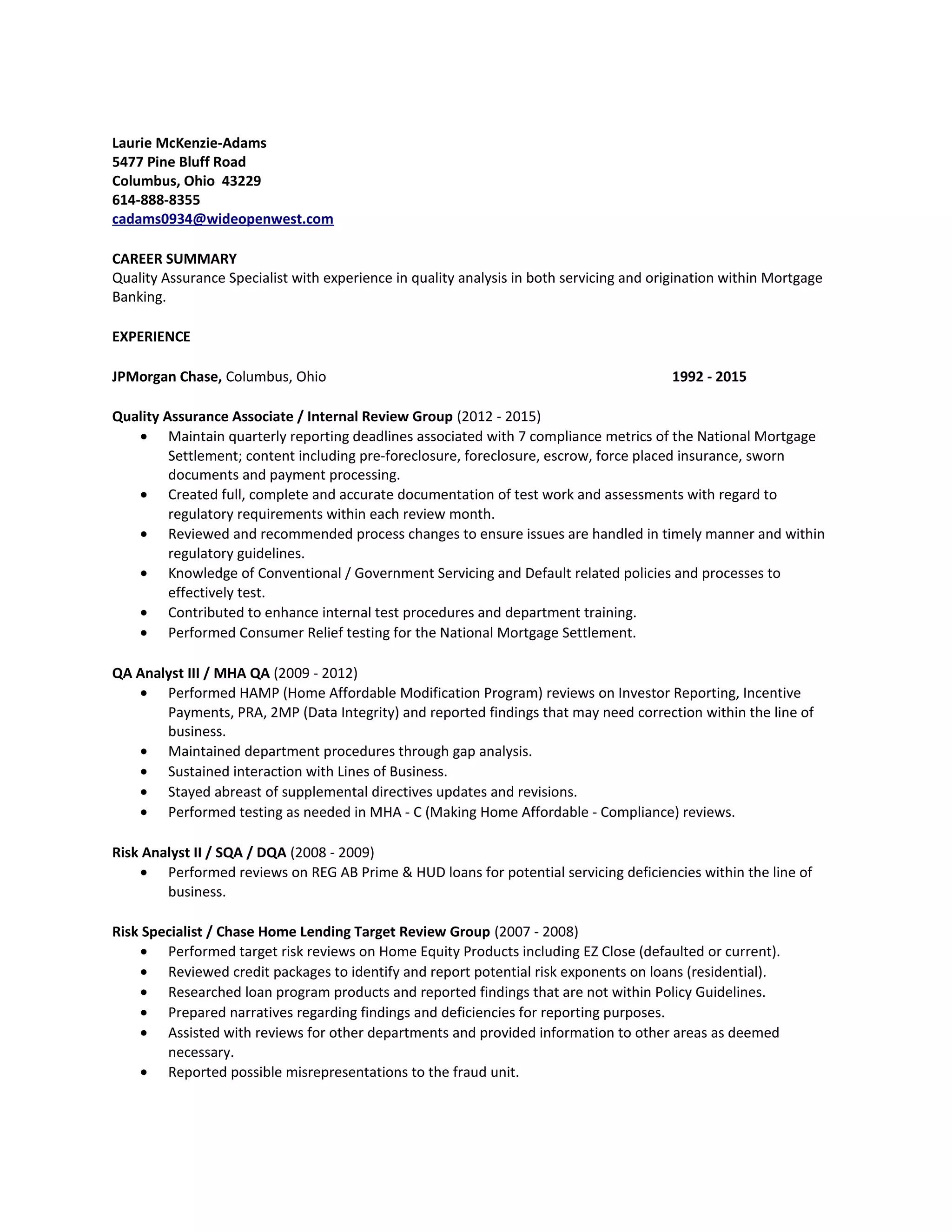

Laurie McKenzie-Adams has over 20 years of experience in quality assurance for mortgage banking, specializing in servicing and origination compliance. She has held various roles at JPMorgan Chase performing reviews, testing, and process improvements to ensure adherence to regulatory guidelines for programs like HAMP, REG AB, and the National Mortgage Settlement. Her background includes analyzing loan quality, underwriting deficiencies, and reporting findings to improve processes and identify potential fraud.