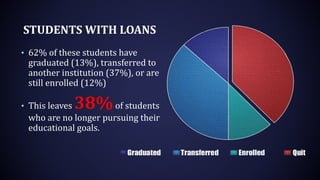

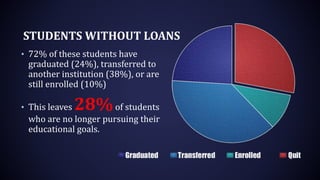

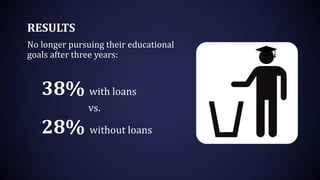

This document summarizes research on the effect of student loans on community college completion and persistence. Some studies show loans have a positive effect, while others show they hinder attainment. The author conducted a study of MCCCD students, finding lower completion rates for those with loans (13% graduated vs 24% without). Students with loans were also less likely to transfer or remain enrolled compared to those without loans (62% vs 72%). The author calls for more research on factors like loan amounts, part-time students, and best counseling practices.