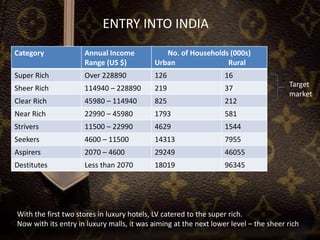

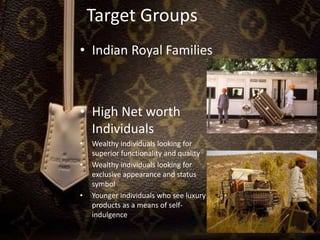

This document discusses Louis Vuitton's entry and expansion in India. It notes that Louis Vuitton originally targeted only the super rich by opening stores in luxury hotels. However, it then aimed at the "sheer rich" market by opening stores in luxury malls, which provide higher foot traffic. Luxury malls are preferable to hotels for visibility and attracting various customer segments, though they require higher investments. The document also examines the different target groups for luxury goods in India and factors that have hindered the market.