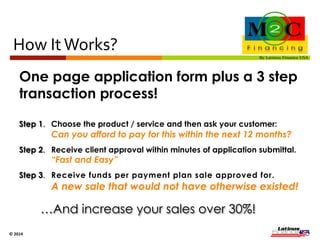

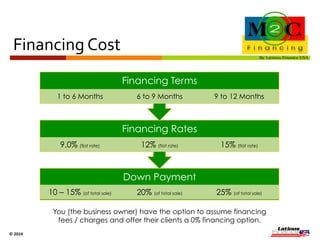

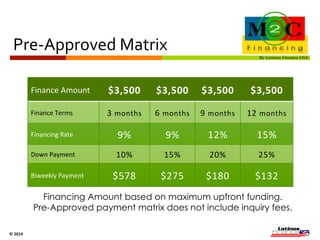

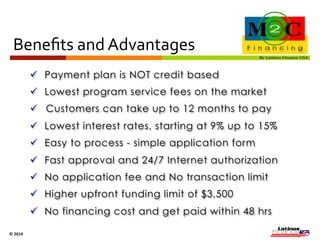

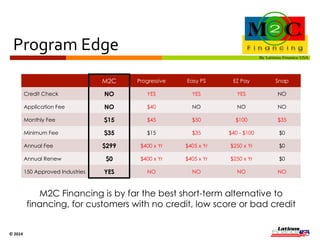

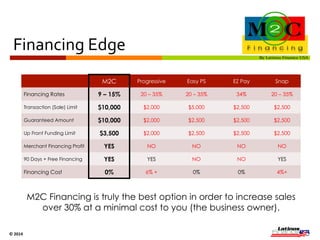

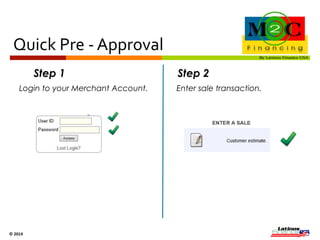

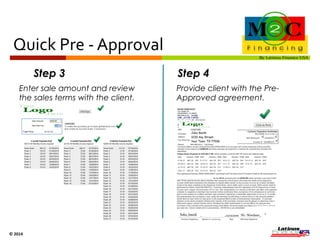

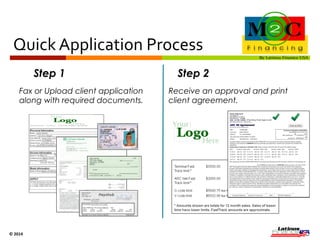

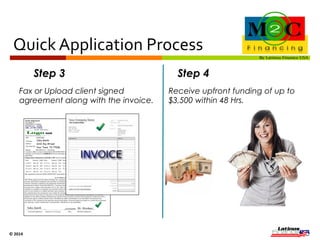

The document describes the M2C Financing program, which offers businesses financing options for clients without credit checks, allowing for up to 12-month repayment plans with interest rates starting at 9%. This program aims to help business owners increase their sales by over 30% within 30 days by providing fast client approvals and upfront funding of up to $3,500. Testimonials from users highlight the program's effectiveness in converting potential customers and improving sales across various industries.