing their production capacities More support to be offered to farmers in the form of credit. A targeted number of Rs. 8,50,000 Infrastructure Development Rs. 70,000 crores allocated to the sector to promote further development Tax-free bonds to be introduced for development projects that have PPP model for infrastructure development to be reintroduced in a stronger shape and in a way that the govt. would be bearing substantial part of the risk rather than passing it on, to encourage more participation Atal Innovation Mission worth Rs. 150 5 ultra mega power projects to be set up in the country to easen up on the power scarcity currently faced by both the individuals as well as businesses. Each power project would be having the production capacity of 4000MW Educational Reforms AIIMS to be set up in more locations to ensure availability of better avenues for medical students, as well as better quality government healthcare to the citizens. New AIIMS to come up in Jammu and Kashmir, Punjab, Tamil Nadu, Himachal Pradesh, Bihar and Assam An IIT to be set up in Karnataka. Instead of opening one more IIT in Dhanbad, the prestigious Indian School of Mines would be upgraded to IIT University of Disability Studies to be set up in Kerala IIM for Jammu and Kashmir and Andhra Pradesh Focus on the creative talent in the country - Centre of film production, animation and gaming to be established in Arunachal Pradesh.

- 15. Defence Sector Increased funds for the defence department. As compared to last year, the allocation of funds for the defence department is ~10% higher To ensure quick manufacturing of Defence equipment, focus would be laid on Make in India campaign in the sector with additional support provided to firms that participate in the initiative Social sector - Allocation for social sector including education and health care is Rs. 1,51,581 crore. - A new health protection scheme for health cover upto Rs. 1 lakh per family. Senior citizens will get additional healthcare cover of Rs. 30,000. - 3,000 stores to be set up for generic drugs. - Rs. 9,000 crore for Swachch Bharat Abhiyan. - National dialysis service programme under PPP model. LPG connection for women members of rural homes. Health Sector: The other huge thrust of this Budget was the focus on increasing savings - and the thrust on bringing most people under the medical insurance and pension net. The importance of this cannot be over- emphasised. India's savings rate has fallen, and a falling savings rate does not bode well for capital formation and capital investments. By giving people - even poor people - an incentive to invest in medical insurance or pension schemes, the government is setting up a social security net that is absolutely must.

- 16. CONCLUSION In conclusion the budget really lived up-to expectation.The inclusion of senior citizens in the budget was a highlight that really the budget was for the country,the easing of the way to do business will help large MNCs and attract investors even more and the simplifications of how the E-commence sector is taxed was a bang not to mention the efforts put in place to boost rural areas.Agriculture wise farmers were supported ready incentives were taken under consideration.One of the main highlights was the rail budget as intense funding was allotted to the electrification of the rail lines.One sector that was hard done was the manufacturing sector because not as much was put into a "make in india" budget. THANK YOU SIR.